Interacting with the IRS: Tax Positions, Audits, Appeals and Judicial Process

This scope delves into the various aspects of professional engagement with the Internal Revenue Service (IRS), encompassing the articulation and defense of tax positions, navigating through audits, managing the appeals process, and understanding the judicial procedures that may come into play when tax controversies arise.

Lesson Videos

Interacting with the IRS: Tax Positions, Audits, Appeals and Judicial Process Overview

Interacting with the IRS: Tax Positions, Audits, Appeals and Judicial Process Overview

Introduction to Interacting with the IRS

Introduction to Interacting with the IRS

IRS Audits

IRS Audits

Administrative Appeals Process

Administrative Appeals Process

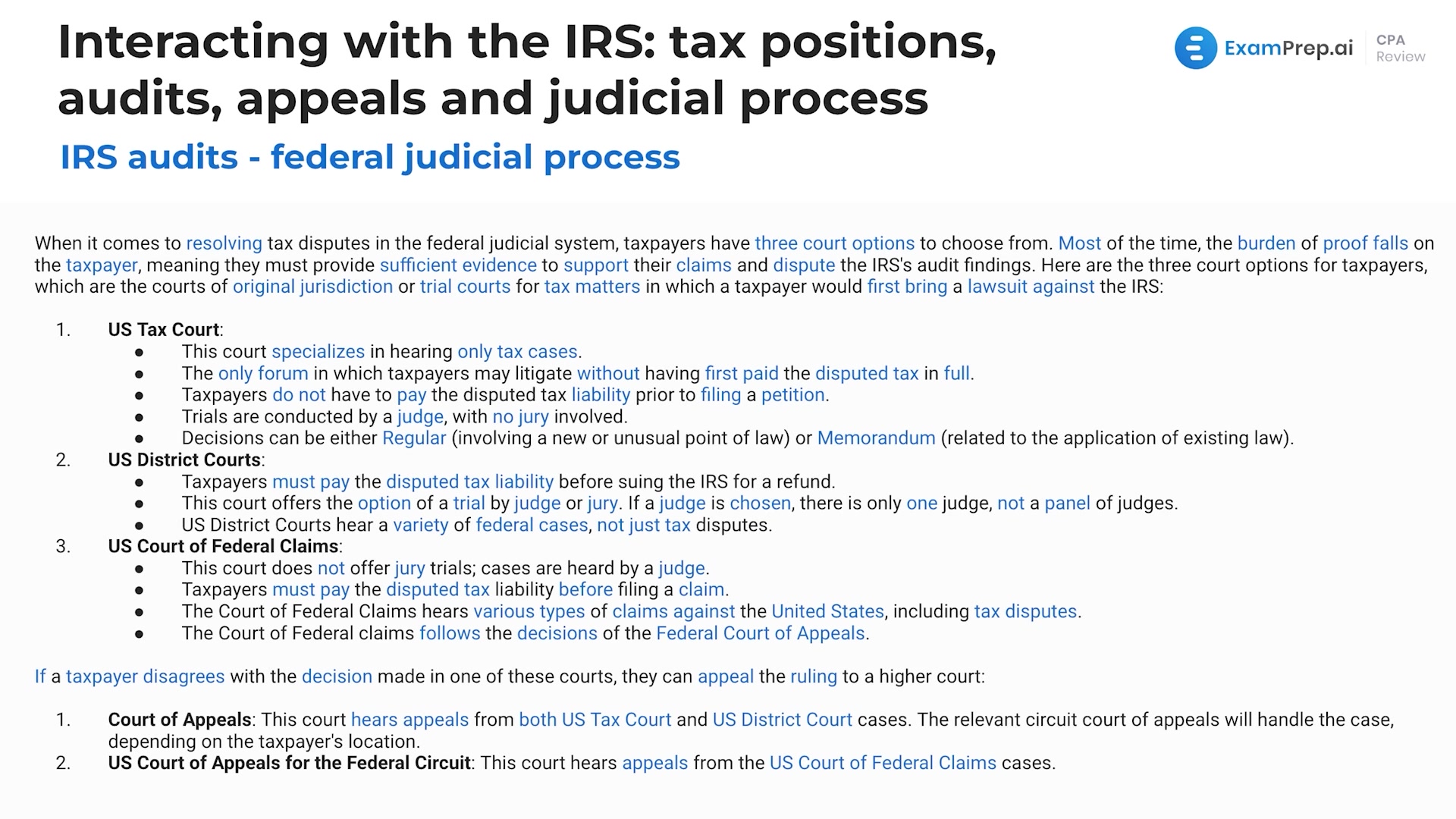

Federal Judicial Process

Federal Judicial Process

Small Cases Division, Writ of Certiorari, and Notices of Deficiency

Small Cases Division, Writ of Certiorari, and Notices of Deficiency

Interacting with the IRS: Tax Positions, Audits, Appeals and Judicial Process Summary

Interacting with the IRS: Tax Positions, Audits, Appeals and Judicial Process Summary

Interacting with the IRS: Tax Positions, Audits, Appeals and Judicial Process - Practice Questions

Interacting with the IRS: Tax Positions, Audits, Appeals and Judicial Process - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate