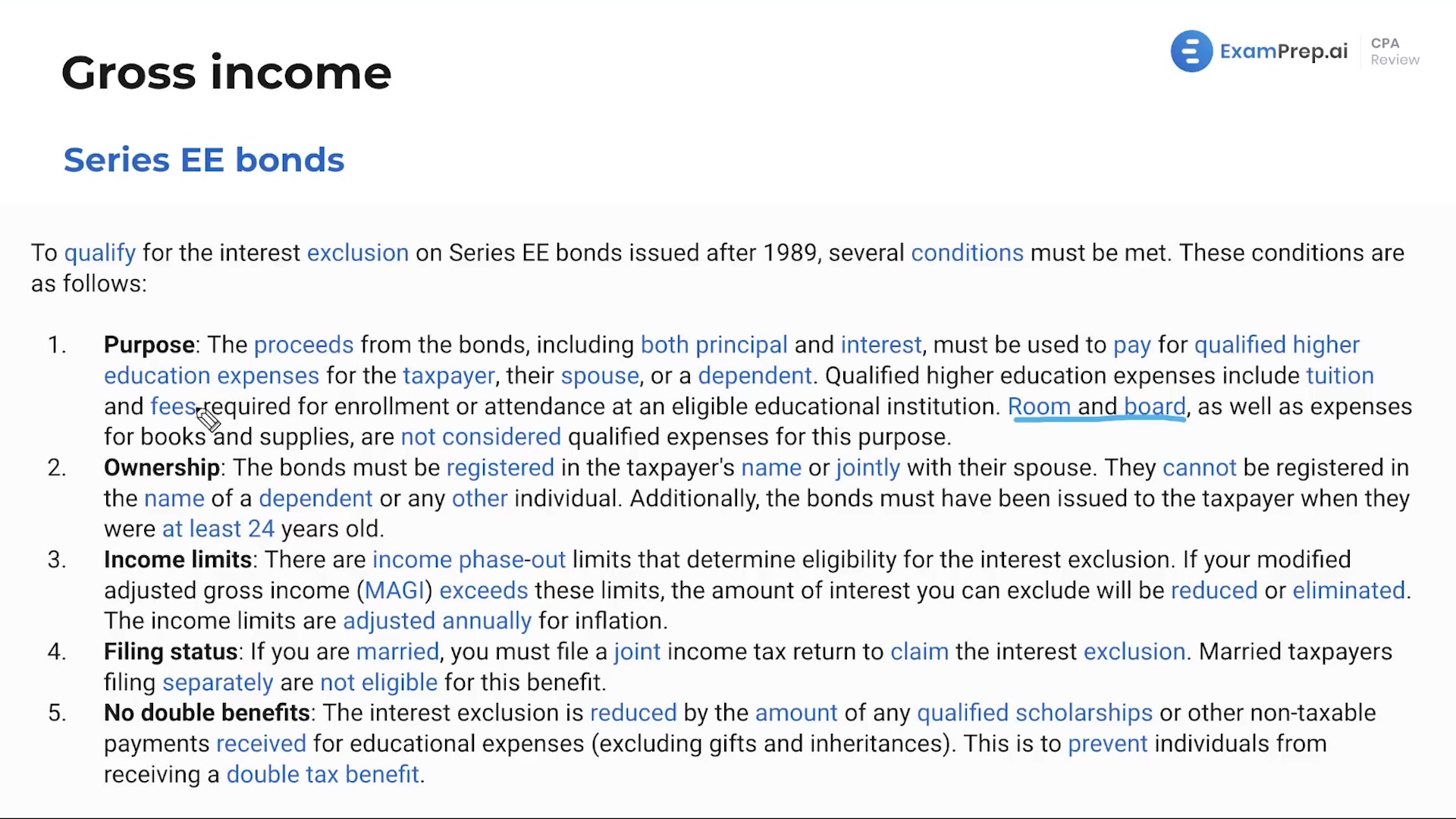

In this lesson, Nick Palazzolo, CPA, demystifies the intricacies of Series EE bonds, breaking down their attributes and the tax implications associated with them. He starts by explaining the basics of these low-risk government savings bonds, including their issuance at a discount, interest accrual, and eventual maturity at face value. Nick dives into the conditions under which interest from these bonds, particularly those issued post-1989, may be excluded from income tax—underscoring the use of funds for higher education expenses. Additionally, he clarifies who qualifies for this tax benefit, which expenses are deemed worthy by the IRS, and the impact of scholarships and other non-taxable educational payments on the interest exclusion. He rounds out the lesson with a practical example that applies these concepts, helping cement understanding of how Series EE bonds can be utilized for educational expenses while navigating the tax advantages they offer.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free