Basis and Holding Period of Assets

The basis of an asset is the value used for tax purposes to determine gain or loss upon sale or disposition, typically originating from the asset's cost with adjustments for improvements, depreciation, or amortization. The holding period refers to the length of time an asset is owned, which affects the classification of capital gains as short-term or long-term for tax implications, with long-term usually being applicable for assets held for more than a year.

Lesson Videos

Basis and Holding Period of Assets Overview

Basis and Holding Period of Assets Overview

Introduction to Basis and Holding Period of Assets

Introduction to Basis and Holding Period of Assets

Costs Included in a Asset's Taxable Basis

Costs Included in a Asset's Taxable Basis

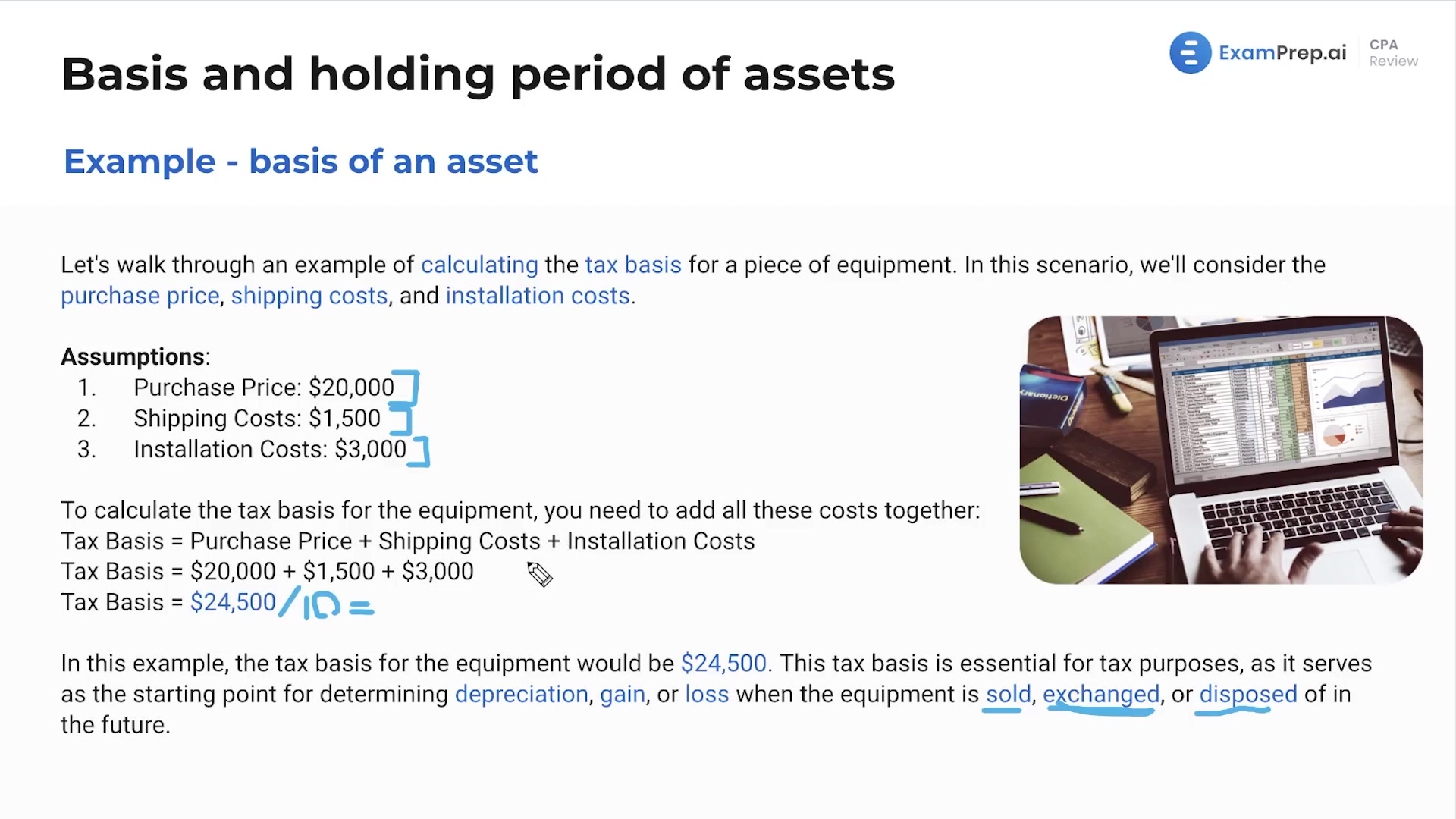

Examples of Calculating Tax Basis

Examples of Calculating Tax Basis

Holding Period of Purchased Property

Holding Period of Purchased Property

Adjusted Basis

Adjusted Basis

Gifted Property

Gifted Property

Inherited Property

Inherited Property

Capitalizing vs. Expensing Costs

Capitalizing vs. Expensing Costs

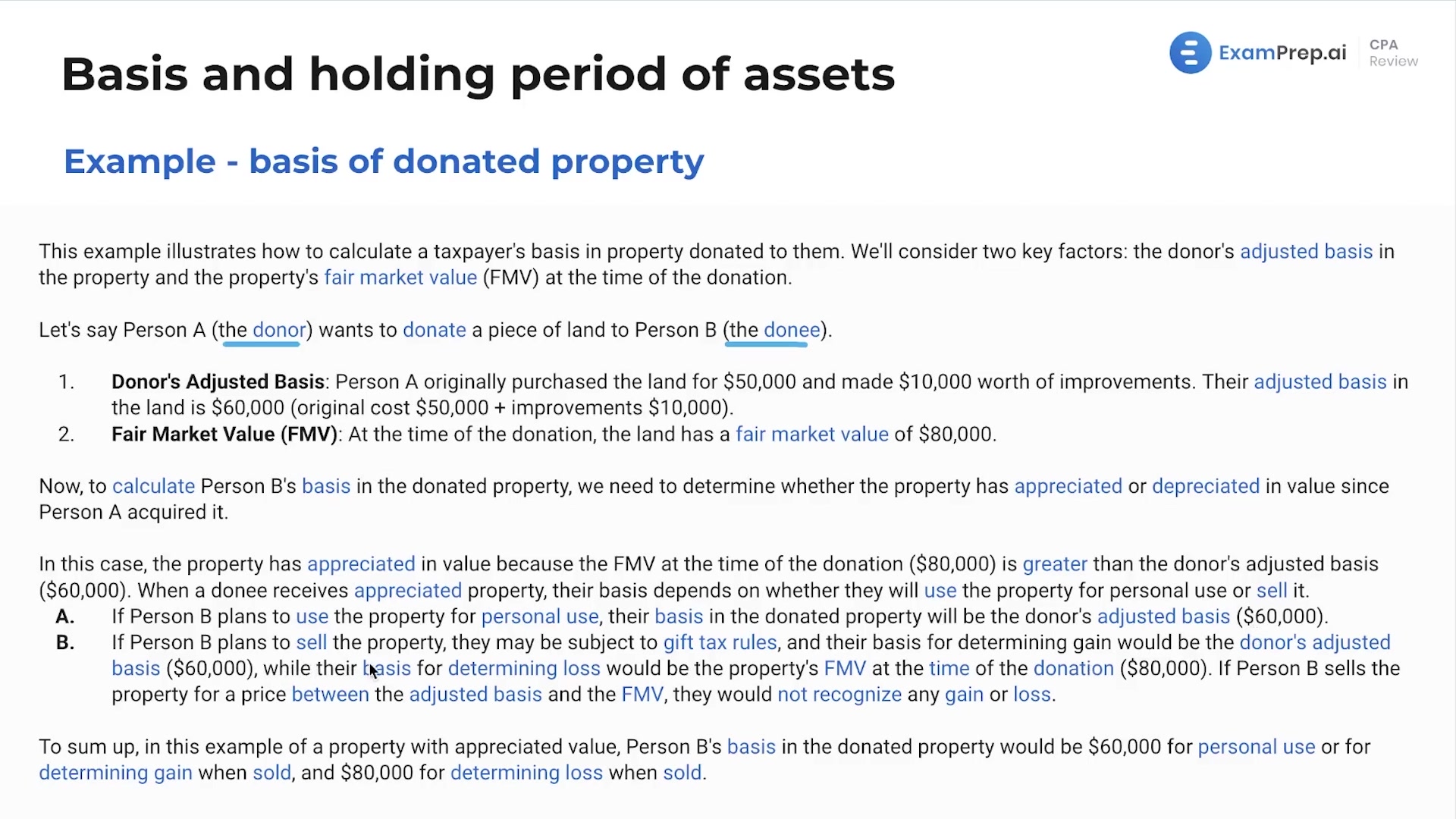

Basis of Donated Property

Basis of Donated Property

Basis and Holding Period of Assets Summary

Basis and Holding Period of Assets Summary

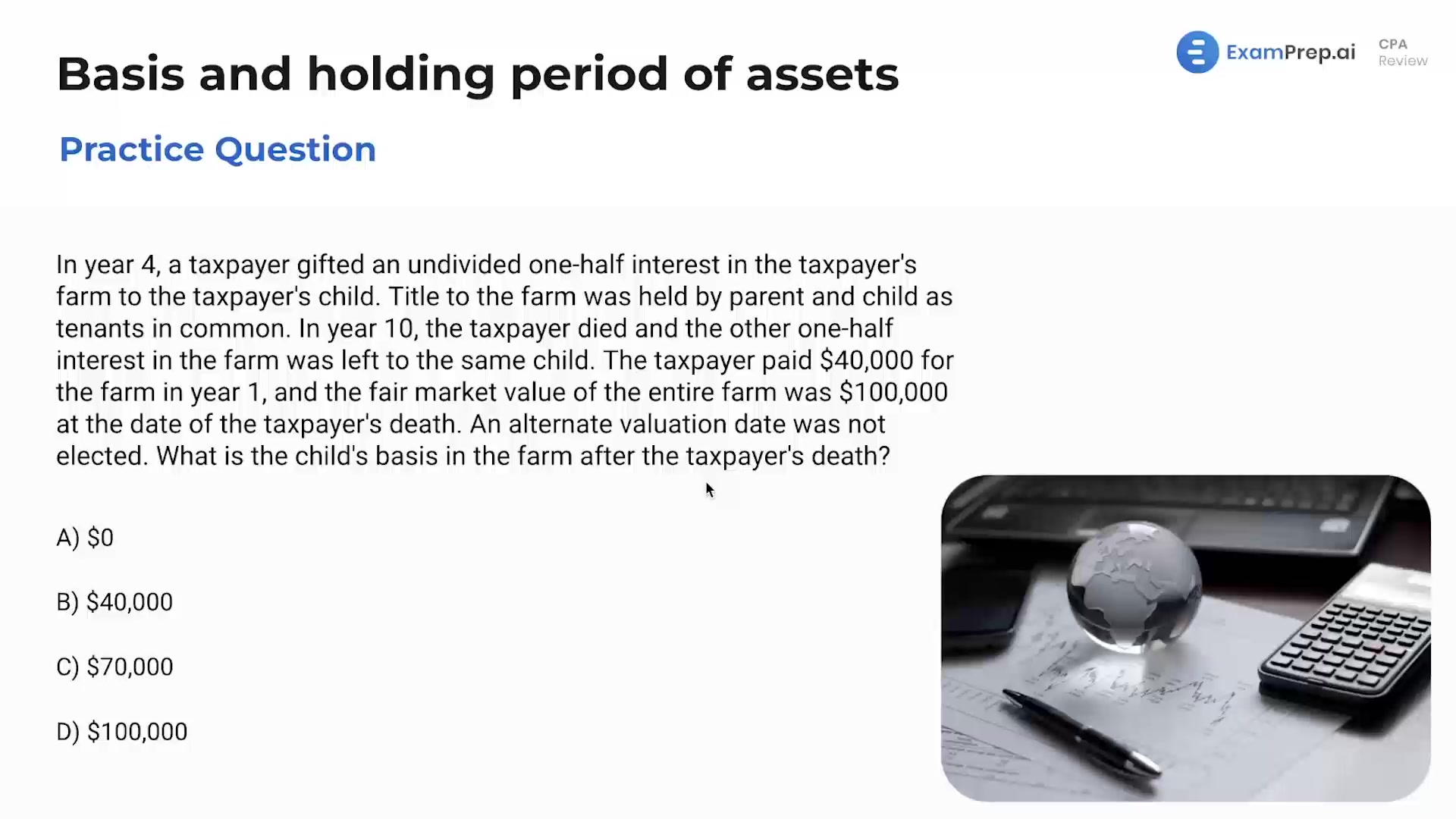

Basis and Holding Period of Assets - Practice Questions

Basis and Holding Period of Assets - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate