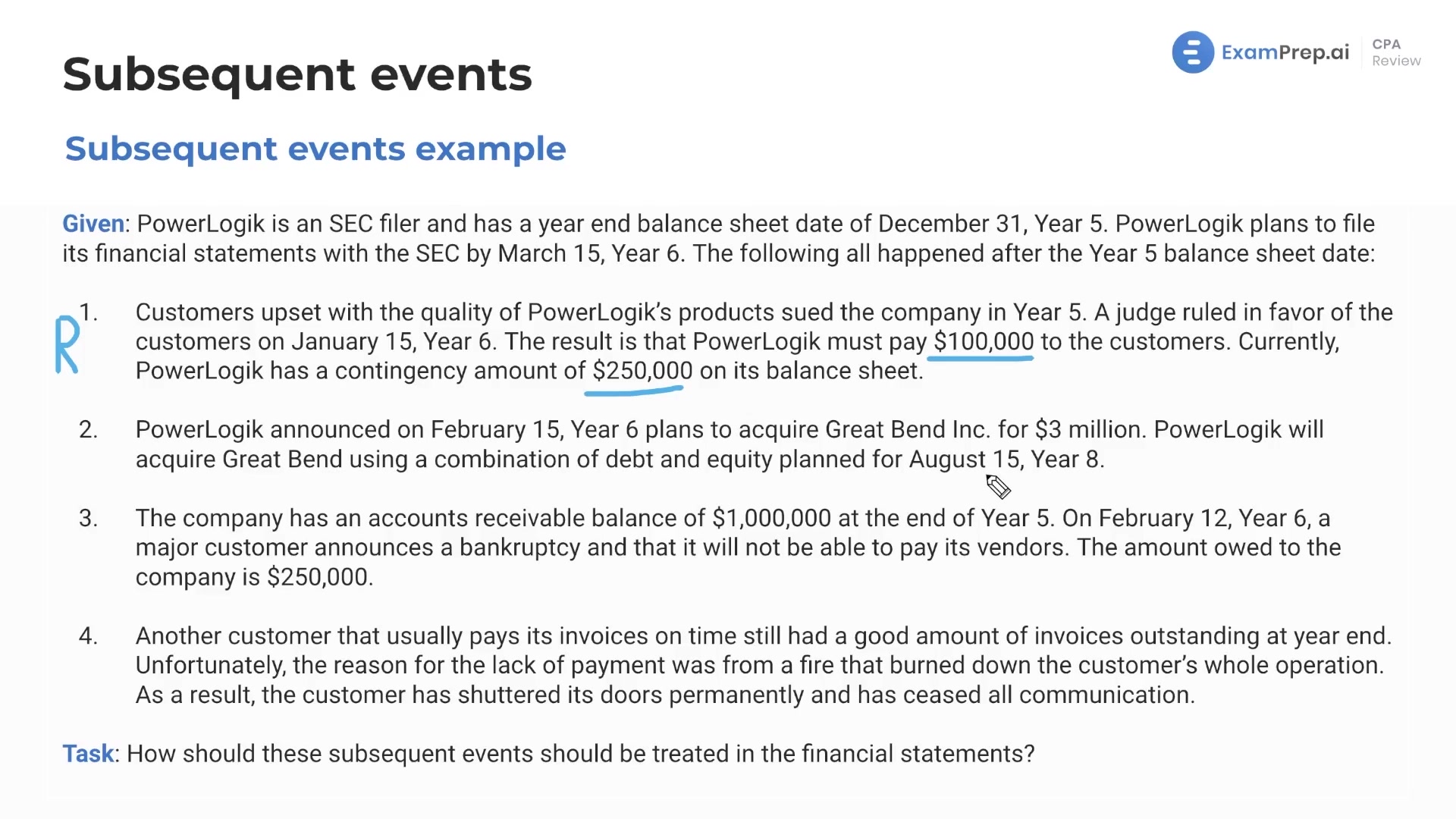

In this lesson, Nick Palazzolo, CPA, discusses the treatment of subsequent events in financial statements using the example of PowerLogic, an SEC filer with various events occurring after its balance sheet date. He explains how to determine whether events should be recorded, disclosed, or do nothing at all based on their relevance to the year under audit. Key examples include a lawsuit settlement, a planned acquisition, accounts receivable adjustments due to bankruptcy, and the impact of a customer's business closure due to a fire. Through these examples, viewers will gain a deeper understanding of how auditors examine subsequent events to ensure accurate financial statement reporting.

This video and the rest on this topic are available with any paid plan.

See Pricing