Governmental Assets, Liabilities, Revenues, and Expenses

Governmental accounting involves tracking and reporting on financial transactions for public sector entities, focusing on assets, liabilities, revenues, and expenses. Assets represent resources controlled or owned by the government, while liabilities denote obligations or debts. Revenues are inflows of resources resulting from delivering government services, taxes, or grants, whereas expenses pertain to the outflows consumed in the delivery of these services and operations.

Lesson Videos

Governmental Accounting: Measurement Focus and Basis Overview and Objectives

Governmental Accounting: Measurement Focus and Basis Overview and Objectives

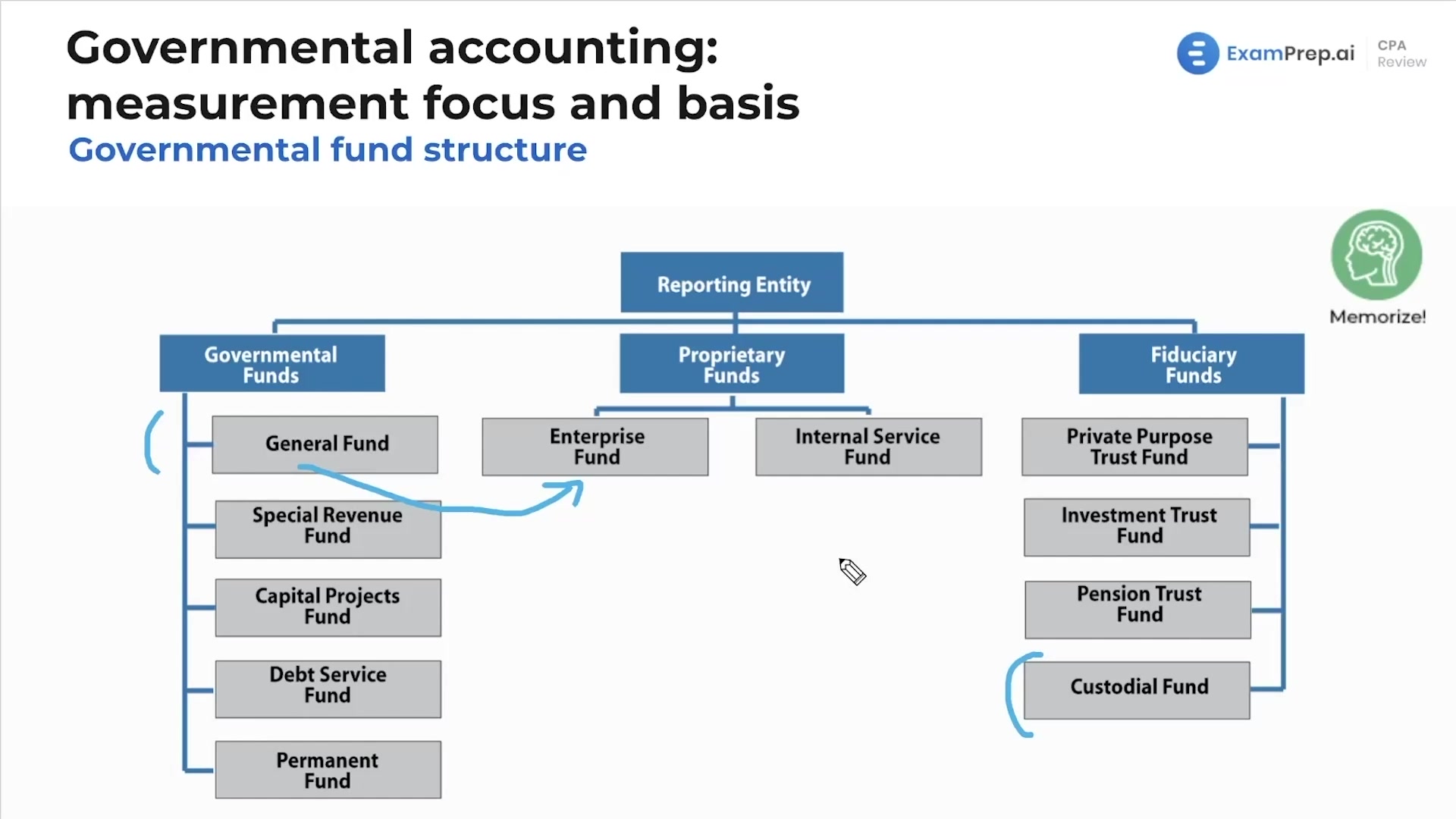

Governmental Fund Structure

Governmental Fund Structure

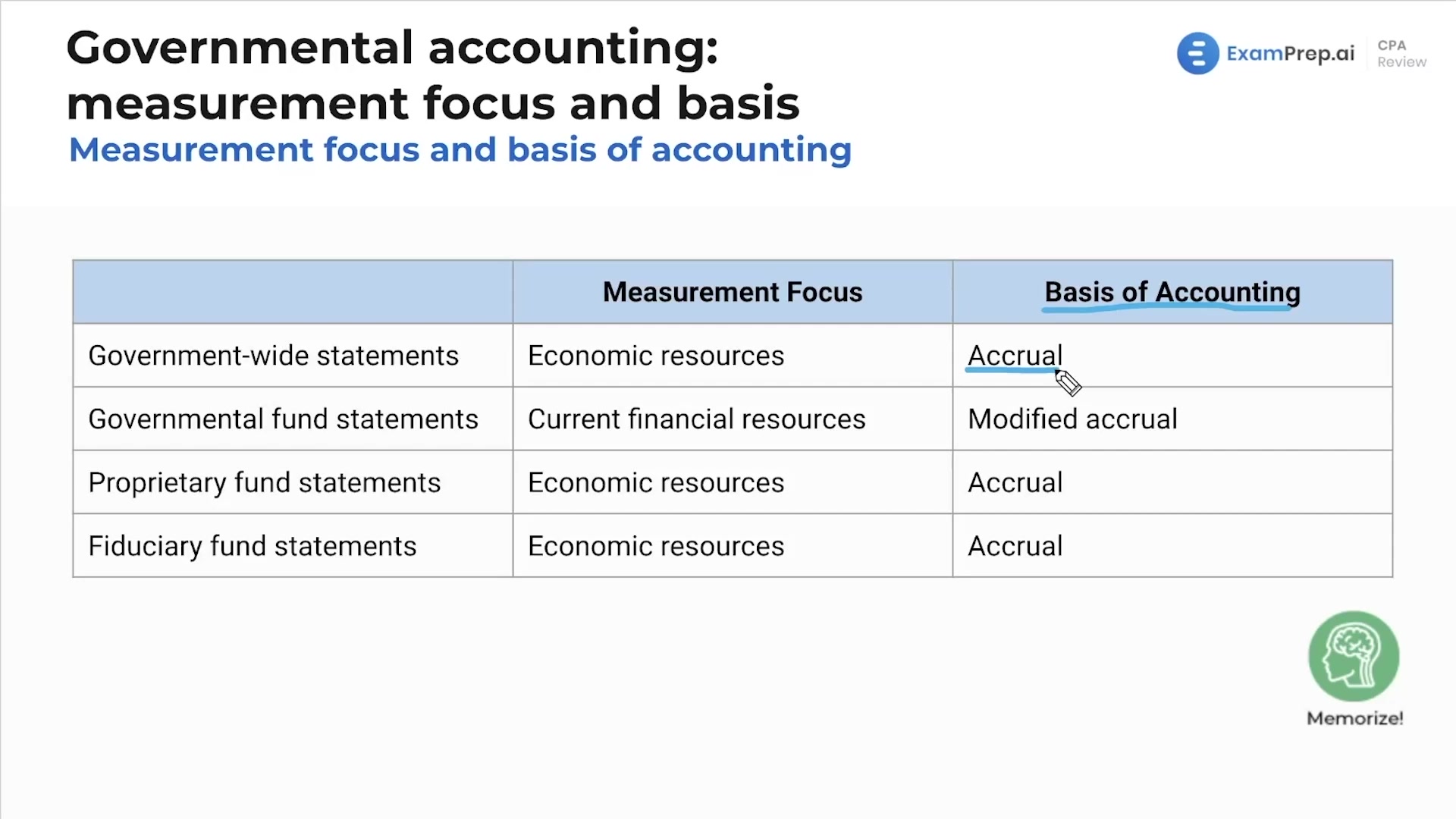

Measurement Focus and Basis of Accounting

Measurement Focus and Basis of Accounting

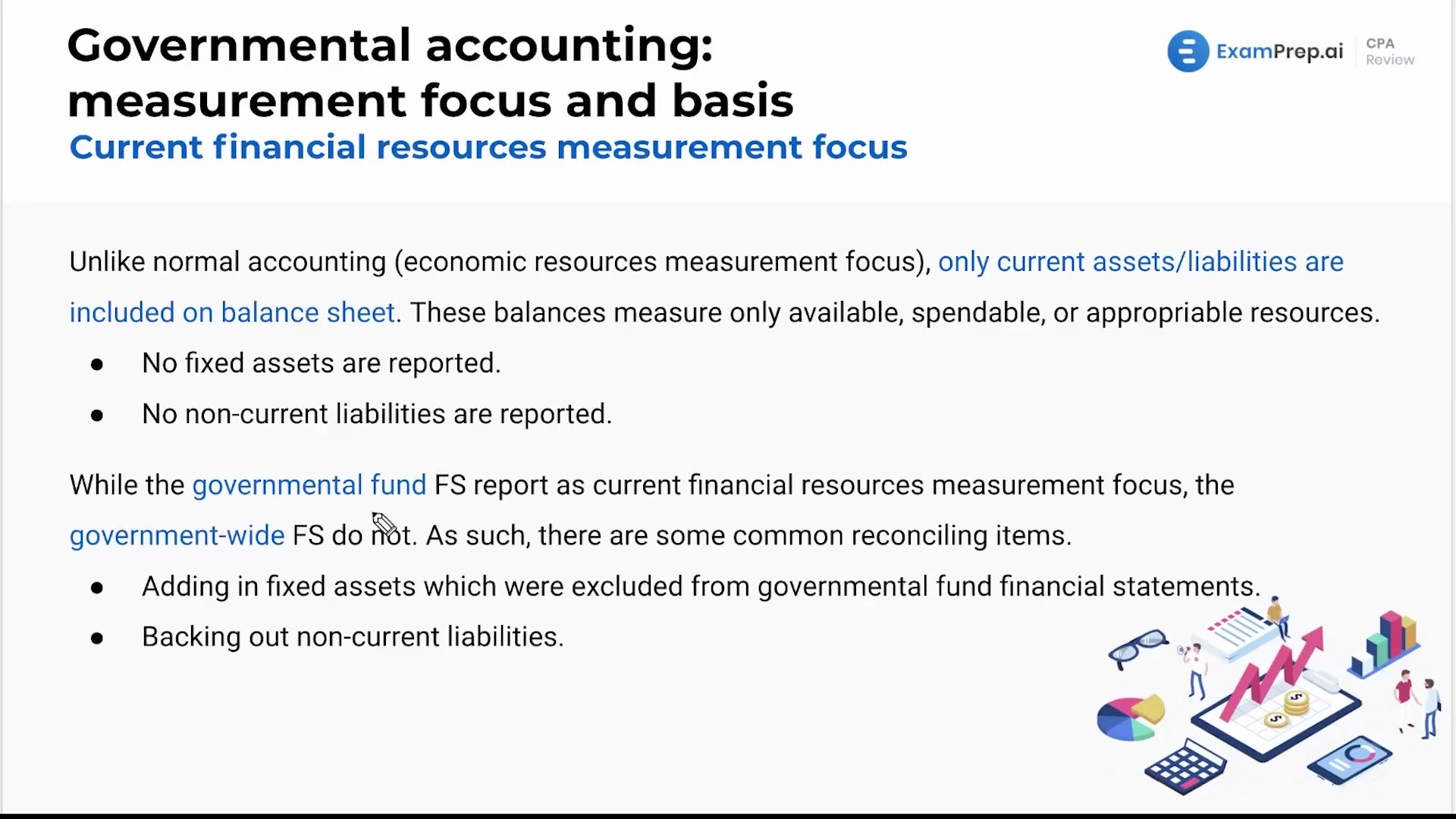

Current Financial Resources Measurement Focus

Current Financial Resources Measurement Focus

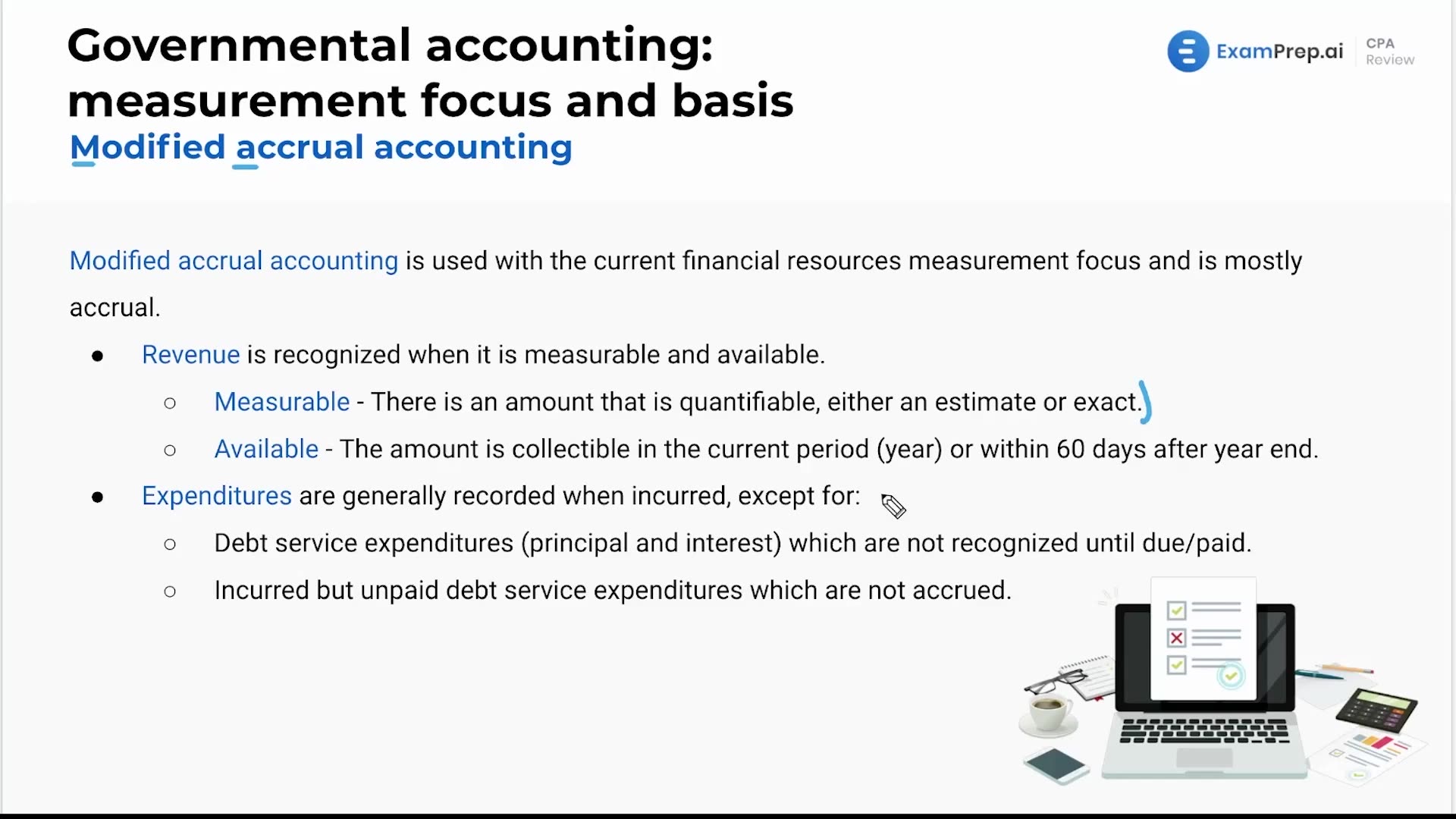

Modified Accrual Accounting

Modified Accrual Accounting

Governmental Accounting: Measurement Focus and Basis Summary

Governmental Accounting: Measurement Focus and Basis Summary

Governmental accounting: measurement focus and basis - Practice Questions

Governmental accounting: measurement focus and basis - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate