S Corporations: Eligibility and Election

S Corporations are distinct legal entities that elect pass-through taxation to avoid double taxation on corporate income, with strict eligibility criteria, including limits on the number and type of shareholders, which must be adhered to for maintaining this status.

Lesson Videos

S Corporations: Eligibility and Election Overview

S Corporations: Eligibility and Election Overview

Introduction to S Corporations: Eligibility and Election

Introduction to S Corporations: Eligibility and Election

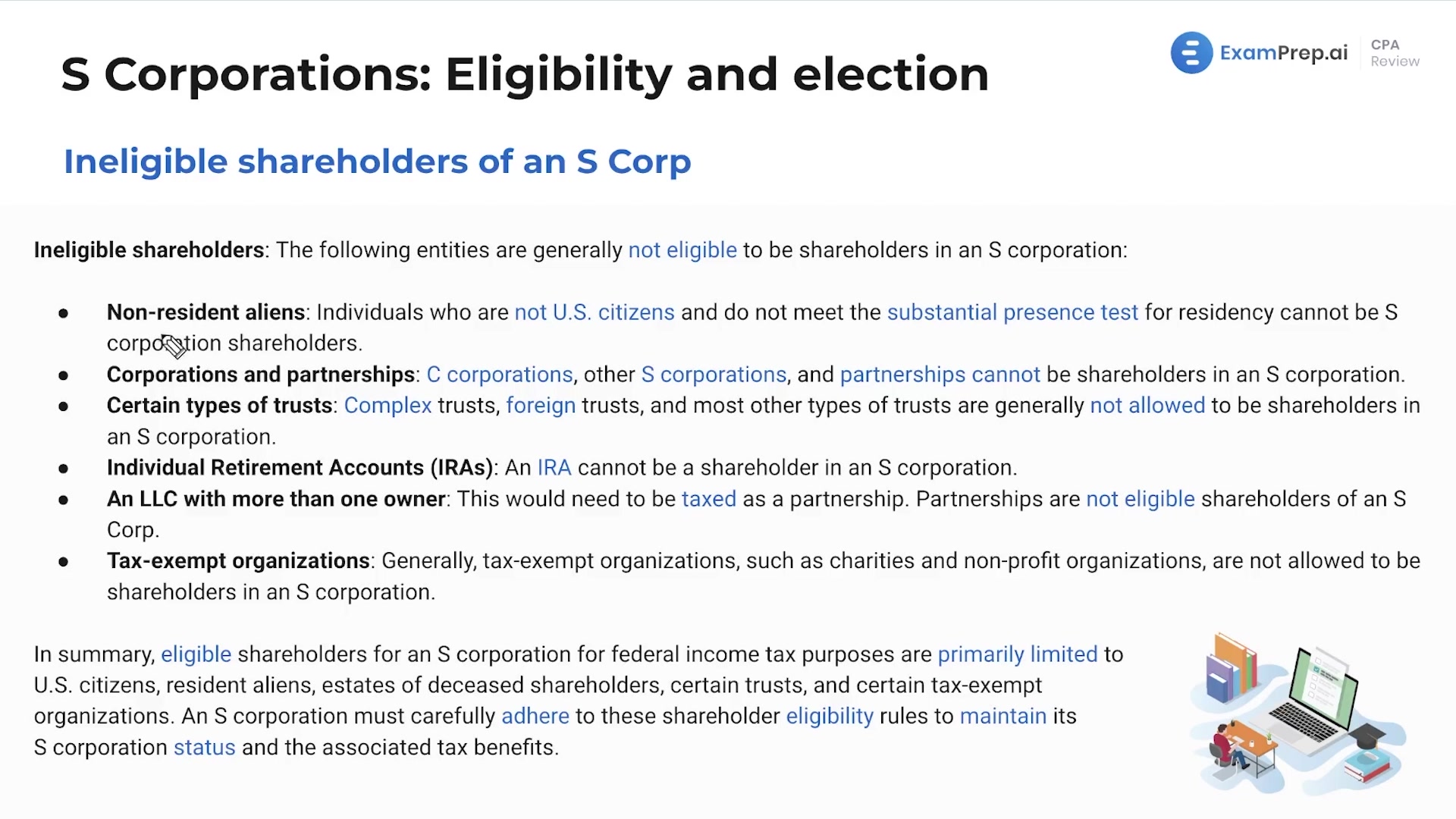

Shareholders of an S Corporation

Shareholders of an S Corporation

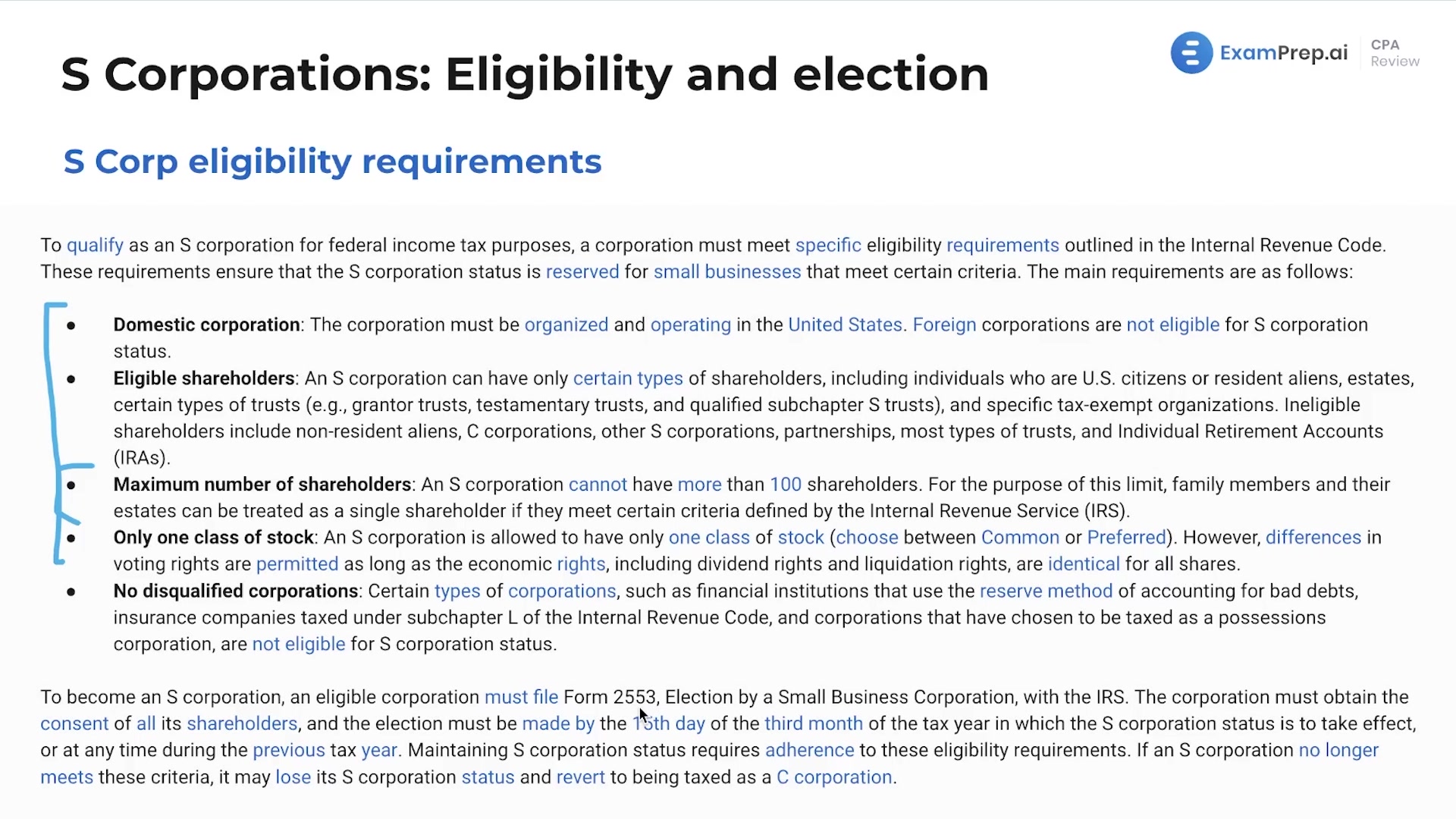

S Corporation Eligibility Requirements

S Corporation Eligibility Requirements

Procedure for Creating an S Corporation

Procedure for Creating an S Corporation

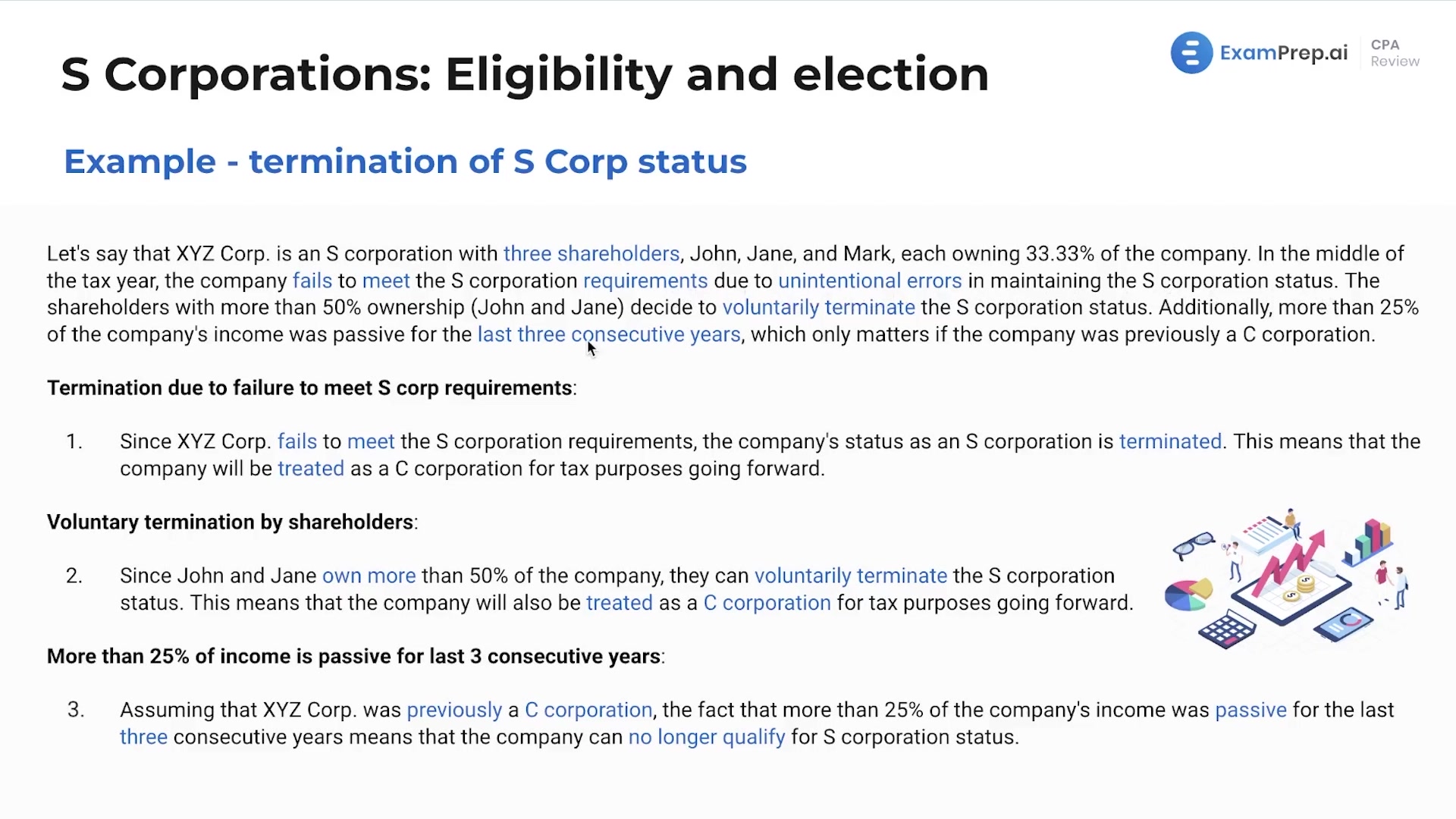

Revocation or Termination of S Corporation Status

Revocation or Termination of S Corporation Status

Characteristics of S Corporations

Characteristics of S Corporations

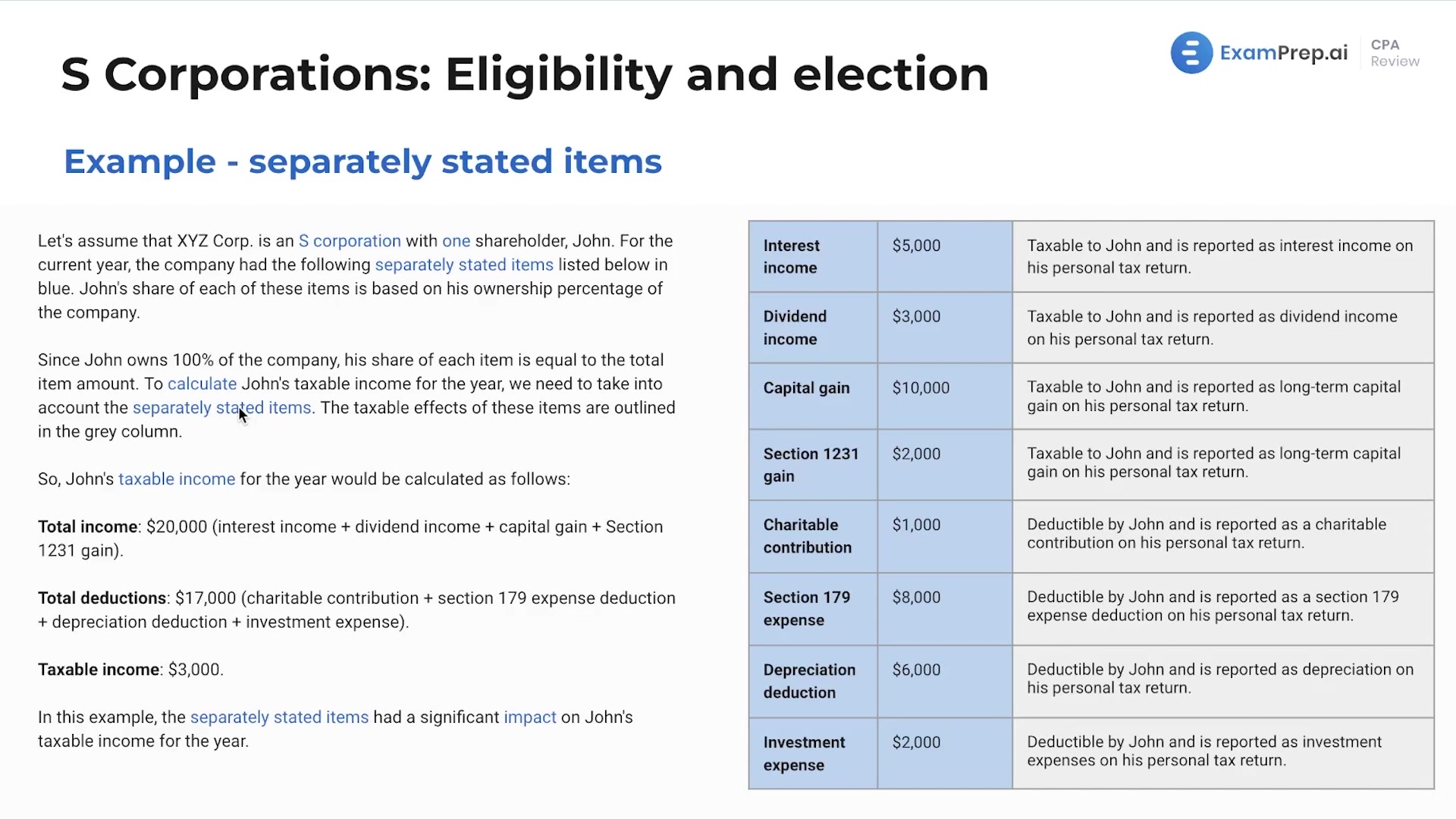

Separately Stated Items

Separately Stated Items

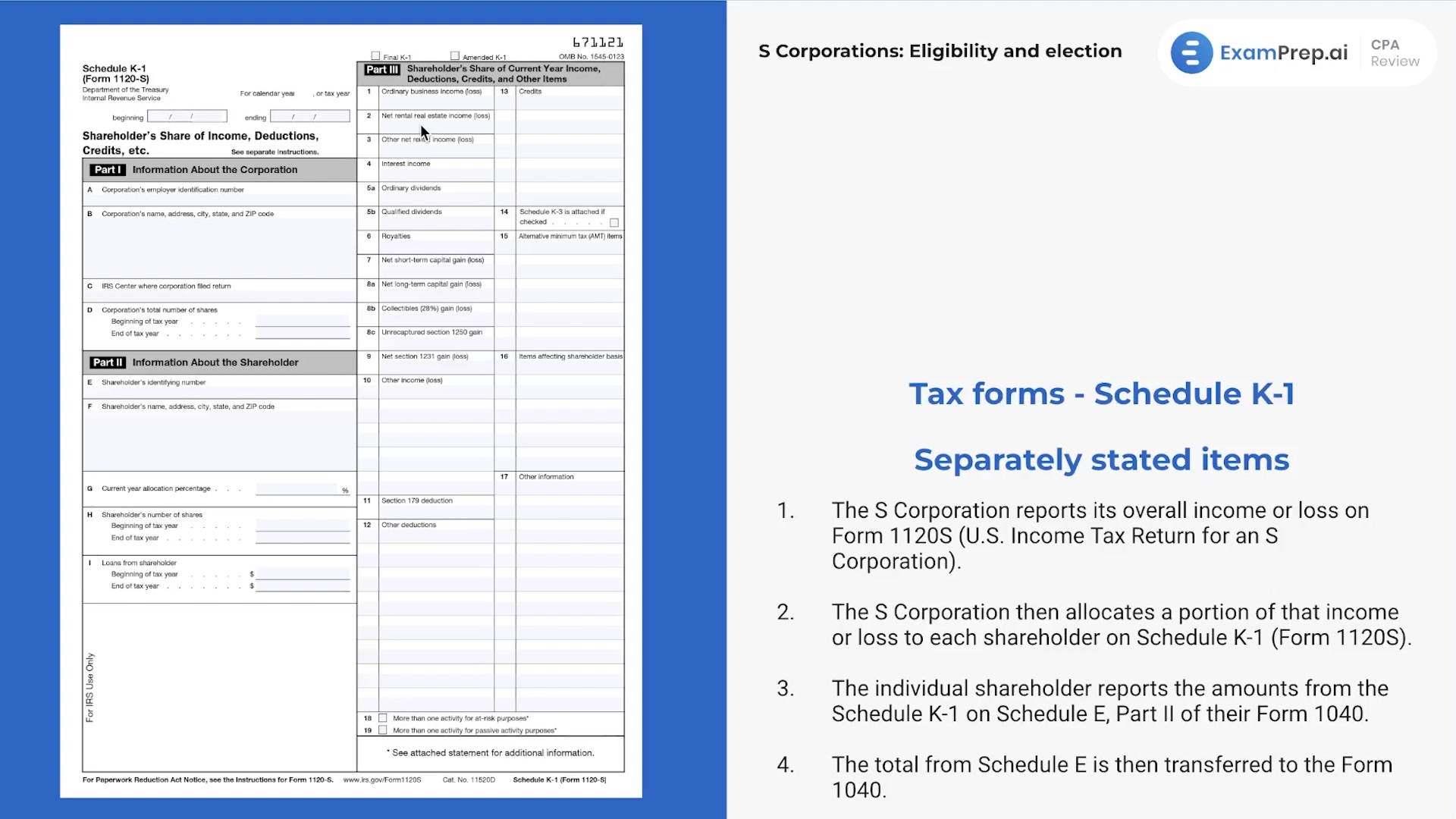

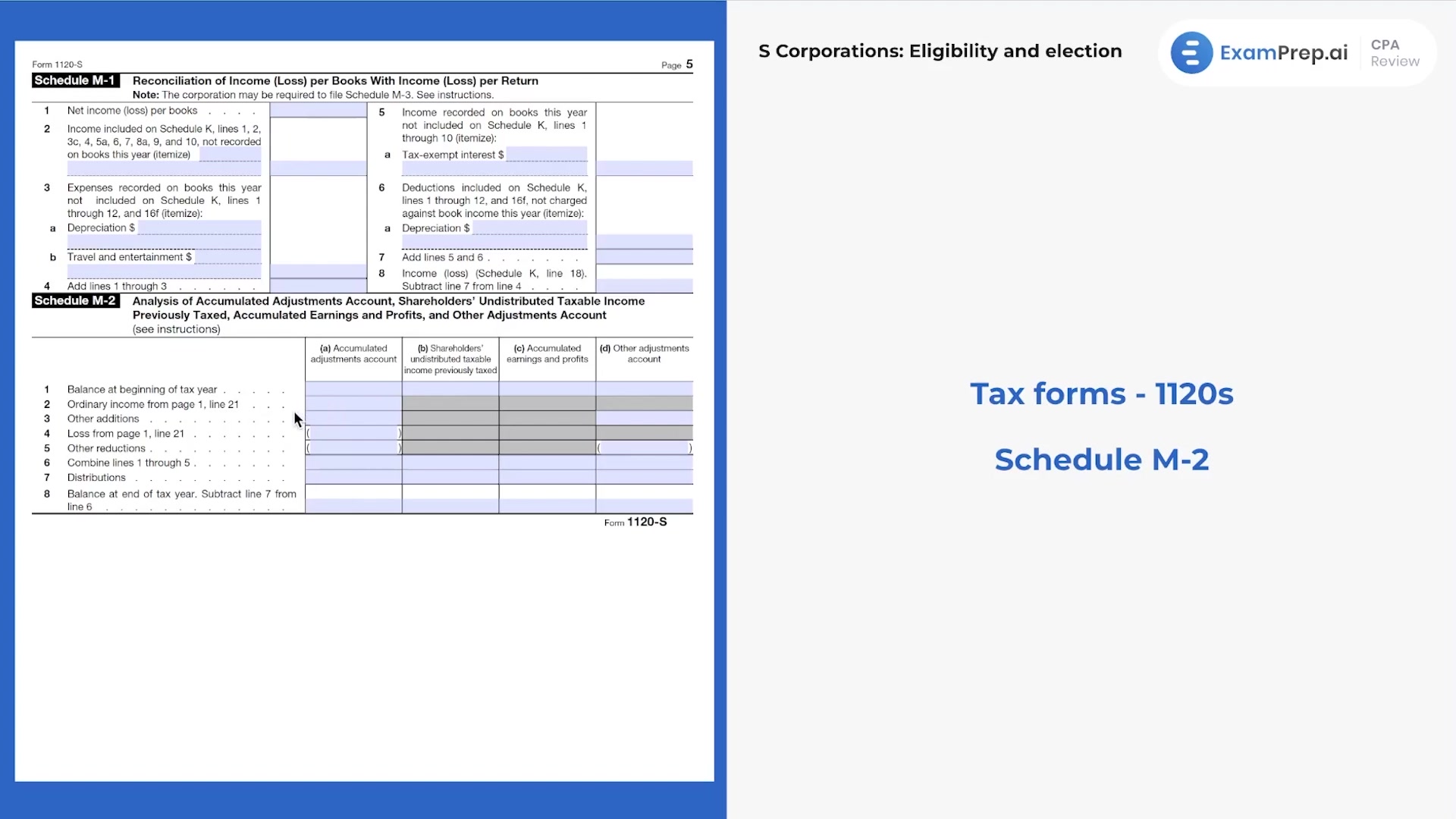

S Corporation Tax Forms

S Corporation Tax Forms

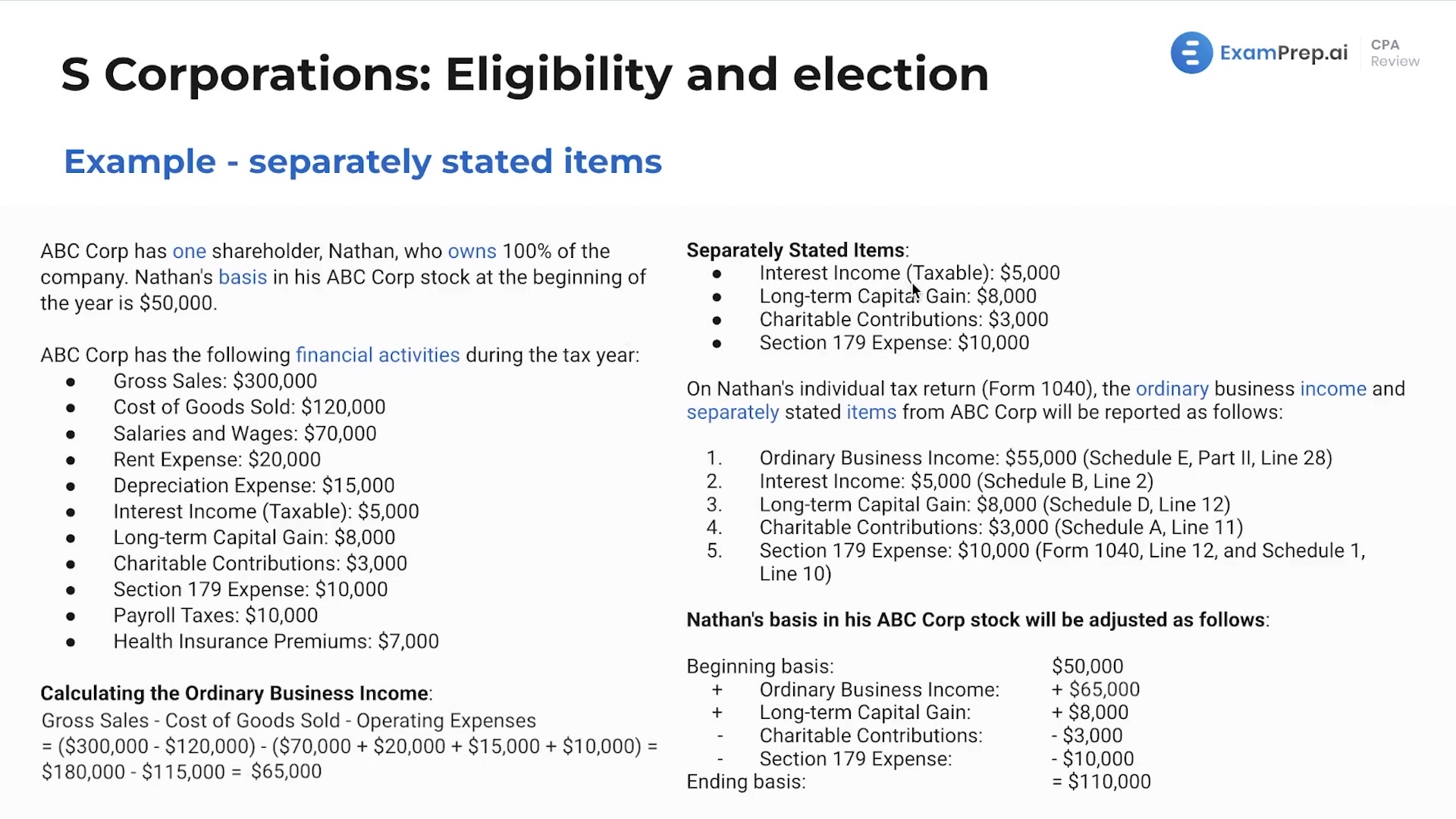

Example of Separately Stated Items

Example of Separately Stated Items

Accumulated Adjustments Account and Other Adjustments Account

Accumulated Adjustments Account and Other Adjustments Account

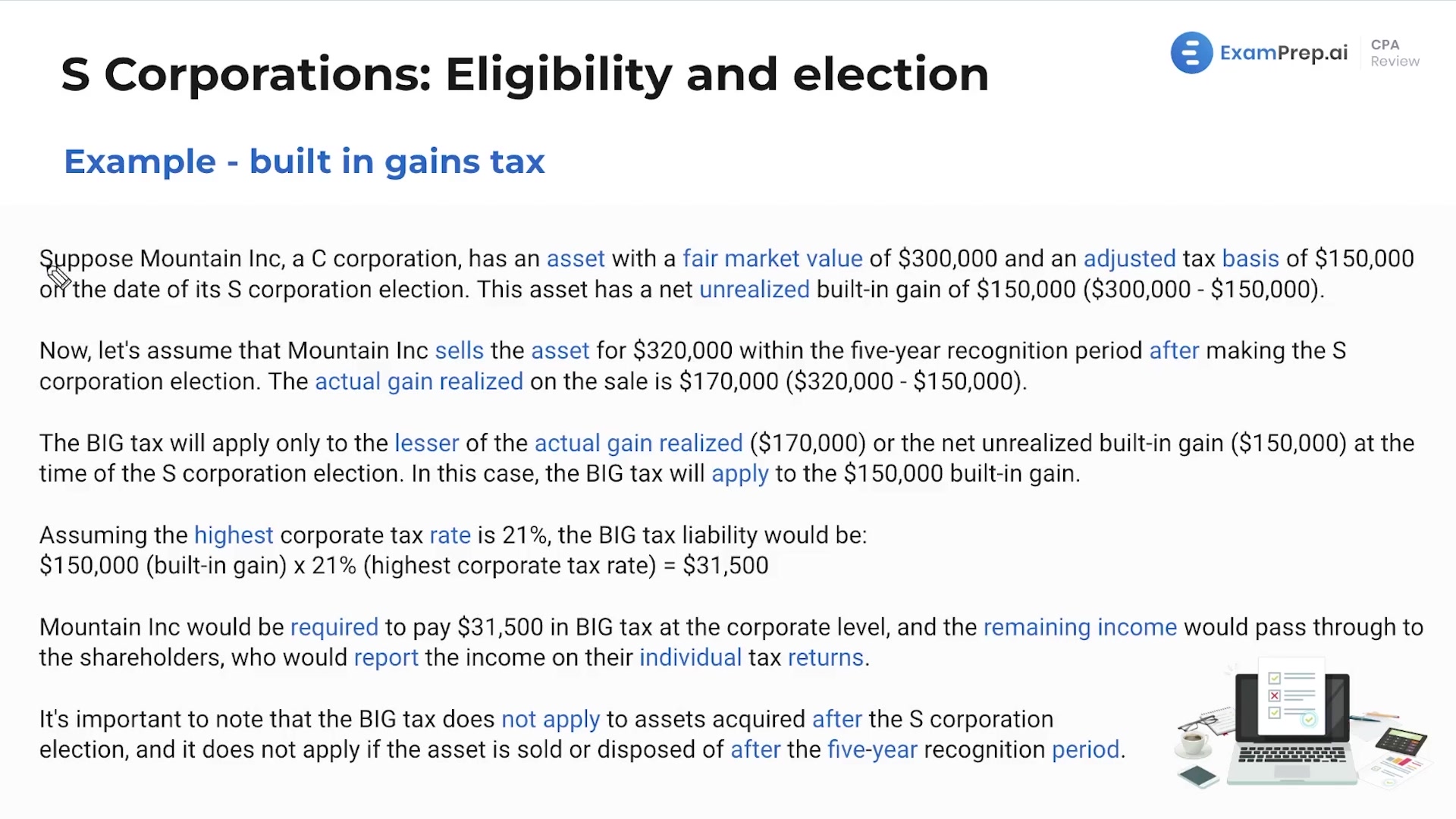

S Corporations: Built-in Gains Tax

S Corporations: Built-in Gains Tax

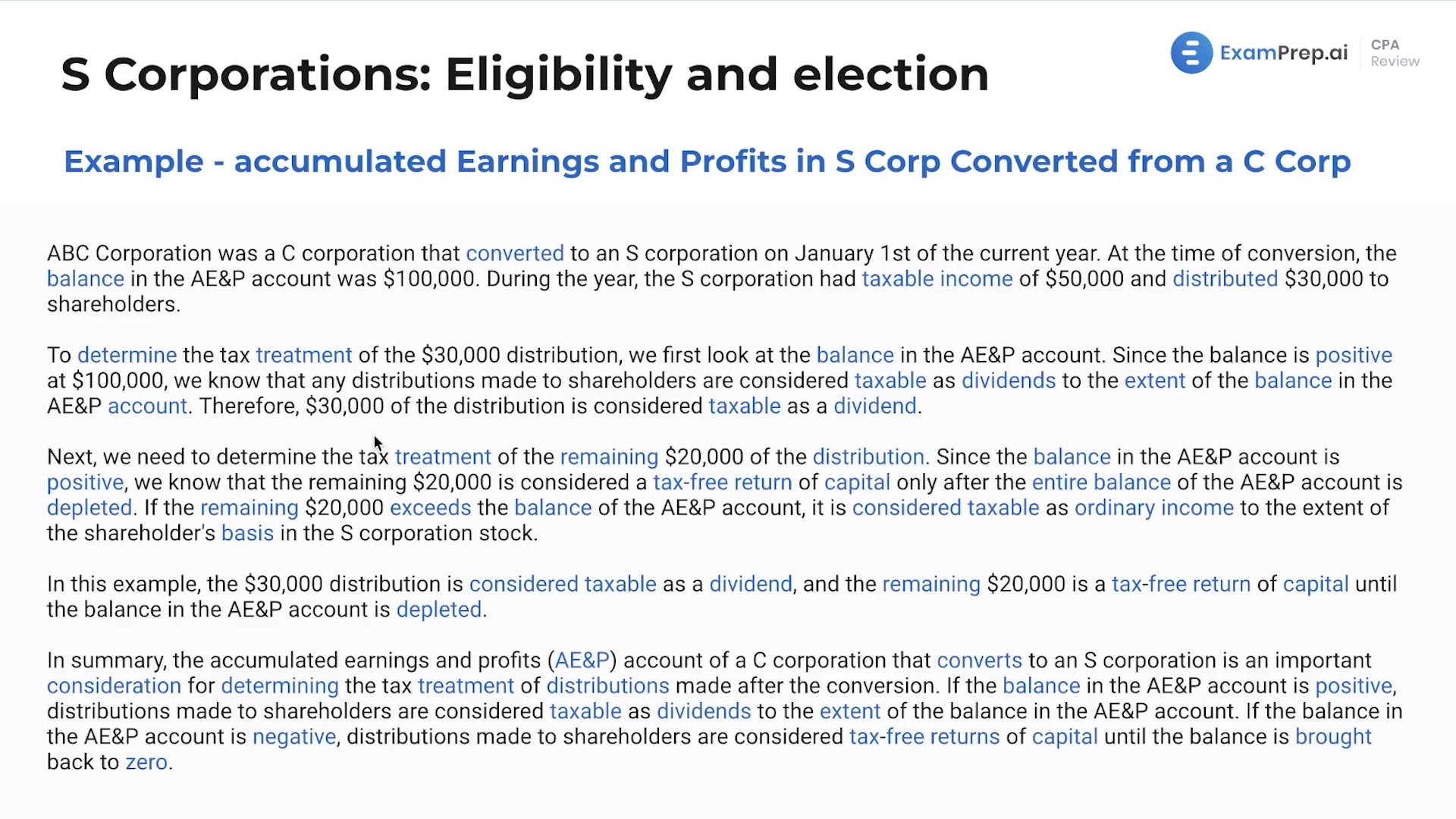

S Corporation Converted from a C Corporation

S Corporation Converted from a C Corporation

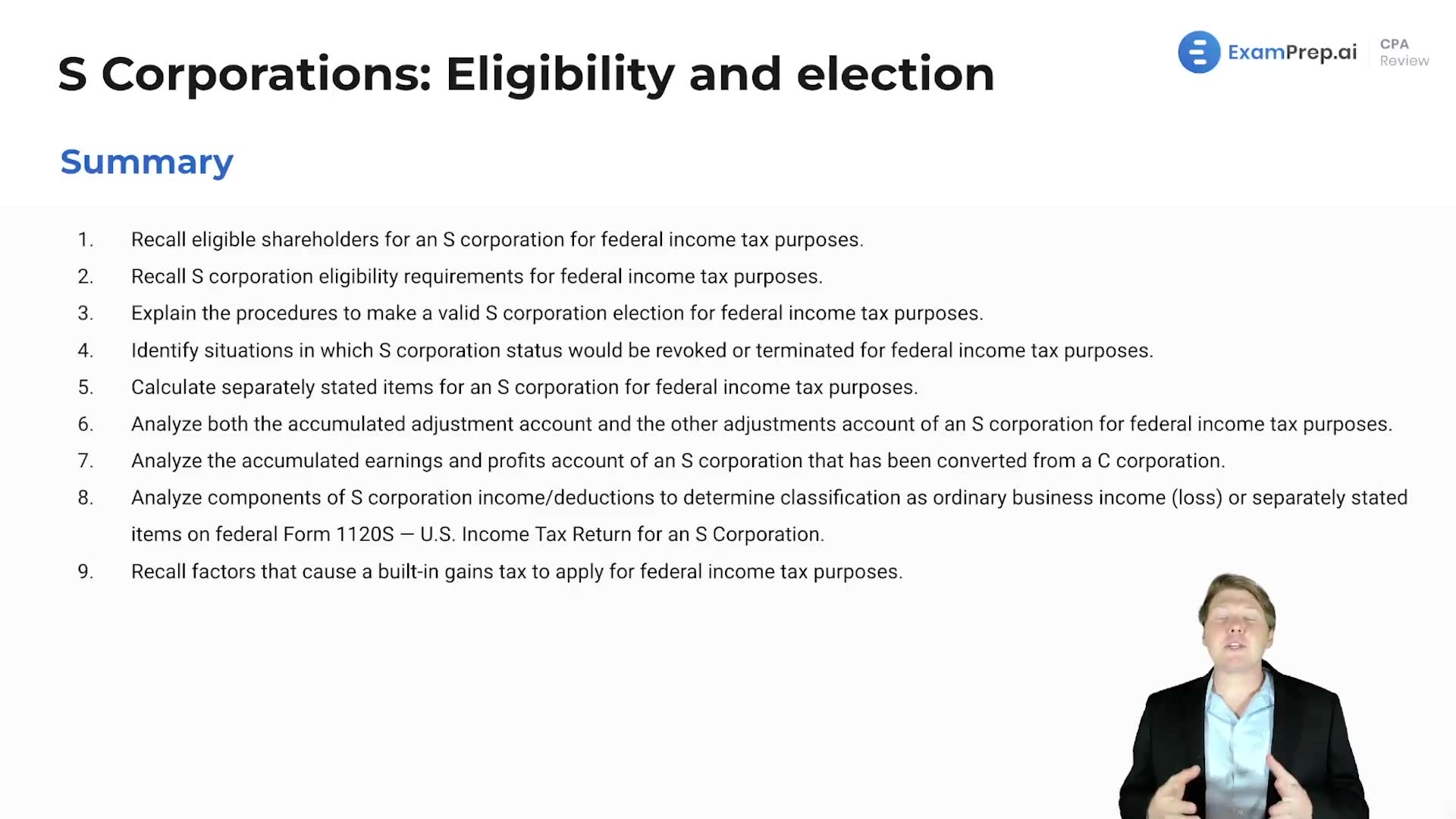

S Corporations: Eligibility and Election Summary

S Corporations: Eligibility and Election Summary

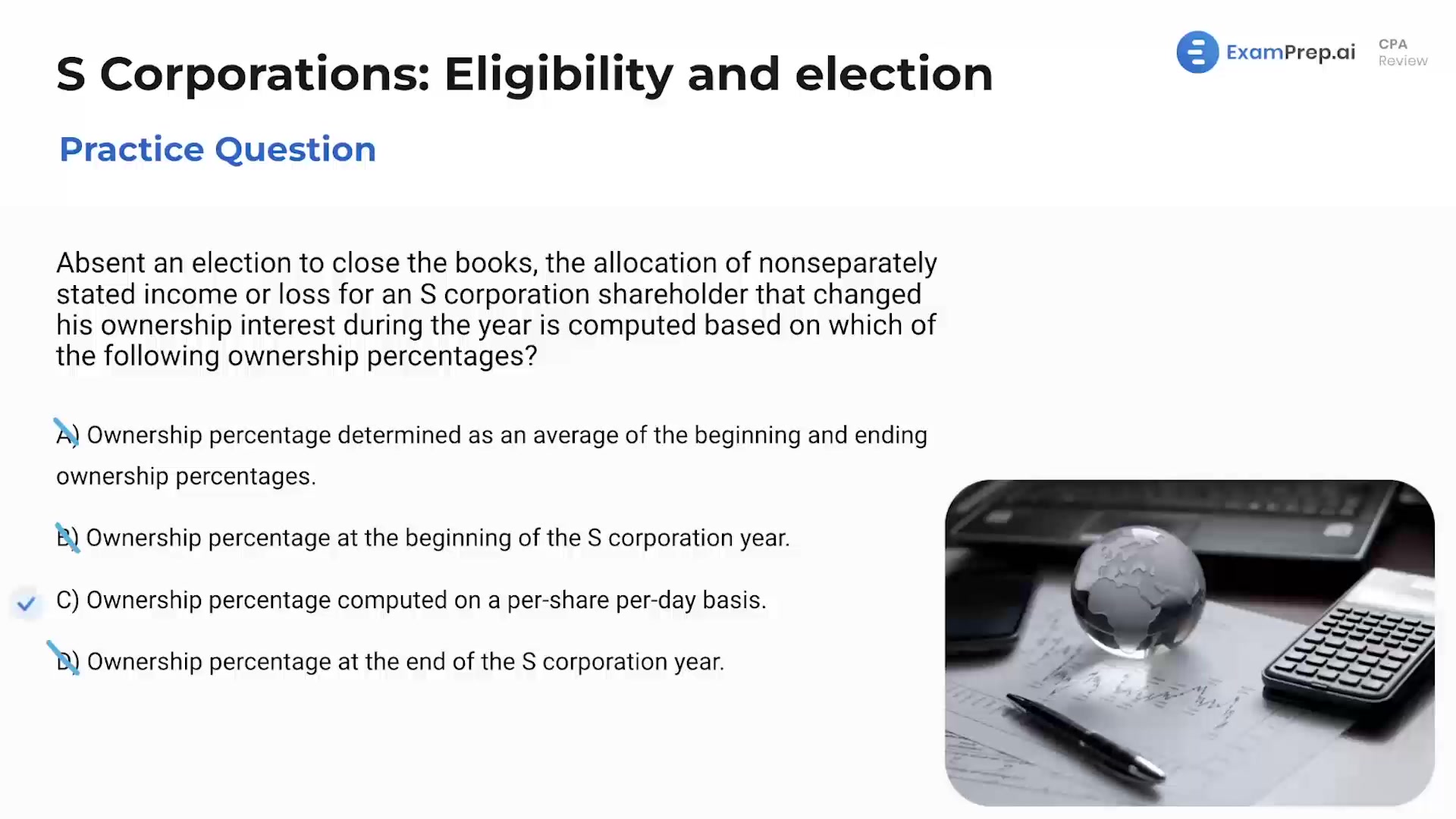

S Corporations: Eligibility and Election - Practice Questions

S Corporations: Eligibility and Election - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate