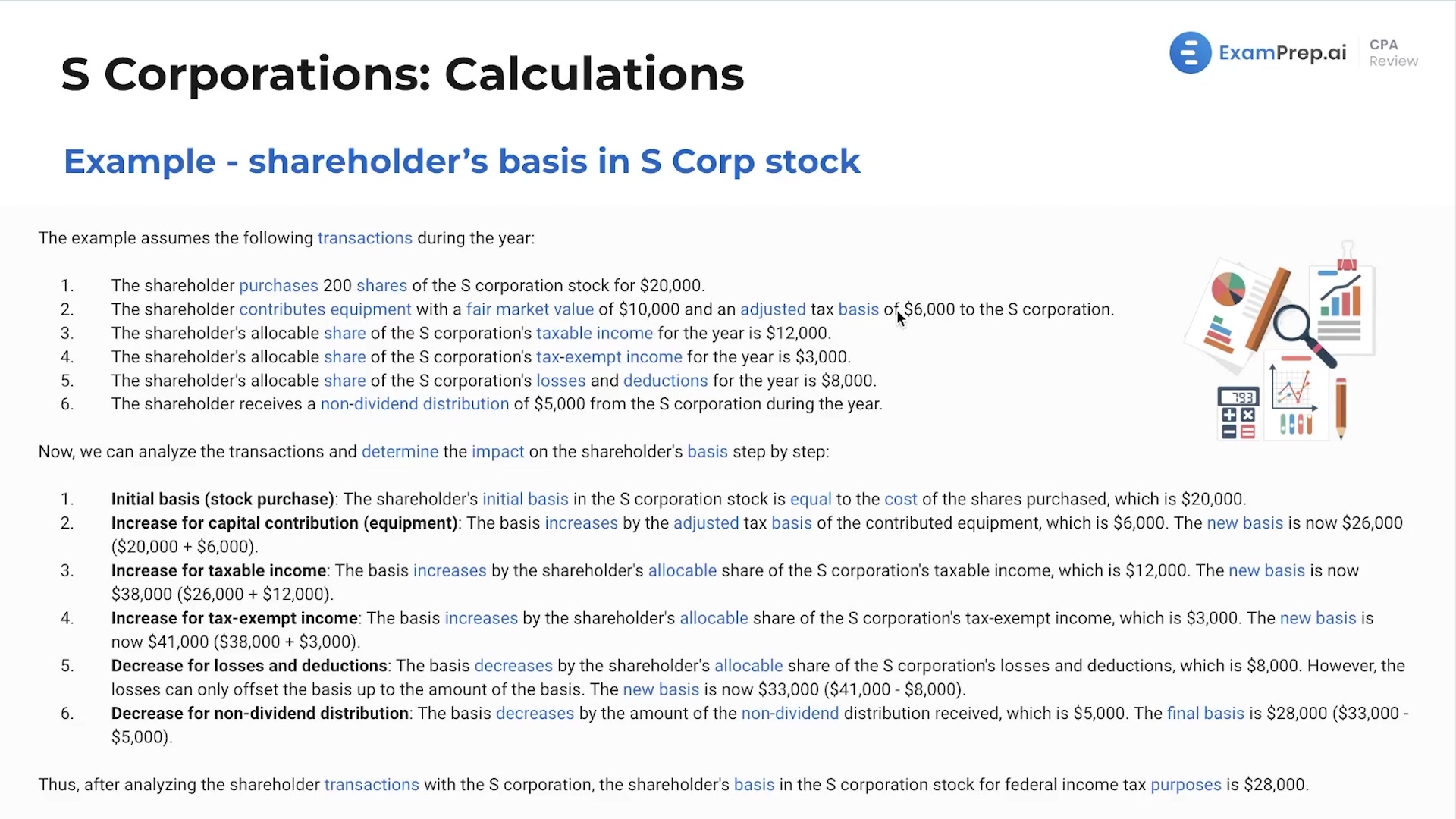

In this lesson, Nick Palazzolo, CPA, breaks down the process of calculating a shareholder's basis in S Corporation stock, using clear examples to illustrate the basic formula involving initial investment, additions, subtractions, and the resulting ending balance. He navigates through the nuanced financial components, such as capital contributions, S-Corp income, losses, and distributions, explaining how each affects the shareholder's stake in the company. Through using the analogy of a bank account to demystify the concepts, Nick ensures a practical understanding of the adjustments that lead to the final basis calculation – critical knowledge for accurately determining potential gains or losses upon selling one's investment in an S-Corp. Further enhancing the session, Nick introduces more complex scenarios including contributions of equipment instead of cash and the distinctions between taxable and tax-exempt income, stressing the importance of understanding these variables to master the concept for the exam.

This video and the rest on this topic are available with any paid plan.

See Pricing