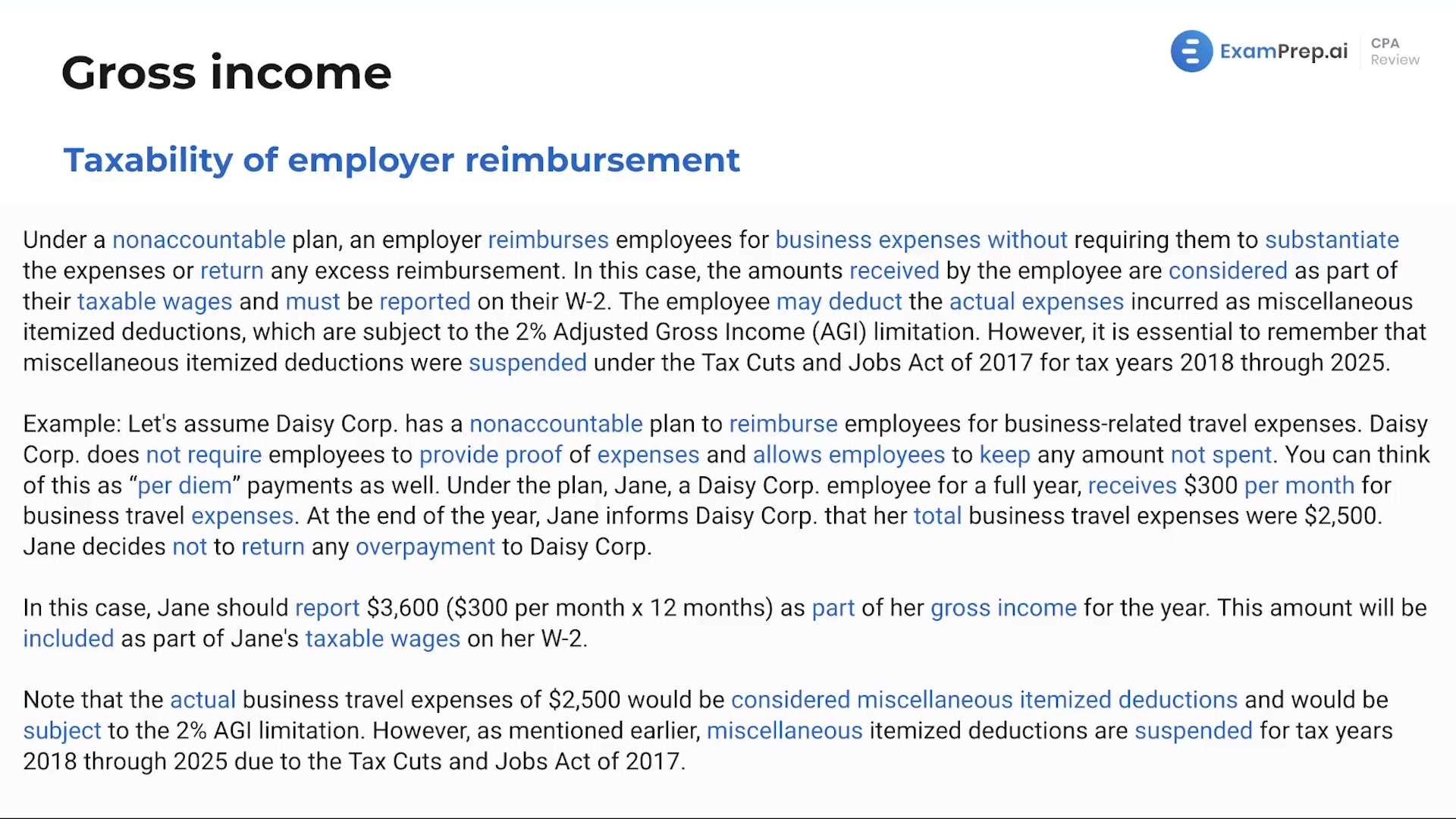

In this lesson, delve into the nuances of employer reimbursement and the implications it holds for employees' taxable income. Nick lays out the distinction between non-accountable plans, where employees aren't required to substantiate or return their business expense reimbursements, and accountable plans, which offer different tax treatments. He clarifies the taxability of reimbursements under non-accountable plans, highlighting that they are included in the employee's wages on Form W-2 and subject to various payroll taxes. Nick also revisits historical tax code changes, explaining how the suspension of miscellaneous itemized deductions from 2018 through 2025 alters the benefits of non-accountable plans. He supplements the discussion with relatable examples to illustrate how these reimbursements are reported as income, and offers practical tips on interpreting Form W-2 for both real-world application and exam preparation.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free