Business Structures

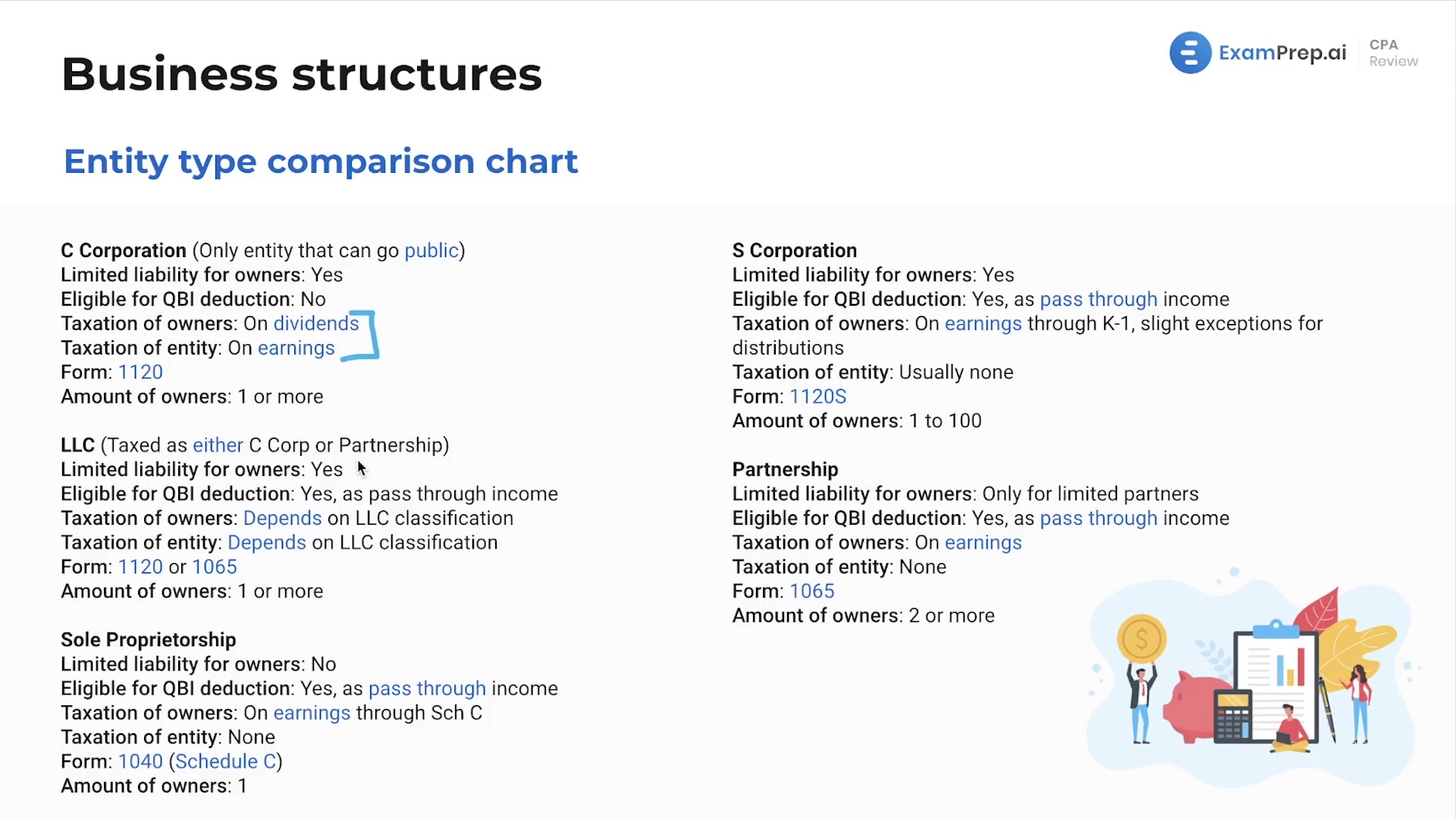

Business Structures refer to the legal configuration of organizations, which define the ownership, control, liability, and taxation for the entity. Common types include sole proprietorships, partnerships, corporations, and limited liability companies (LLCs), each with distinct legal and financial implications for owners and investors.

Lesson Videos

Business Structures Overview

Business Structures Overview

Introduction to Business Structures

Introduction to Business Structures

Entities Formed Without Filing

Entities Formed Without Filing

Sole Proprietorship Business Structure

Sole Proprietorship Business Structure

Types of Partnerships

Types of Partnerships

General Partnership Business Structure

General Partnership Business Structure

Termination of a General Partnership

Termination of a General Partnership

Joint Ventures

Joint Ventures

Limited and Limited Liability Partnerships

Limited and Limited Liability Partnerships

Limited Liability Company

Limited Liability Company

C Corporation Business Structure

C Corporation Business Structure

C Corporation Characteristics

C Corporation Characteristics

Corporate Shareholders

Corporate Shareholders

Corporate Directors and Officers

Corporate Directors and Officers

Significant Changes and Termination of a Corporation

Significant Changes and Termination of a Corporation

Foreign Corporations

Foreign Corporations

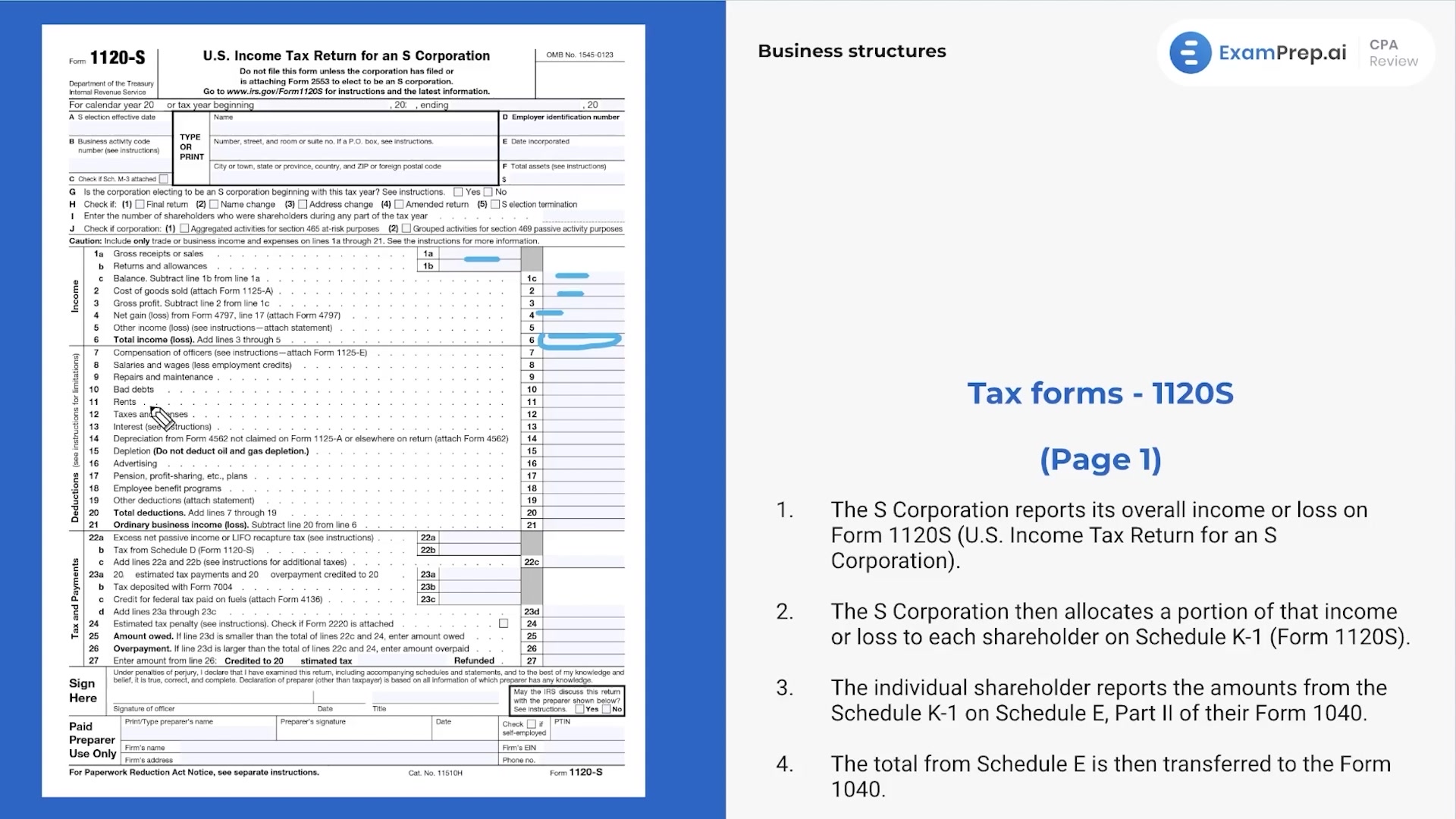

S Corporation

S Corporation

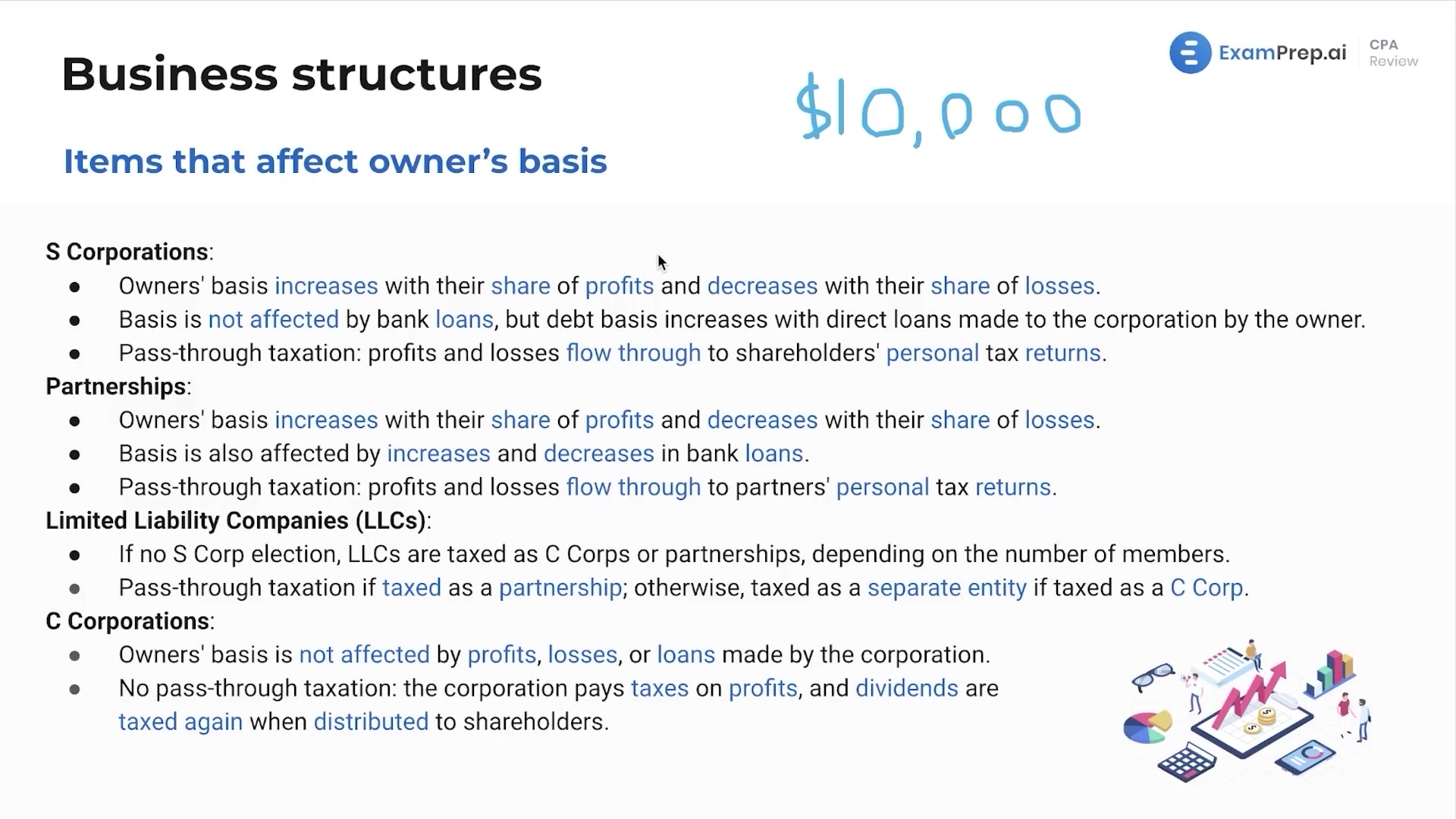

Comparison Between Business Entity Types

Comparison Between Business Entity Types

Business Structures Summary

Business Structures Summary

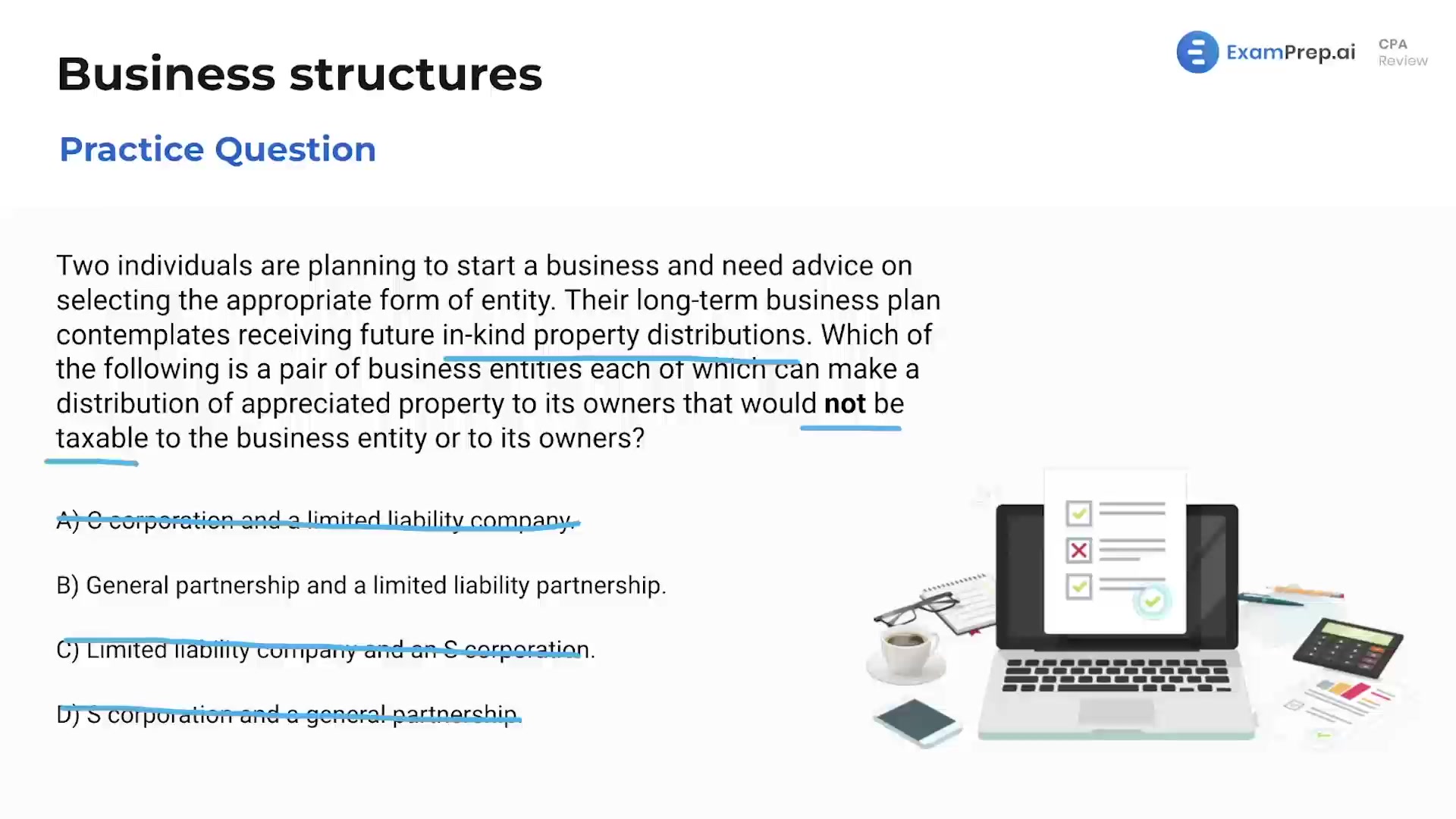

Business Structures - Practice Questions

Business Structures - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate