Consolidated Tax Returns

Consolidated tax returns are corporate income tax filings made by a group of affiliated companies that engage in a complete or partial pooling of their resources and report their combined taxable incomes and deductions as one entity. This method allows for the offsetting of losses of one company against the profits of another within the group, potentially resulting in a reduction of the overall tax liability.

Lesson Videos

Corporations: Consolidated Tax Returns Overview

Corporations: Consolidated Tax Returns Overview

Introduction to Consolidated Tax Returns

Introduction to Consolidated Tax Returns

Entities Not Able to File a Consolidated Return

Entities Not Able to File a Consolidated Return

Requirements for Affiliated Groups

Requirements for Affiliated Groups

Advantages and Disadvantages to Consolidated Tax Returns

Advantages and Disadvantages to Consolidated Tax Returns

Examples of Affiliated Groups

Examples of Affiliated Groups

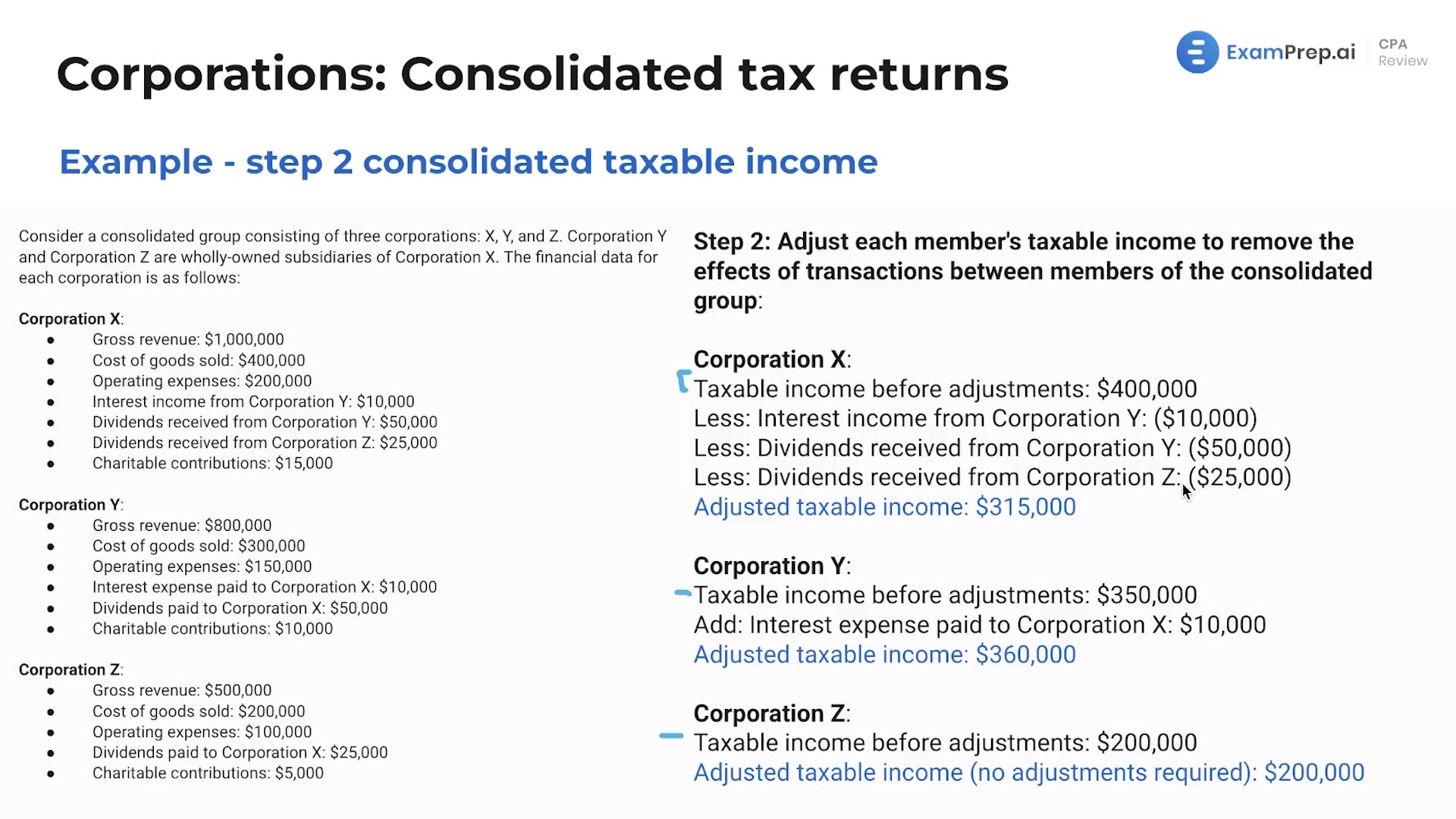

Consolidated Taxable Income Calculation

Consolidated Taxable Income Calculation

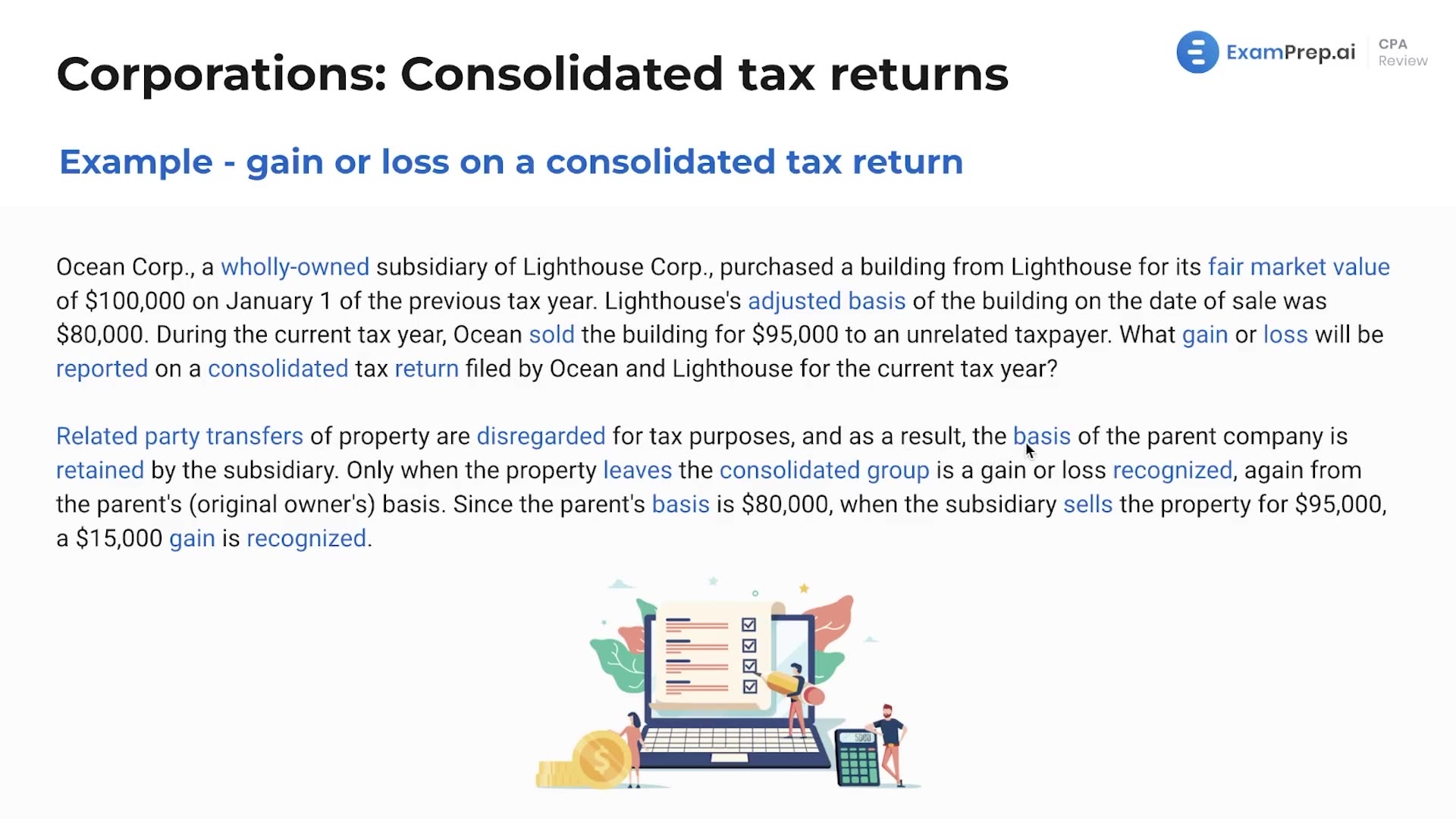

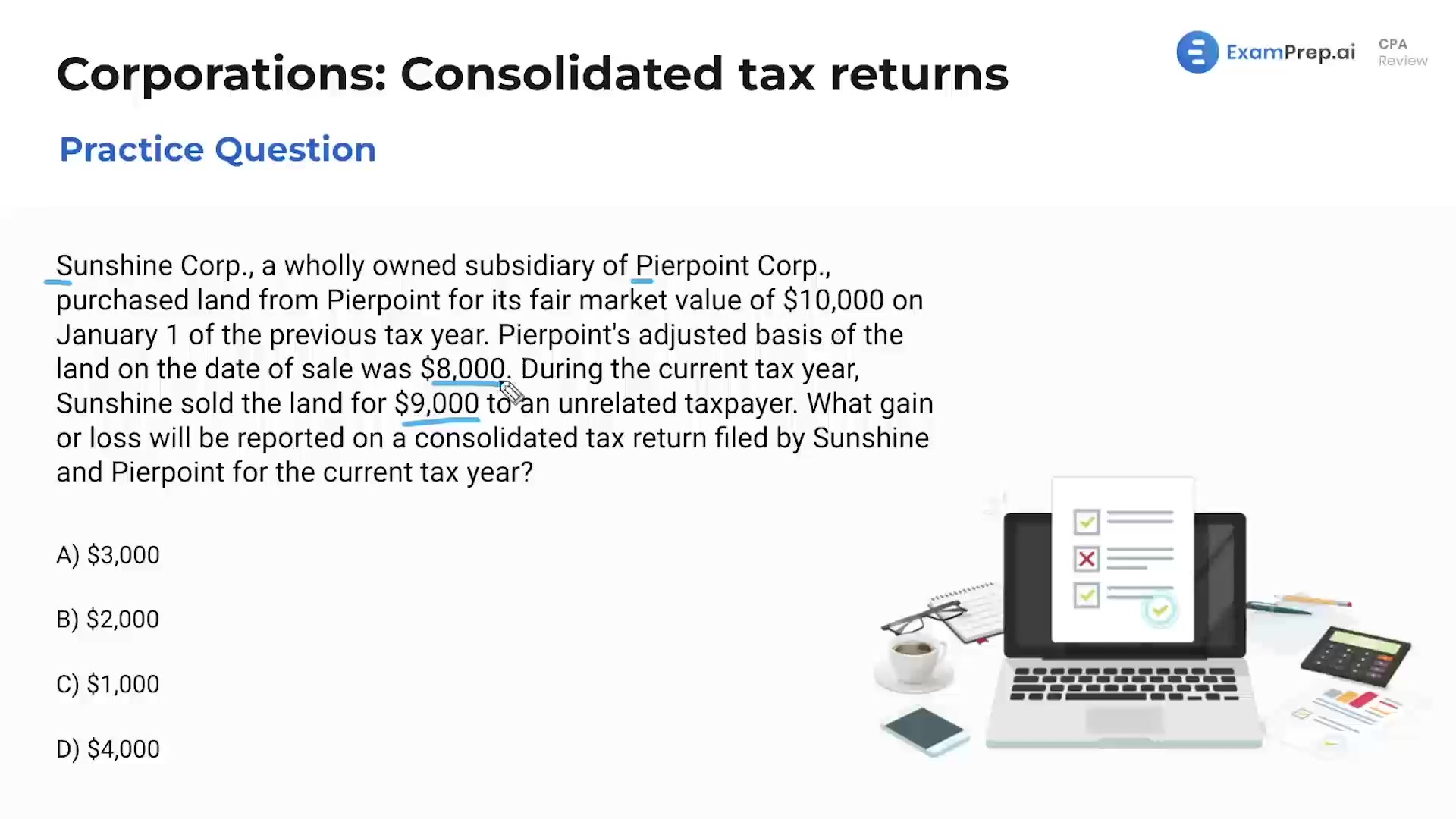

Gain or Loss on a Consolidated Tax Return

Gain or Loss on a Consolidated Tax Return

Corporations: Consolidated Tax Returns Summary

Corporations: Consolidated Tax Returns Summary

Corporations: Consolidated Tax Returns - Practice Questions

Corporations: Consolidated Tax Returns - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate