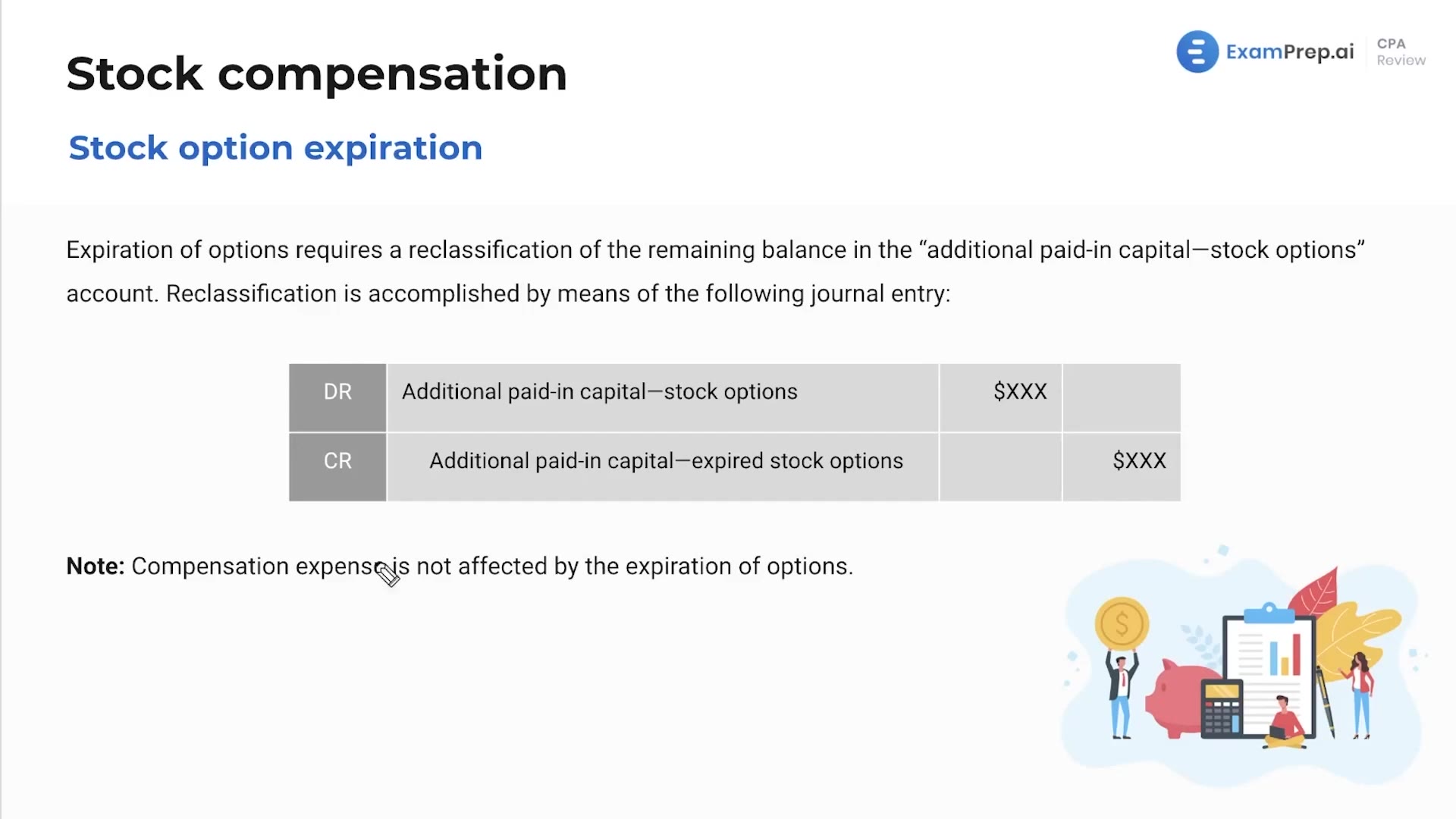

In this lesson, Nick Palazzolo, CPA, delves into the mechanics of stock option expiration, highlighting the financial reporting implications when stock options go unexercised. He details the specific journal entries needed to reclassify the remaining balance from additional paid-in capital to an expired stock options account. These entries are important for ensuring the financial statements accurately reflect the lapse of these options. Nick provides a clear example of this process, using hypothetical figures to illustrate adjustments in cases where only a portion of the options are exercised before expiration, reinforcing the concept that compensation expense remains unaffected due to it being retrospective in nature.

This video and the rest on this topic are available with any paid plan.

See Pricing