Property, Plant and Equipment

Property, Plant, and Equipment (PP&E) are tangible assets that are expected to generate economic benefits for a company for more than one fiscal period, including land, buildings, machinery, vehicles, and furniture. These assets are used in the production or supply of goods and services, for rental to others, or for administrative purposes and are recorded at historical cost less accumulated depreciation.

Lesson Videos

Property, Plant and Equipment Overview and Objectives

Property, Plant and Equipment Overview and Objectives

Introduction to Property, Plant and Equipment

Introduction to Property, Plant and Equipment

Cost of Acquiring Fixed Assets

Cost of Acquiring Fixed Assets

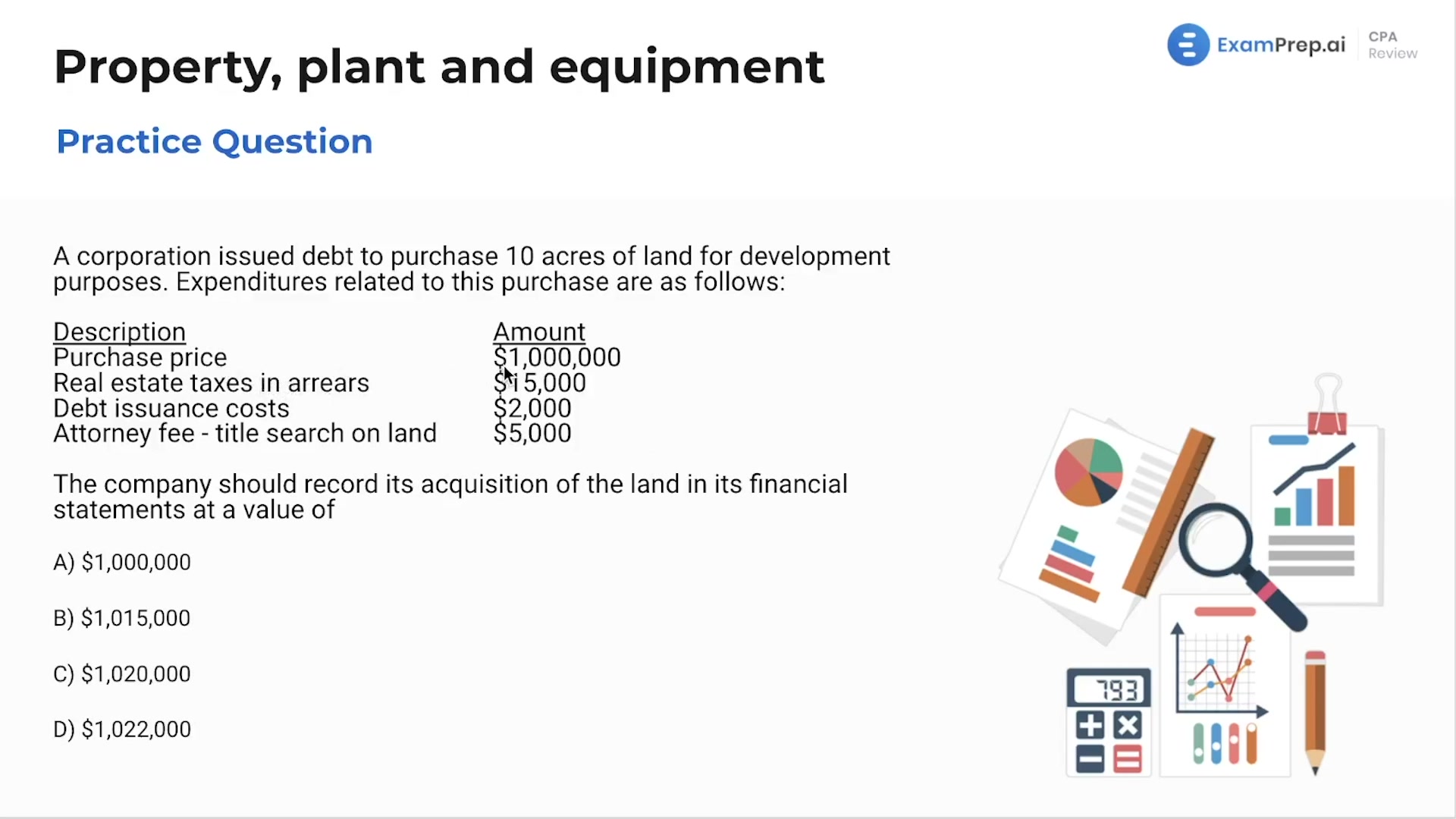

Land Costs

Land Costs

Plant Costs

Plant Costs

Improvements to Property, Plant and Equipment

Improvements to Property, Plant and Equipment

Capitalizing vs Expensing

Capitalizing vs Expensing

Equipment Costs

Equipment Costs

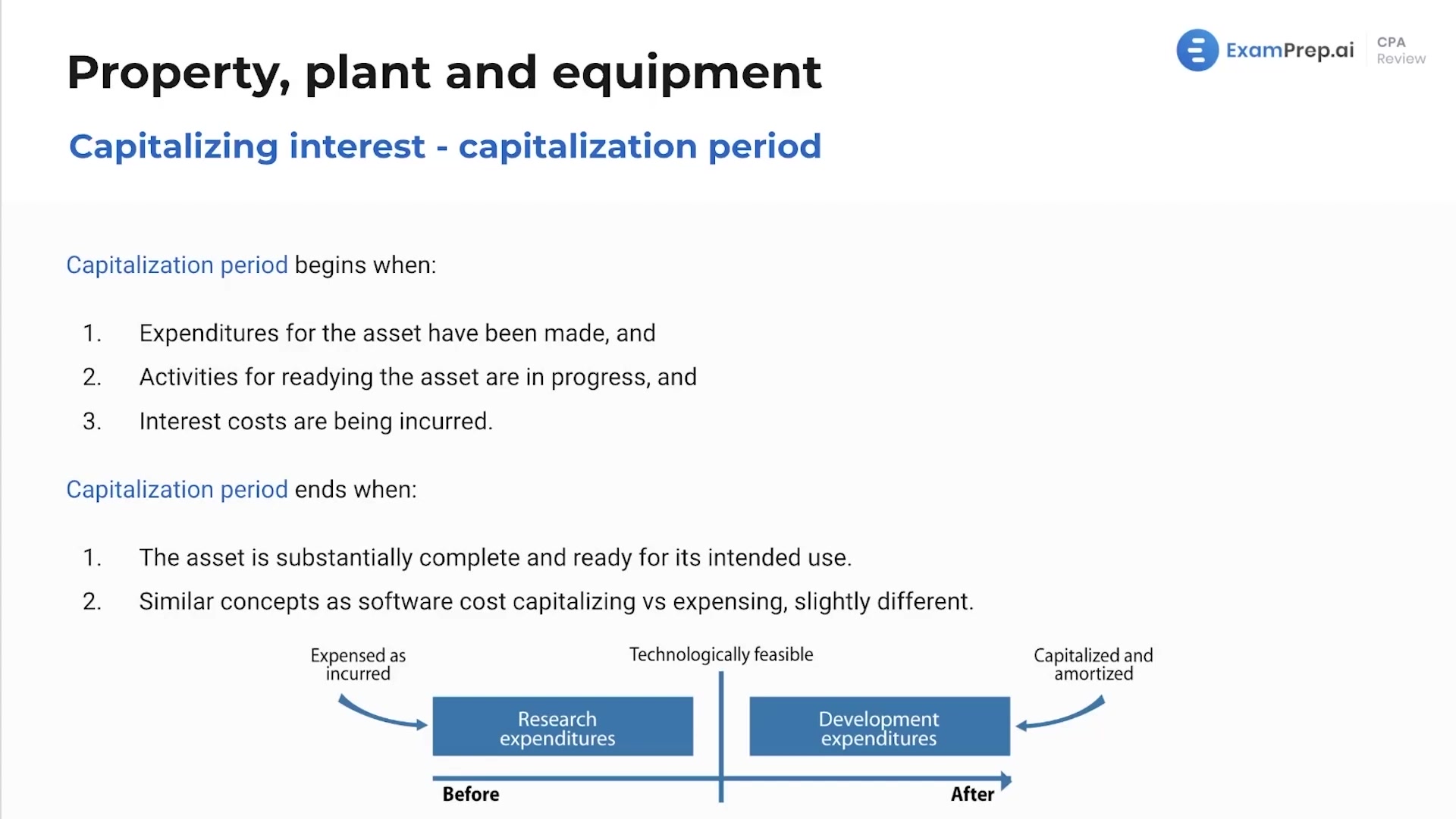

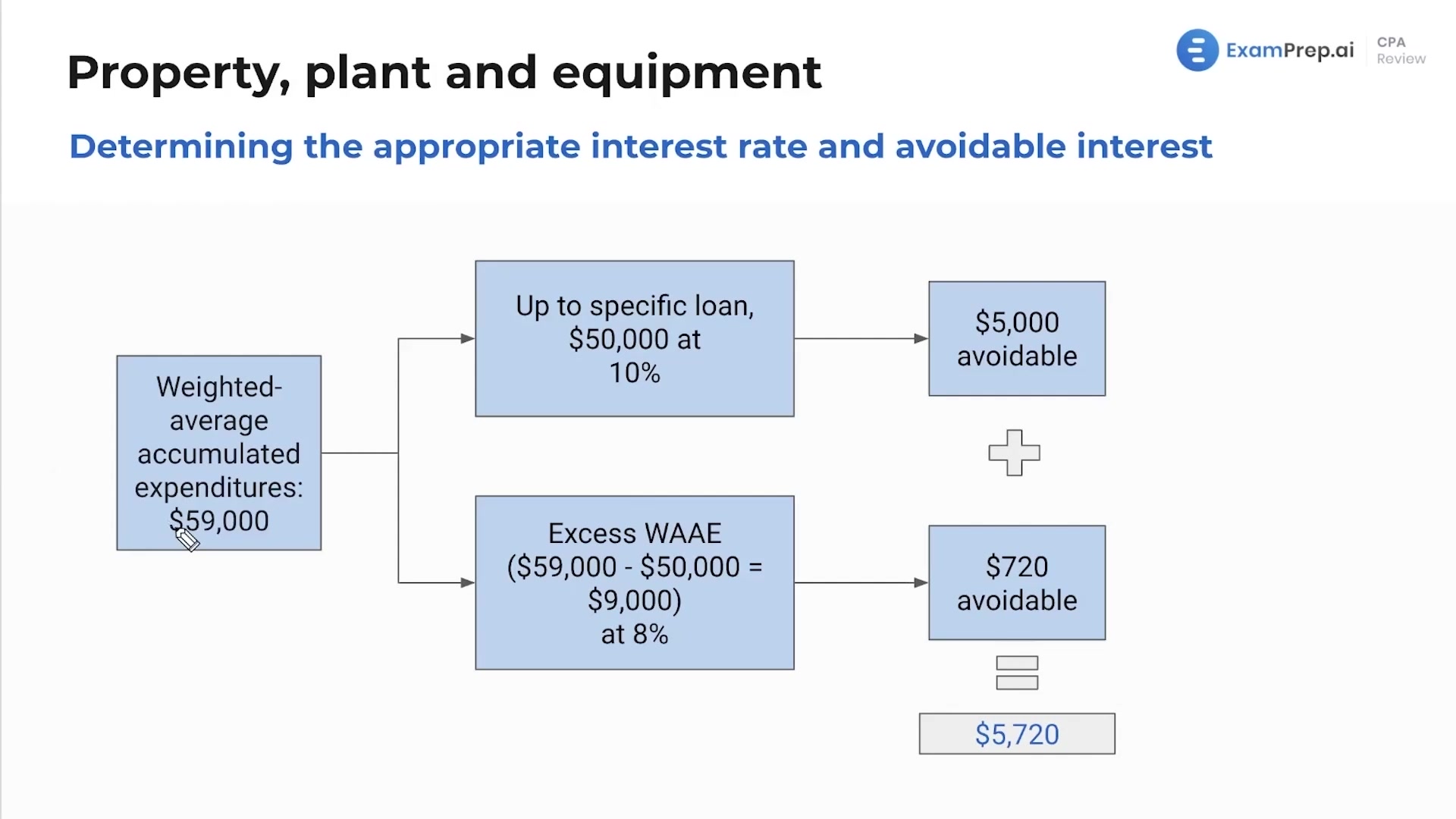

Interest Capitalization

Interest Capitalization

Property, Plant and Equipment Calculation Examples

Property, Plant and Equipment Calculation Examples

Valuation Issues

Valuation Issues

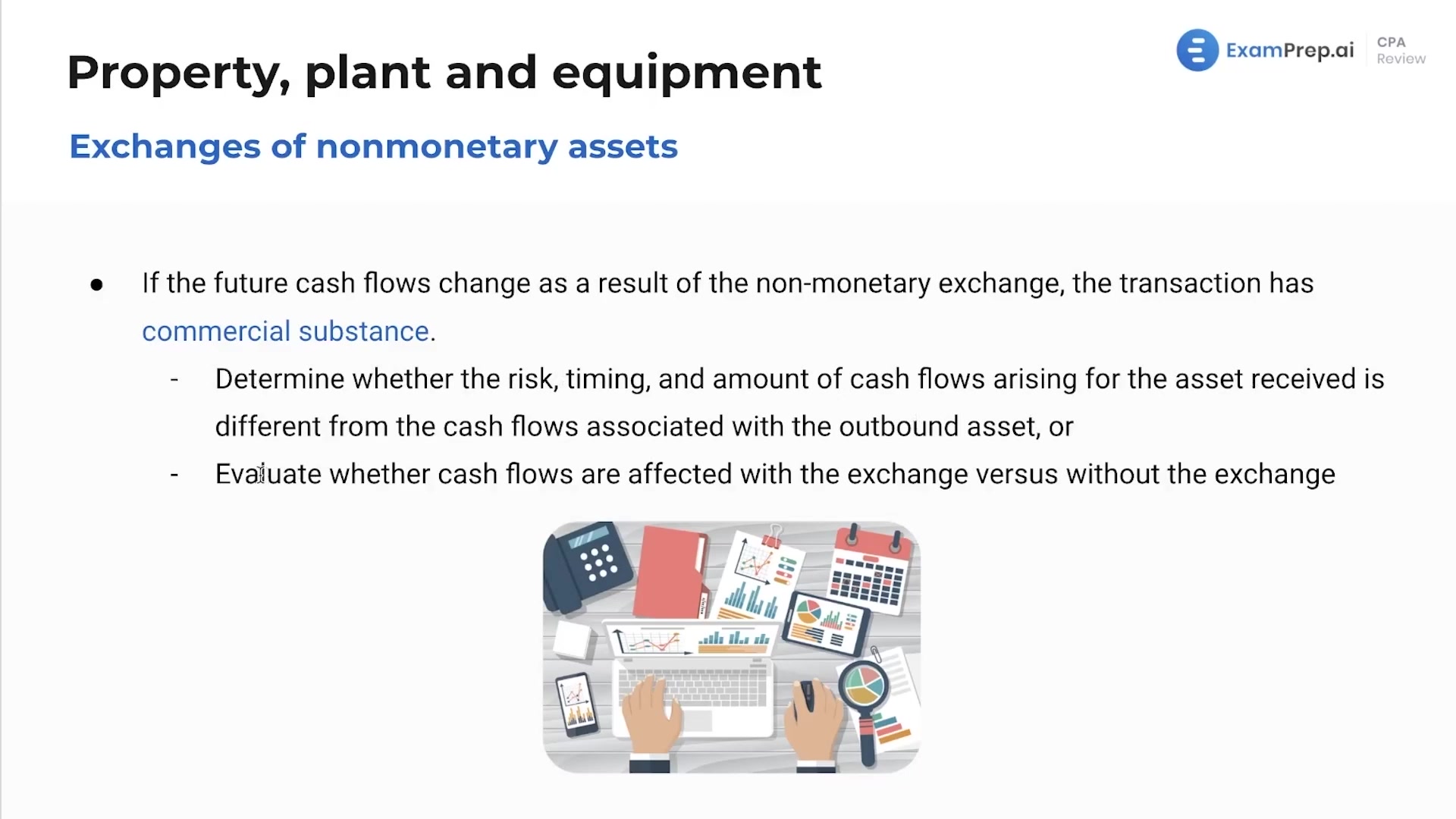

Exchanges of Nonmonetary Assets

Exchanges of Nonmonetary Assets

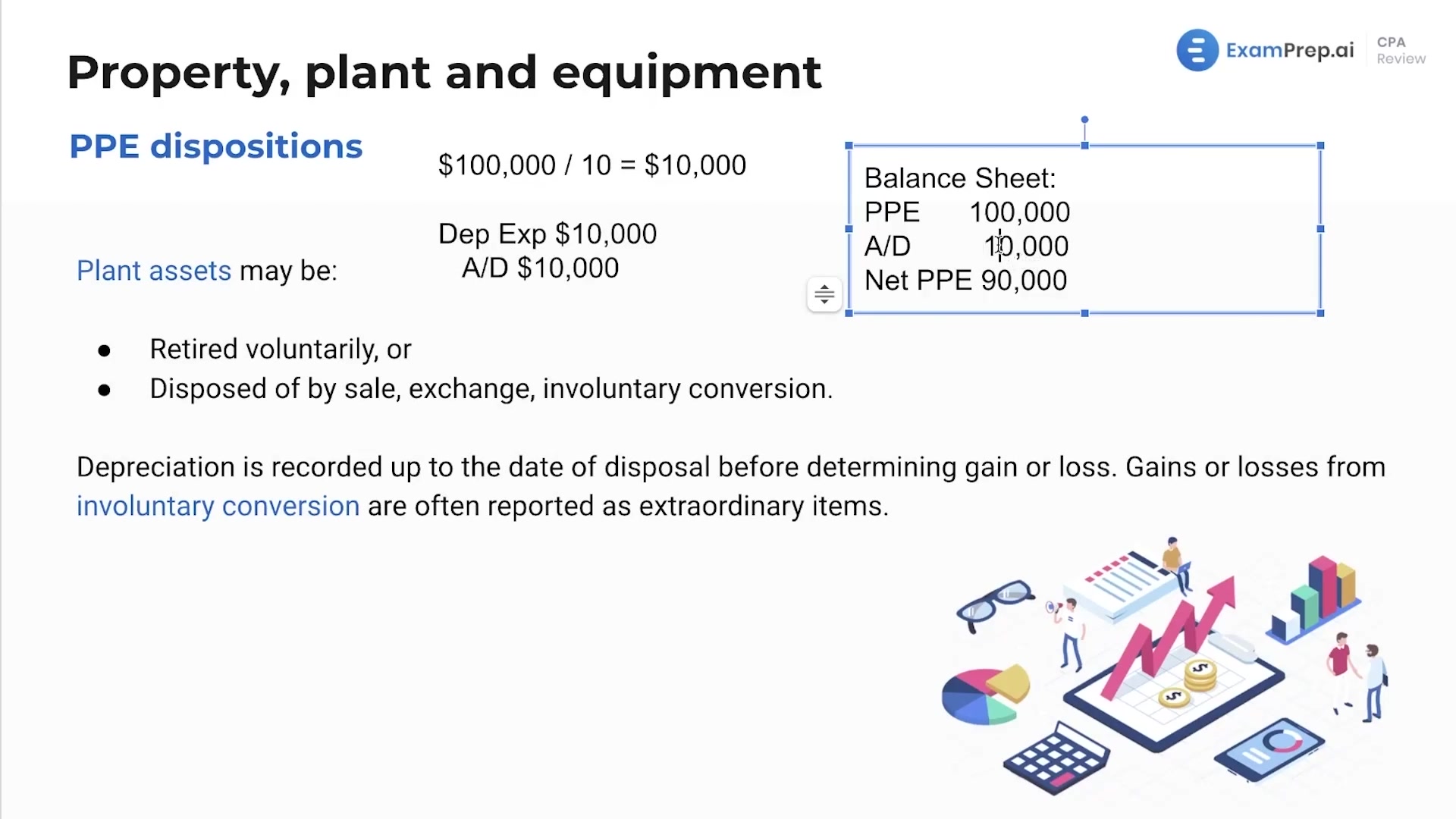

Disposal of Property, Plant and Equipment

Disposal of Property, Plant and Equipment

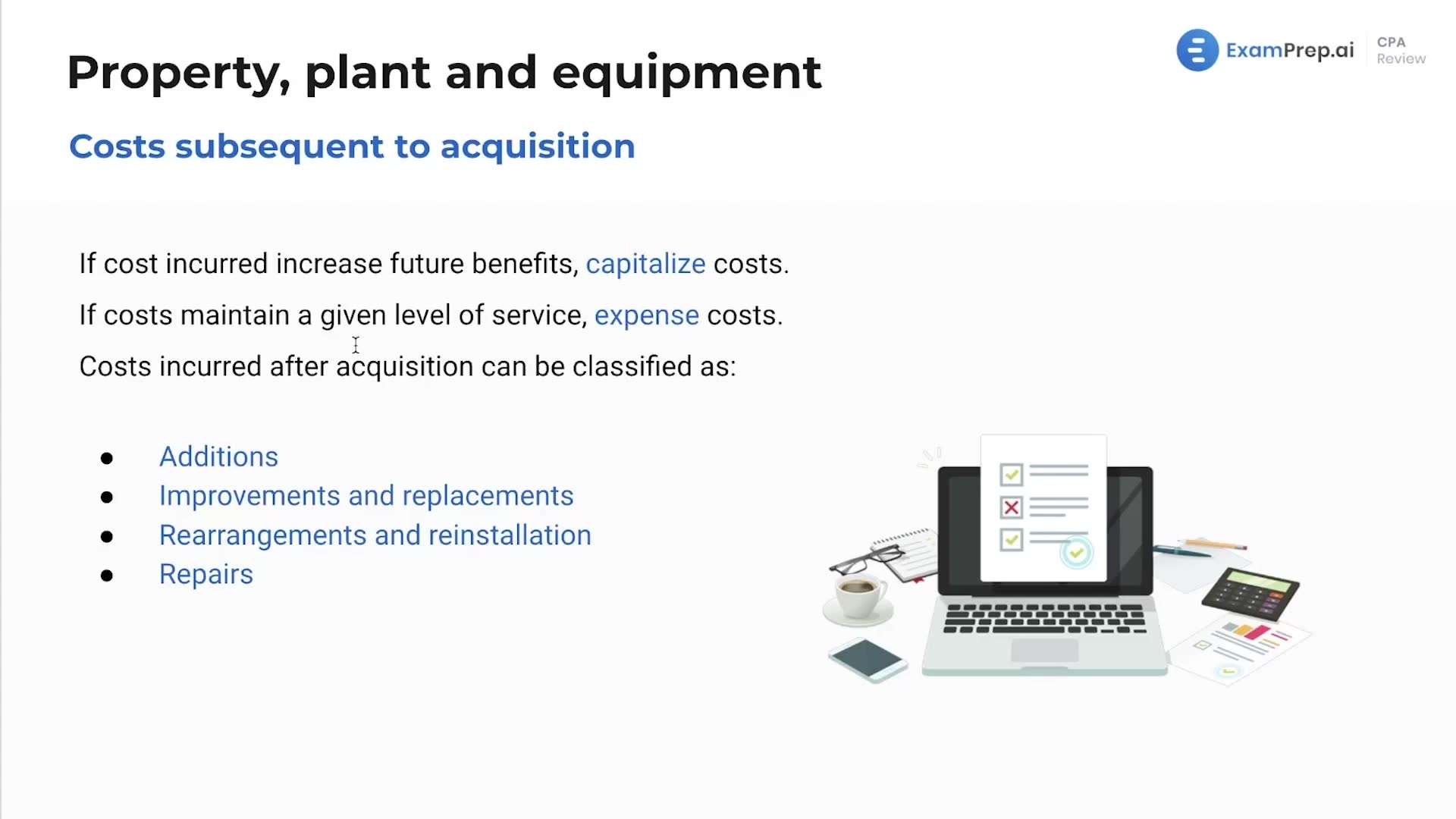

Costs Subsequent to Acquisition

Costs Subsequent to Acquisition

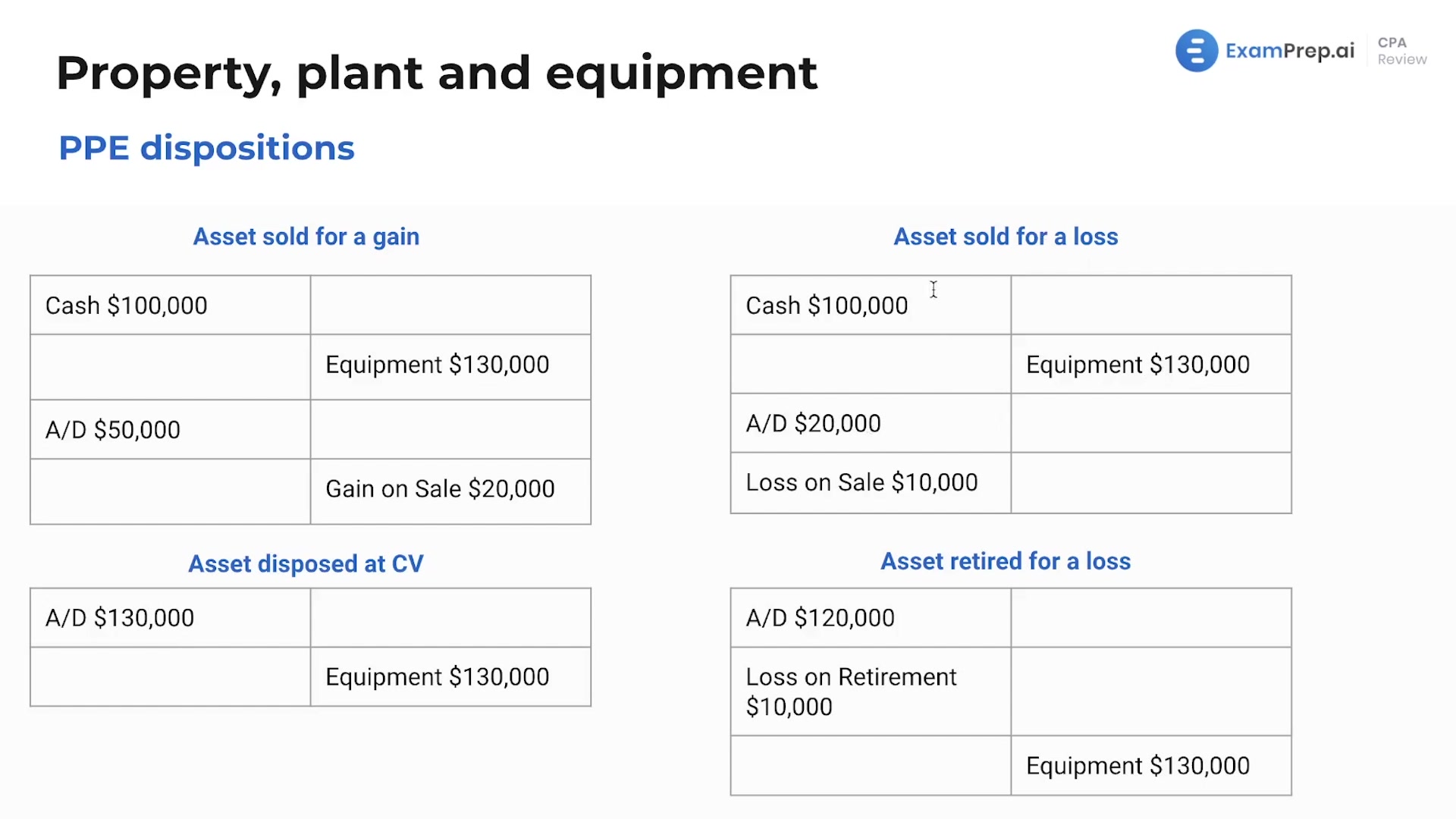

Asset Disposal Journal Entries

Asset Disposal Journal Entries

Net Book Value Calculation

Net Book Value Calculation

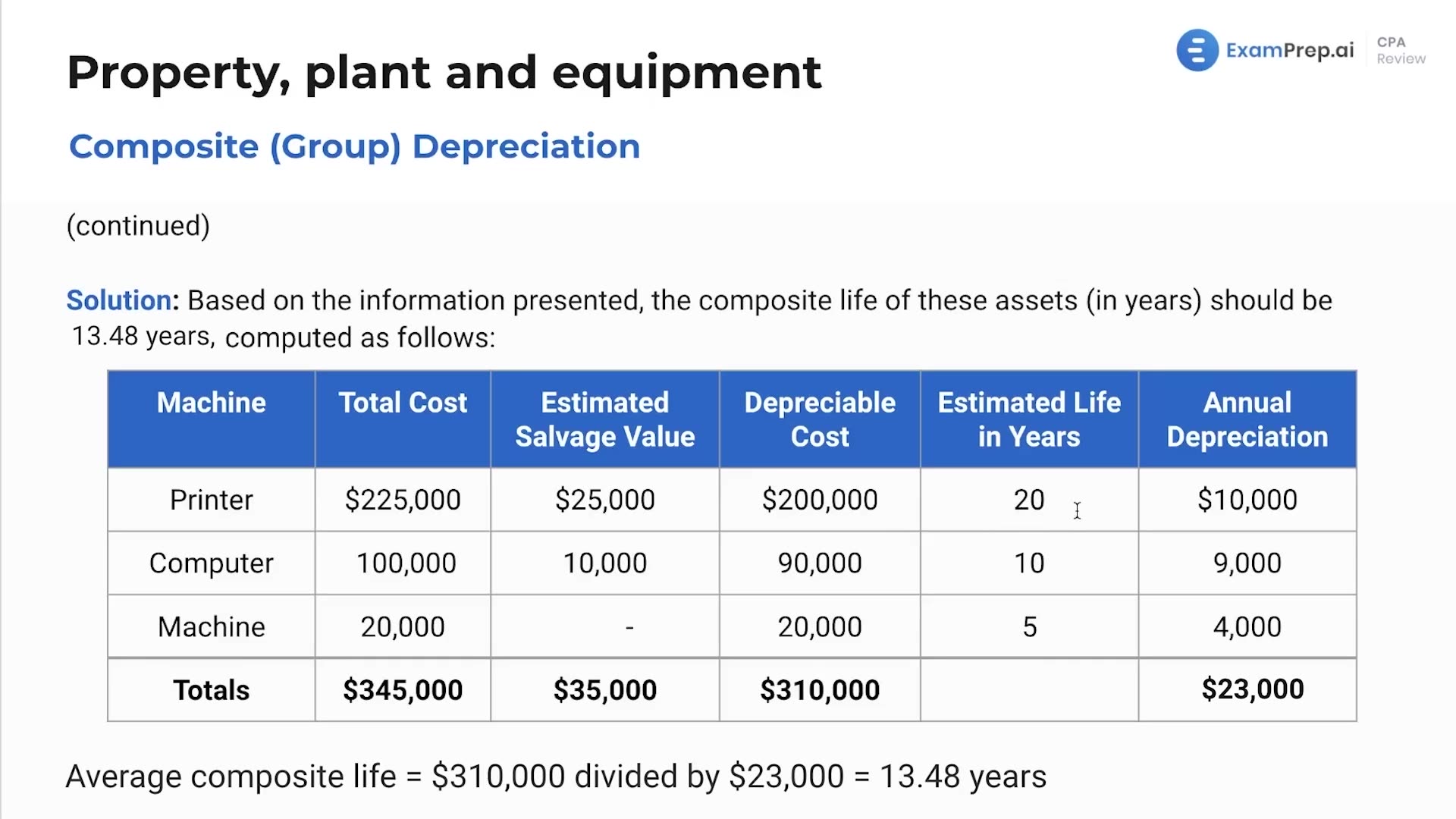

Composite Depreciation

Composite Depreciation

Property, Plant and Equipment Summary

Property, Plant and Equipment Summary

Property, plant and equipment - Practice Questions

Property, plant and equipment - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate