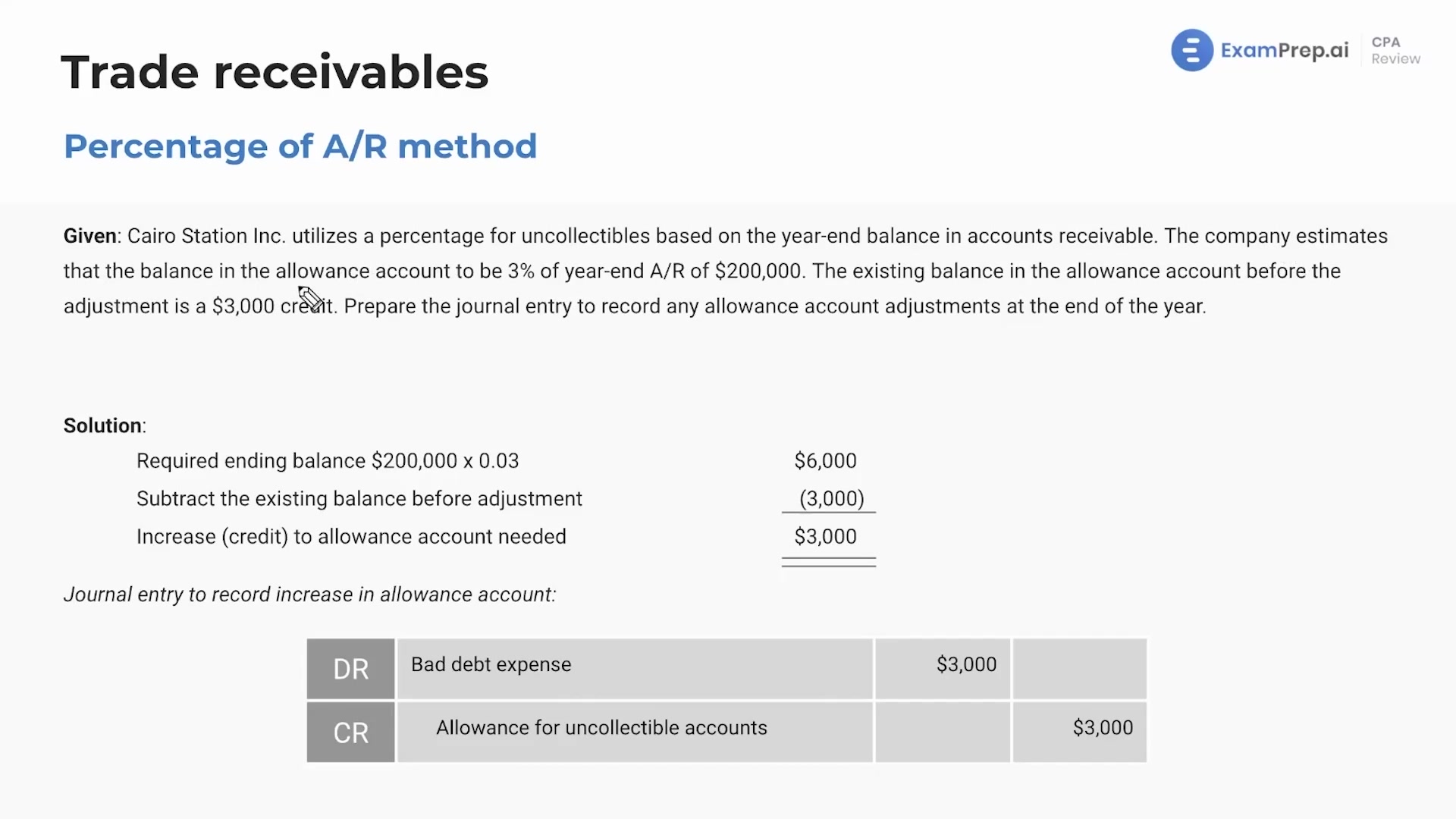

In this lesson, delve into the mechanics of accounts receivable and the intricacies of the direct write-off method versus the allowance method. Nick Palazzolo, CPA, uses a practical scenario involving Georgia Company to illustrate the immediate impact of writing off bad debt expenses, contrasting it with the allowance method's approach of adjusting the allowance for doubtful accounts. He explains the implications of this on the matching principle, as well as how to calculate and adjust the allowance for doubtful accounts using the percentage of accounts receivable method, drawing from another illustrative example with Cairo Station Inc. Throughout, Nick ensures that the process of managing uncollectible accounts is crystal clear, from adjusting ledger balances to understanding the financial statement effects.

This video and the rest on this topic are available with any paid plan.

See Pricing