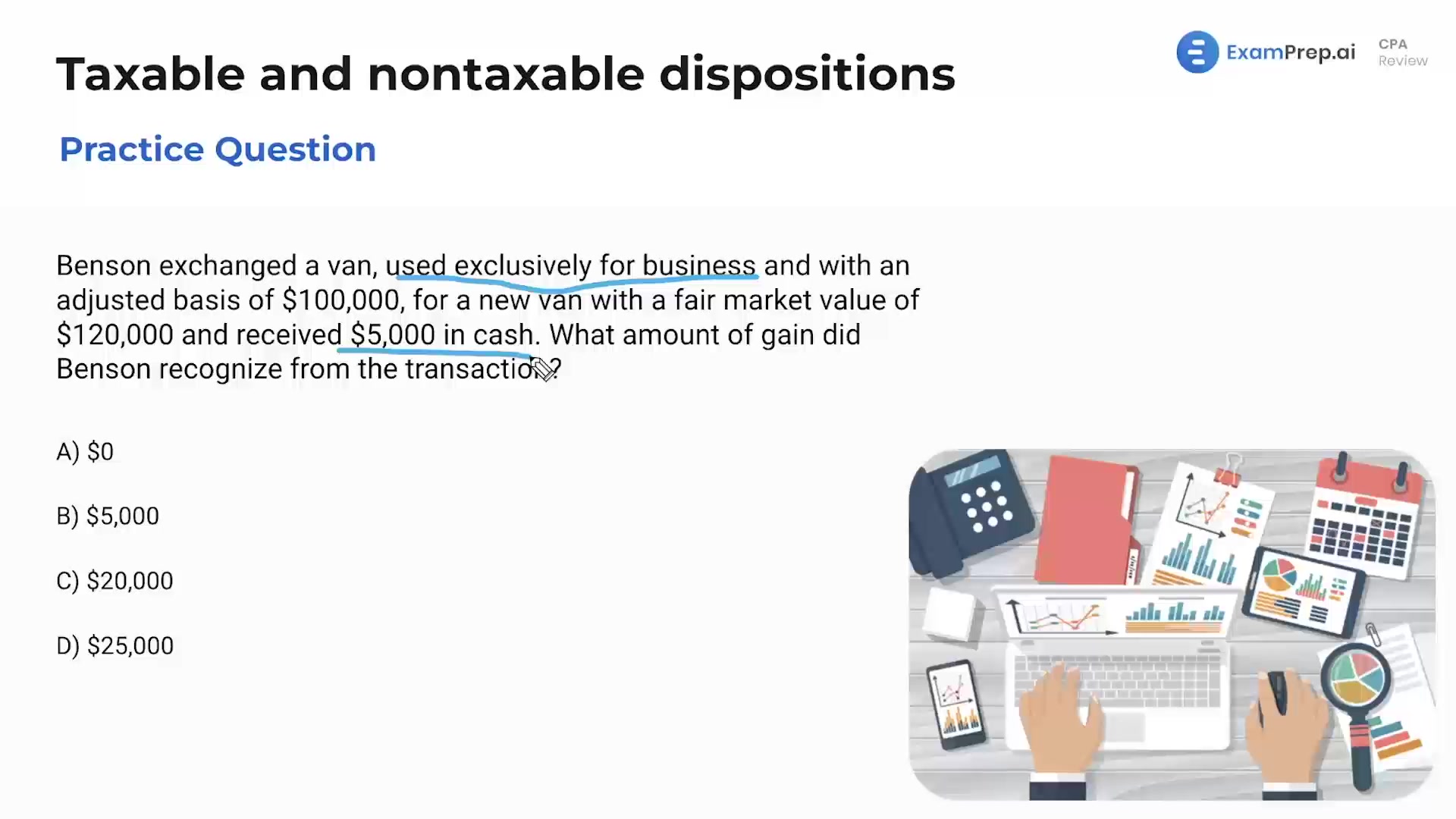

In this lesson, Nick Palazzolo, CPA, delves into the nuances of taxable and non-taxable dispositions through a series of engaging practice questions. He breaks down the criteria for like-kind exchanges with a focus on real property, shedding light on how to distinguish between eligible and ineligible assets for such transactions. Nick also intricately explains the concept of "boot" in like-kind exchanges, clarifying how it impacts the recognition of gain and the new basis of exchanged assets. His practical approach not only reinforces the underlying principles but also sharpens problem-solving skills with thought-provoking examples that are key for mastering this area of tax regulation.

This video and the rest on this topic are available with any paid plan.

See Pricing