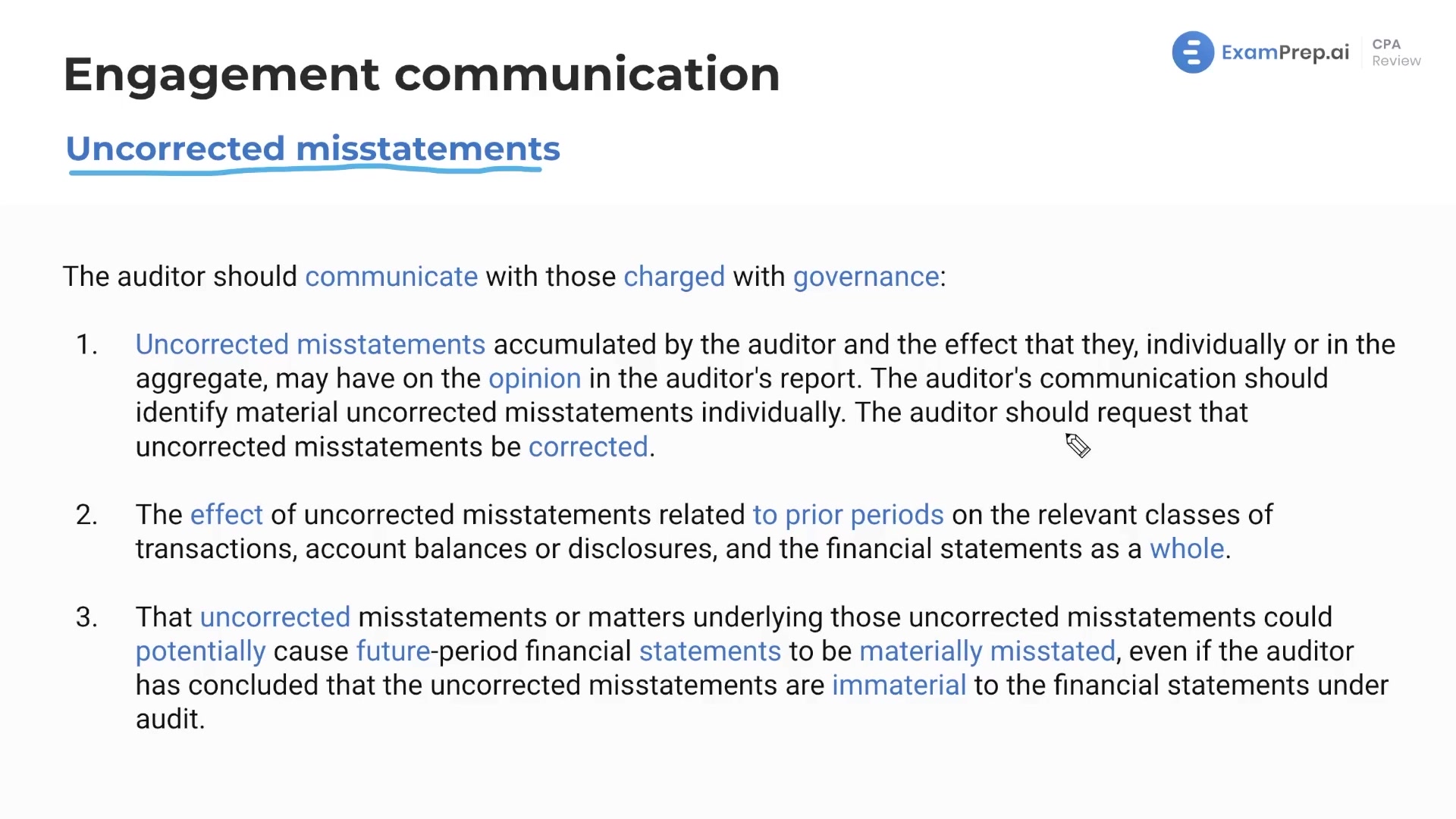

In this lesson, Nick Palazzolo, CPA, discusses the auditor's obligations regarding uncorrected misstatements found during an audit. He explains the two possible scenarios where management might not correct a misstatement and the importance of assessing whether these misstatements are material. Nick further emphasizes the importance of the auditor's communication, identifying material uncorrected misstatements individually, and requesting their correction. Moreover, the lesson covers the consequences of uncorrected misstatements on prior periods and potential future implications, and how the auditor should communicate these aspects, regardless of whether these misstatements are immaterial for the current year's financial statements.

This video and the rest on this topic are available with any paid plan.

See Pricing