Tax Planning for S corporations

Tax planning for S corporations involves strategizing to optimize the tax liabilities of these entities which, by design, pass corporate income, losses, credits, and deductions to their shareholders for federal tax purposes. Effective planning requires understanding the specific tax implications of distributions, compensation, and business expenses, ensuring compliance with the complex regulations governing these pass-through entities.

Lesson Videos

Introduction to Tax Planning for S Corporations

Introduction to Tax Planning for S Corporations

Calculating Projected Built-in Gains Tax for an S Corporation

Calculating Projected Built-in Gains Tax for an S Corporation

Implications of Terminating an S Corporation Election

Implications of Terminating an S Corporation Election

Tax Implications of Various S Corporation Transactions

Tax Implications of Various S Corporation Transactions

Accumulated Earnings and Profits vs. Accumulated Adjustments Account

Accumulated Earnings and Profits vs. Accumulated Adjustments Account

Tax Planning for S Corporations Summary

Tax Planning for S Corporations Summary

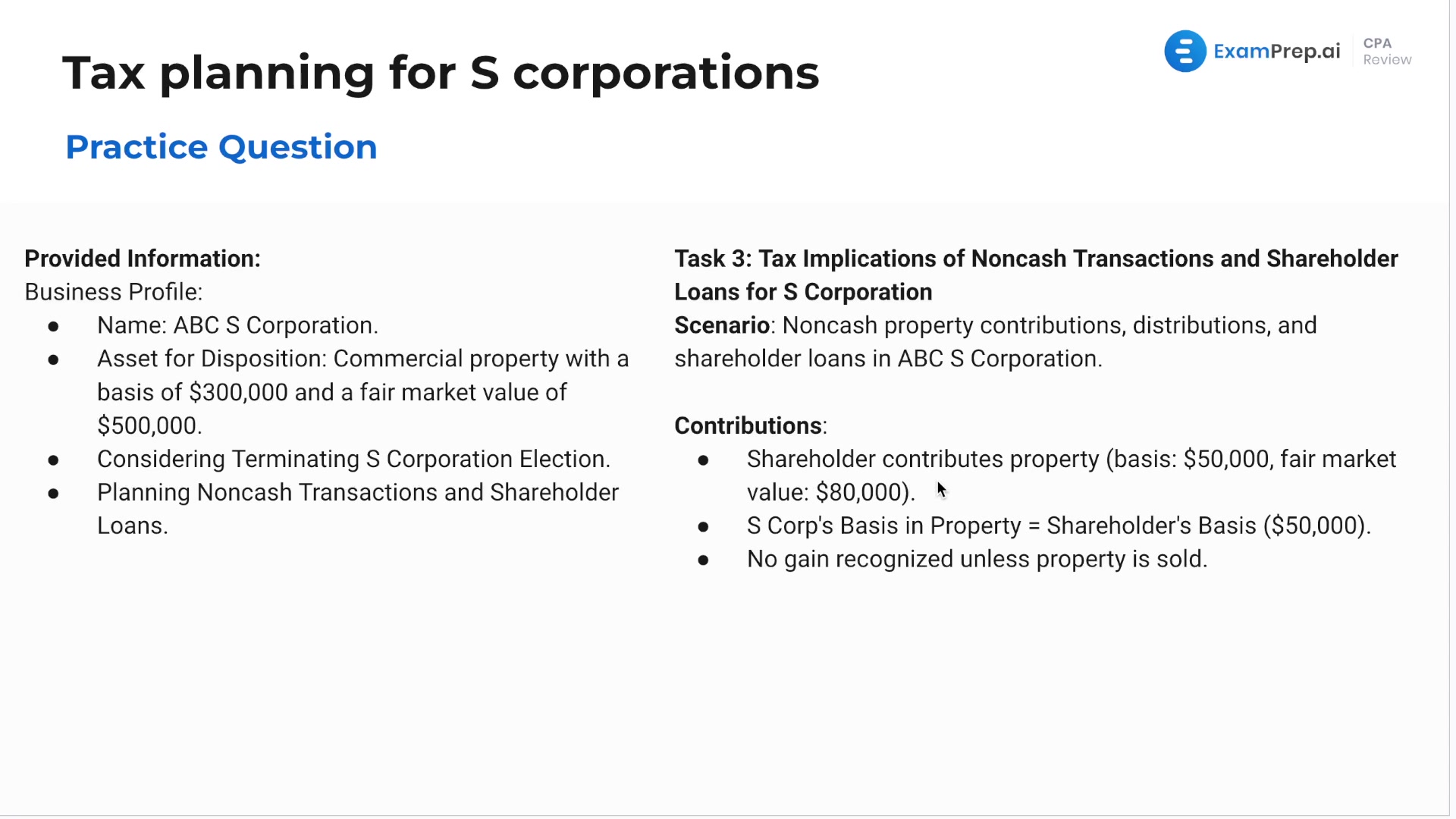

Tax Planning for S Corporations - Practice Questions

Tax Planning for S Corporations - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate