Contingencies and Commitments

Contingencies and commitments are potential liabilities or expenditures stemming from past events whose outcomes are uncertain but likely to be resolved by a future event. Contingencies might include things like lawsuits or tax disputes, where probable costs will be recognized in financial statements, while commitments, like contracts for future purchases, are disclosed in the notes to financial statements if material.

Lesson Videos

Contingencies and Commitments Overview

Contingencies and Commitments Overview

Contingencies and Commitments Objectives

Contingencies and Commitments Objectives

Basic Concepts of Contingencies and Commitments

Basic Concepts of Contingencies and Commitments

Loss Contingencies

Loss Contingencies

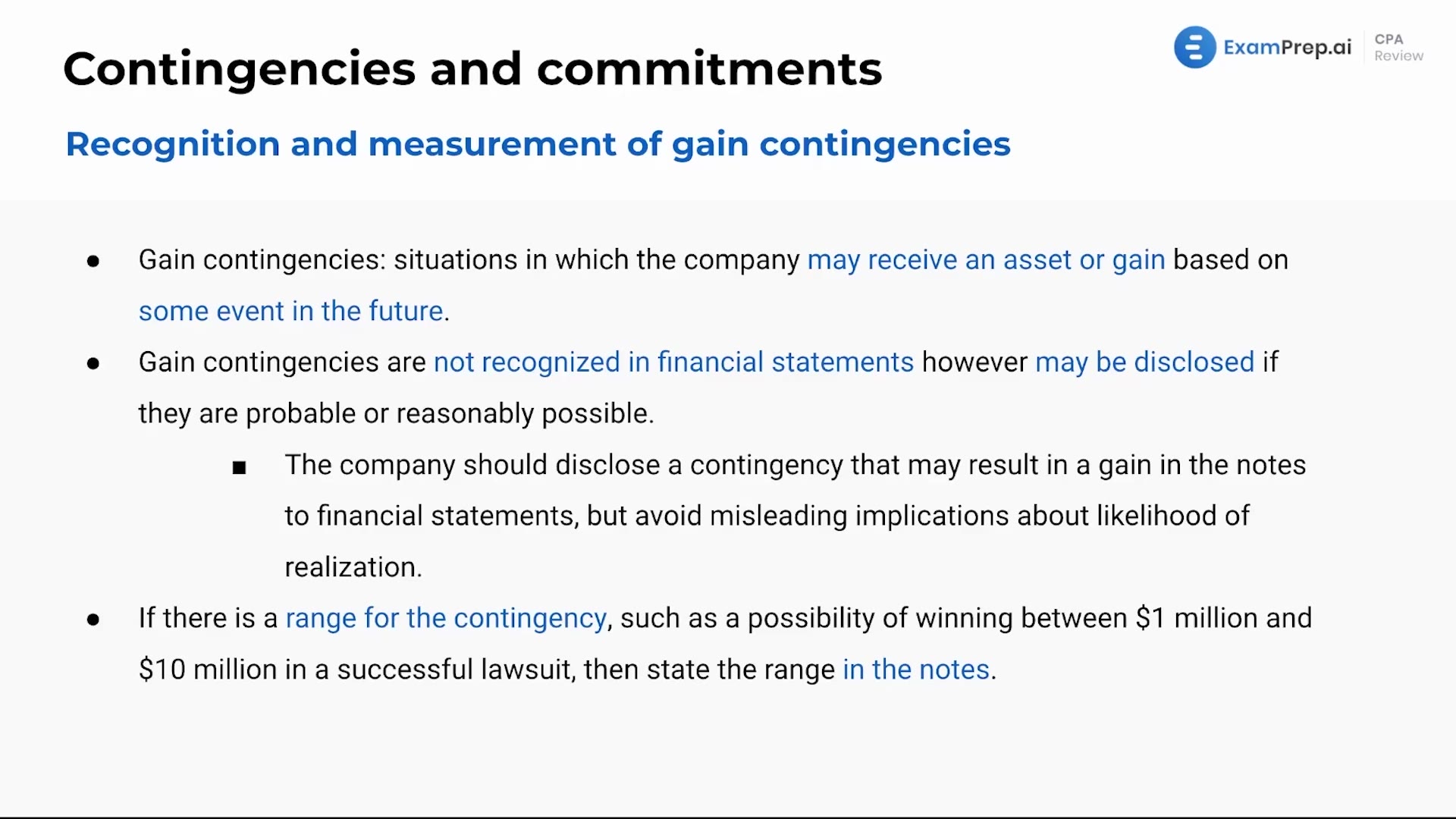

Gain Contingencies

Gain Contingencies

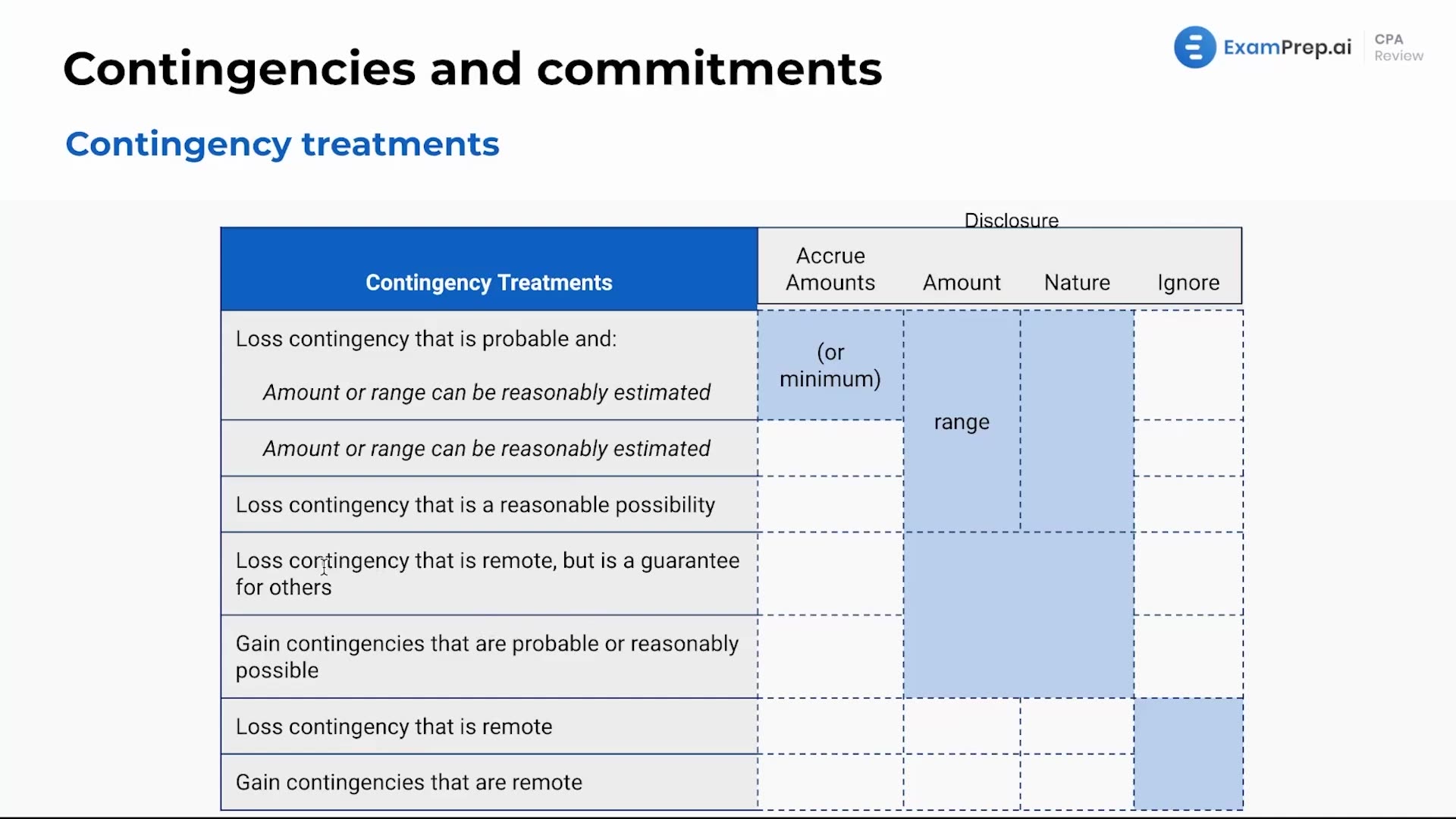

Contingency Treatments

Contingency Treatments

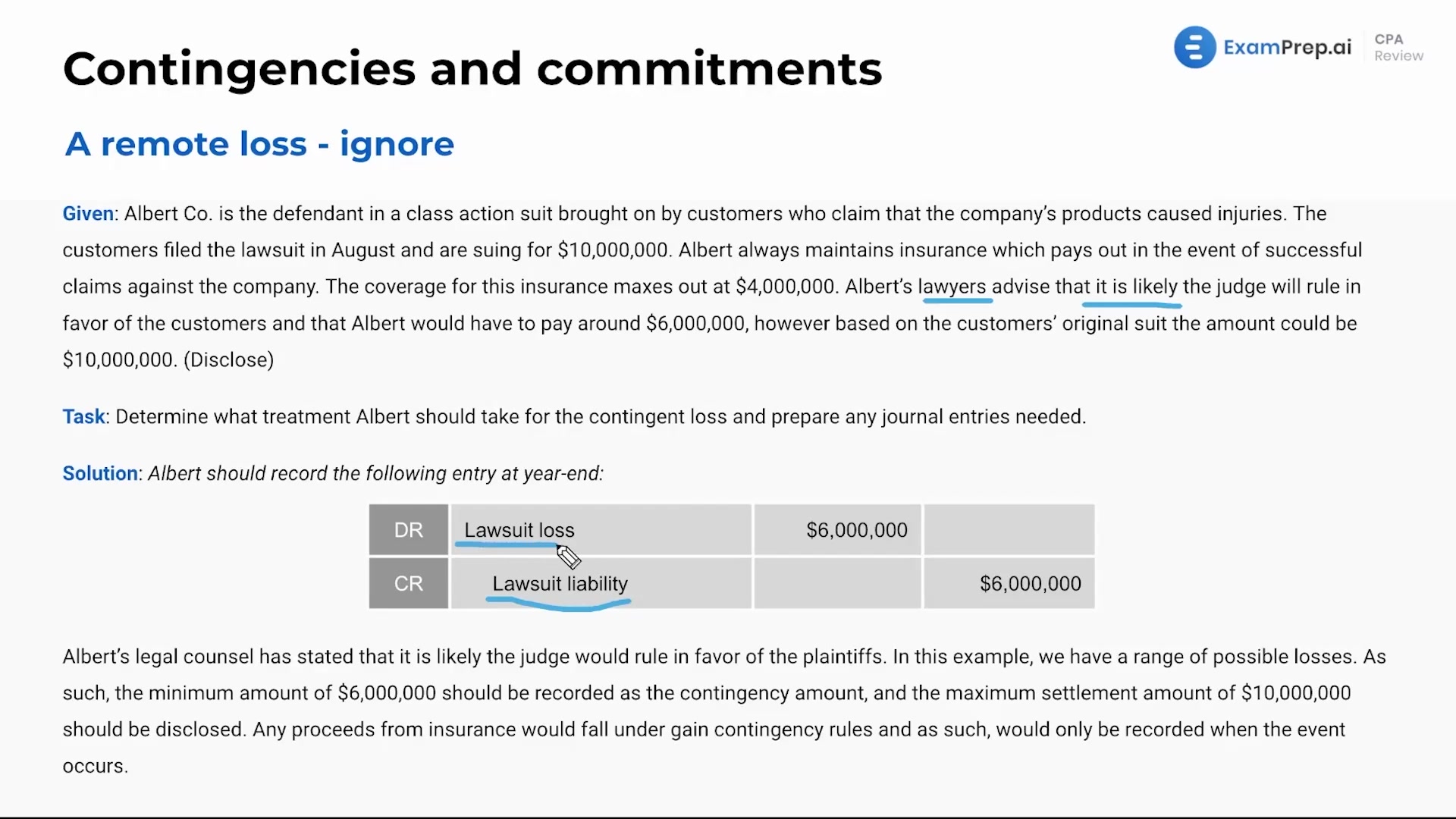

Contingencies and Commitments Example

Contingencies and Commitments Example

Contingencies and Commitments Summary

Contingencies and Commitments Summary

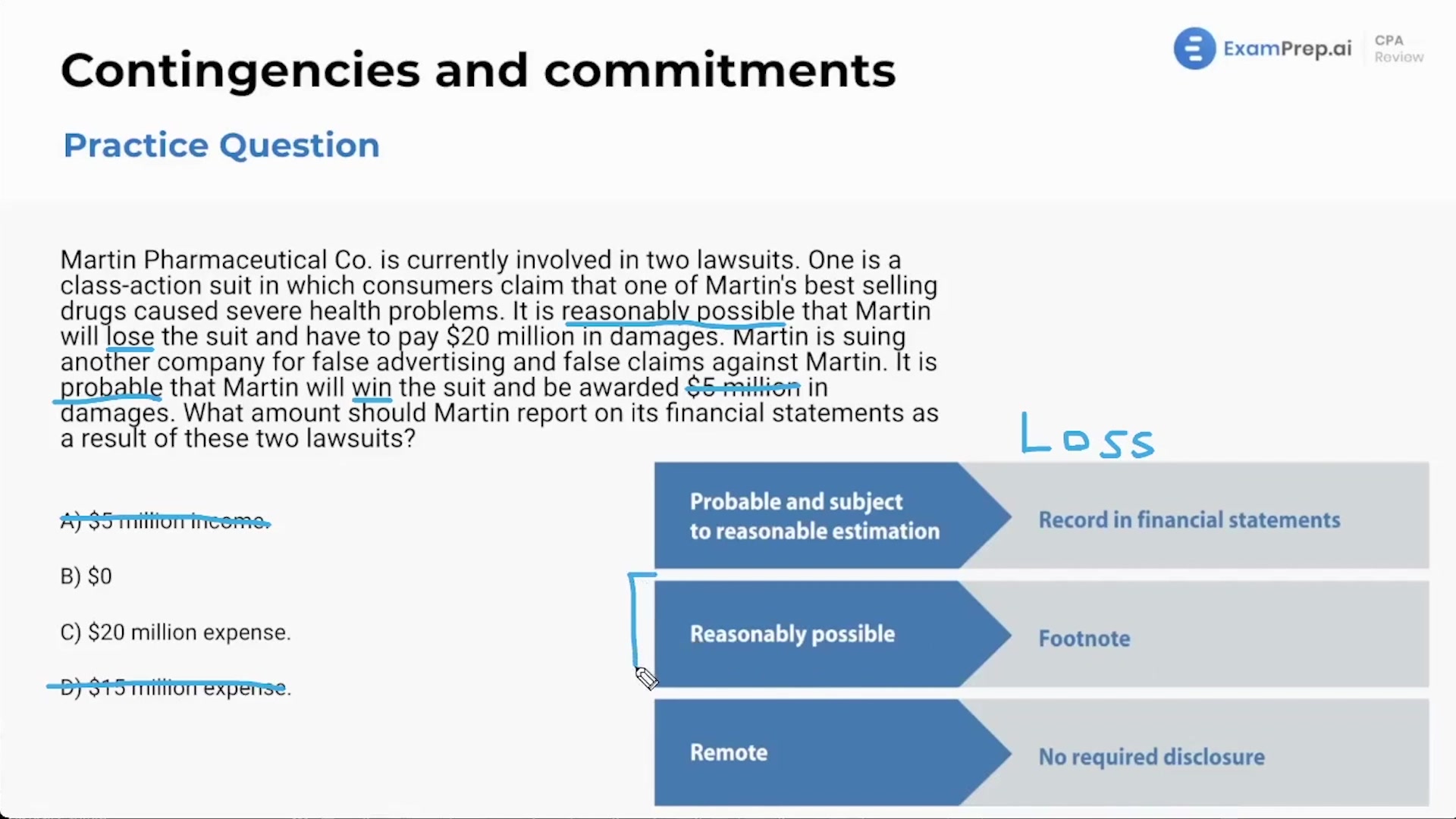

Contingencies and commitments - Practice Questions

Contingencies and commitments - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate