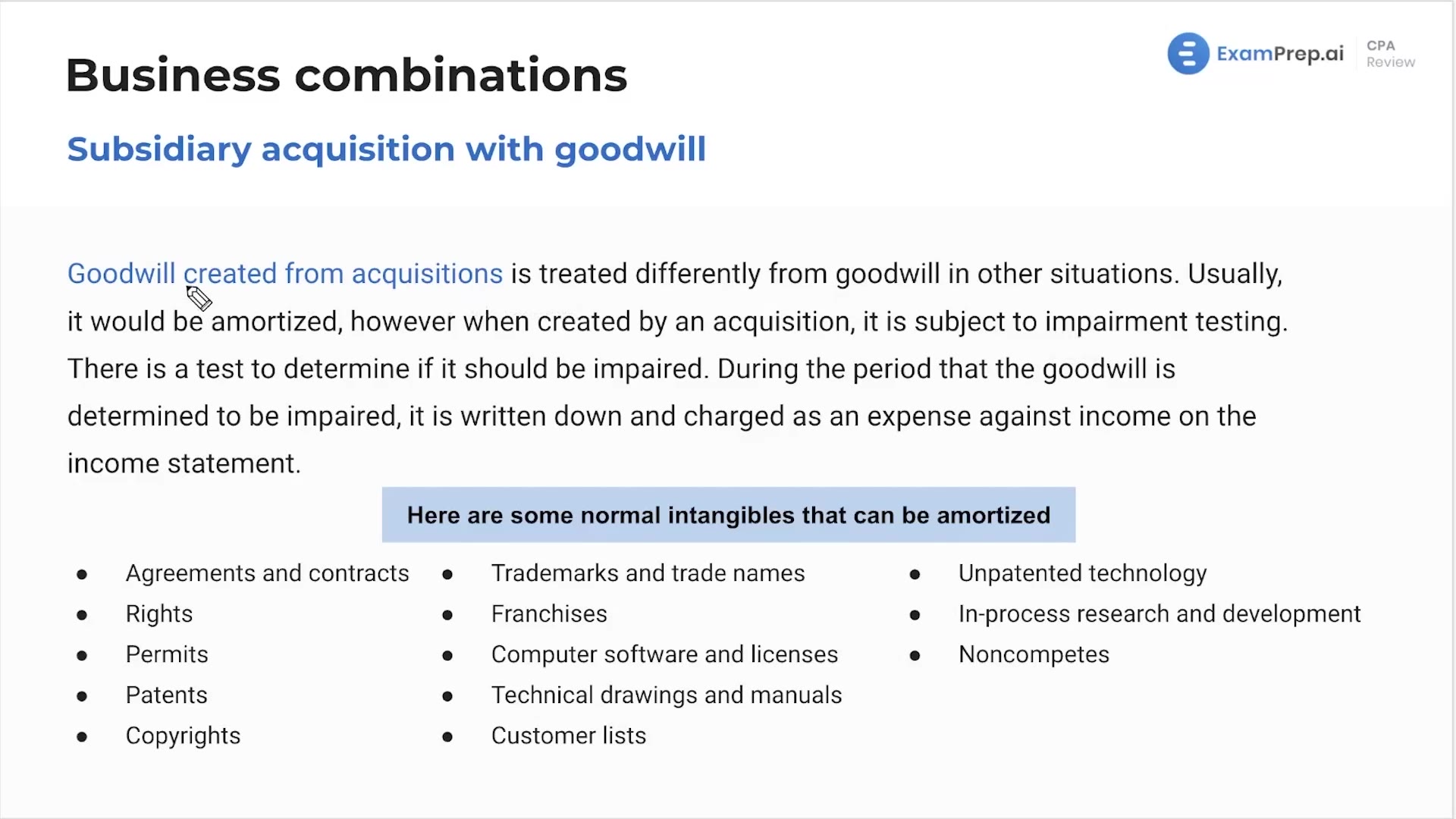

In this lesson, Nick Palazzolo, CPA, demystifies the process of accounting for goodwill during a subsidiary acquisition. He starts by outlining the necessity of revaluing the subsidiary's balance sheet items to fair value, which serves as a foundation for the subsequent allocation of acquisition costs. Key insights include the differences in treatment of goodwill generated from an acquisition as opposed to other scenarios—highlighting that while most intangible assets are subject to amortization, acquired goodwill undergoes impairment testing rather than amortization. Nick likens this to the way land is accounted for: not depreciated, but subject to impairment. The lesson ties these concepts together with a focus on the practical implications for the income statement when impairments are detected and recorded.

This video and the rest on this topic are available with any paid plan.

See Pricing