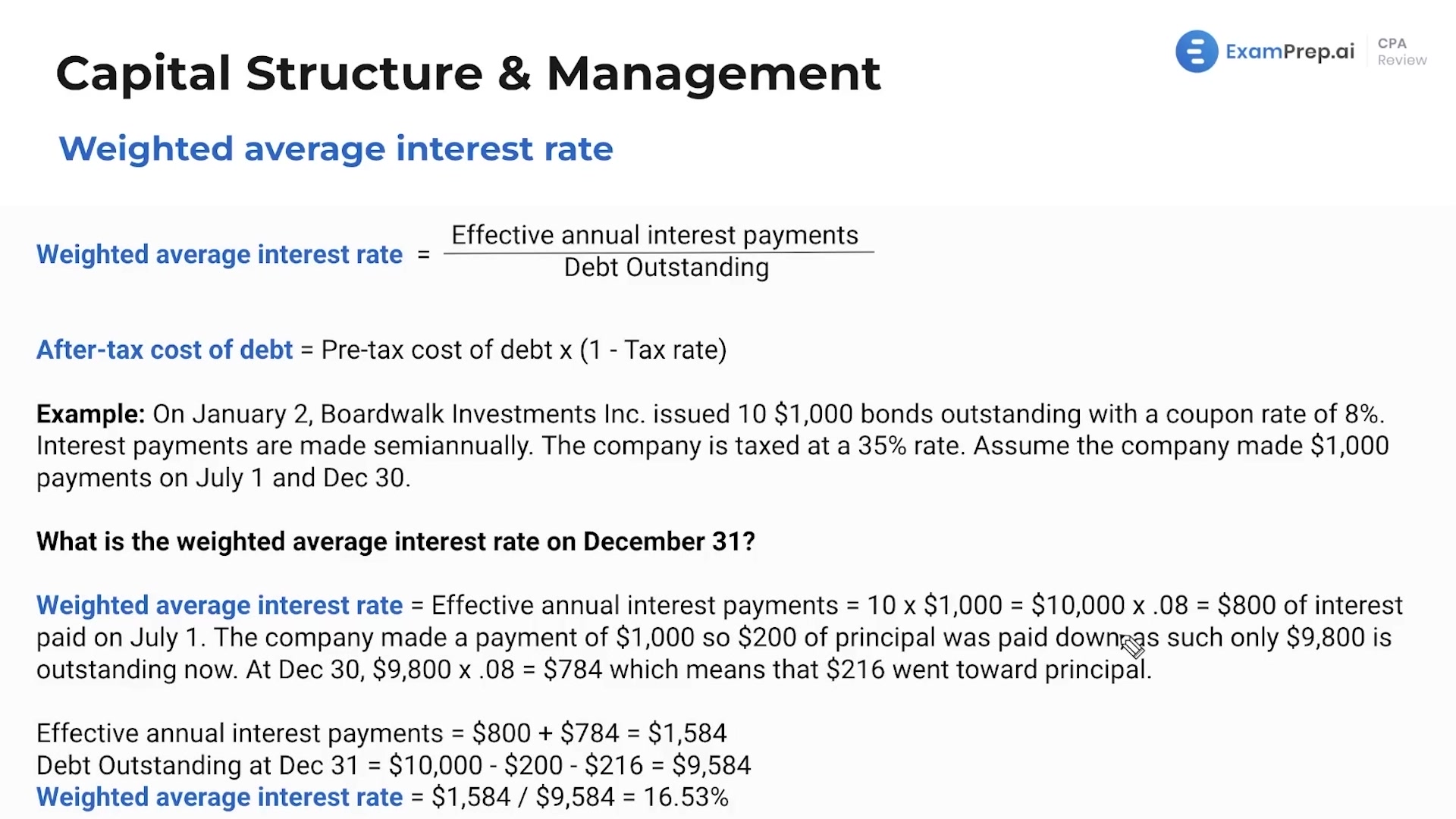

In this lesson, Nick Palazzolo, CPA, brings clarity to the calculation of the weighted average interest rate, an essential concept for understanding the cost of debt. Breaking down each step with a practical example, Nick illustrates how to determine effective annual interest payments using hypothetical bond scenarios. He provides insights into the nuances between interest expense and interest payable, and deciphers how payments towards interest and principal alter the outstanding debt balance over time. By the end of the session, you'll grasp how to calculate the weighted average interest rate and appreciate that it can differ from the stated coupon rate, equipping you with the knowledge to tackle related exam questions with confidence.

This video and the rest on this topic are available with any paid plan.

See Pricing