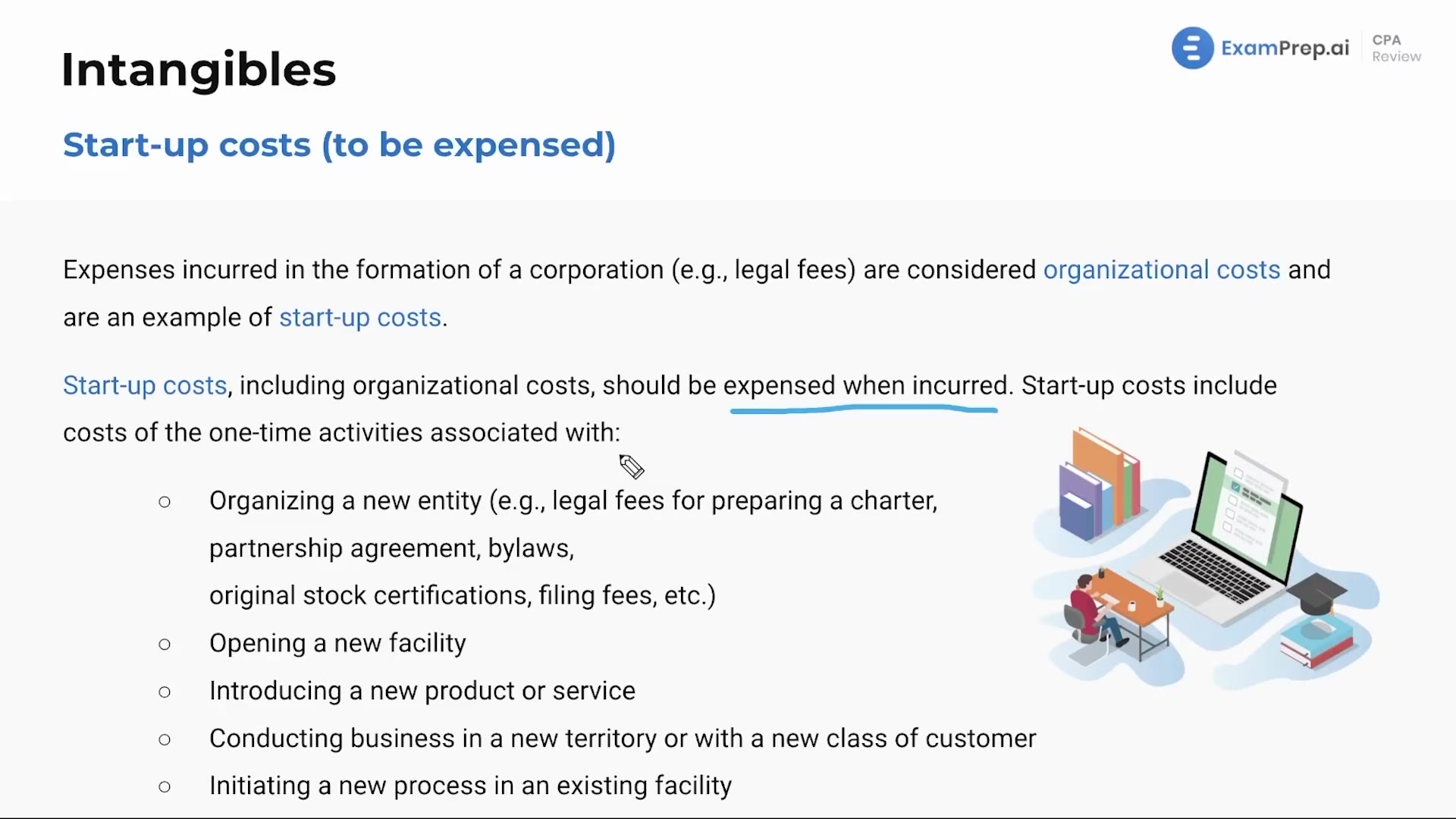

In this lesson, Nick Palazzolo, CPA, delves into the complexities of startup costs and their accounting treatment under Generally Accepted Accounting Principles (GAAP). He details the nuances of distinguishing between different types of startup expenses, such as legal and accounting fees, and highlights the contrast in handling these costs for tax purposes versus financial reporting. Nick articulates the criteria for expensing these costs upon incurrence, touching upon the beneficial impact this treatment has on financial statements. He walks through various examples of startup costs, from organizing a new entity to introducing a new product line, emphasizing the straightforward approach of expensing these costs under GAAP, as opposed to the more complex tax regulations.

This video and the rest on this topic are available with any paid plan.

See Pricing