S Corporations: Eligibility and Election

S Corporations are a specific type of corporation that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. To be eligible, a corporation must meet certain IRS criteria, such as having only allowable shareholders and a single class of stock, and it must submit a timely election with Form 2553.

Lesson Videos

S Corporations: Eligibility and Election Overview

S Corporations: Eligibility and Election Overview

Introduction to S Corporations: Eligibility and Election

Introduction to S Corporations: Eligibility and Election

Shareholders of an S Corporation

Shareholders of an S Corporation

S Corporation Eligibility Requirements

S Corporation Eligibility Requirements

Procedure for Creating an S Corporation

Procedure for Creating an S Corporation

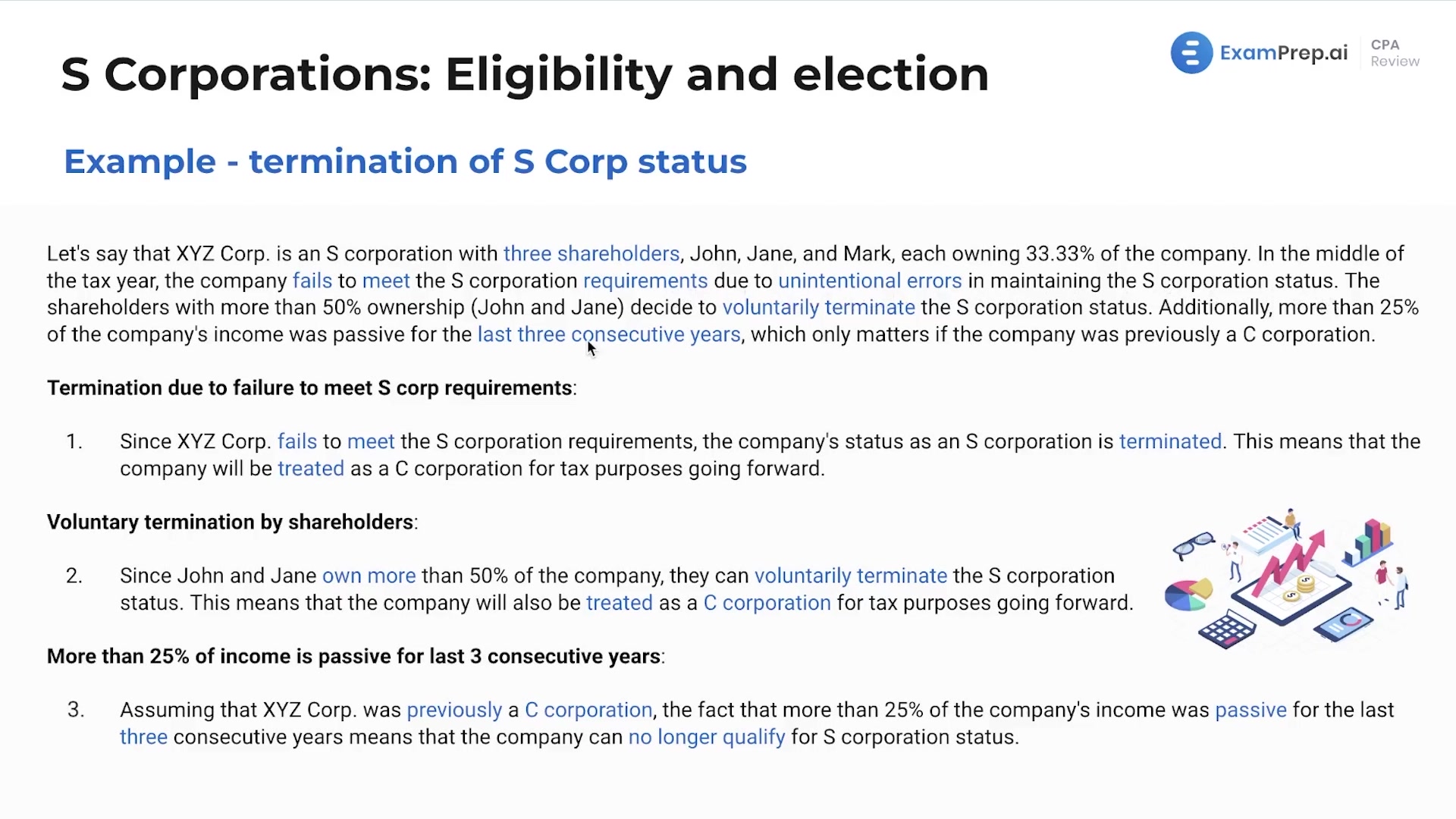

Revocation or Termination of S Corporation Status

Revocation or Termination of S Corporation Status

Characteristics of S Corporations

Characteristics of S Corporations

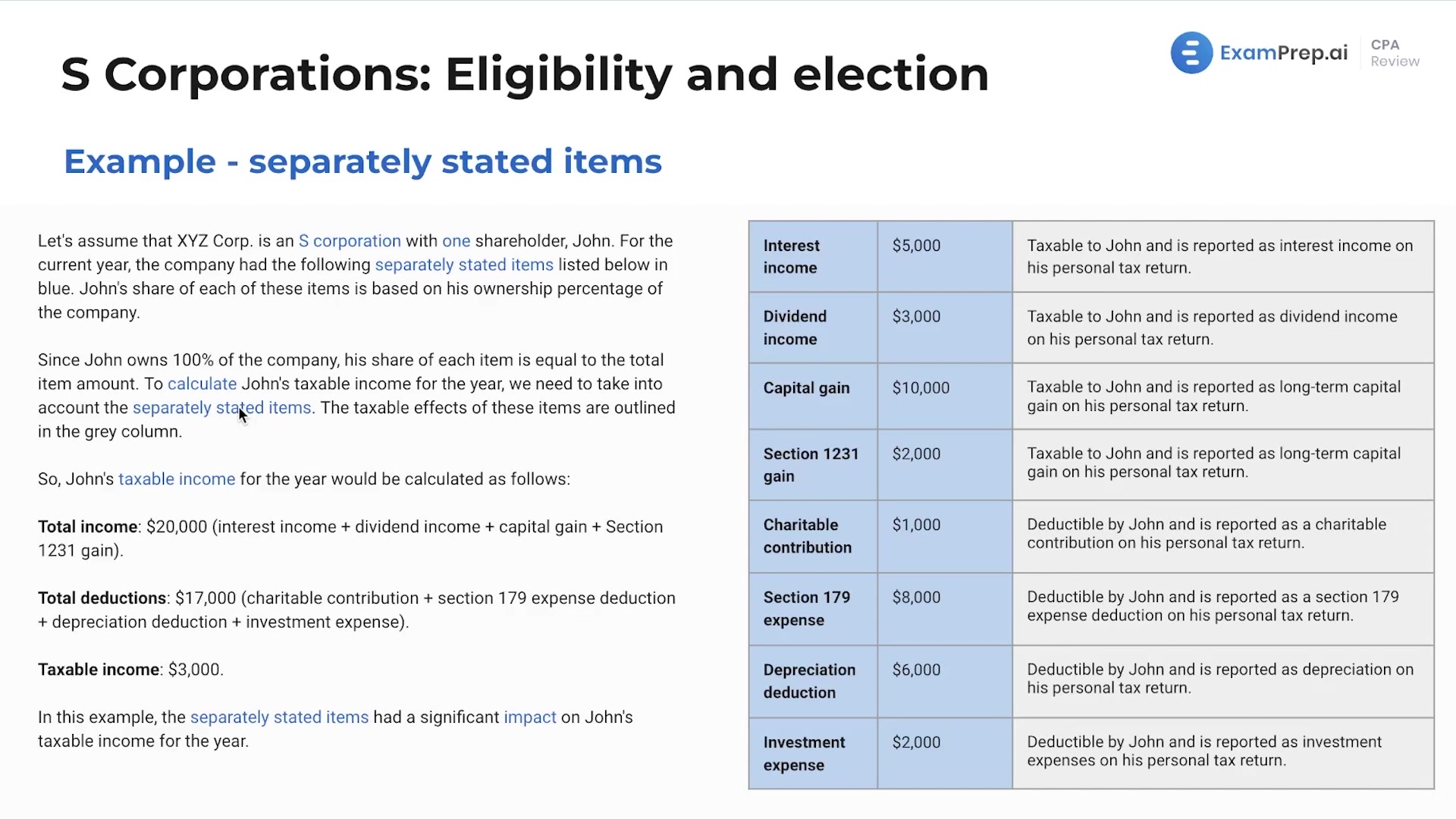

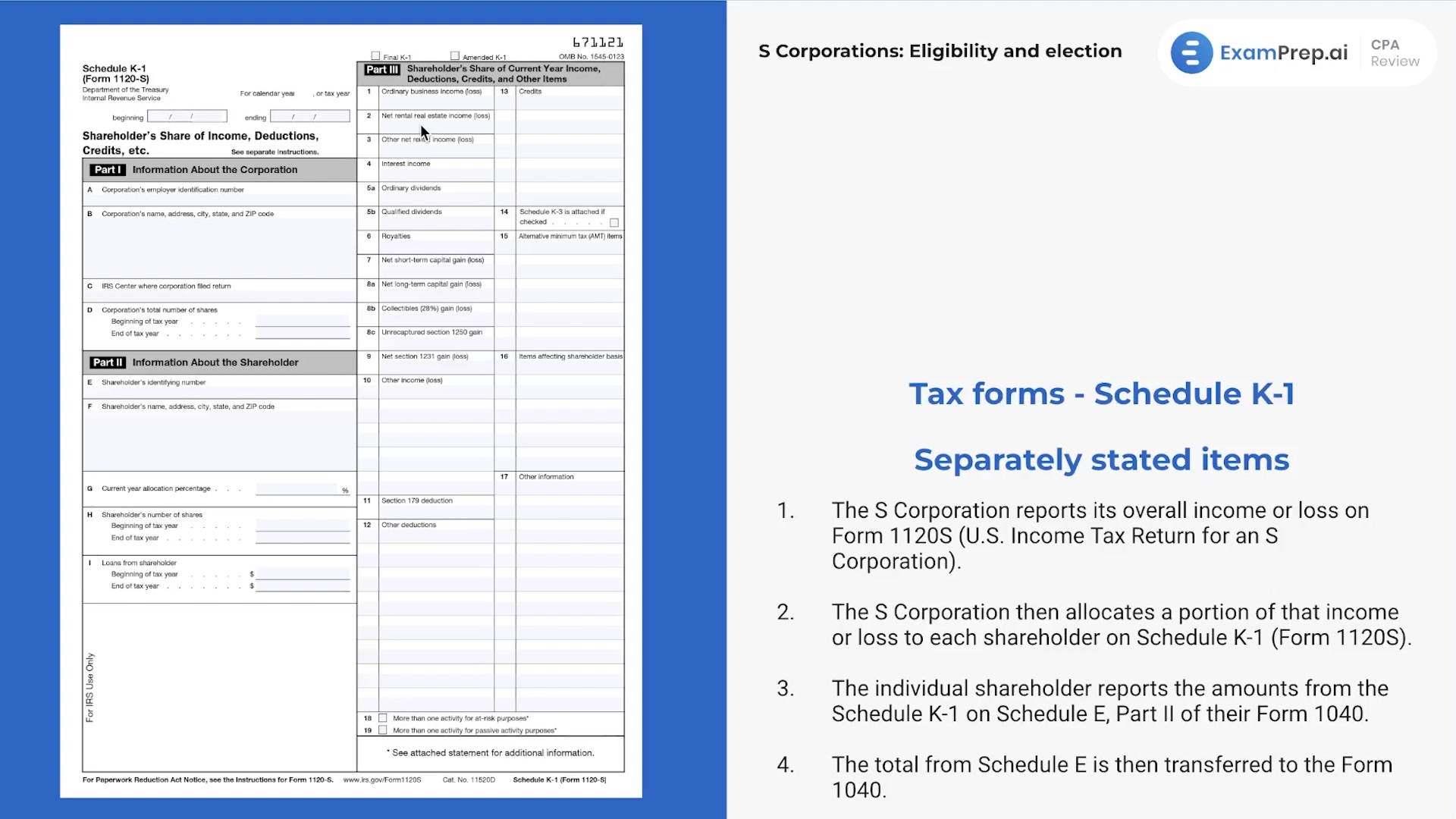

Separately Stated Items

Separately Stated Items

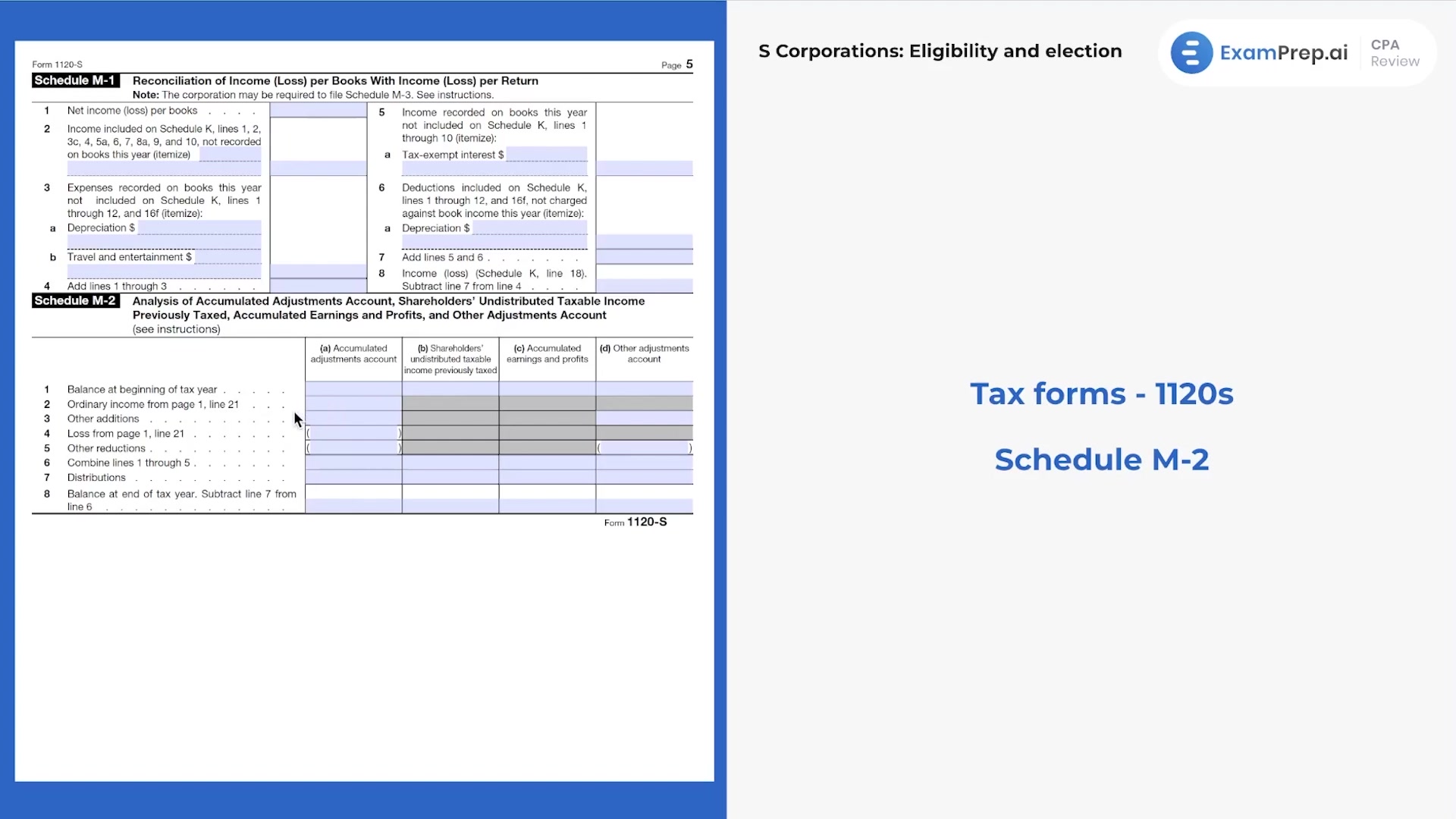

S Corporation Tax Forms

S Corporation Tax Forms

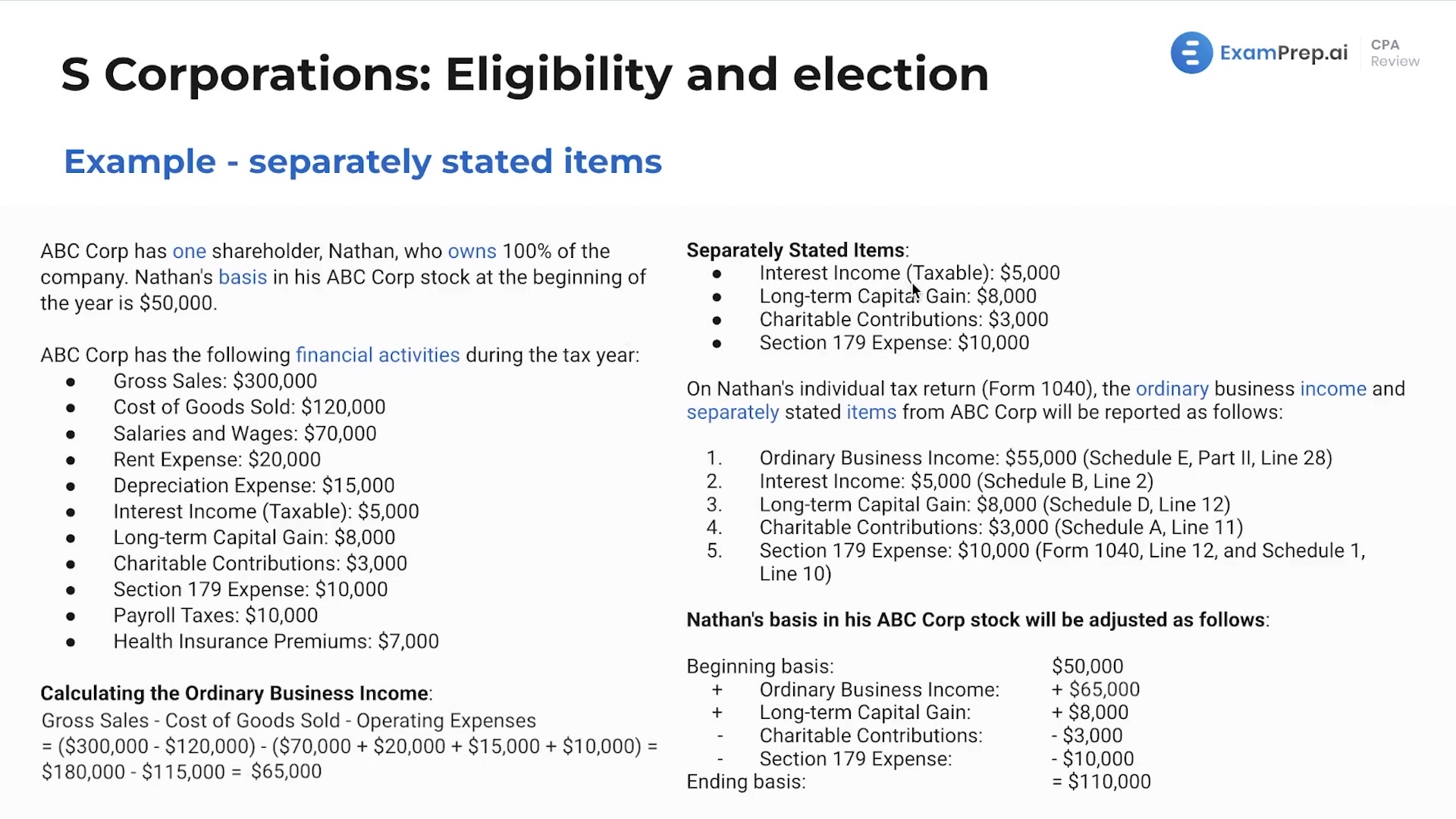

Example of Separately Stated Items

Example of Separately Stated Items

Accumulated Adjustments Account and Other Adjustments Account

Accumulated Adjustments Account and Other Adjustments Account

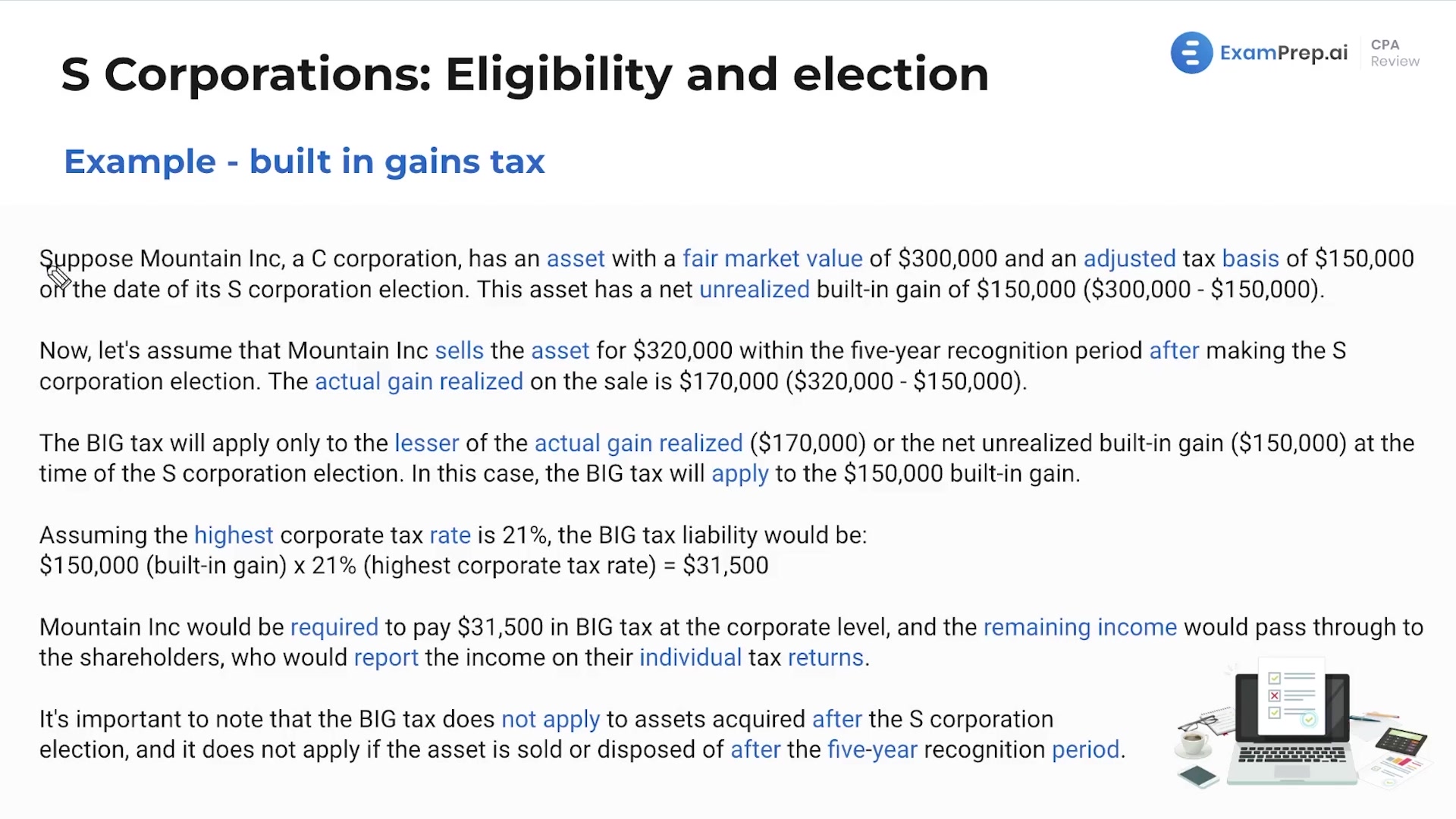

S Corporations: Built-in Gains Tax

S Corporations: Built-in Gains Tax

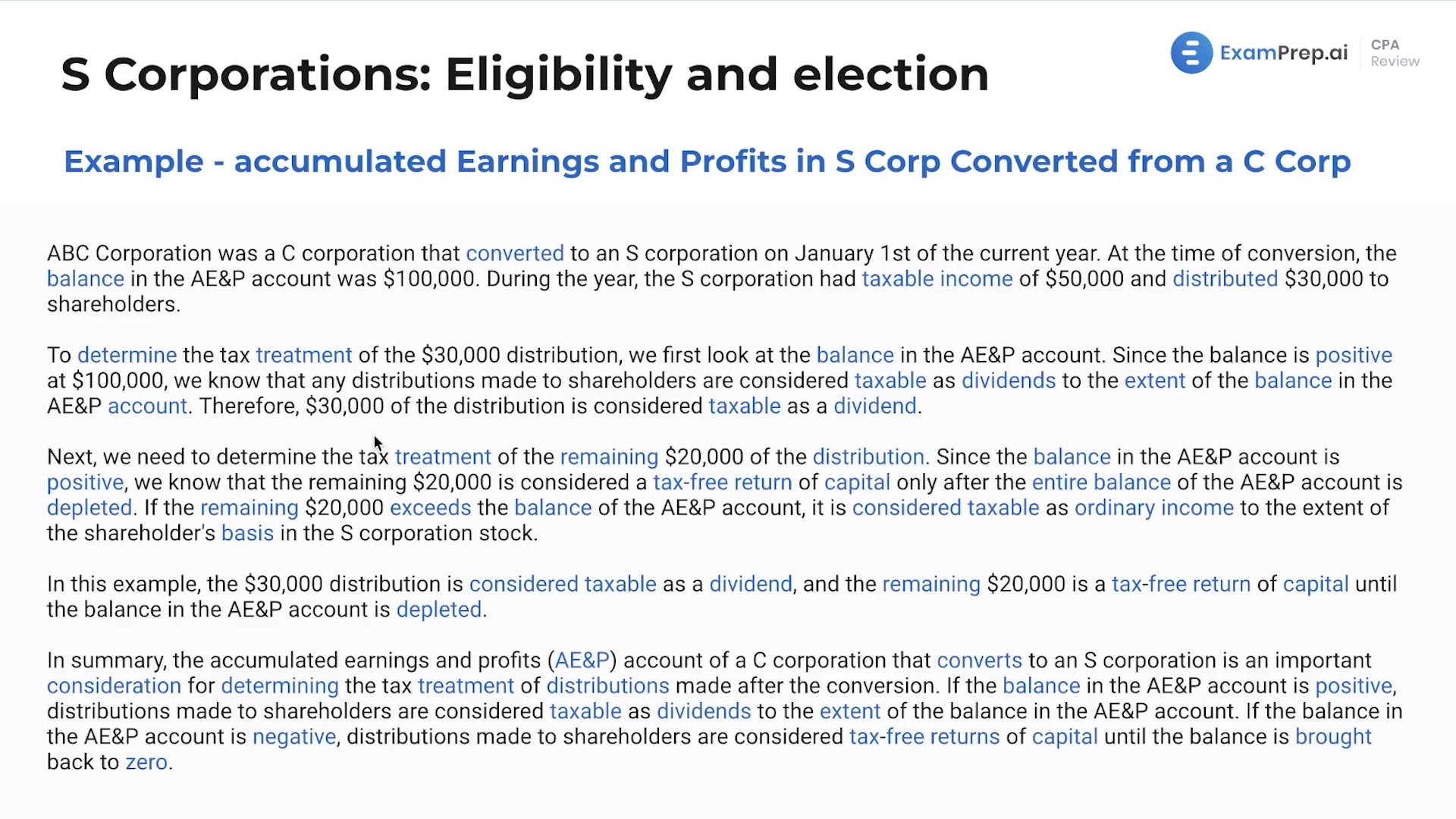

S Corporation Converted from a C Corporation

S Corporation Converted from a C Corporation

S Corporations: Eligibility and Election Summary

S Corporations: Eligibility and Election Summary

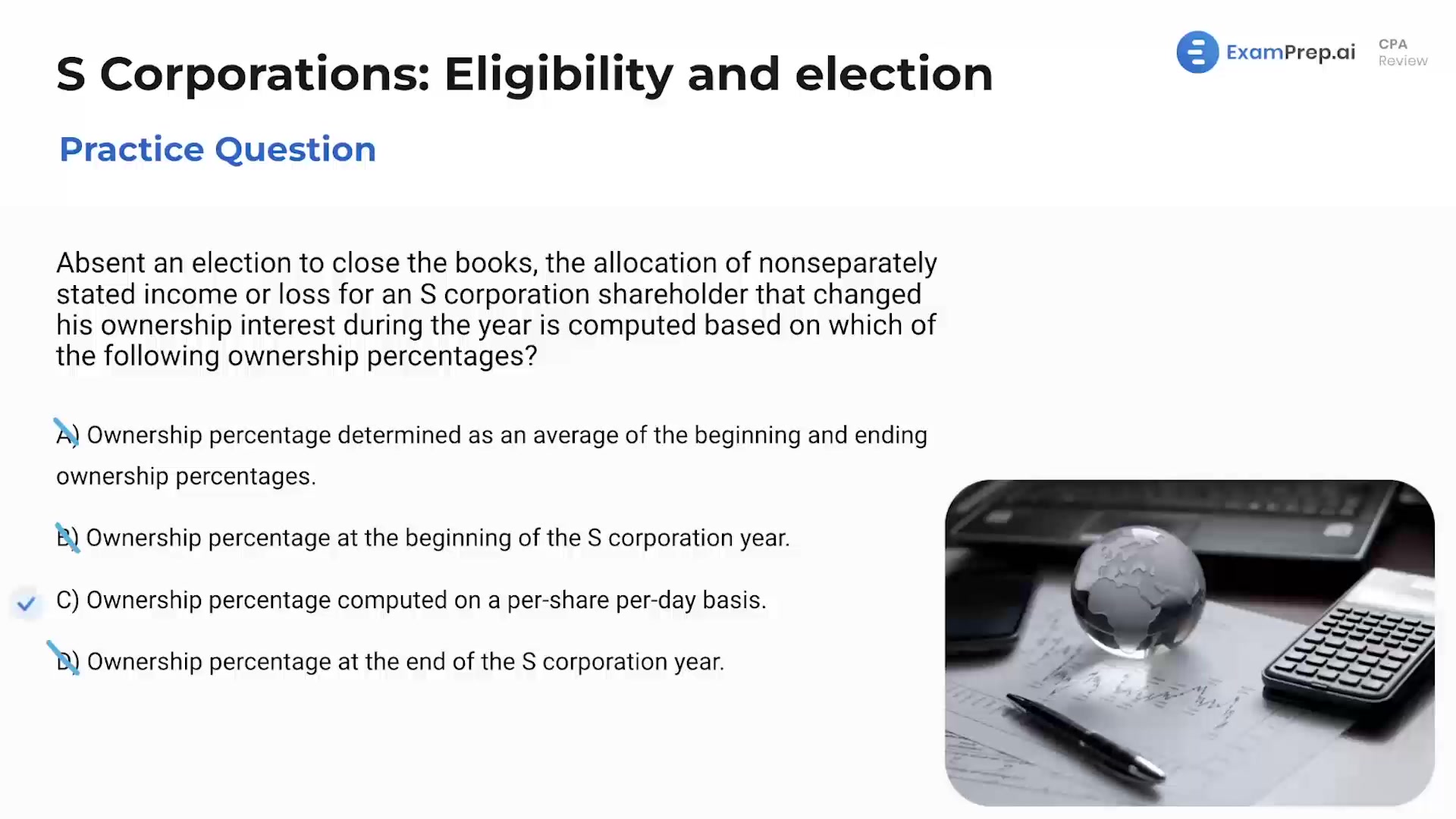

S Corporations: Eligibility and Election - Practice Questions

S Corporations: Eligibility and Election - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate