Individual Tax Compliance and Planning

Individual tax compliance and planning refers to the adherence to tax regulations and the strategic approach individuals use to minimize their tax liability. This includes understanding and applying tax laws, accurately reporting income and deductions, and utilizing tax planning opportunities to optimize one's financial situation.

Lesson Videos

Introduction to Individual Tax Compliance and Planning

Introduction to Individual Tax Compliance and Planning

Impact of Equity Compensation Awards on Taxable Income

Impact of Equity Compensation Awards on Taxable Income

Alternative Minimum Taxable Income

Alternative Minimum Taxable Income

Imputed Interest and Foreign-Earned Income

Imputed Interest and Foreign-Earned Income

Tax on a Child's Investment and Other Unearned Income

Tax on a Child's Investment and Other Unearned Income

Impact of Changing Tax Rates and Legislation on Tax Planning

Impact of Changing Tax Rates and Legislation on Tax Planning

Flexible Spending Accounts and Health Savings Accounts

Flexible Spending Accounts and Health Savings Accounts

Choosing Between Itemized and Standard Deduction

Choosing Between Itemized and Standard Deduction

Calculating Estimated Tax Payments

Calculating Estimated Tax Payments

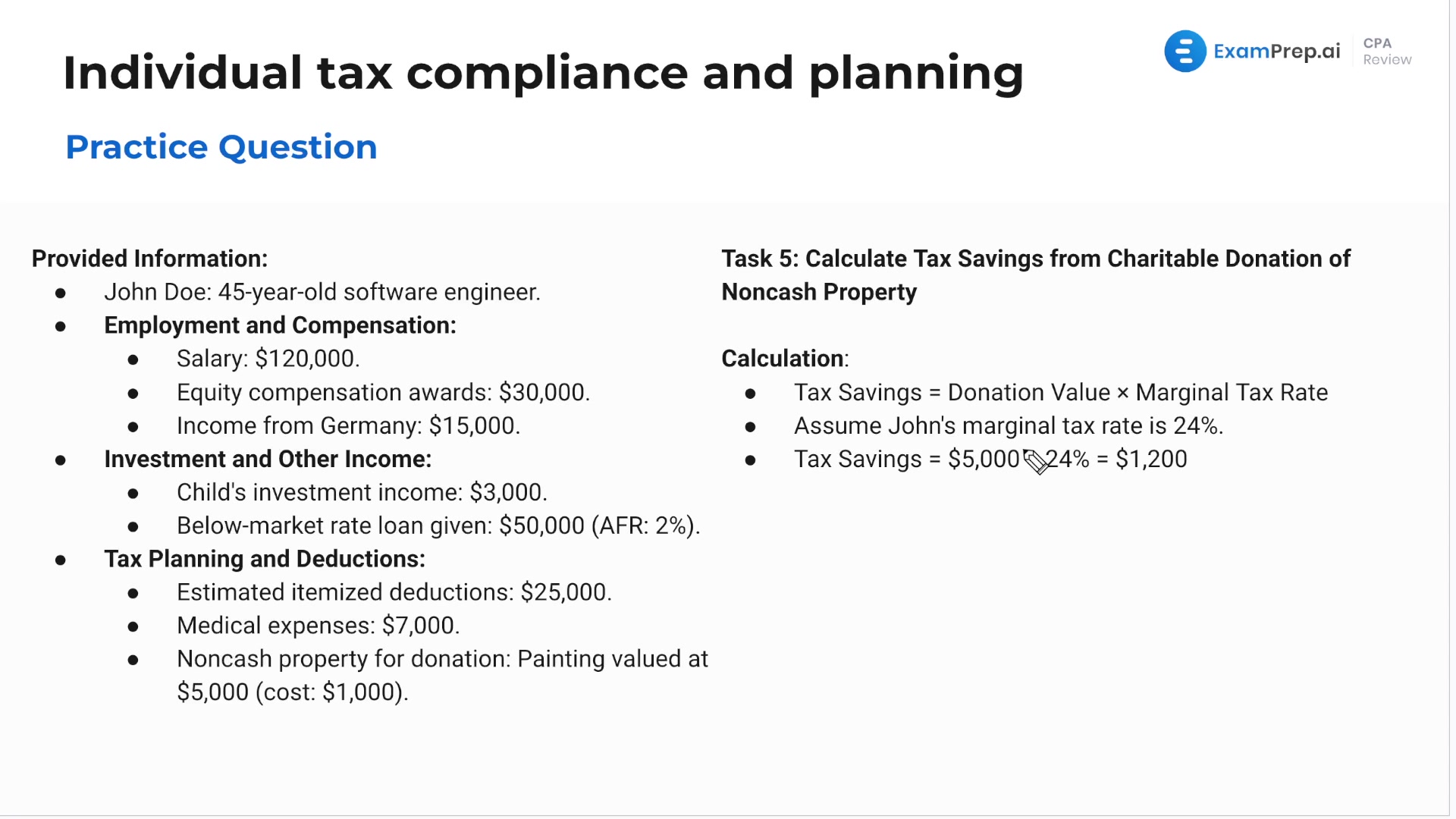

Donating Non-Cash Property to a Charitable Organization

Donating Non-Cash Property to a Charitable Organization

Year-End Planning for Minimizing Tax Liability

Year-End Planning for Minimizing Tax Liability

Individual Tax Compliance and Planning Summary

Individual Tax Compliance and Planning Summary

Individual Tax Compliance and Planning - Practice Questions

Individual Tax Compliance and Planning - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate