Leases

Leases in accounting refer to contractual arrangements where one party, the lessor, grants the other, the lessee, the right to use an asset for a specified period in exchange for consideration, typically regular payments. This financial arrangement necessitates specific recognition, measurement, and reporting practices on the financial statements of both lessors and lessees.

Lesson Videos

Leases Overview and Objectives

Leases Overview and Objectives

Introduction to Leases

Introduction to Leases

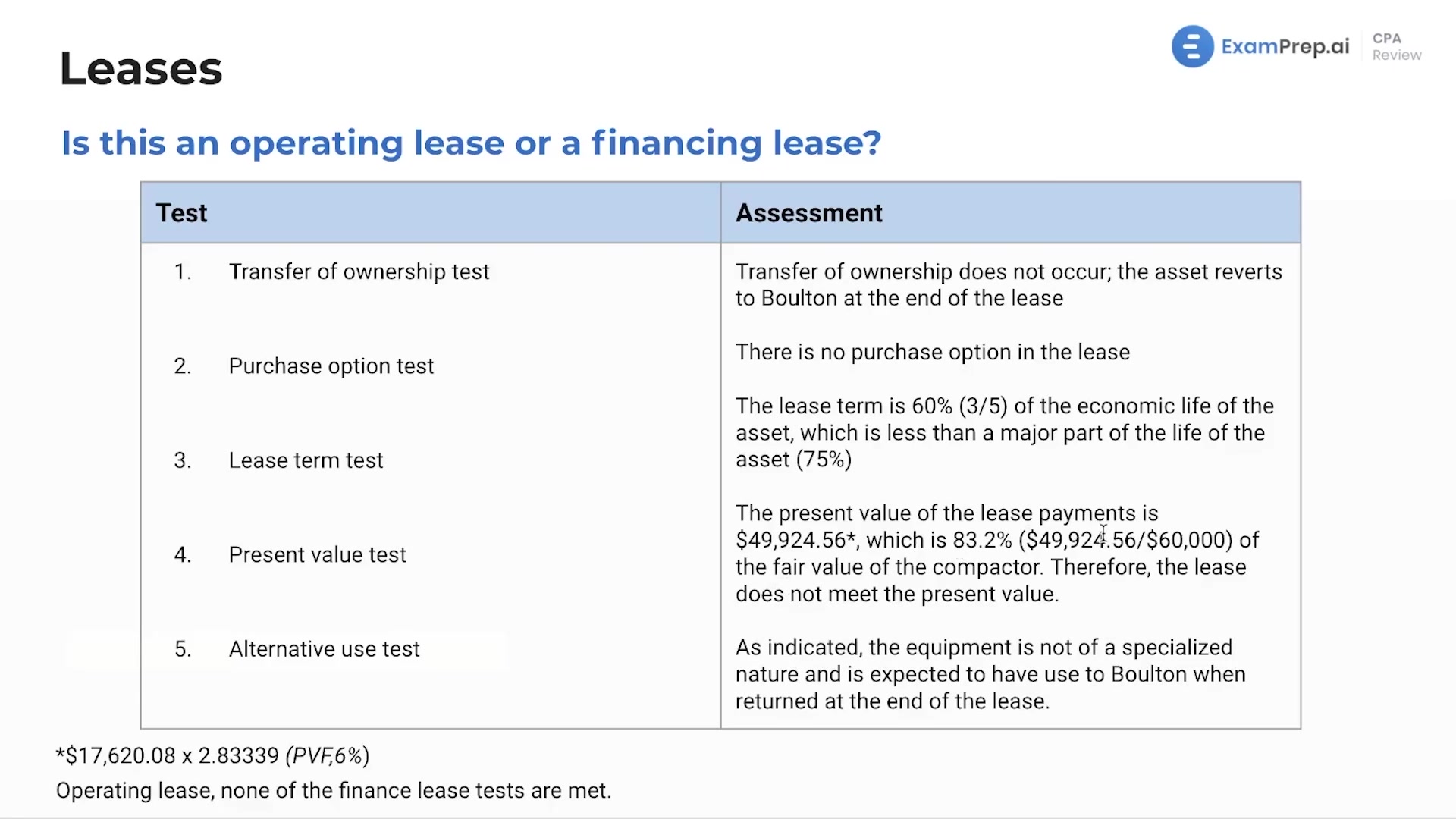

Lease Classification Process

Lease Classification Process

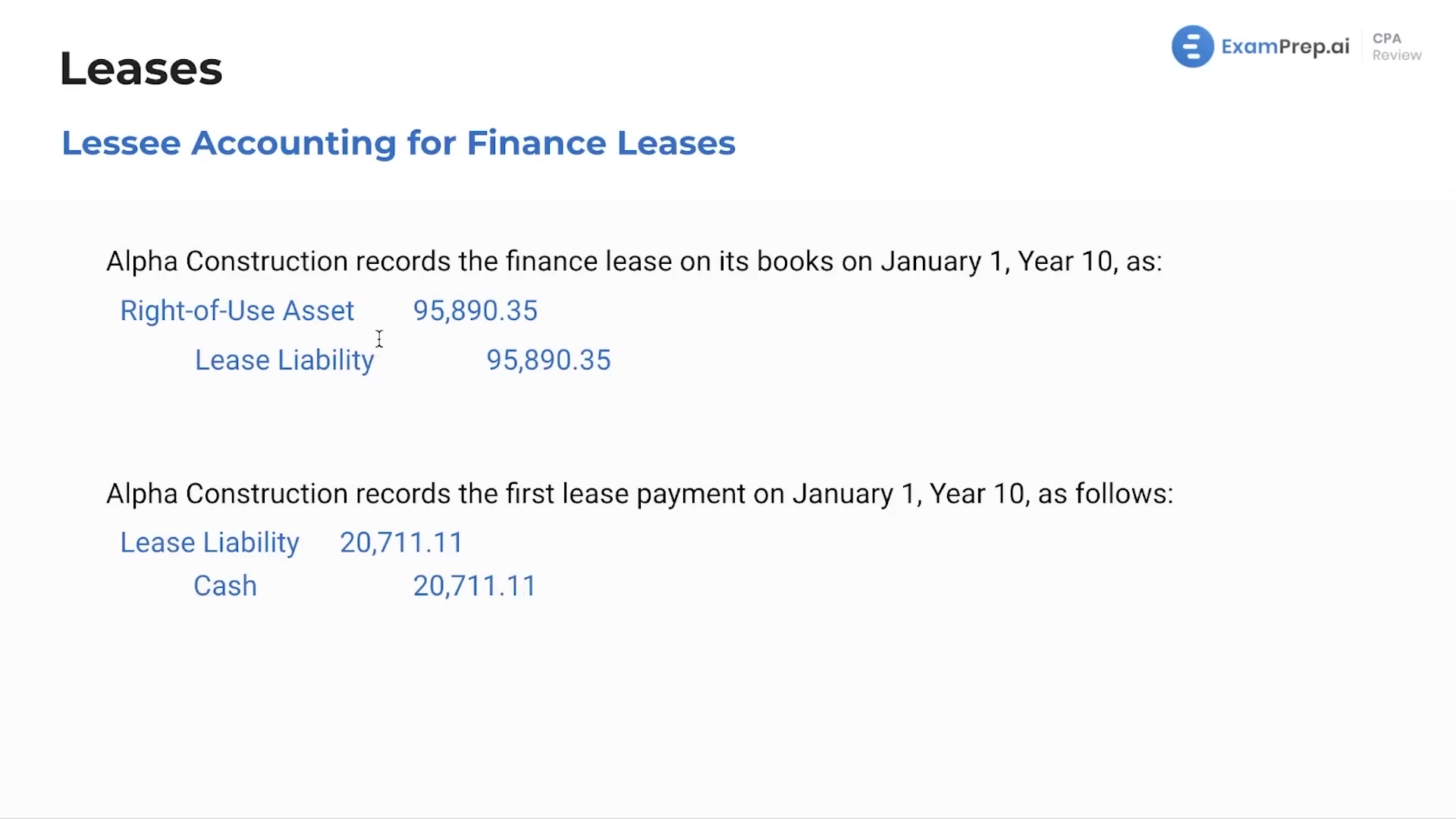

Lessee Accounting for Finance Leases

Lessee Accounting for Finance Leases

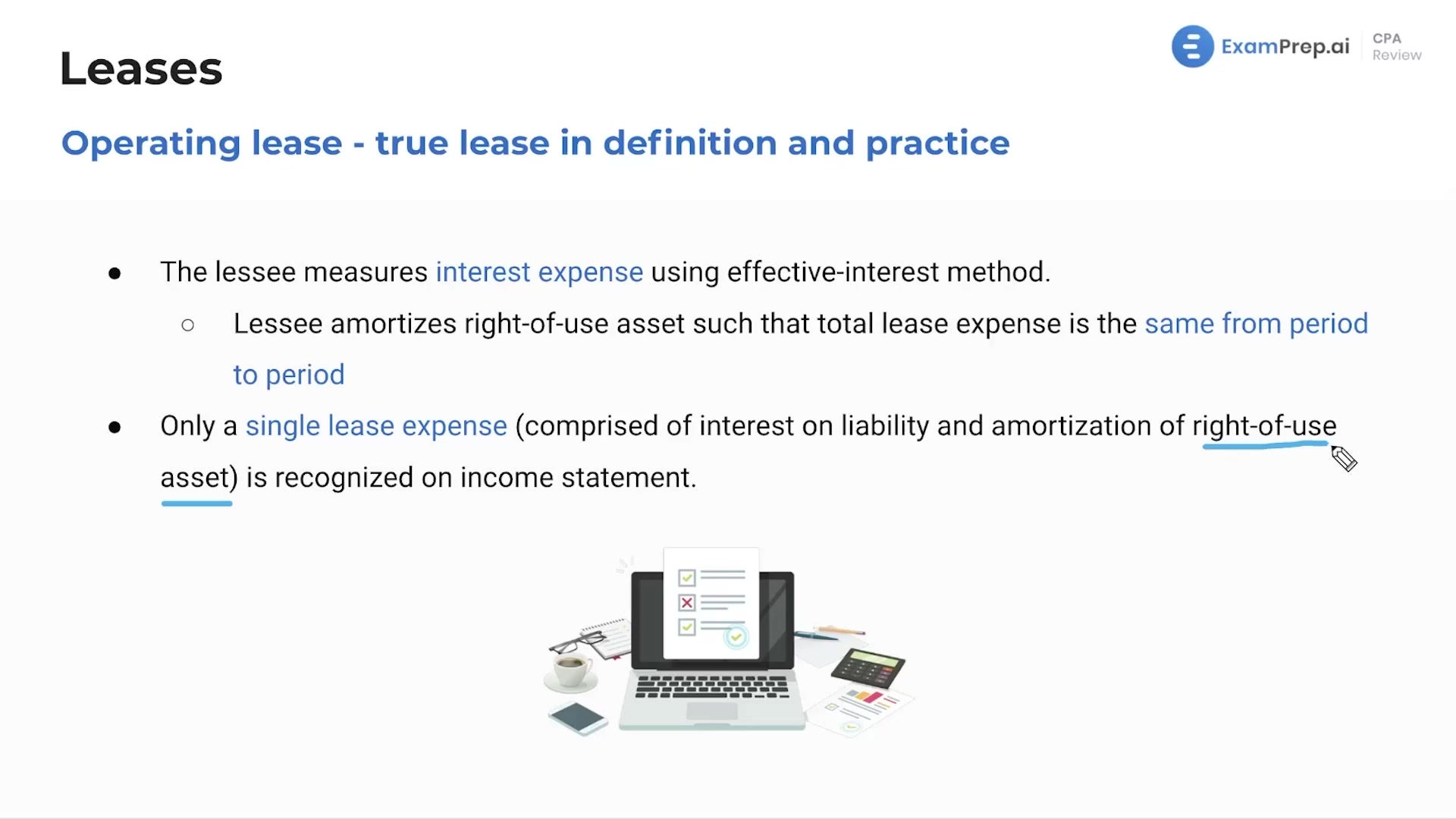

Lessee Accounting for Operating Leases

Lessee Accounting for Operating Leases

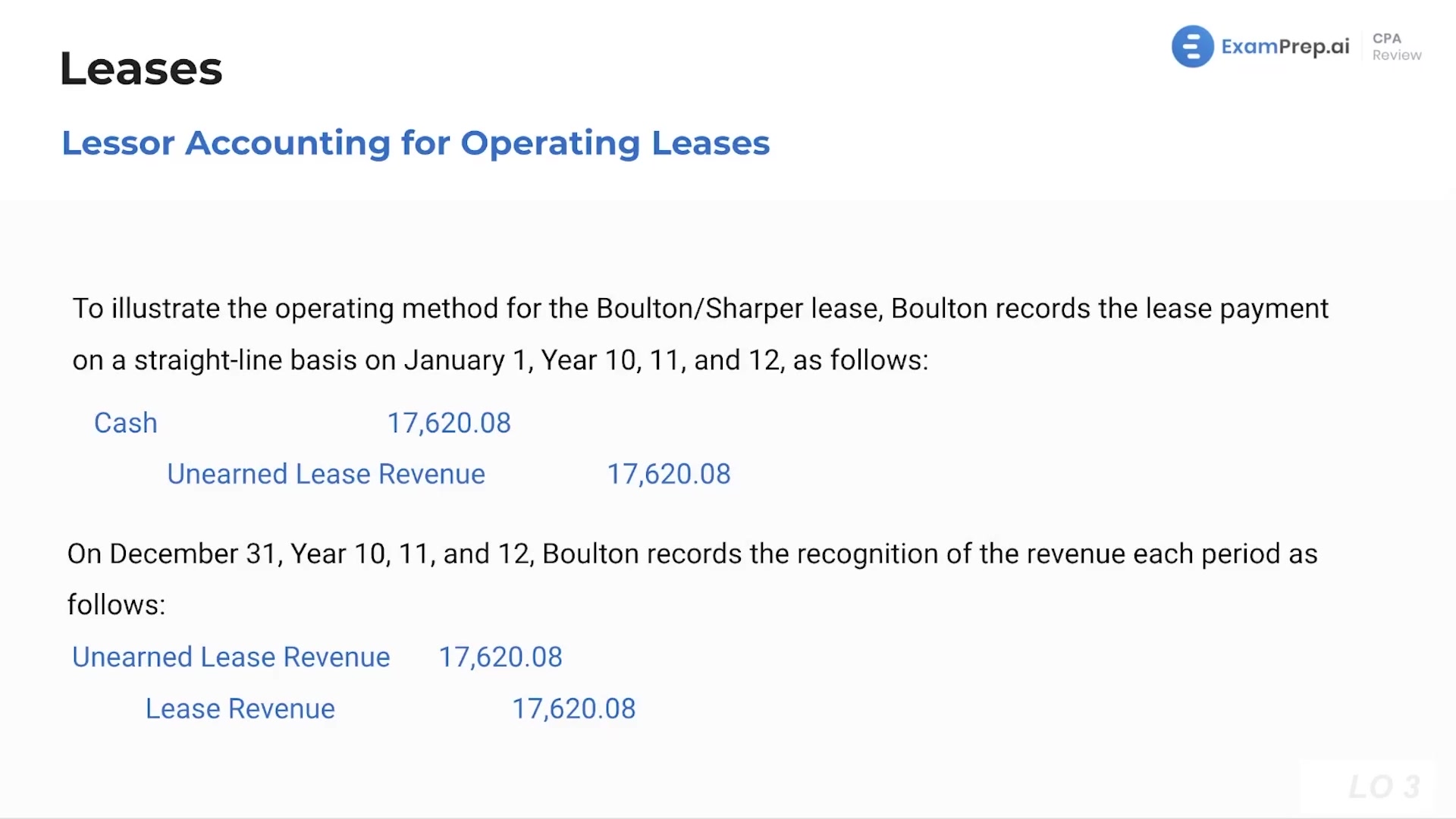

Lessor Accounting for Operating Leases

Lessor Accounting for Operating Leases

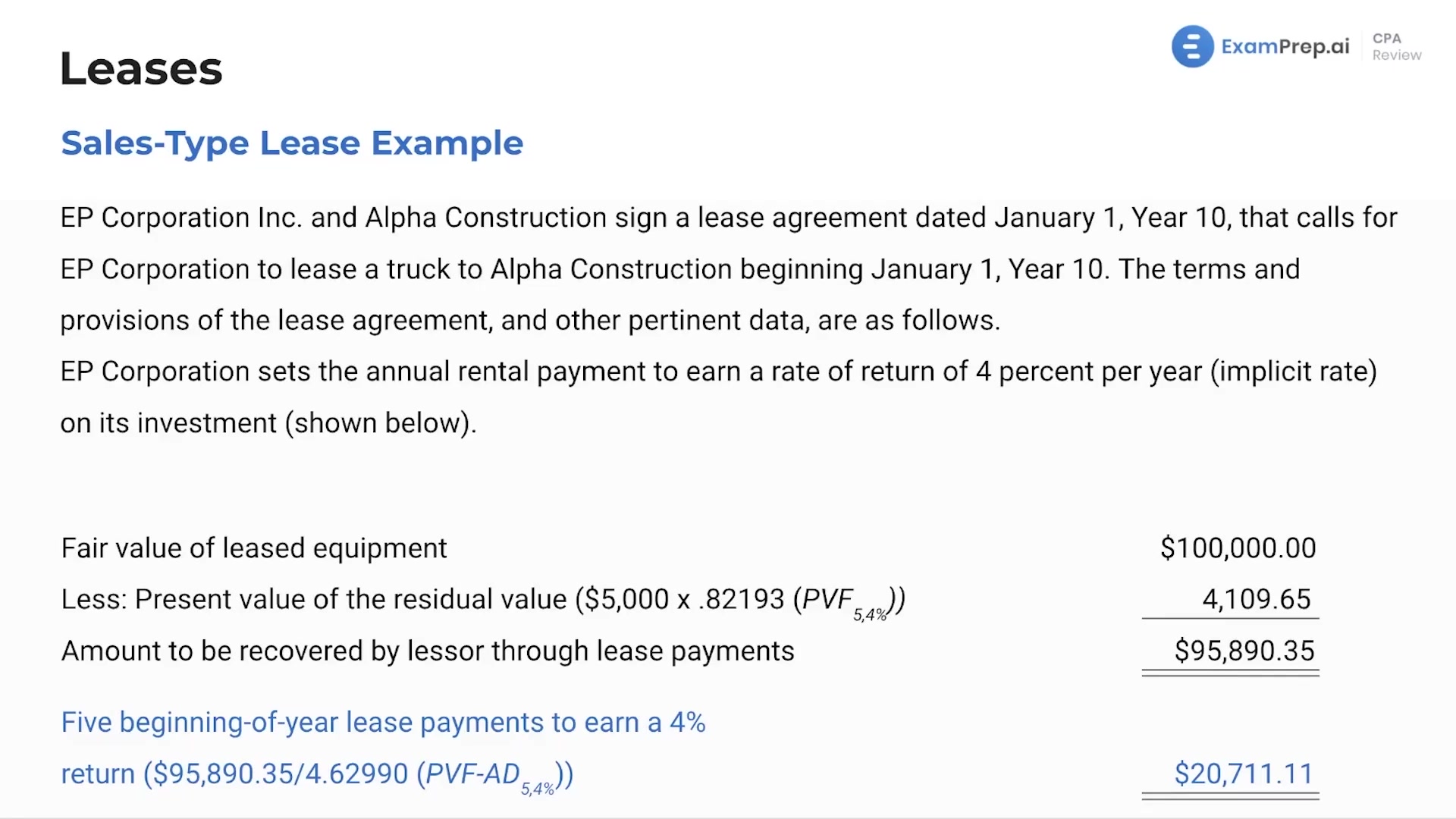

Lessor Accounting for Sales-Type Leases

Lessor Accounting for Sales-Type Leases

Leases Summary

Leases Summary

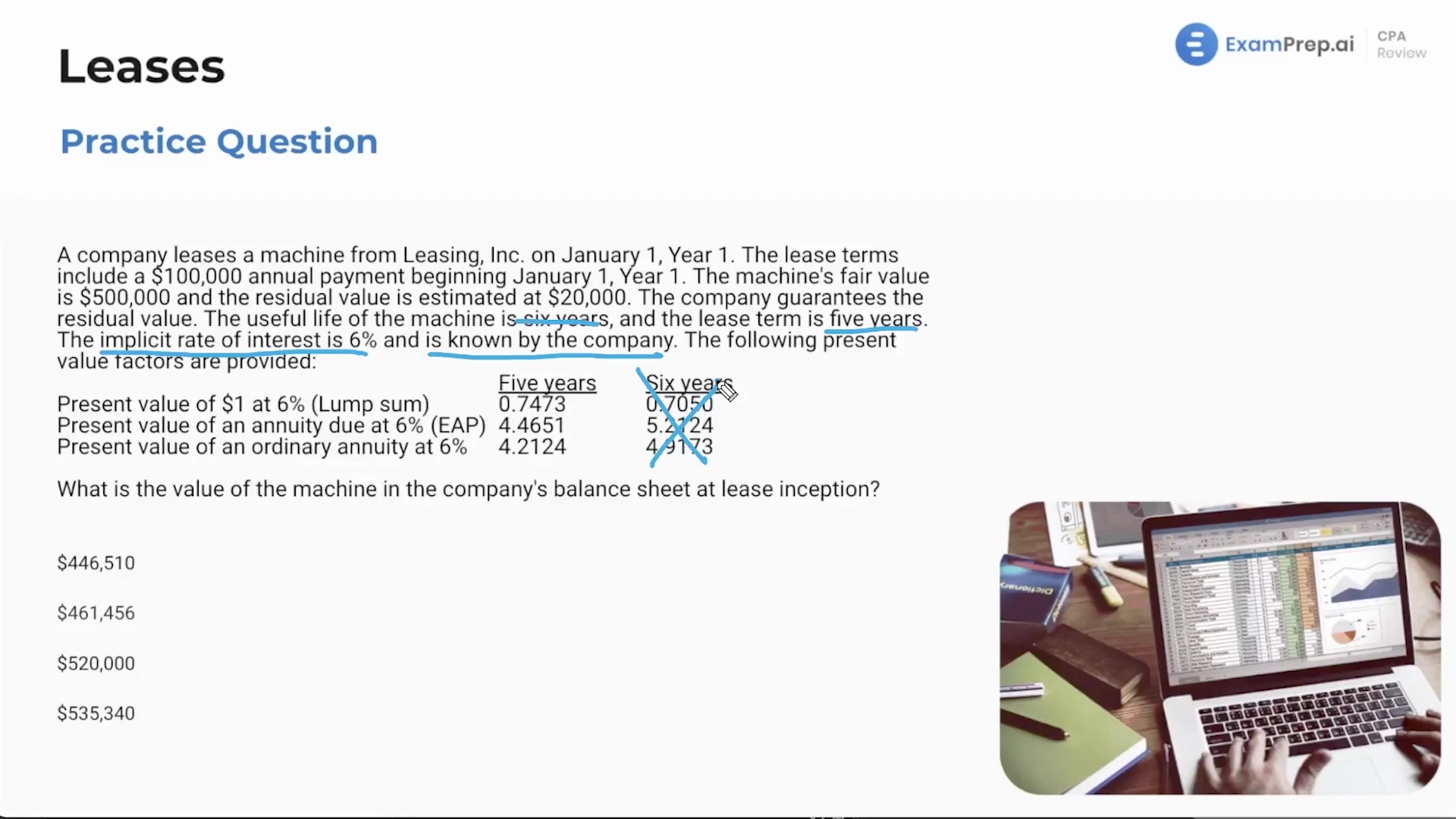

Leases - Practice Questions

Leases - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate