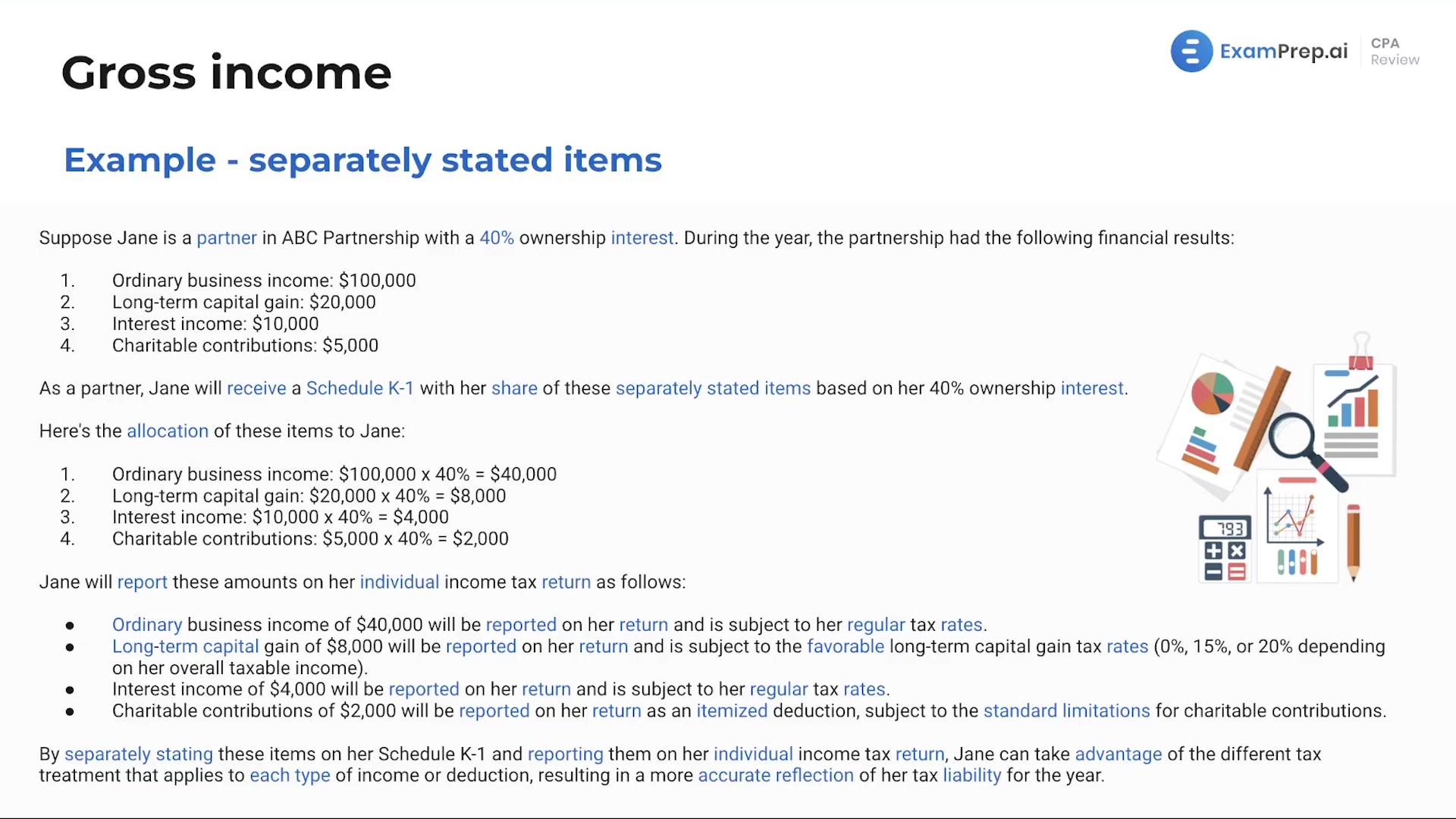

In this lesson, Nick Palazzolo, CPA, delves into the complexities of separately stated items and how they impact the taxation of shareholders and partners in S-corporations and partnerships. He starts off by shedding light on what ‘separately stated items’ are, emphasizing their importance in affecting individuals' tax liabilities. Nick provides a clear distinction between the tax treatment of C-corporations and flow-through entities, ensuring an understanding of why and how certain income, losses, and deductions must be reported individually. By deconstructing the contents of Schedule K-1, he walks through various examples of how these entities distribute different types of income and deductions to their owners' personal tax returns. Moreover, Nick highlights the necessity of memorizing which items are categorized as 'separately stated' for tax planning purposes. The lesson culminates with practical examples to prepare for discerning these nuanced tax details in real-world applications and on the exam.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free