Related Party Transactions

Related Party Transactions refer to financial dealings between entities that have a pre-existing, often familial or associative, connection which may not be conducted at arm's length, potentially leading to conflicts of interest and requiring careful scrutiny to ensure the transactions are in accordance with generally accepted accounting principles (GAAP).

Lesson Videos

Related Party Transactions Overview

Related Party Transactions Overview

Introduction to Related Party Transactions

Introduction to Related Party Transactions

Overview of Section 267

Overview of Section 267

Examples of Related Parties

Examples of Related Parties

Section 267 Attribution Rules

Section 267 Attribution Rules

Disallowed Losses Due to Related Party Transactions

Disallowed Losses Due to Related Party Transactions

Capital Gains and Losses for Related Parties

Capital Gains and Losses for Related Parties

Below Market Loans and Imputed Interest

Below Market Loans and Imputed Interest

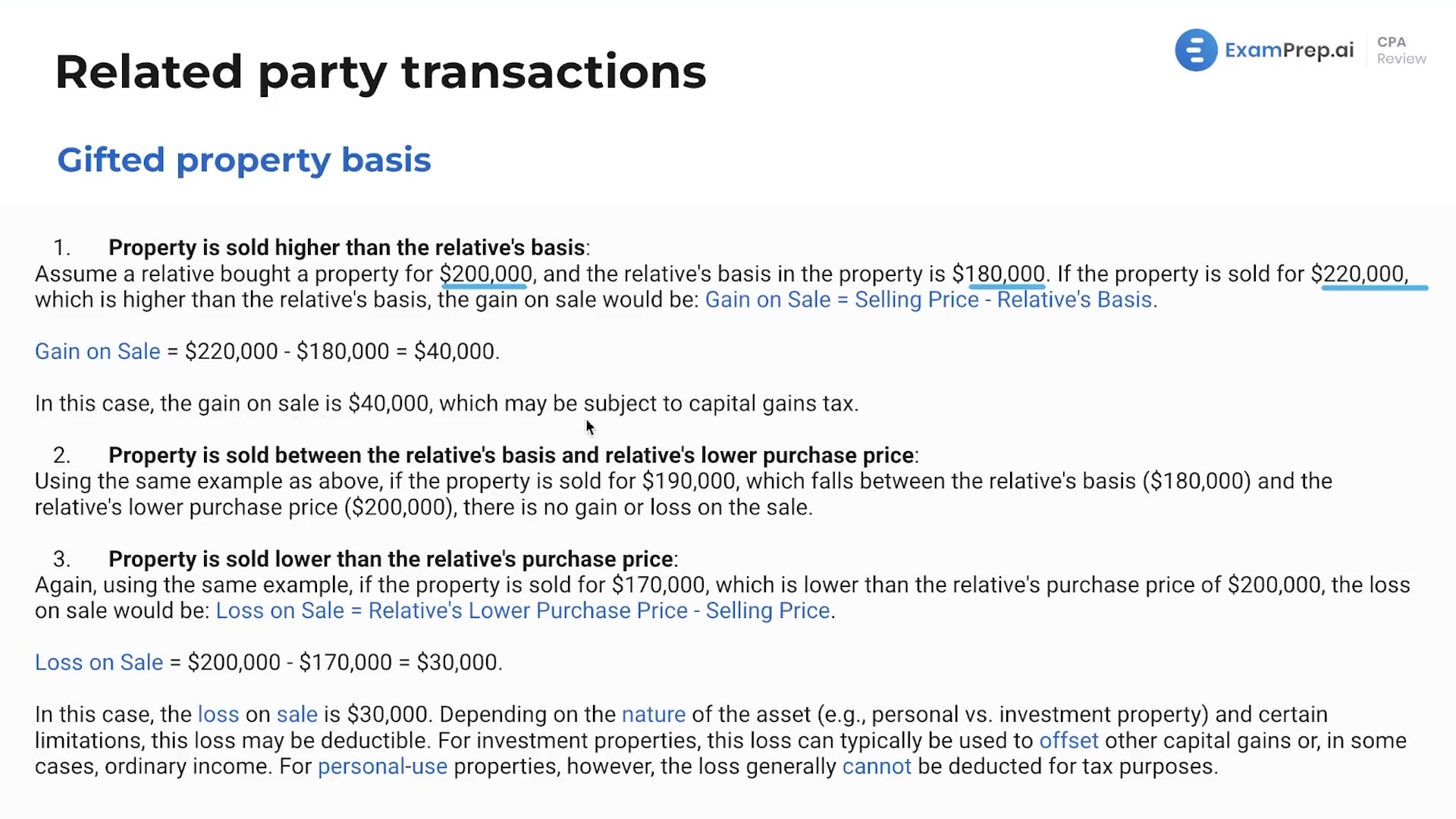

Gifted Property Basis

Gifted Property Basis

Related Party Transactions Summary

Related Party Transactions Summary

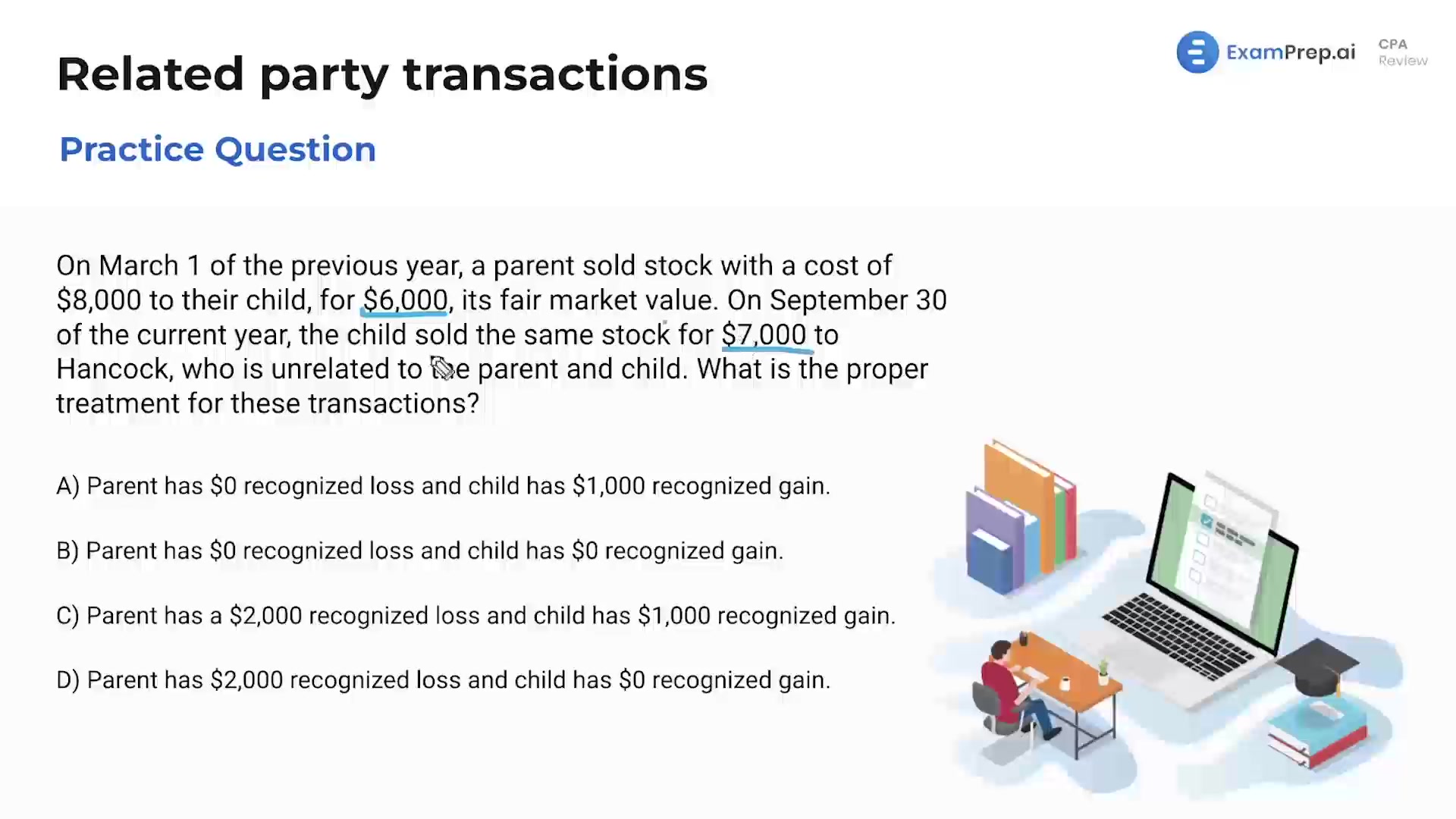

Related Party Transactions - Practice Questions

Related Party Transactions - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate