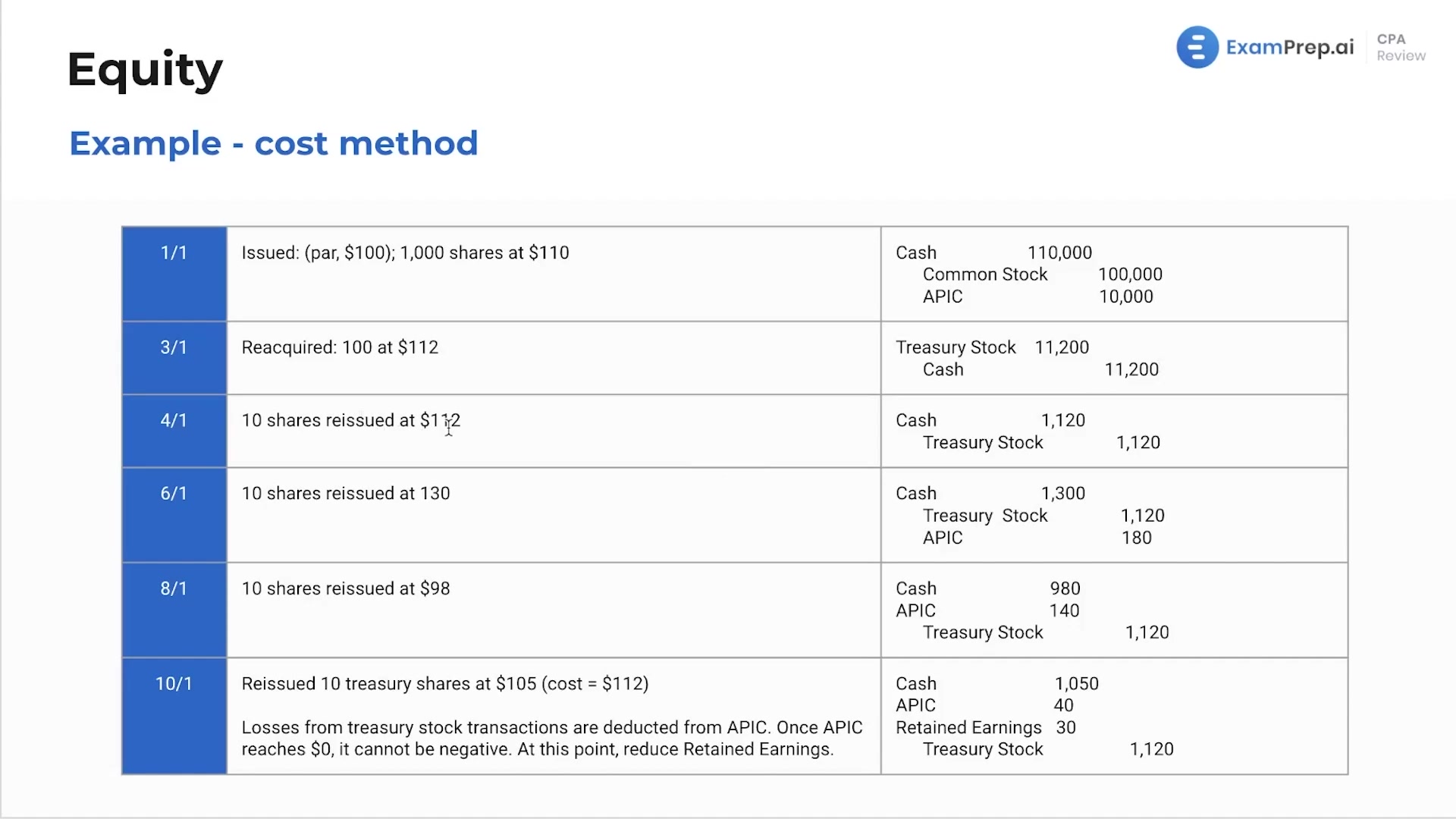

In this lesson, Nick Palazzolo, CPA, breaks down the treasury stock transactions using the cost method in a clear and practical way. Step into the accounting process as he illustrates how to handle the repurchase and reissuance of treasury stock, effectively demystifying the journal entries associated with these actions. With real-life examples from Harrison Company, Nick clarifies the initial transaction steps, from issuing stock above par value to the reacquisition and subsequent impact on additional paid-in capital (APIC) and retained earnings. Throughout the lesson, he shares valuable insights, including why APIC cannot go negative and the treatment of losses when they occur. This lesson is a must-watch to grasp the nuances of equity transactions and their implications on a company's financial statements.

This video and the rest on this topic are available with any paid plan.

See Pricing