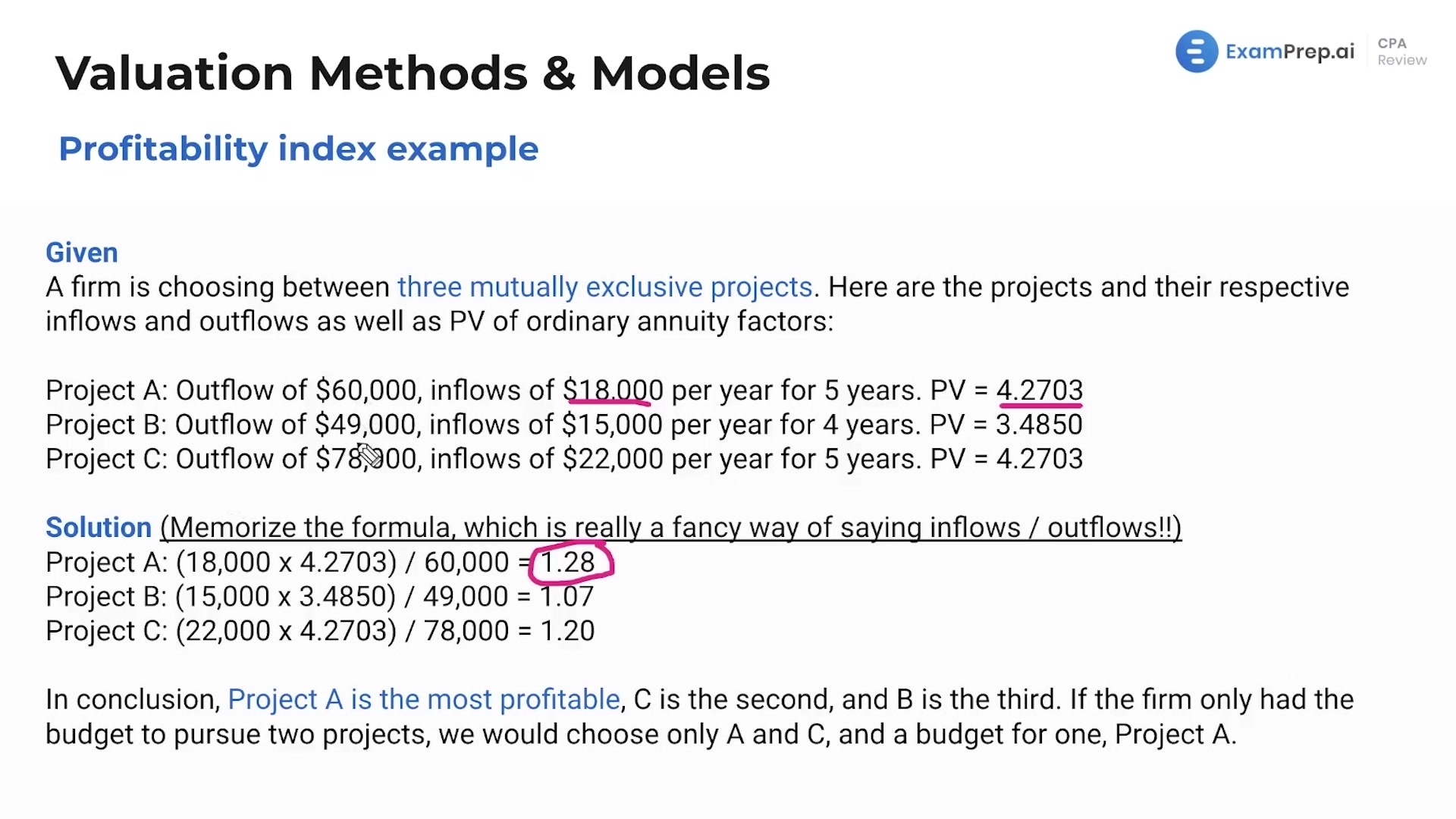

In this lesson, dive into the intricacies of valuation decision formulas as Nick Palazzolo, CPA, takes a deep dive into the profitability index and payback periods. With a dynamic and practical approach, Nick breaks down the concept of cash inflows and outflows and explains how businesses use these formulas to evaluate the potential profitability of an investment. He lays out how to compute the profitability index, use it for capital rationing, and rank investment projects based on their anticipated returns. Further, Nick simplifies the concept of the payback period by illustrating how businesses measure the time it will take to recoup their initial investment. This engaging discussion of financial decision-making tools offers insights into the subtle differences between various investment appraisal methods and how to select the most profitable projects under capital constraints.

This video and the rest on this topic are available with any paid plan.

See Pricing