Taxable and Nontaxable Dispositions

Taxable and nontaxable dispositions pertain to the treatment of gains or losses from the sale or exchange of an asset, determining whether such financial changes are subject to income tax. Taxable dispositions result in reportable income or deductible loss, affecting an entity's tax liability, while nontaxable dispositions typically do not impact taxable income, often due to specific exclusions, deferrals, or tax provisions.

Lesson Videos

Taxable and Nontaxable Dispositions Overview

Taxable and Nontaxable Dispositions Overview

Introduction to Taxable and Nontaxable Dispositions

Introduction to Taxable and Nontaxable Dispositions

Gain Recognized on Property Received as Compensation

Gain Recognized on Property Received as Compensation

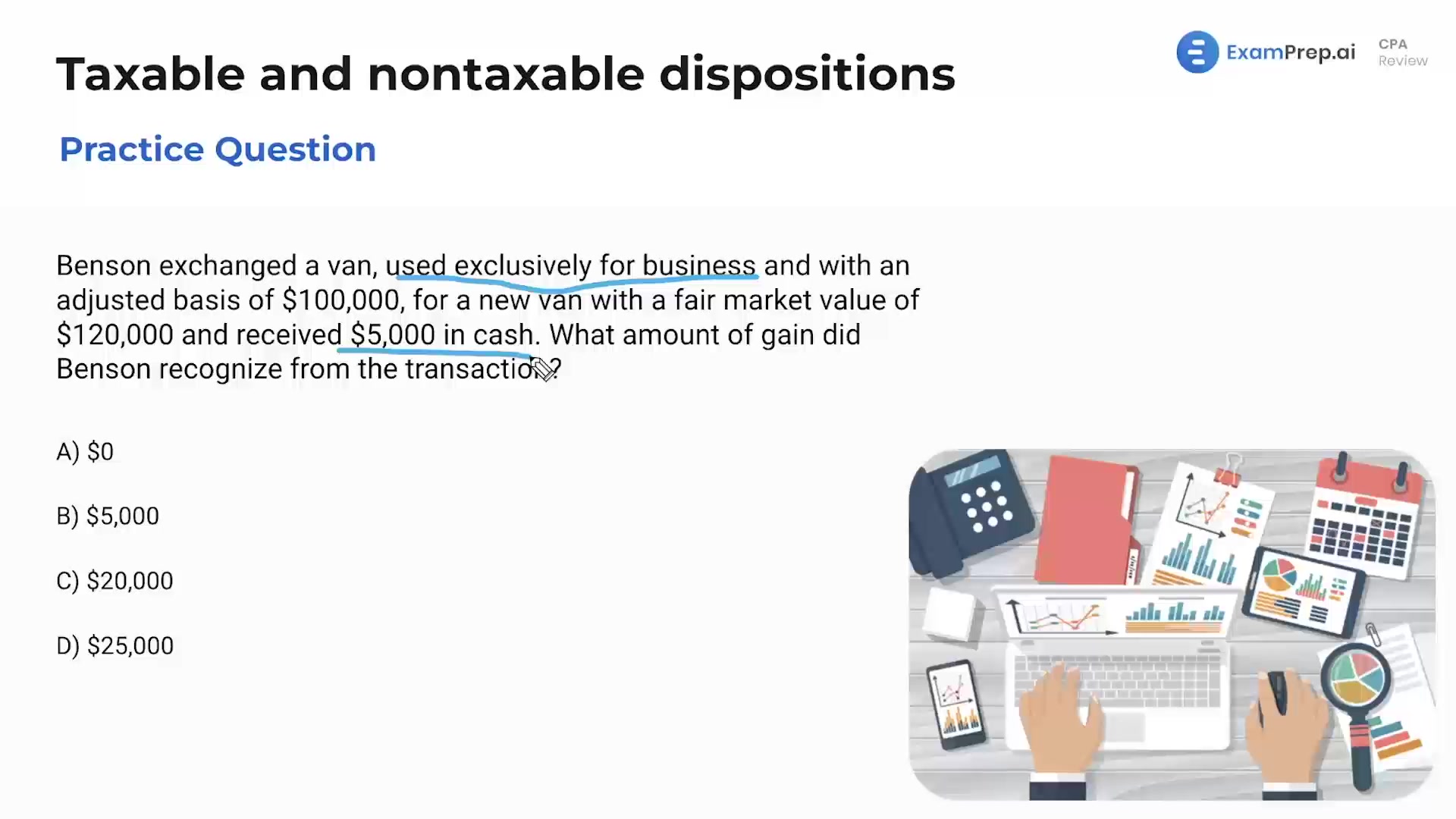

Like-Kind Exchanges (Real Property Only)

Like-Kind Exchanges (Real Property Only)

Disposition of Assets

Disposition of Assets

Gain Exclusions for Disposition of Assets

Gain Exclusions for Disposition of Assets

Loss Exclusions for Disposition of Assets

Loss Exclusions for Disposition of Assets

Taxable and Nontaxable Dispositions Summary

Taxable and Nontaxable Dispositions Summary

Taxable and Nontaxable Dispositions - Practice Questions

Taxable and Nontaxable Dispositions - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate