Adjustments and Deductions to Arrive at Adjusted Gross Income and Taxable Income

Adjustments and deductions are critical elements in determining an individual's taxable income, involving alterations to gross income that can include contributions to retirement accounts, student loan interest, and specific educator expenses. Once these adjustments are made, the result is adjusted gross income (AGI), from which standard or itemized deductions are subtracted to compute the final taxable income on which income tax is based.

Lesson Videos

Adjustments and Deductions to Arrive at Adjusted Gross Income and Taxable Income Overview

Adjustments and Deductions to Arrive at Adjusted Gross Income and Taxable Income Overview

Introduction to Adjusted Gross Income and Taxable Income

Introduction to Adjusted Gross Income and Taxable Income

Above and Below the Line Items

Above and Below the Line Items

Tax Credits, Deductions, and Phase-outs

Tax Credits, Deductions, and Phase-outs

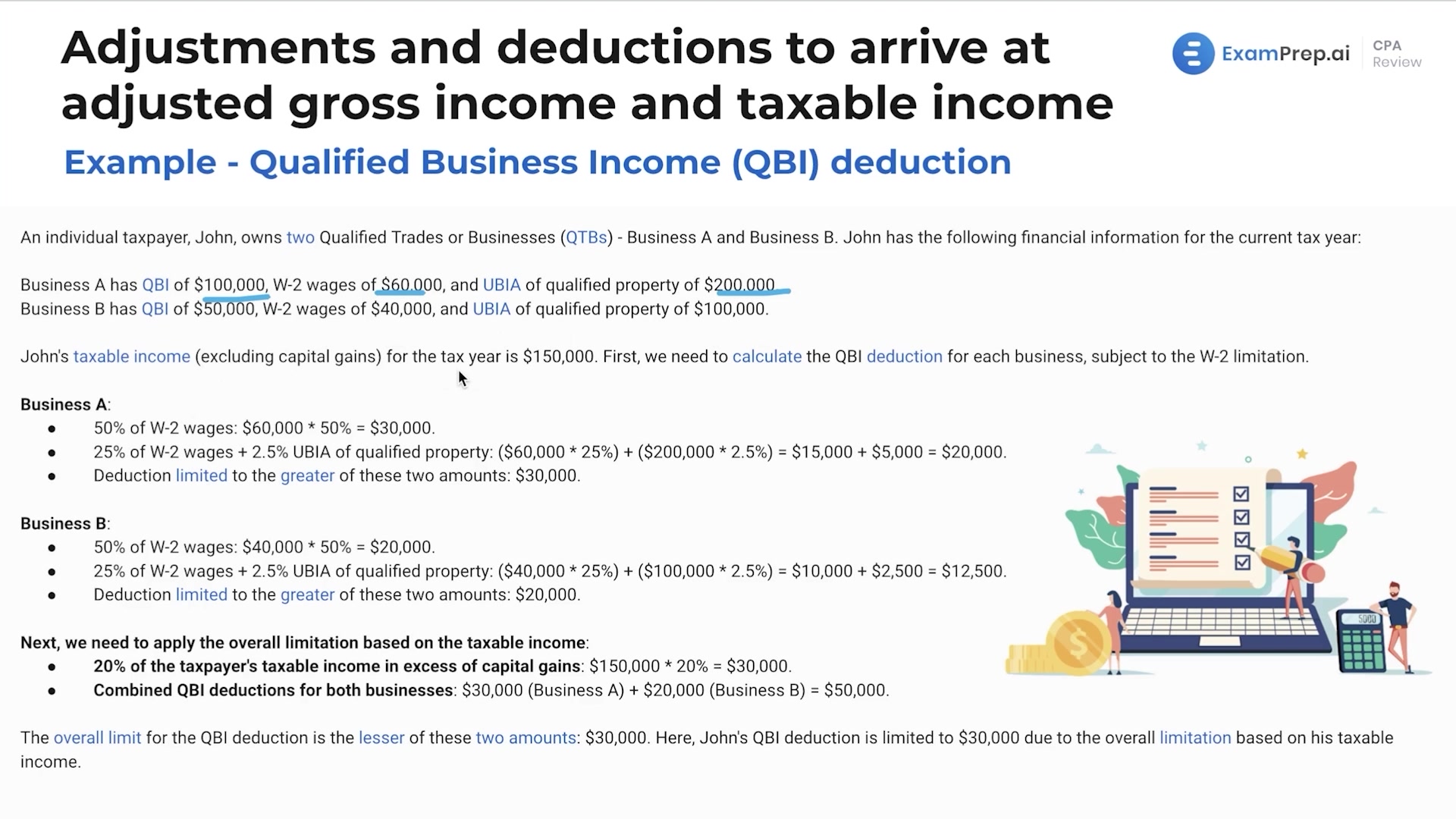

Qualified Business Income

Qualified Business Income

Adjusted Gross Income

Adjusted Gross Income

Alimony, Child Support, and Student Loan Interest Expense

Alimony, Child Support, and Student Loan Interest Expense

Individual Retirement Accounts

Individual Retirement Accounts

Health Savings Account

Health Savings Account

Self-Employment Retirement Accounts and Taxes

Self-Employment Retirement Accounts and Taxes

Penalty on Early Withdrawal of Savings

Penalty on Early Withdrawal of Savings

Itemized Deductions

Itemized Deductions

The Standard Deduction

The Standard Deduction

Tax Consequences of Home Ownership

Tax Consequences of Home Ownership

Net Investment Income Tax

Net Investment Income Tax

Kiddie Tax

Kiddie Tax

Adjustments and Deductions to Arrive at Adjusted Gross Income and Taxable Income Summary

Adjustments and Deductions to Arrive at Adjusted Gross Income and Taxable Income Summary

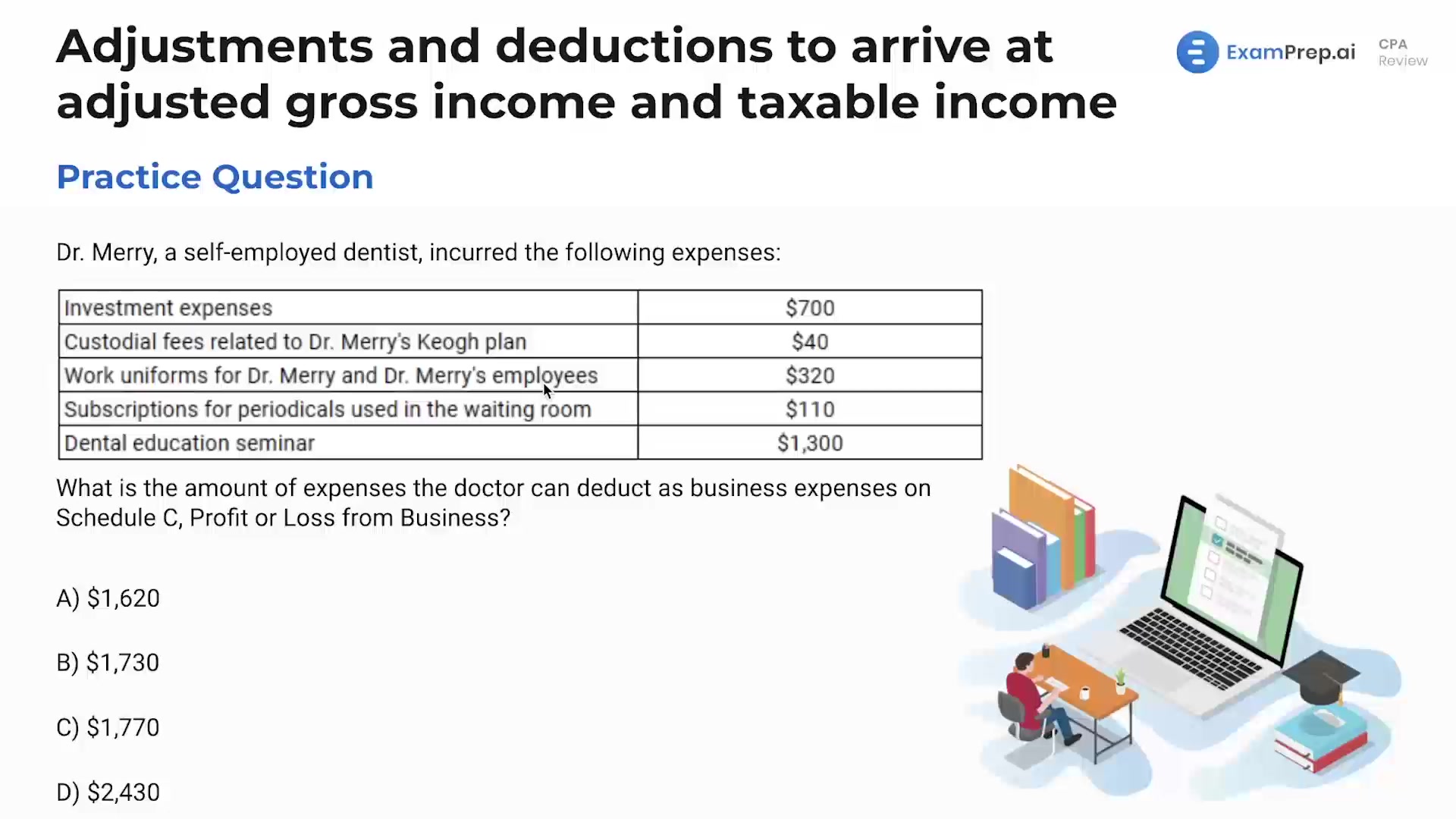

Adjustments and Deductions to Arrive at Adjusted Gross Income and Taxable Income - Practice Questions

Adjustments and Deductions to Arrive at Adjusted Gross Income and Taxable Income - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate