Cost Recovery

Cost recovery refers to the accounting method used to recoup the value of an expense or investment over time. This process typically involves the written down of fixed assets through depreciation, depletion, or amortization, thereby reducing taxable income as the asset provides service.

Lesson Videos

Cost Recovery Overview

Cost Recovery Overview

Introduction to Cost Recovery

Introduction to Cost Recovery

Types of Property Per the IRS

Types of Property Per the IRS

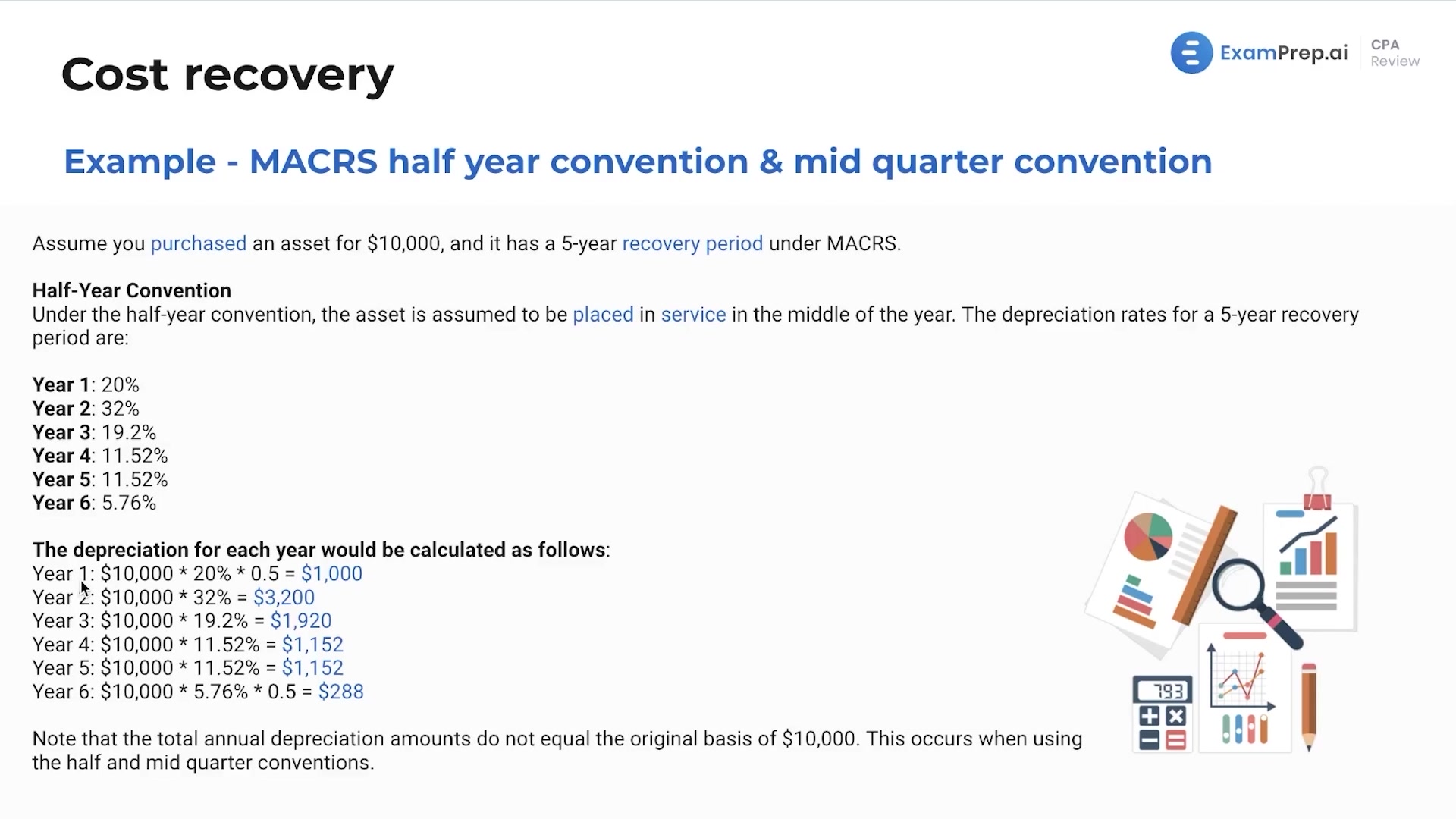

Modified Accelerated Cost Recovery System (MACRS) Depreciation

Modified Accelerated Cost Recovery System (MACRS) Depreciation

Section 179 Expense

Section 179 Expense

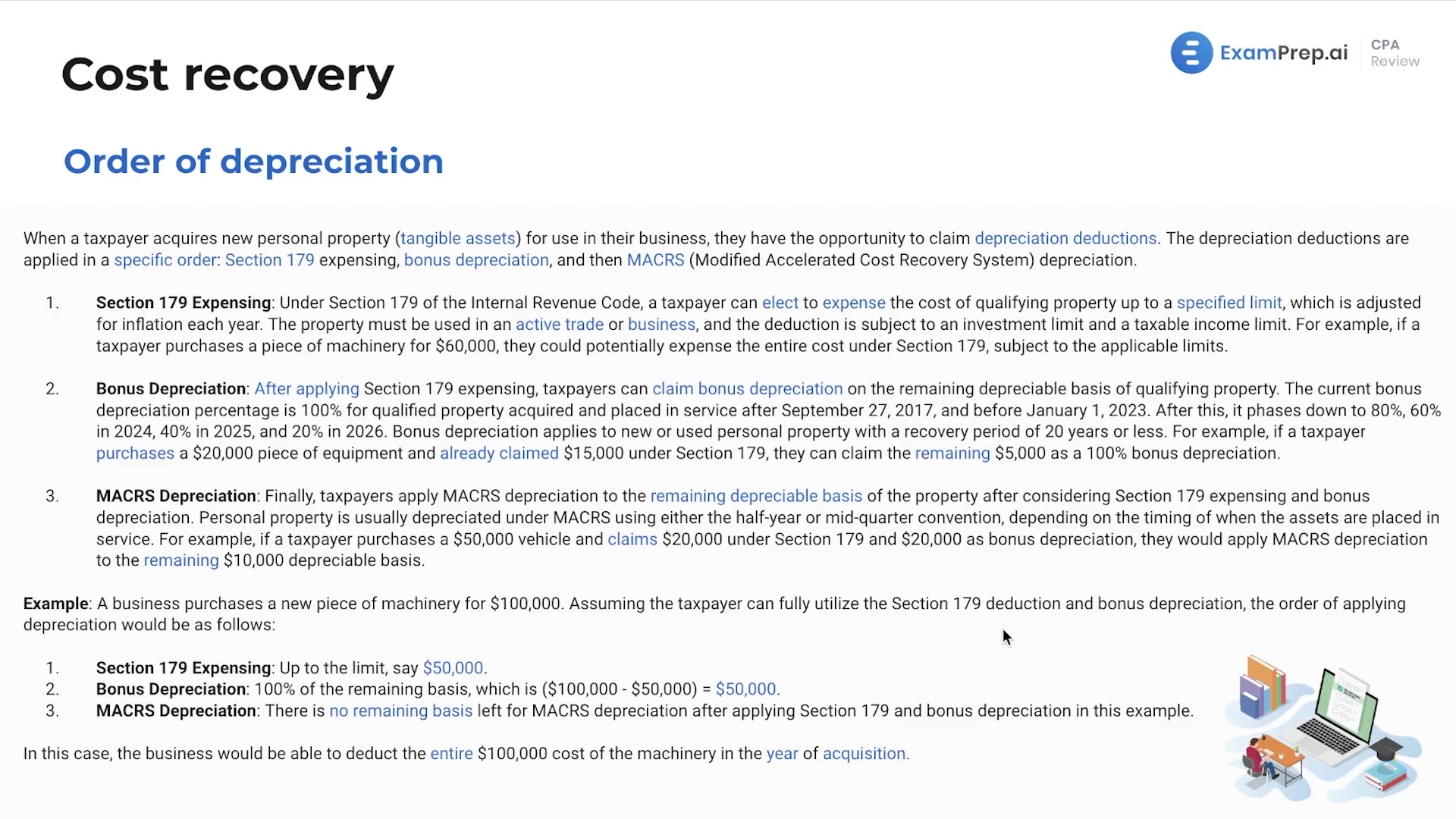

Order of Depreciation and Depletion

Order of Depreciation and Depletion

Amortization of Intangible Assets

Amortization of Intangible Assets

Cost Recovery Summary

Cost Recovery Summary

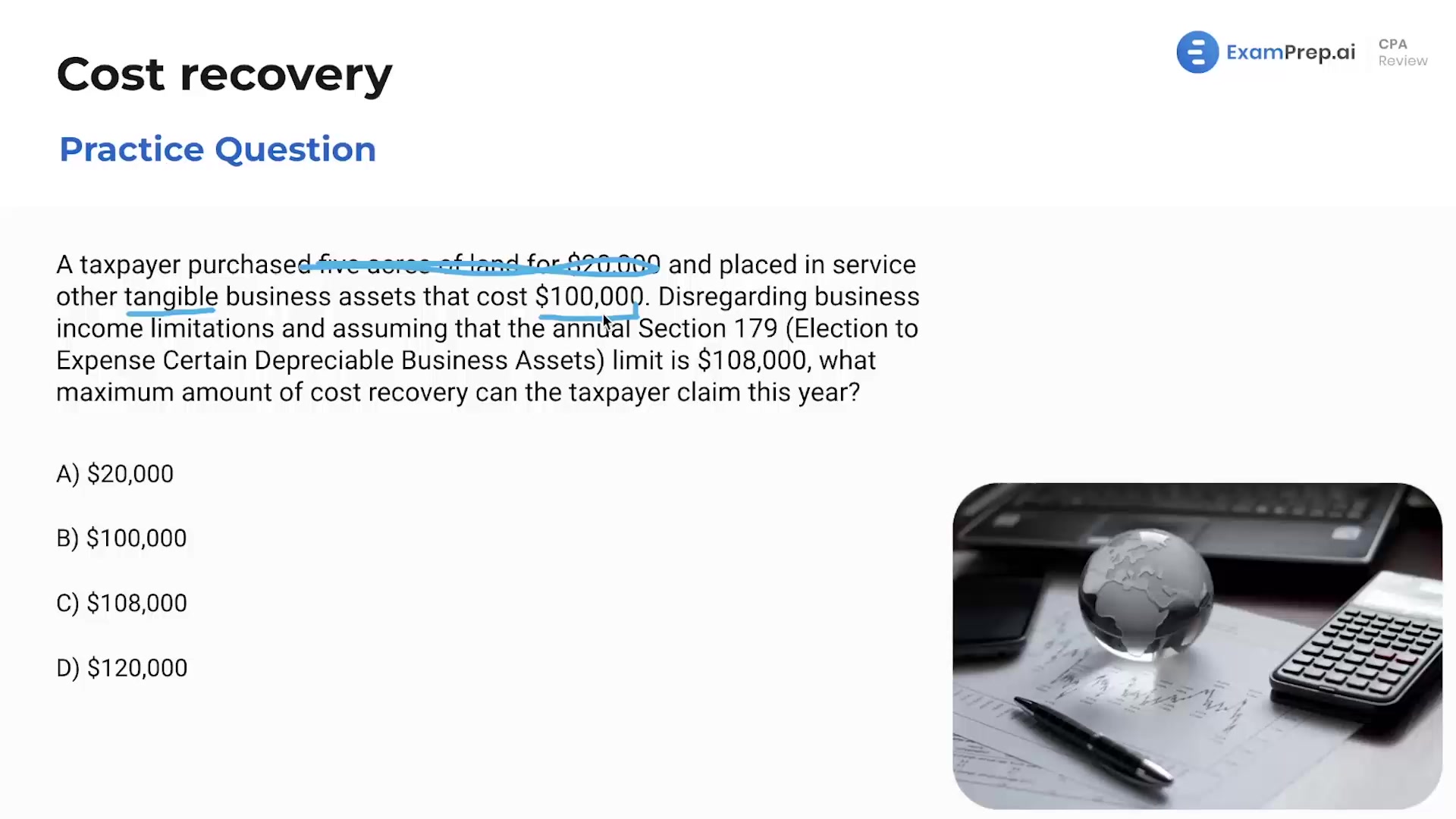

Cost Recovery - Practice Questions

Cost Recovery - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate