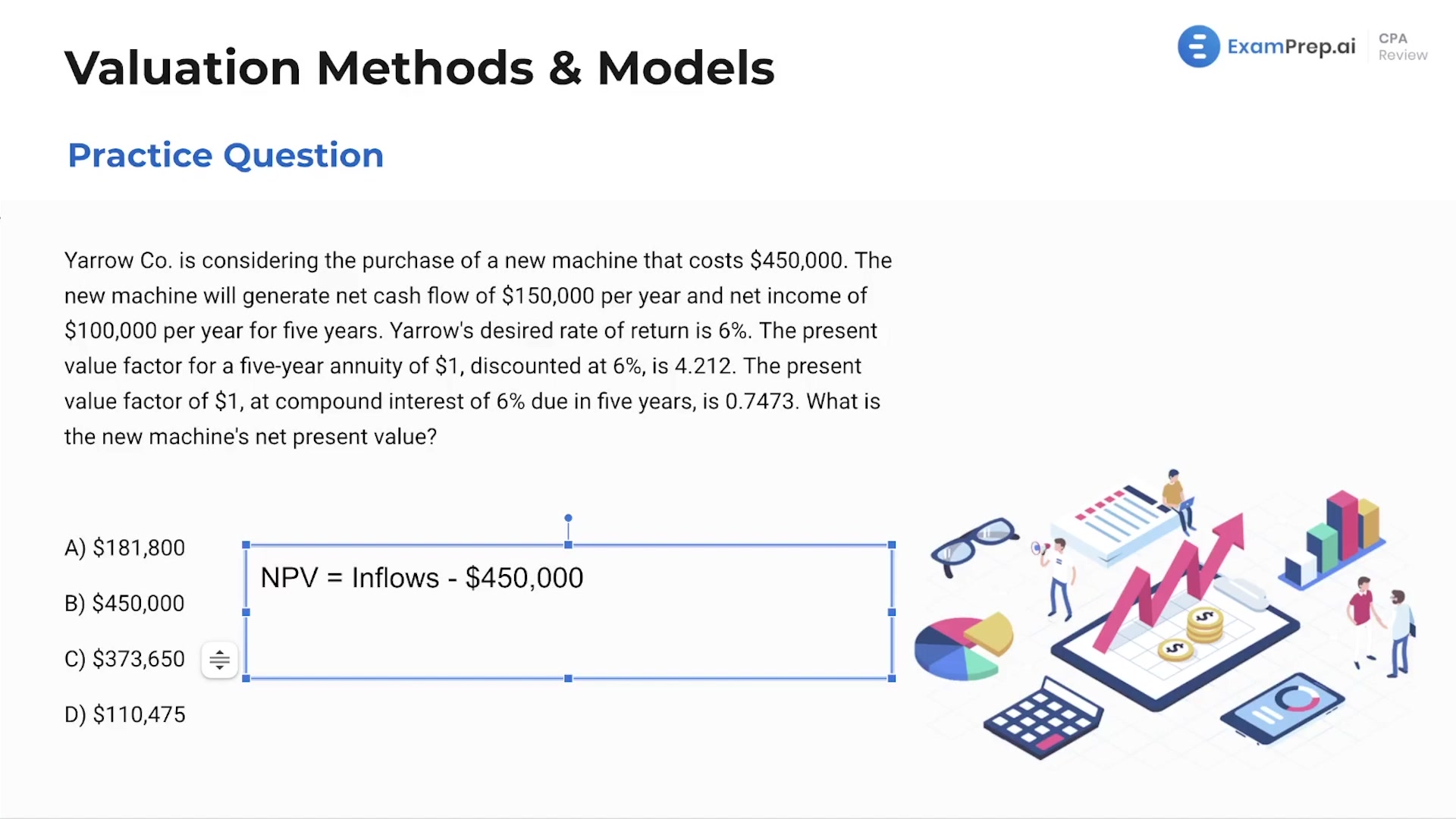

In this lesson, Nick Palazzolo, CPA, takes a practical approach to understanding valuation methods and models through multiple choice questions, demystifying concepts like CAPM, market risk premium, and equity risk premium. By discussing the distinctions between market return and the risk-free rate, Nick conveys the essence of the market risk premium in an engaging manner, using examples that clarify its relation to investments. Moreover, he elucidates the principles of net present value and internal rate of return, underlining their roles in evaluating potential projects. Through the breakdown of complex formulas into comprehensible elements, this lesson helps to shed light on the critical decisions faced when assessing the viability of investments, preparing viewers for similar questions they might encounter.

This video and the rest on this topic are available with any paid plan.

See Pricing