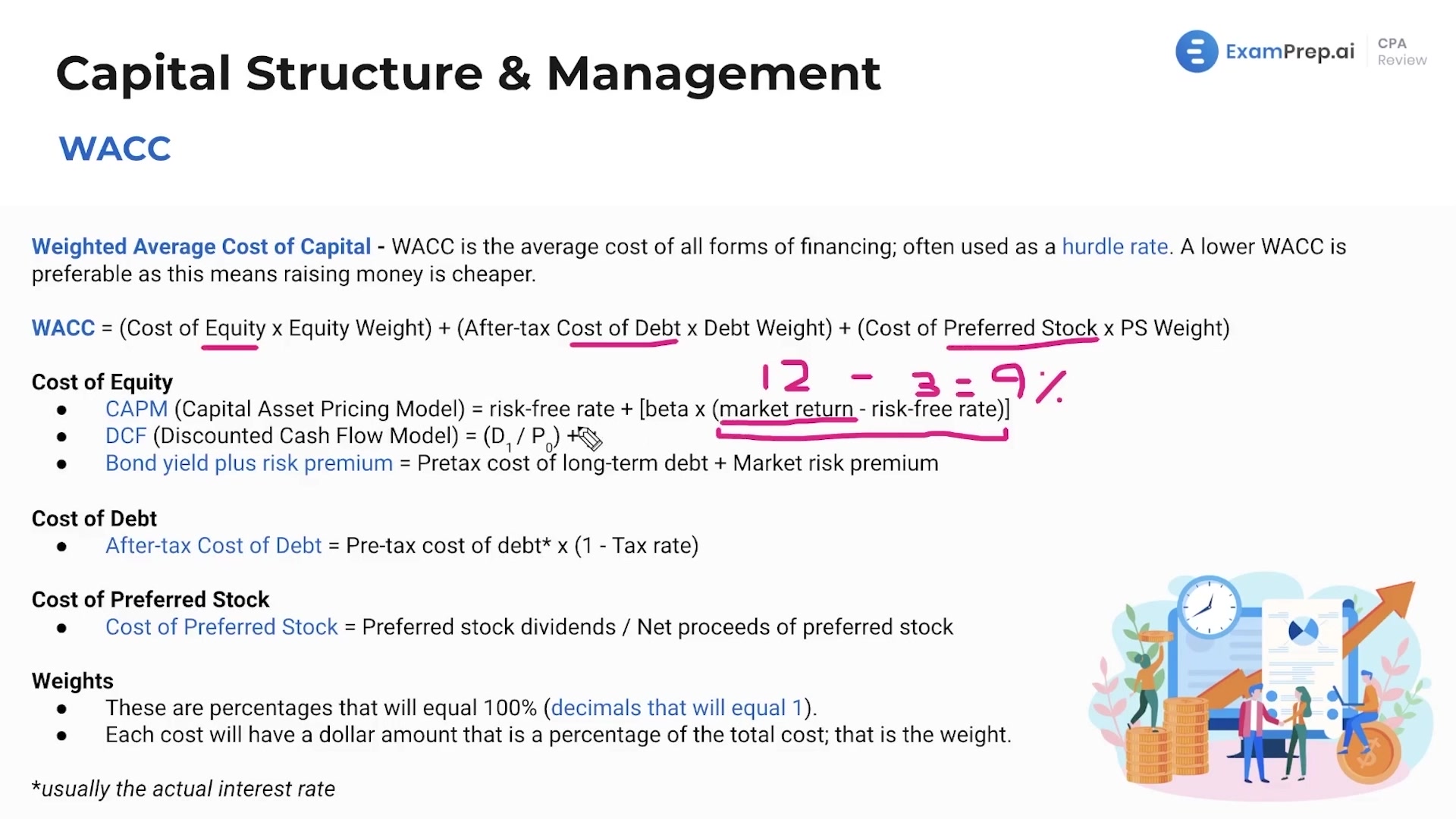

In this lesson, Nick Palazzolo, CPA, breaks down the concept of weighted averages and how they apply to the calculation of the Weighted Average Cost of Capital (WACC). With a relatable example involving test scores from various cities, Nick illustrates the difference between a normal average and a weighted average, setting the scene for understanding the WACC's components. He proceeds to explain the importance of WACC as a hurdle rate, detailing how it represents the average cost of financing from equity, debt, and preferred stock. Nick also clarifies how costs of these capital components are weighted and why a lower WACC is beneficial. This engaging and practical approach makes the underlying principles of WACC and its computation clear and accessible.

This video and the rest on this topic are available with any paid plan.

See Pricing