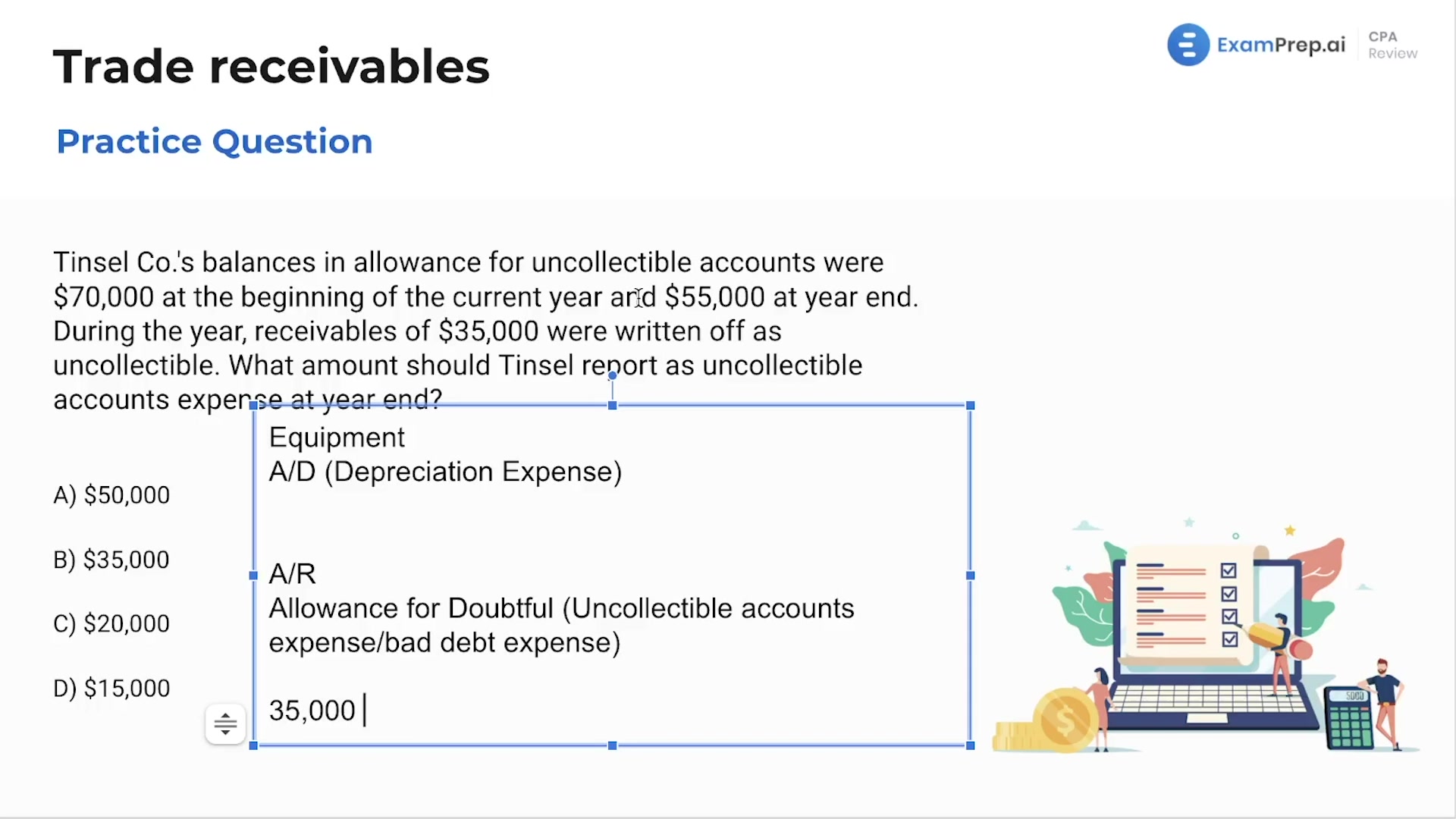

In this lesson, Nick Palazzolo, CPA, tackles multiple choice questions on trade receivables, providing a straightforward walkthrough on how to address uncollectible accounts expense calculations. He explains the role of the allowance for uncollectible accounts as a contra account and demonstrates how to figure out the adjustments needed when receivables are written off, utilizing an engaging question-and-answer format to reinforce the concept. Nick also delves into the allowance method of recognizing bad debt expense, clearly distinguishing situations that would lead to a decrease in the allowance. This practice-focused approach injects confidence and clarity into tackling trade receivables questions, ensuring ready application of these principles to exam-style problems.

This video and the rest on this topic are available with any paid plan.

See Pricing