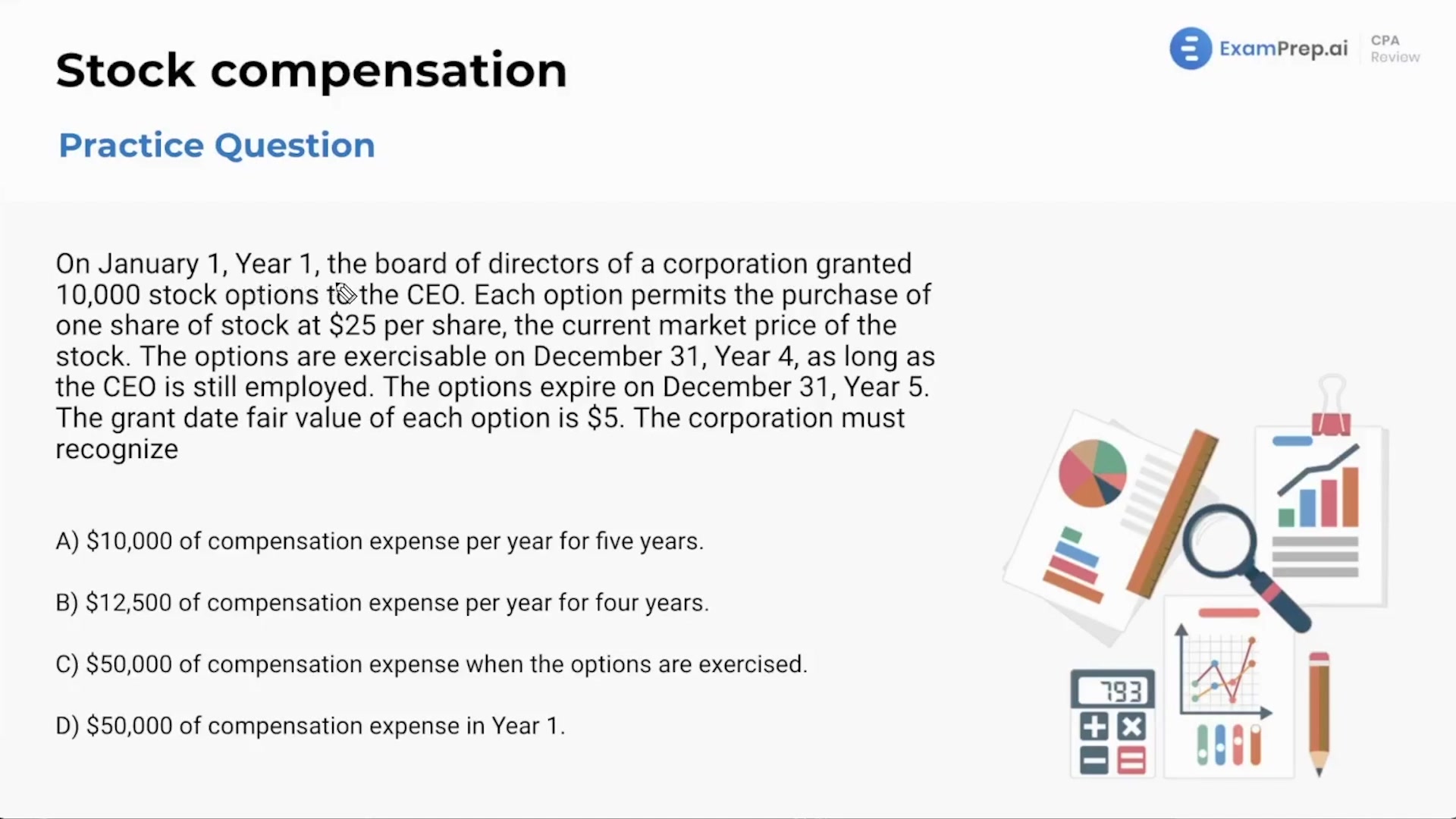

In this lesson, Nick Palazzolo, CPA, dives into the intricacies of stock compensation accounting, taking on practice questions that bring clarity to real-world scenarios involving equity payments to employees. He kicks off by dissecting how companies measure the cost of services paid for with equity interests like stock options, detailing important dates such as the grant date, vesting date, and exercise date—and their significance in financial reporting. As the lesson progresses, Nick guides you step-by-step through calculations to determine the timing and amount of compensation expense that a company must recognize. He provides practical examples to illustrate how these financial events are represented in the books. The session concludes with Nick working out a detailed problem involving the grant of options to a CEO, cementing your understanding of how to apply these principles in practice.

This video and the rest on this topic are available with any paid plan.

See Pricing