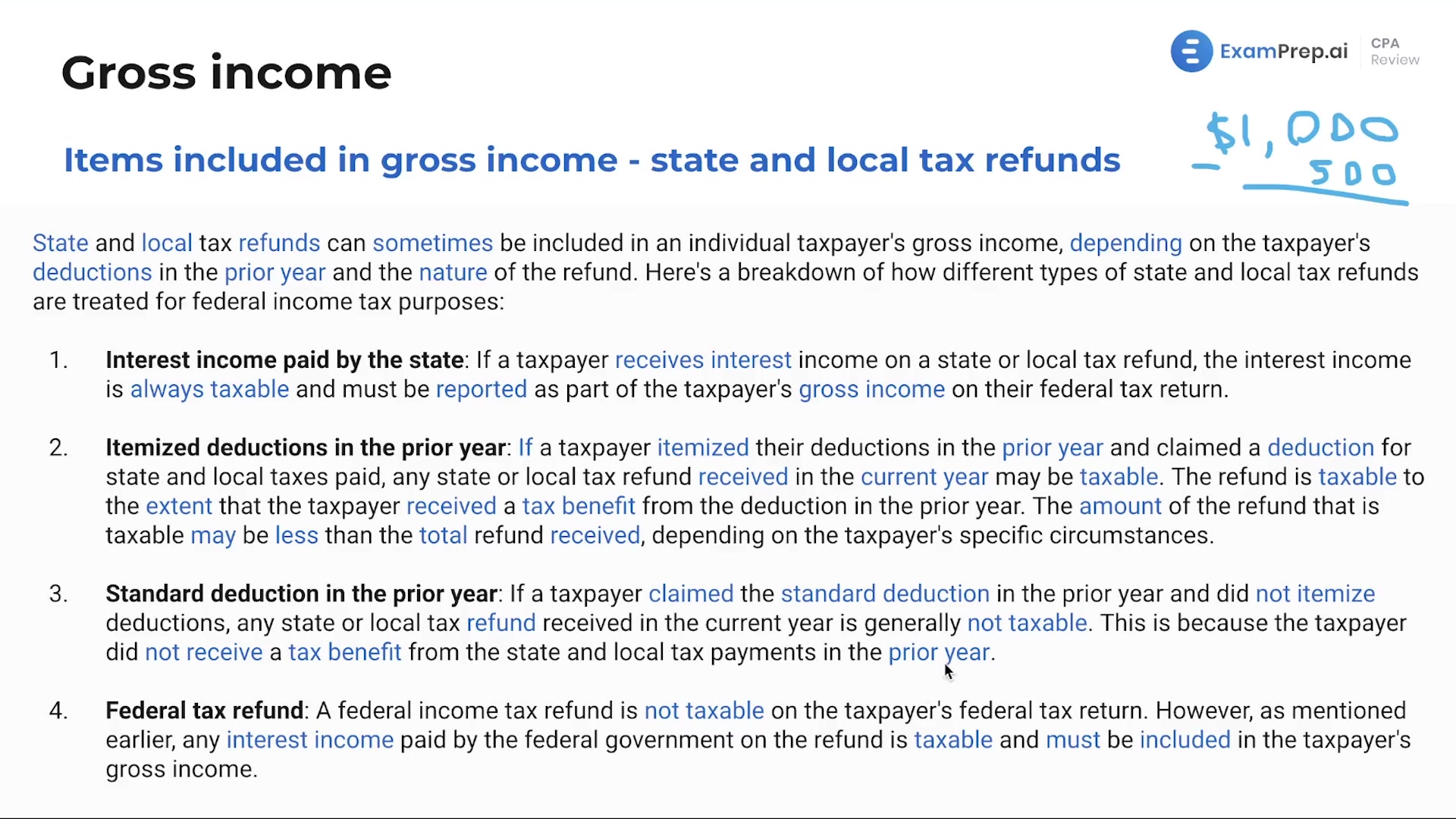

In this lesson, take a breather with Nick Palazzolo, CPA, as you dive into the intricate details of state and local tax refunds and their impact on gross income. Nick breaks down the conditions under which such refunds are considered taxable, starting with the tax implications of interest income on state or local tax refunds. He clearly illustrates the contrast between choosing itemized deductions versus the standard deduction in the previous tax year and how each scenario affects the taxability of any refunds received. Through relatable examples, Nick ensures that even complex concepts are easily grasped, guiding you through illustrative scenarios and reinforcing the material with a summary ideal for revision before tackling multiple choice questions and simulations.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free