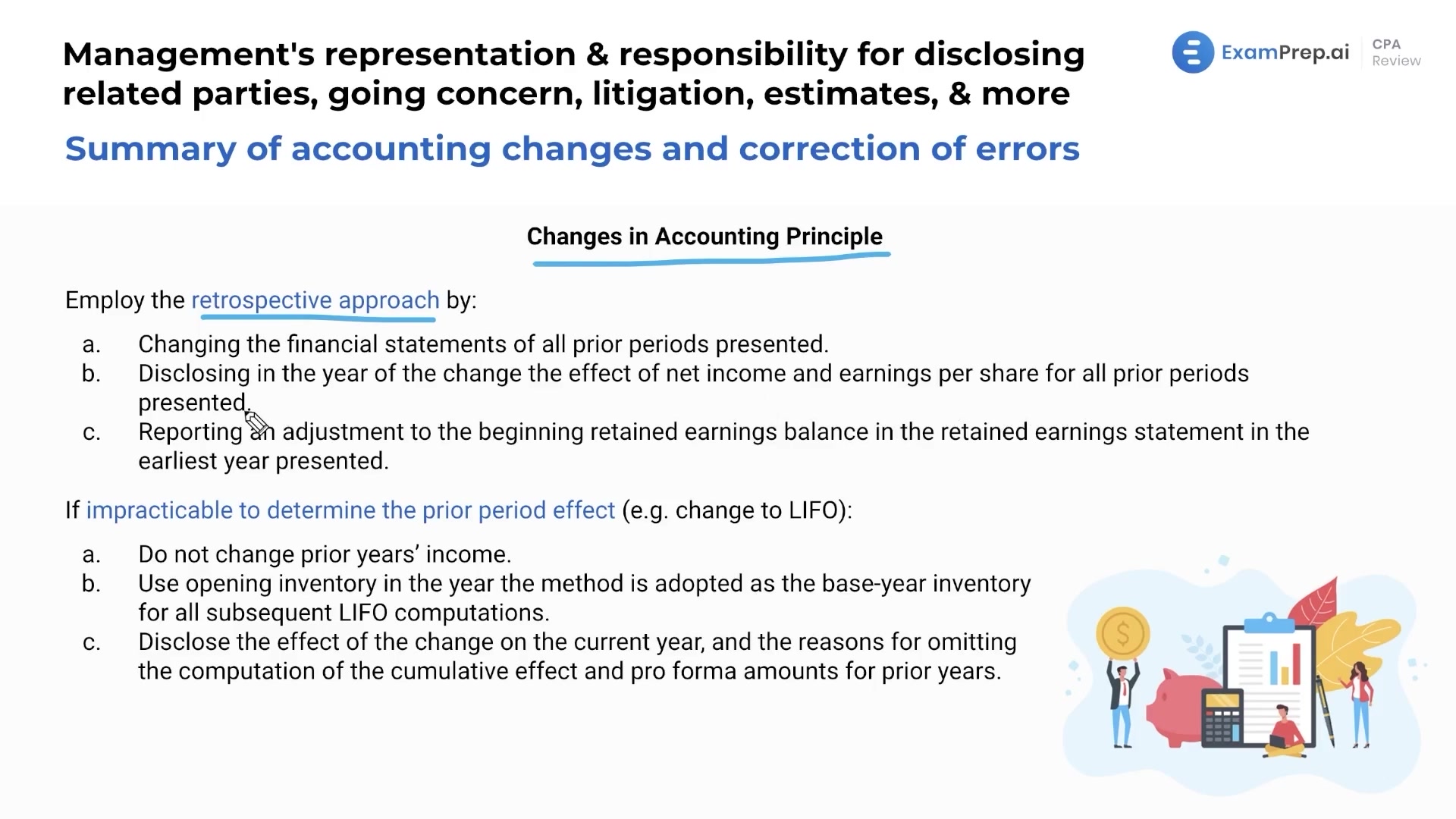

This lesson delves into types of accounting errors that auditors should search for when examining financial statements. These errors include changes from a non-GAAP acceptable accounting policy to an acceptable one, calculation errors, estimates made without proper due diligence or good faith, not accruing or deferring expenses or revenues, improper usage of facts, and improper or incorrect classification. Nick Palazzolo, CPA, discusses the steps for correcting these accounting errors and highlights the importance of ensuring that retained earnings are accurately stated. Furthermore, the lesson covers changes in accounting principles, estimates, and reporting entities, as well as the consequences of impractical situations when determining the prior period effect.

This video and the rest on this topic are available with any paid plan.

See Pricing