Common Law Duties and Liabilities to Clients and Third Parties

Common law duties and liabilities to clients and third parties encompass the obligations and potential legal responsibilities that accountants have towards their clients and any impacted third parties. These duties are typically derived from torts such as negligence or breach of contract and require accountants to exercise due care, fidelity, and good faith in the services they provide, while maintaining standards of performance to avoid legal repercussions from those who rely on their work.

Lesson Videos

Common Law Duties and Liabilities to Clients and Third Parties Overview

Common Law Duties and Liabilities to Clients and Third Parties Overview

Introduction to Common Law Duties and Liabilities to Clients and Third Parties

Introduction to Common Law Duties and Liabilities to Clients and Third Parties

Legal Liabilities of Tax Preparers

Legal Liabilities of Tax Preparers

Example of a Breach of Contract

Example of a Breach of Contract

Common Law Duties of Tax Preparers

Common Law Duties of Tax Preparers

Breach of Contract

Breach of Contract

Fraud and Constructive Fraud

Fraud and Constructive Fraud

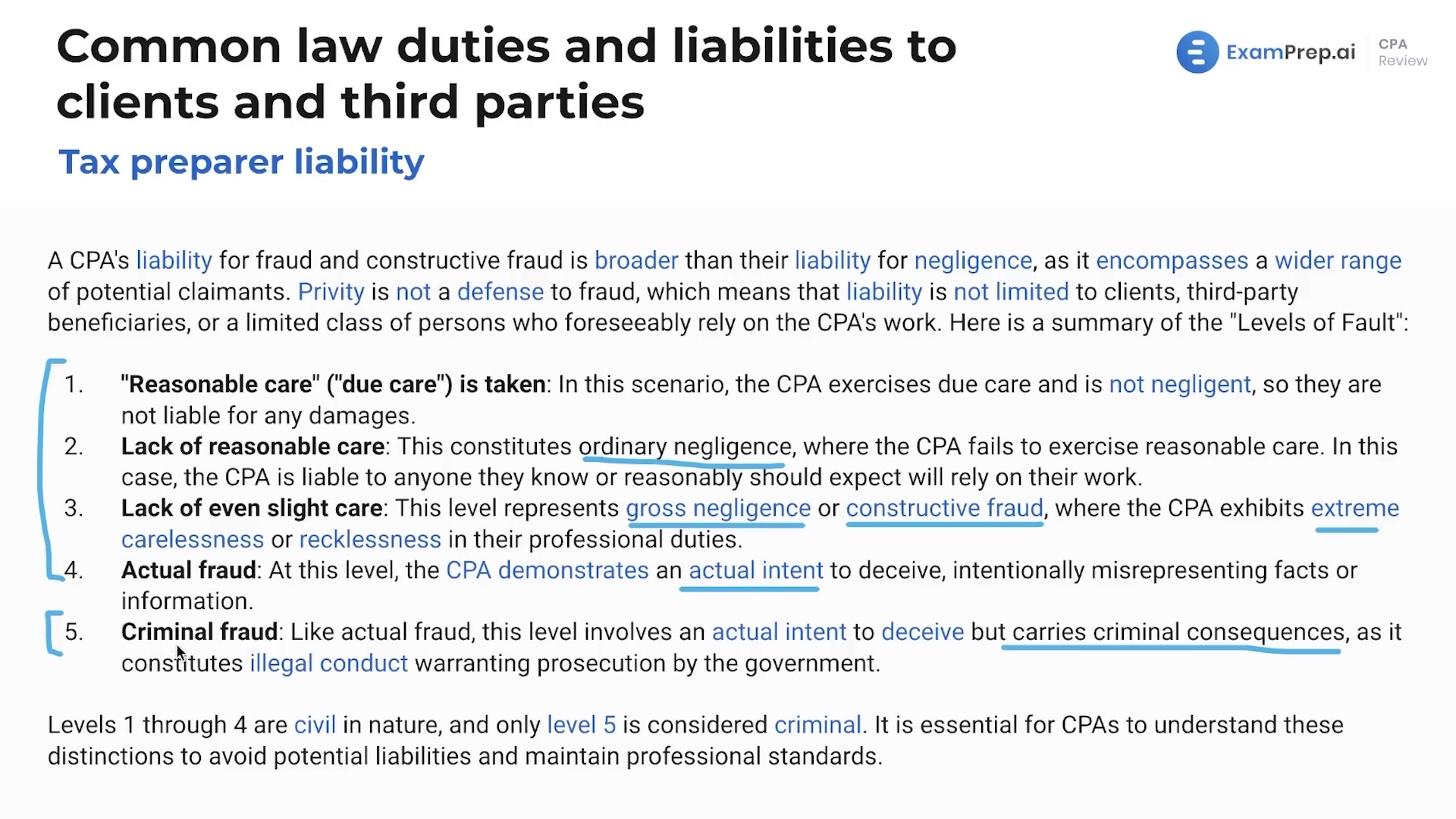

Tax Preparer Liability

Tax Preparer Liability

Damages Associated with Malpractice

Damages Associated with Malpractice

Privileged Communication in Tax Practice

Privileged Communication in Tax Practice

Accountant Workpapers

Accountant Workpapers

Penalties for Breach of Contract

Penalties for Breach of Contract

Client Disclosure

Client Disclosure

Common Law Duties and Liabilities to Clients and Third Parties Summary

Common Law Duties and Liabilities to Clients and Third Parties Summary

Common Law Duties and Liabilities to Clients and Third Parties - Practice Questions

Common Law Duties and Liabilities to Clients and Third Parties - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate