Compliance for Passive Activity and At-risk Loss Limitations

This scope encompasses the rules and regulations governing the limitations on the deductibility of losses from passive activities—where a taxpayer does not materially participate—and from investments or businesses where the taxpayer is considered at risk for an amount equal to the money and adjusted basis of property contributed to the activity. It involves understanding the restrictions in place to prevent inflated deductions and ensuring that losses claimed reflect legitimate economic activity to which the taxpayer is genuinely exposed to economic risk.

Lesson Videos

Passive Activity Losses & Loss Limitations Overview

Passive Activity Losses & Loss Limitations Overview

Introduction to Passive Activity Losses and Loss Limitations

Introduction to Passive Activity Losses and Loss Limitations

Recourse vs. Nonrecourse Liabilities

Recourse vs. Nonrecourse Liabilities

Tax Basis vs. At-Risk Basis

Tax Basis vs. At-Risk Basis

Types of Income

Types of Income

Capital Losses

Capital Losses

Passive Activity Losses and Limitations

Passive Activity Losses and Limitations

Passive Activity Losses & Loss Limitations Summary

Passive Activity Losses & Loss Limitations Summary

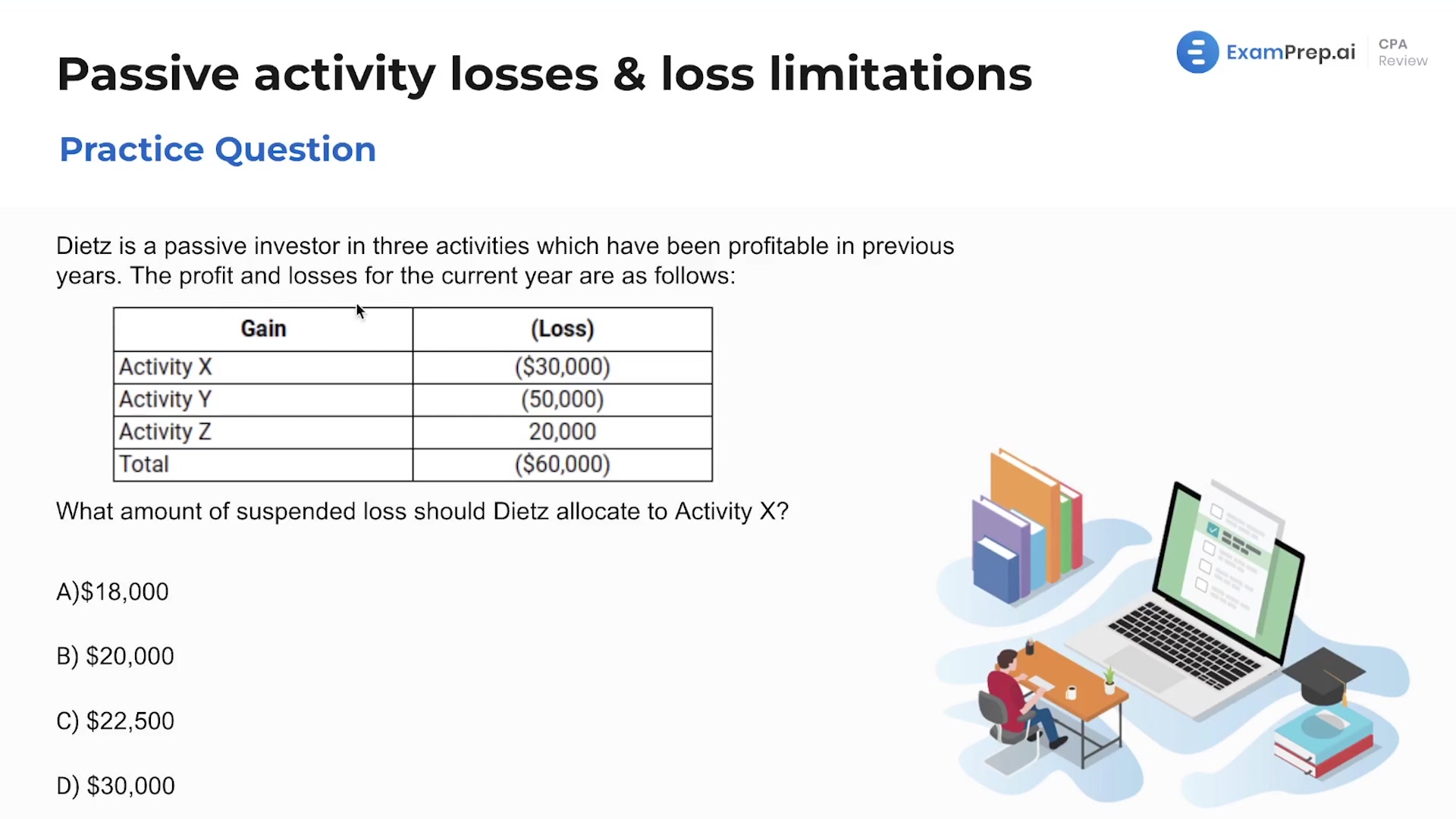

Passive Activity Losses & Loss Limitations - Practice Questions

Passive Activity Losses & Loss Limitations - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate