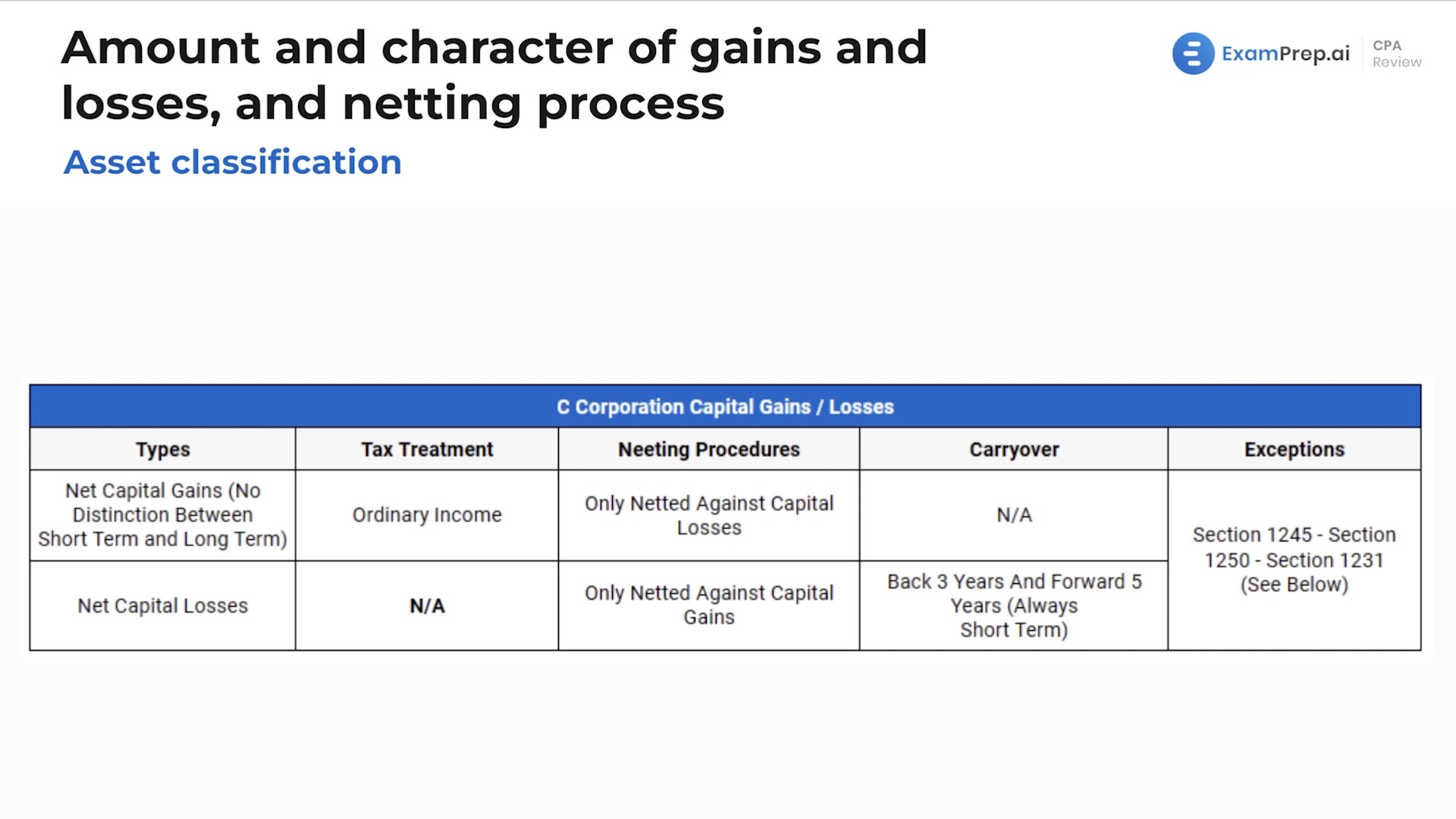

In this lesson, dive into the complexities of asset classification with a focus on capital gain section 1231 and how it applies to individuals and C-Corporations. Nick highlights the need for memorization using a variety of graphic aids to cement the concepts of tax treatment and rates for various types of gains or losses. As he walks you through the intricate rules surrounding asset classification, Nick offers reassurance about the daunting task of memorization by emphasizing its importance for exam success. He concludes by reminding everyone that while it may seem overwhelming at first, understanding these classifications plays a crucial role in mastering the material necessary for the CPA exam.

This video and the rest on this topic are available with any paid plan.

See Pricing