Governmental Accounting: Measurement Focus and Basis

Governmental accounting involves tracking and managing the financial practices of public sector entities. The measurement focus and basis within this area determine what is recorded and reported in financial statements, with the measurement focus guiding which transactions and events are measured and recognized in the accounting system, and the basis of accounting dictating when these transactions and events are recognized. Common bases for governmental entities include cash, accrual, and modified accrual accounting.

Lesson Videos

Governmental Assets, Liabilities, Revenues & Expenses Overview and Objectives

Governmental Assets, Liabilities, Revenues & Expenses Overview and Objectives

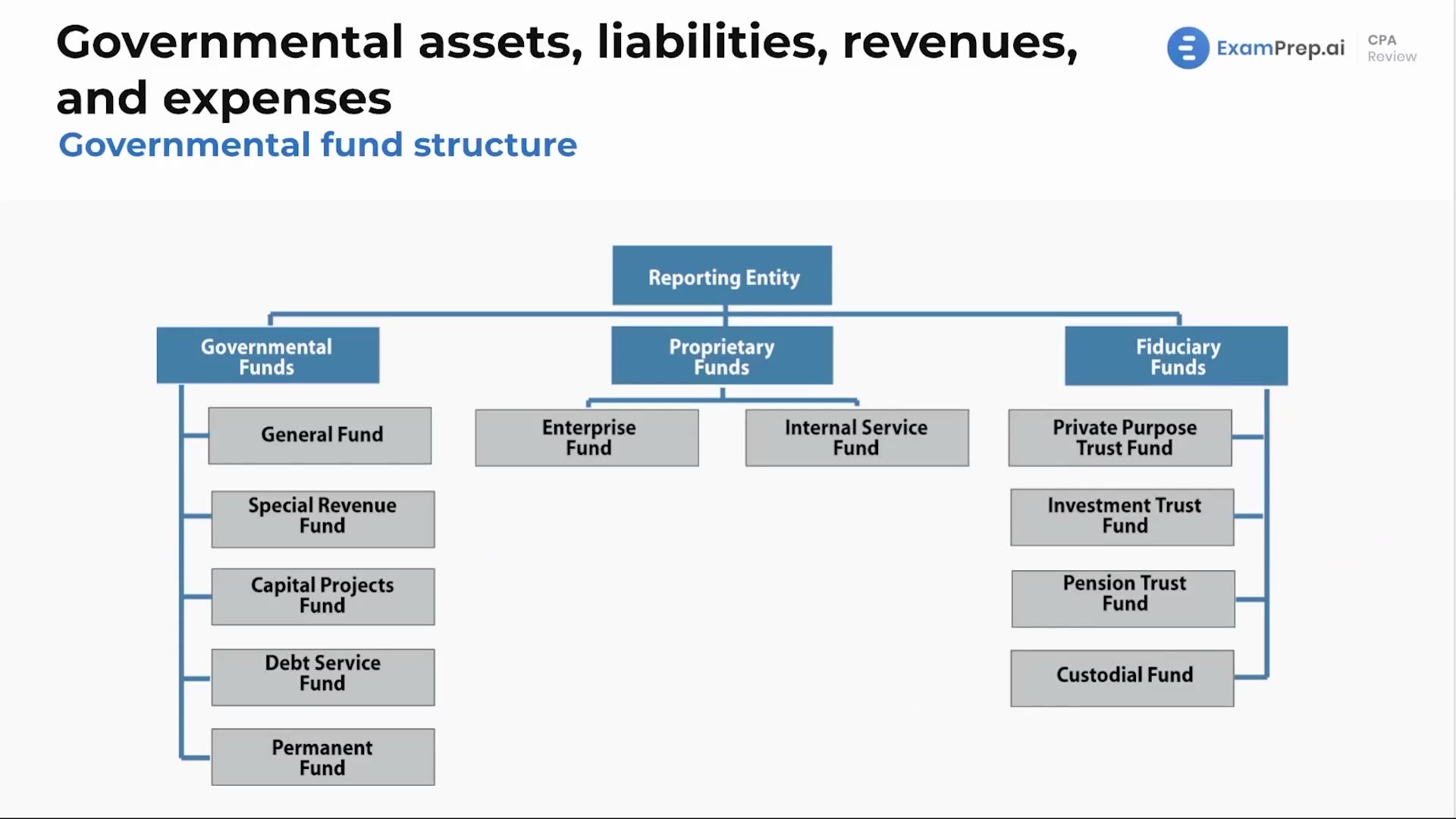

Governmental Fund Structure

Governmental Fund Structure

Governmental Revenues - General Fund

Governmental Revenues - General Fund

Governmental Expenditures - General Fund

Governmental Expenditures - General Fund

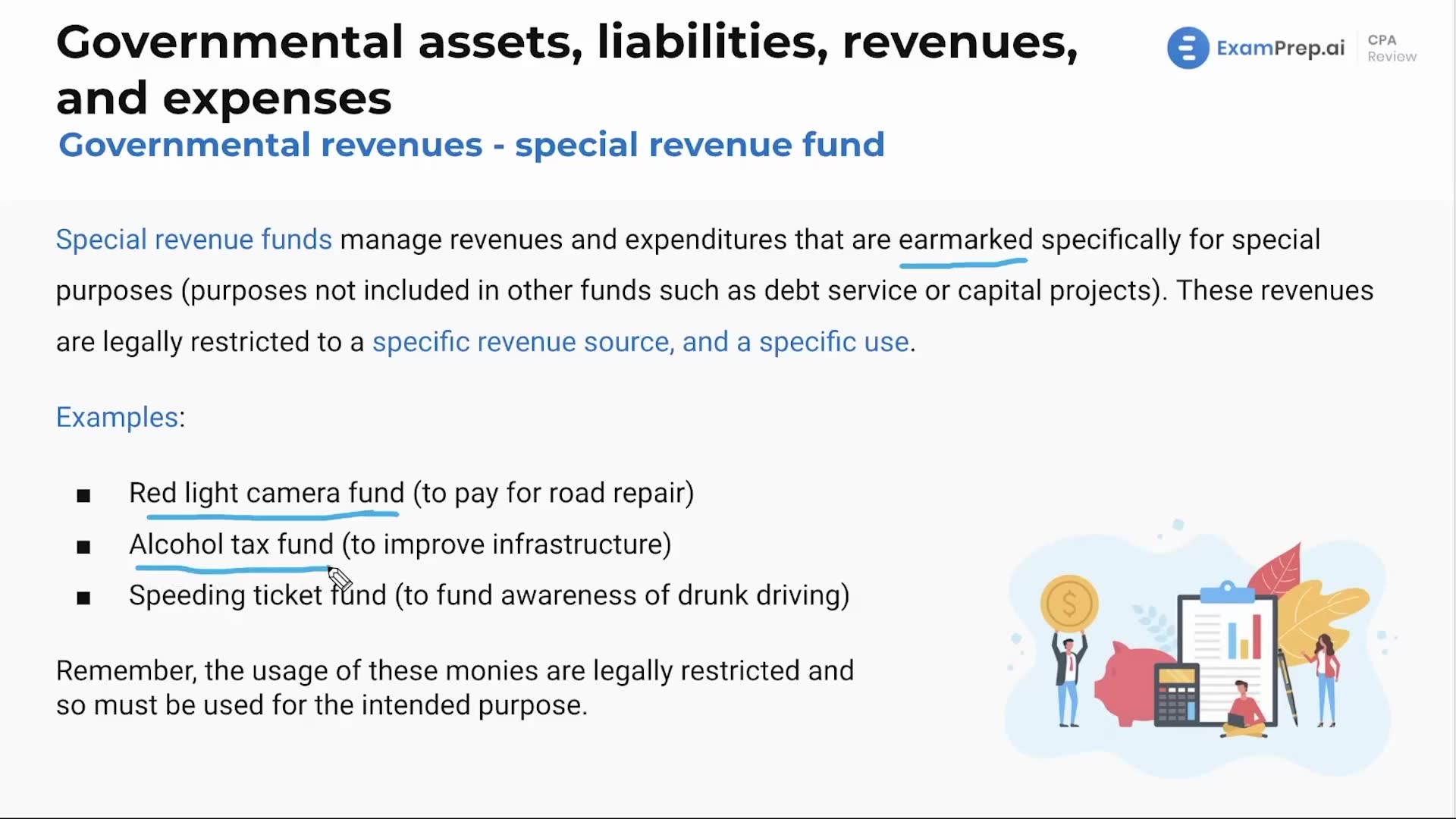

Governmental Revenues - Special Revenue Fund

Governmental Revenues - Special Revenue Fund

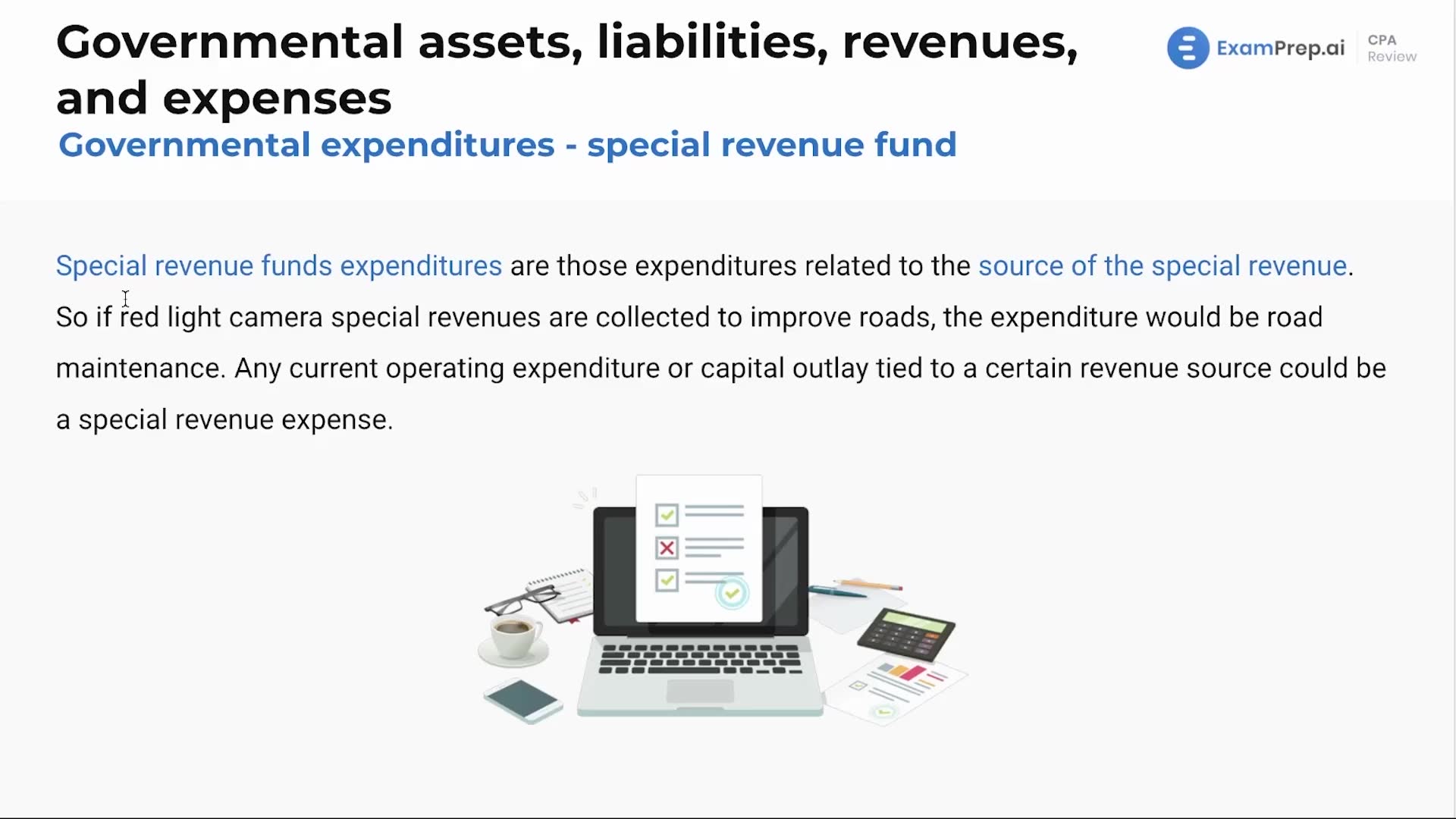

Governmental Expenditures - Special Revenue Fund

Governmental Expenditures - Special Revenue Fund

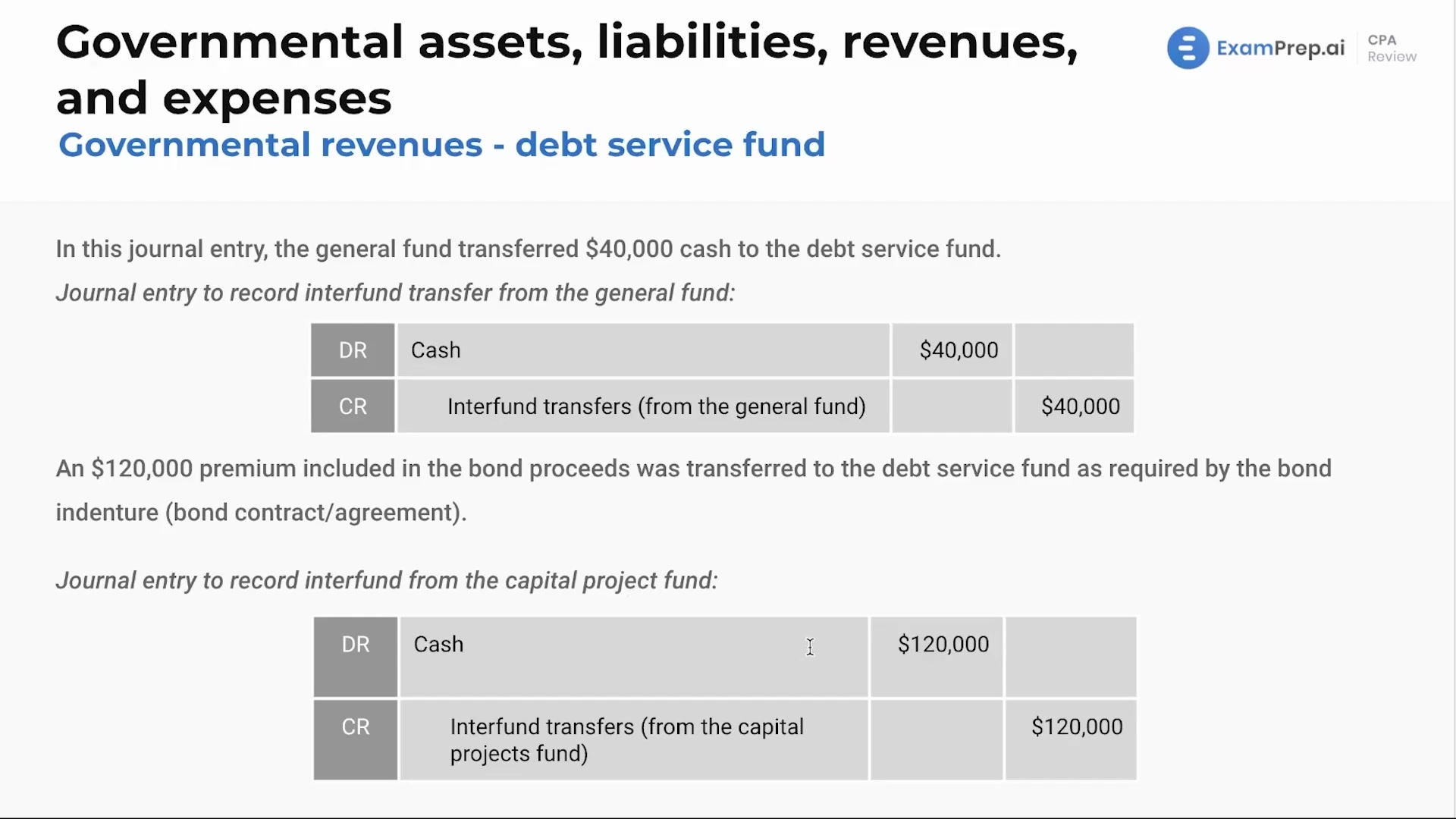

Governmental Revenues - Debt Service Fund

Governmental Revenues - Debt Service Fund

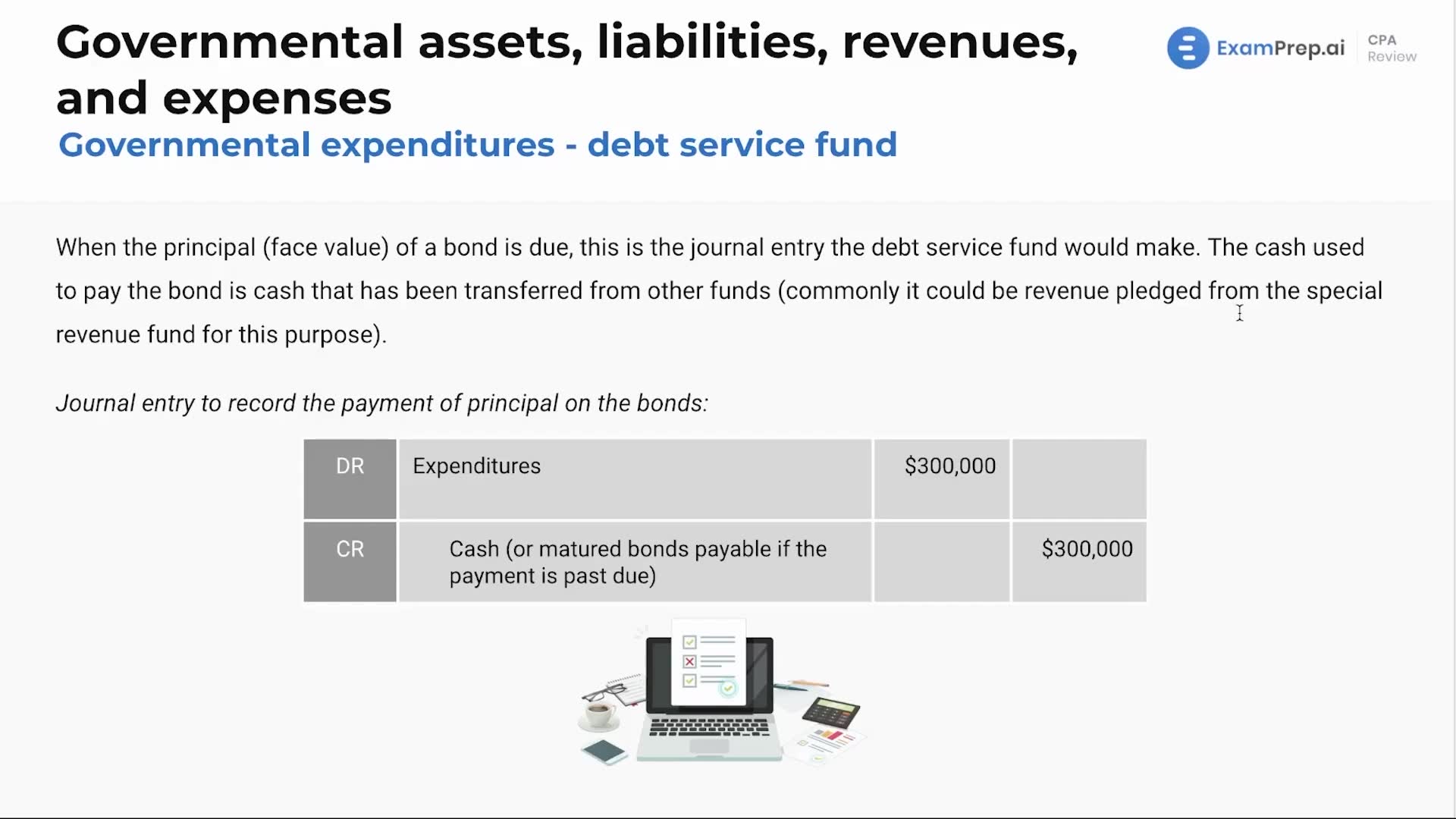

Governmental Expenditures - Debt Service Fund

Governmental Expenditures - Debt Service Fund

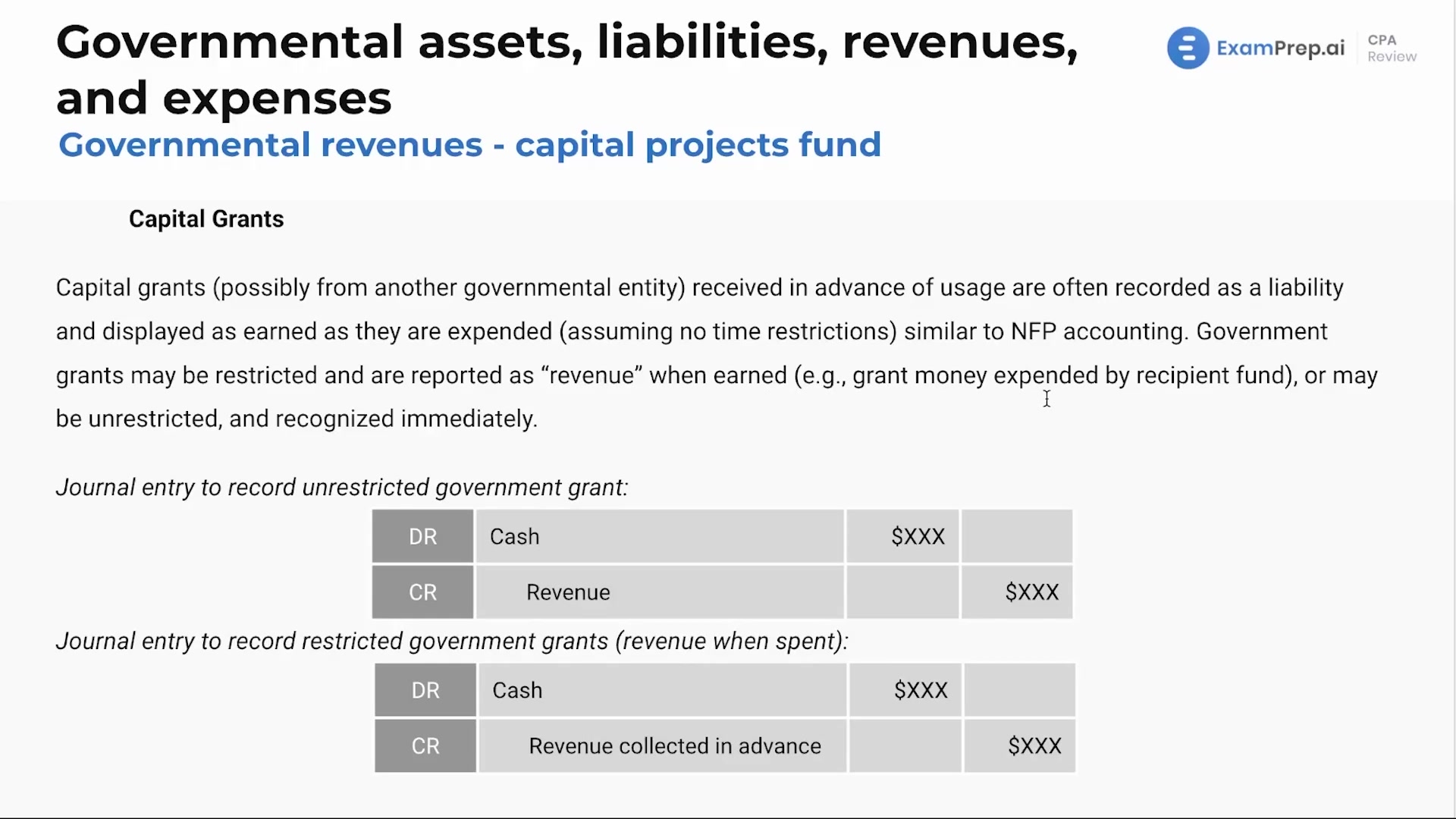

Governmental Revenues - Capital Projects Fund

Governmental Revenues - Capital Projects Fund

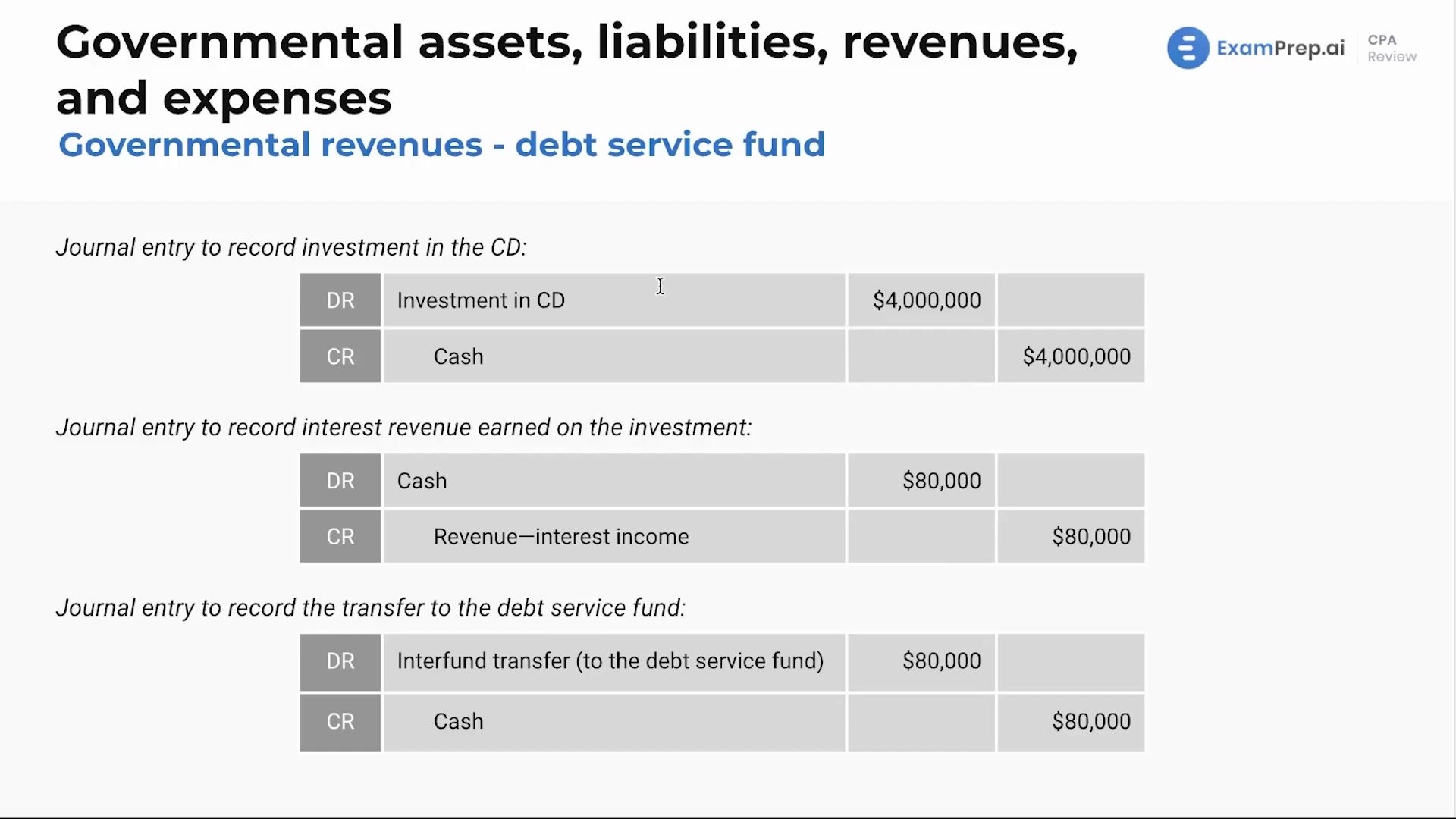

Governmental Revenues - Debt Service Fund Example

Governmental Revenues - Debt Service Fund Example

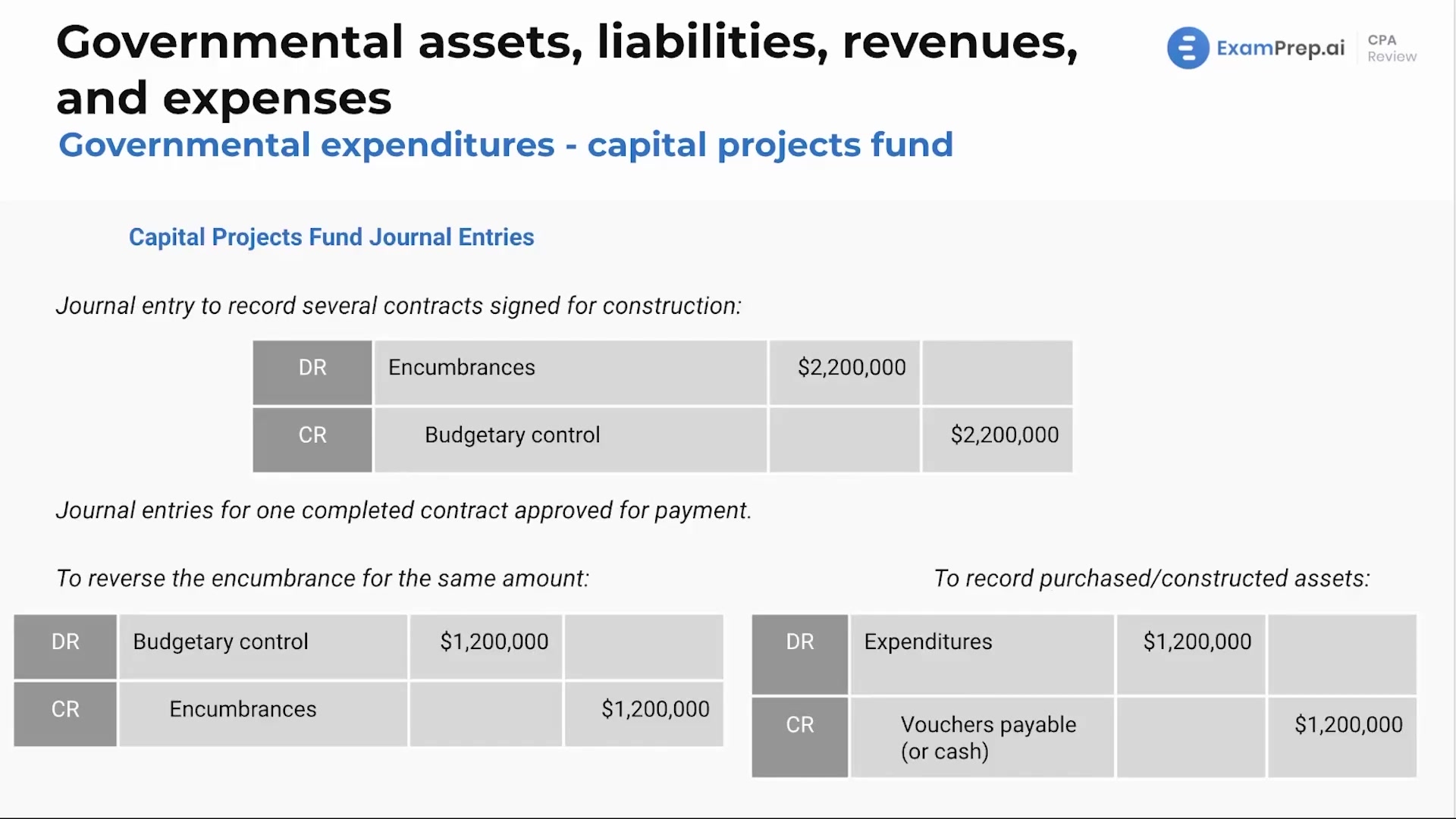

Governmental Expenditures - Capital Projects Fund

Governmental Expenditures - Capital Projects Fund

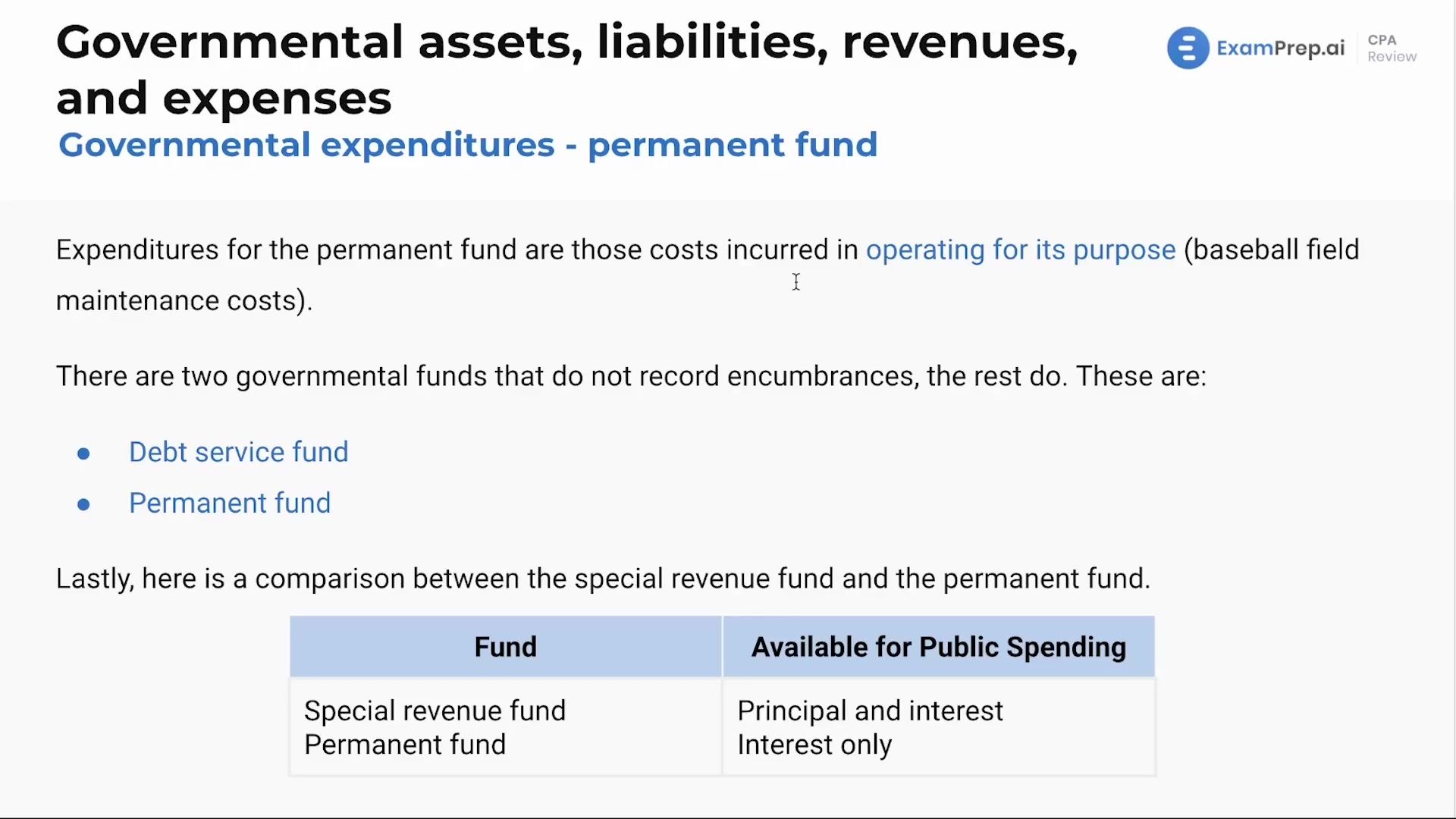

Governmental Revenues and Expenditures - Permanent Fund

Governmental Revenues and Expenditures - Permanent Fund

Governmental Assets, Liabilities, Revenues & Expenses Summary

Governmental Assets, Liabilities, Revenues & Expenses Summary

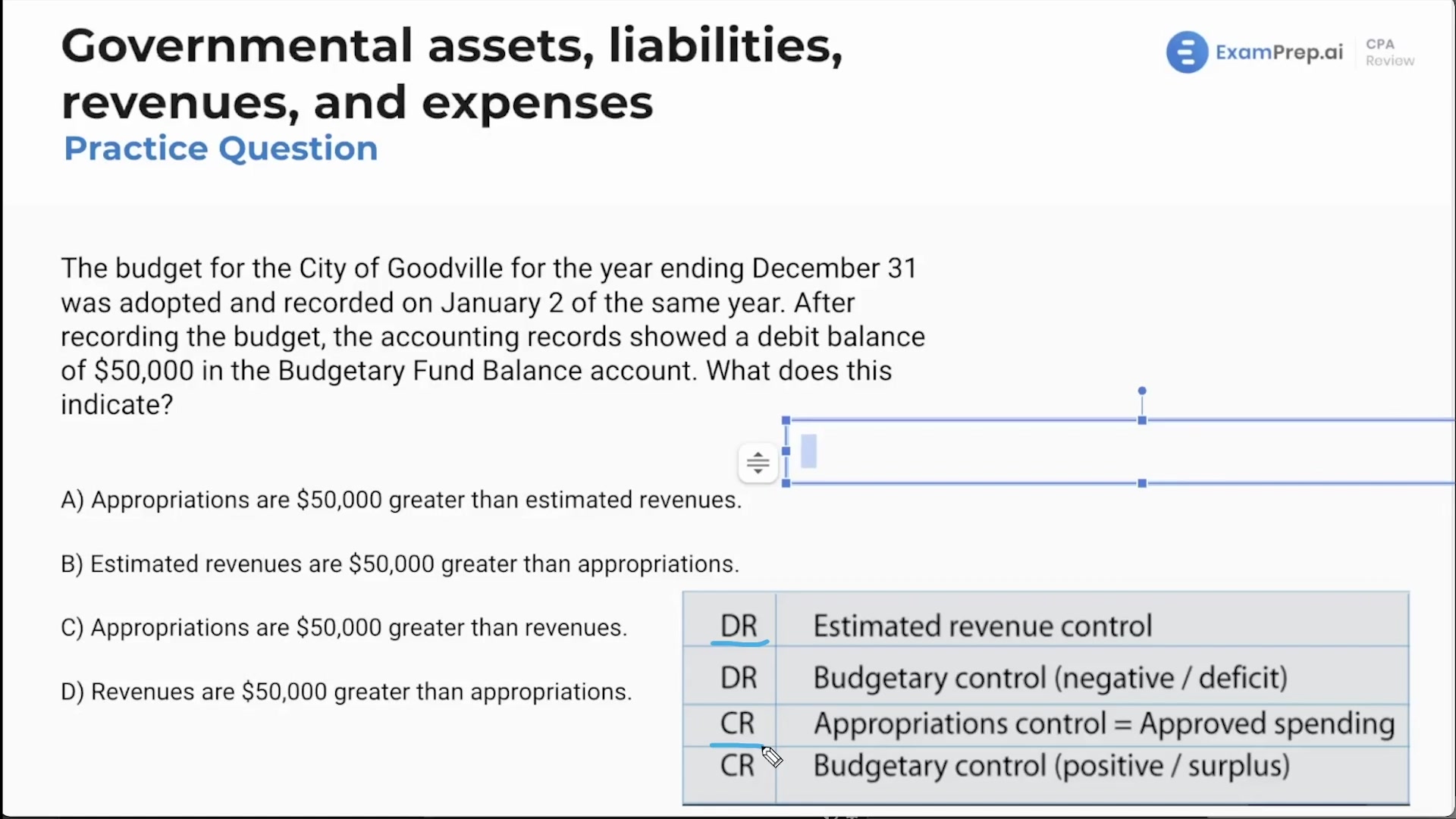

Conceptual framework - Practice Questions

Conceptual framework - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate