Foreign Currency Transactions

Foreign currency transactions and translation involves the conversion of the financial statement of an organization from the currency of the country in which the organization is based to the currency of another country. This process is necessary when a company has operations in multiple countries and needs to report its financial performance in a consistent manner. The process of foreign currency transactions and translation involves determining the exchange rate, revaluing assets and liabilities, and restating income and expenses. The exchange rate is used to convert the functional currency of the organization to the reporting currency. Revaluing assets and liabilities involves adjusting their values to account for changes in the exchange rate. Restating income and expenses involves converting income and expense items to the reporting currency.

Lesson Videos

Foreign Currency Transactions and Translation Overview and Objectives

Foreign Currency Transactions and Translation Overview and Objectives

Terminology for Foreign Currency Transactions

Terminology for Foreign Currency Transactions

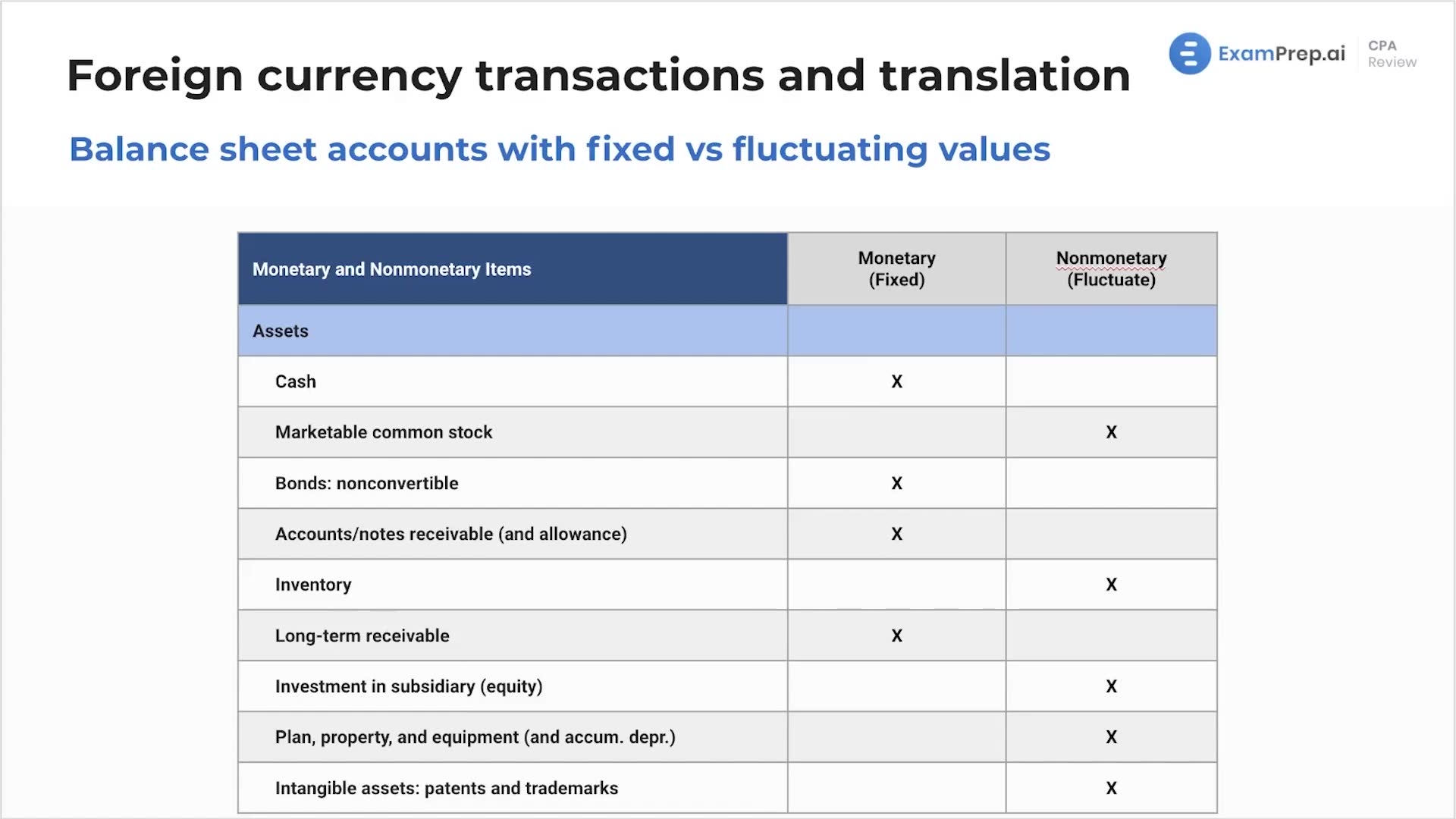

Balance Sheet Accounts with Fixed Versus Fluctuating Values

Balance Sheet Accounts with Fixed Versus Fluctuating Values

Translation Versus Remeasurement

Translation Versus Remeasurement

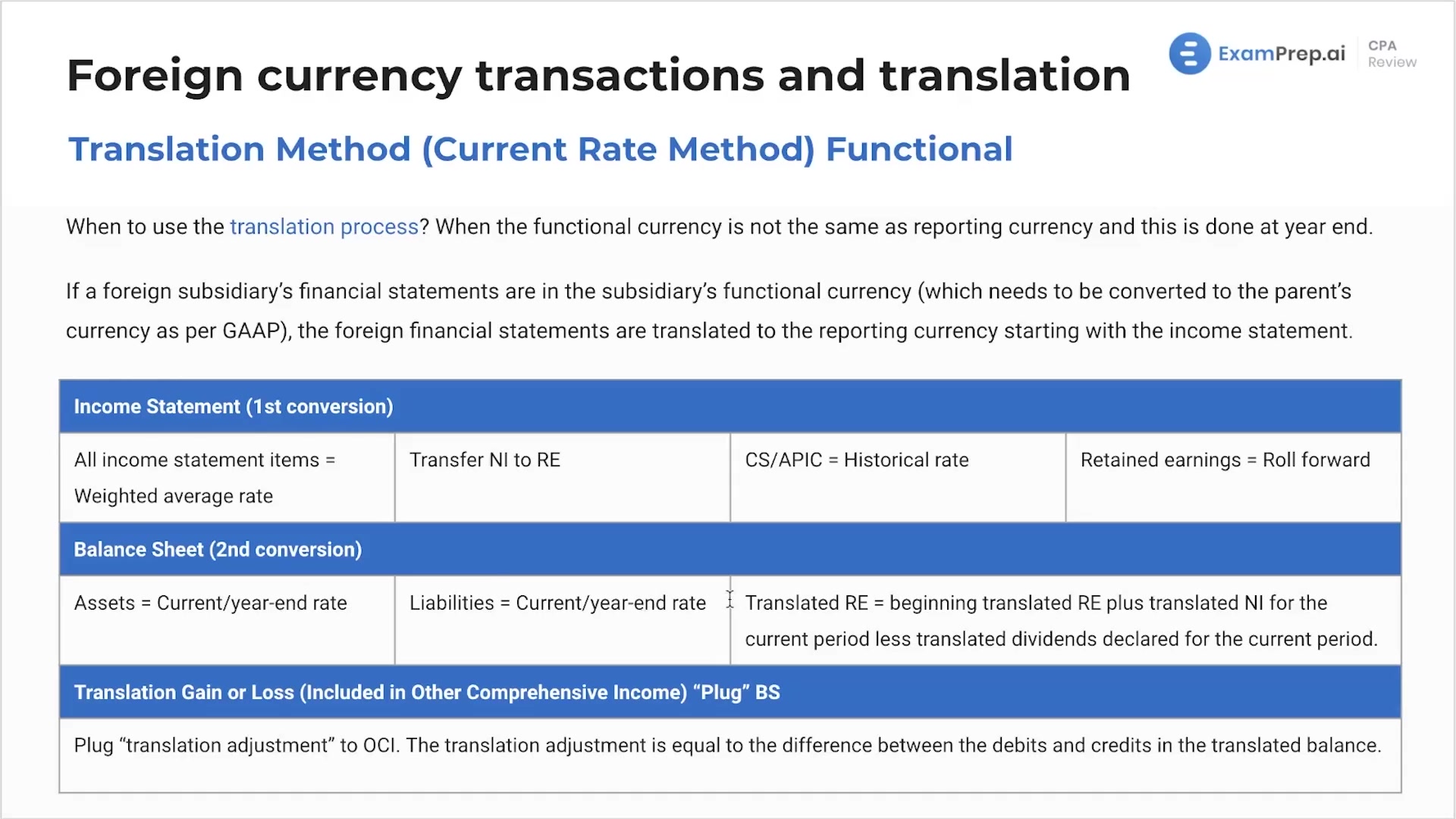

Translation Method of Converting Financial Statements

Translation Method of Converting Financial Statements

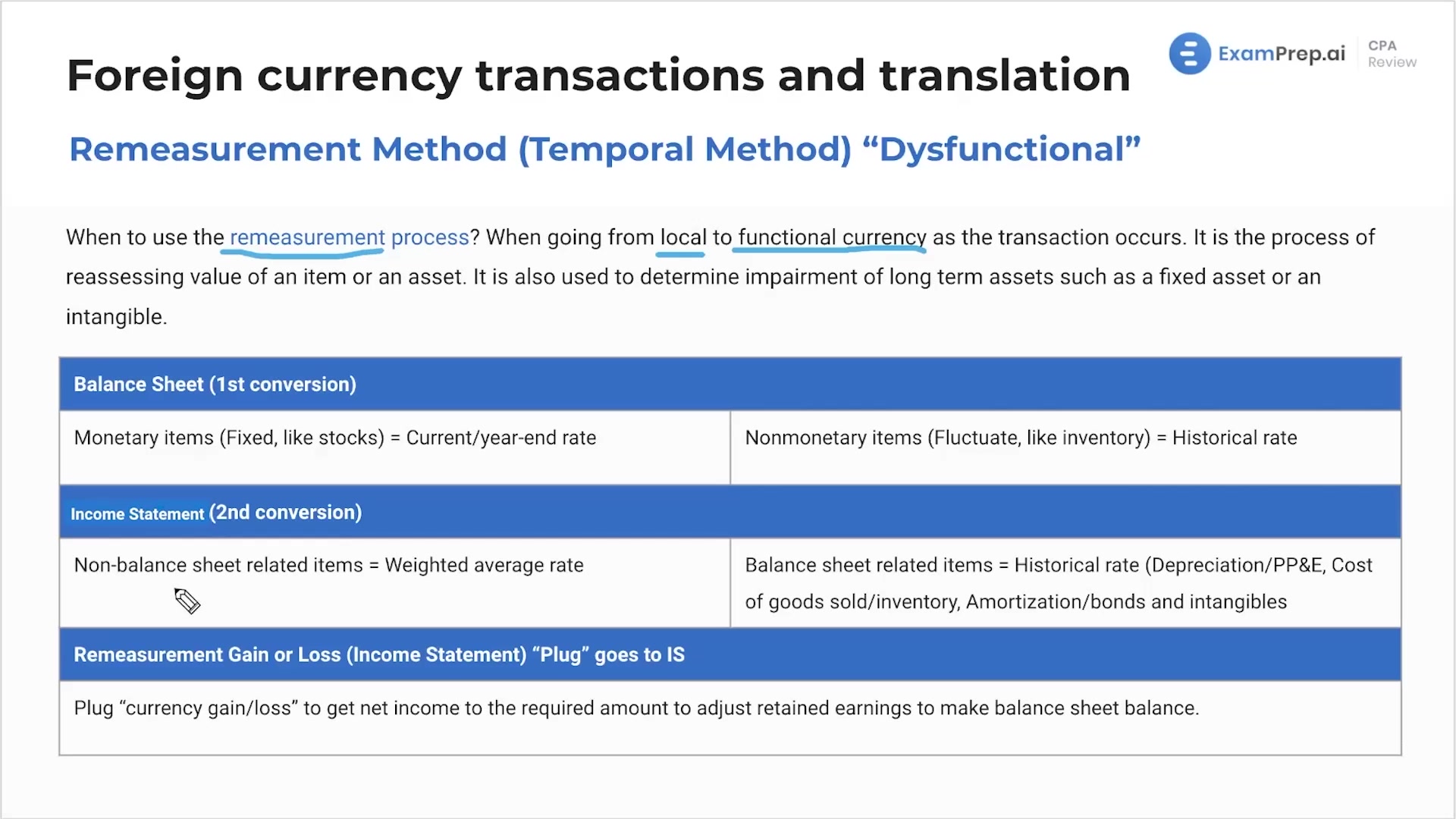

Remeasurement Method of Converting Financial Statements

Remeasurement Method of Converting Financial Statements

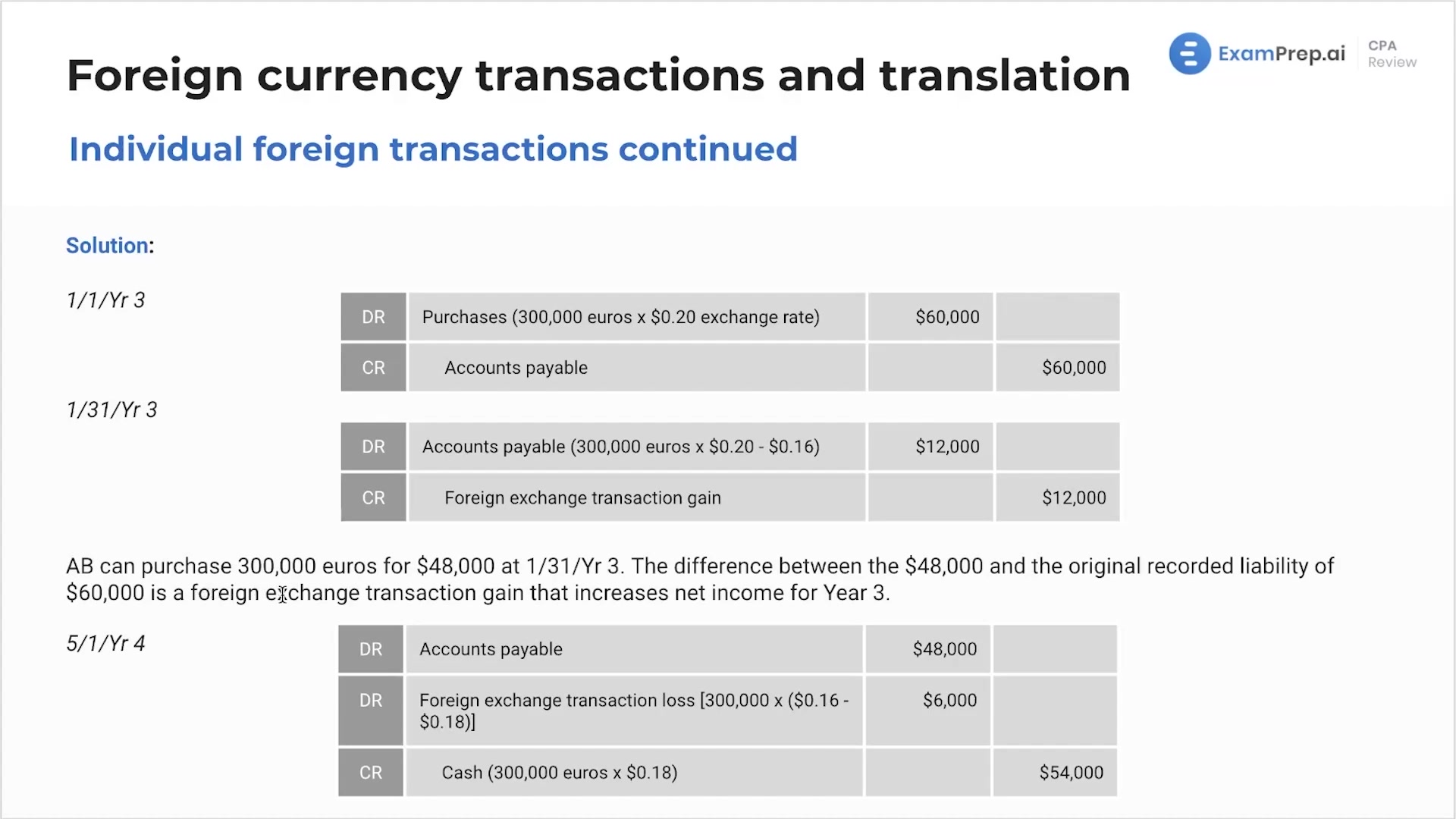

Journal Entries for Foreign Currency Transactions

Journal Entries for Foreign Currency Transactions

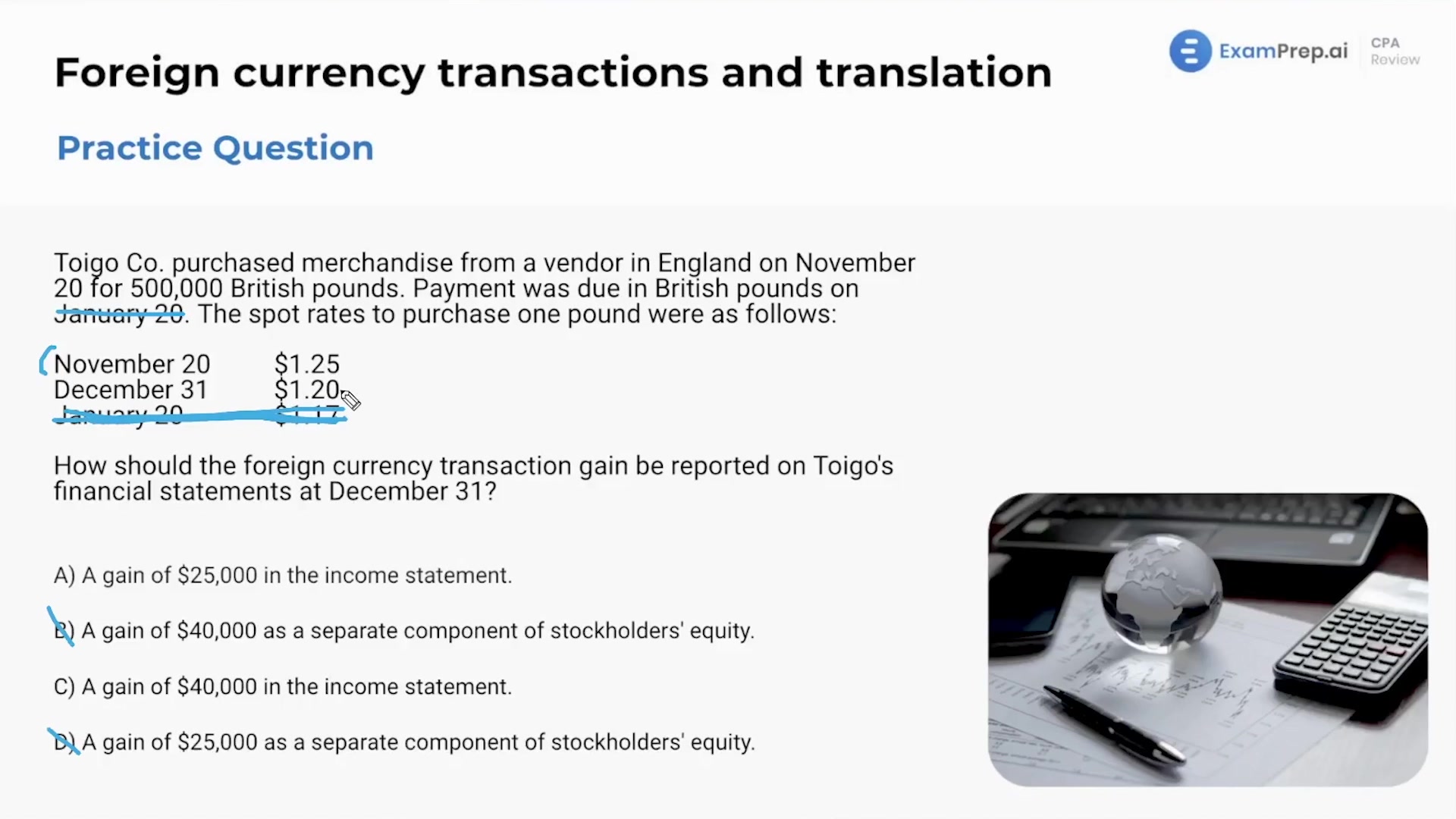

Foreign currency transactions and translation - Practice Questions

Foreign currency transactions and translation - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate