Types of Trusts

Trusts are fiduciary arrangements wherein a trustee holds and manages assets for the benefit of beneficiaries, according to the terms set by the trustor. There are various types of trusts, including revocable and irrevocable trusts, which can be altered or remain unchangeable after their creation, respectively, and testamentary and living trusts, which are established after death or during the trustor's lifetime. These legal entities can serve multiple purposes, such as asset protection, estate planning, and tax management.

Lesson Videos

Trusts Overview

Trusts Overview

Introduction to Trusts

Introduction to Trusts

Reasons for Establishing a Trust

Reasons for Establishing a Trust

Trusts vs. Estates

Trusts vs. Estates

Types of Trusts

Types of Trusts

Simple Trusts

Simple Trusts

Complex Trusts

Complex Trusts

Grantor Trusts

Grantor Trusts

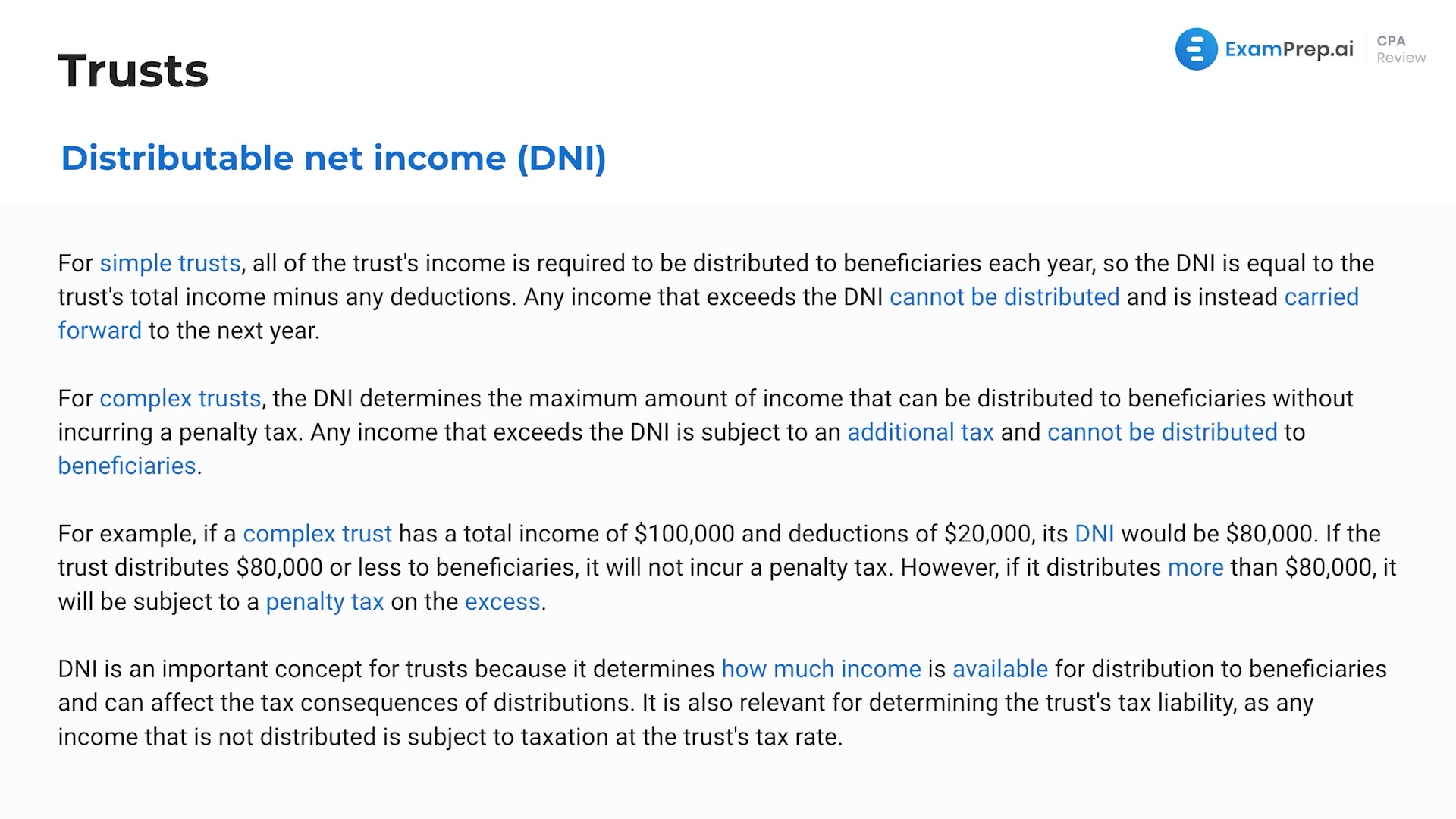

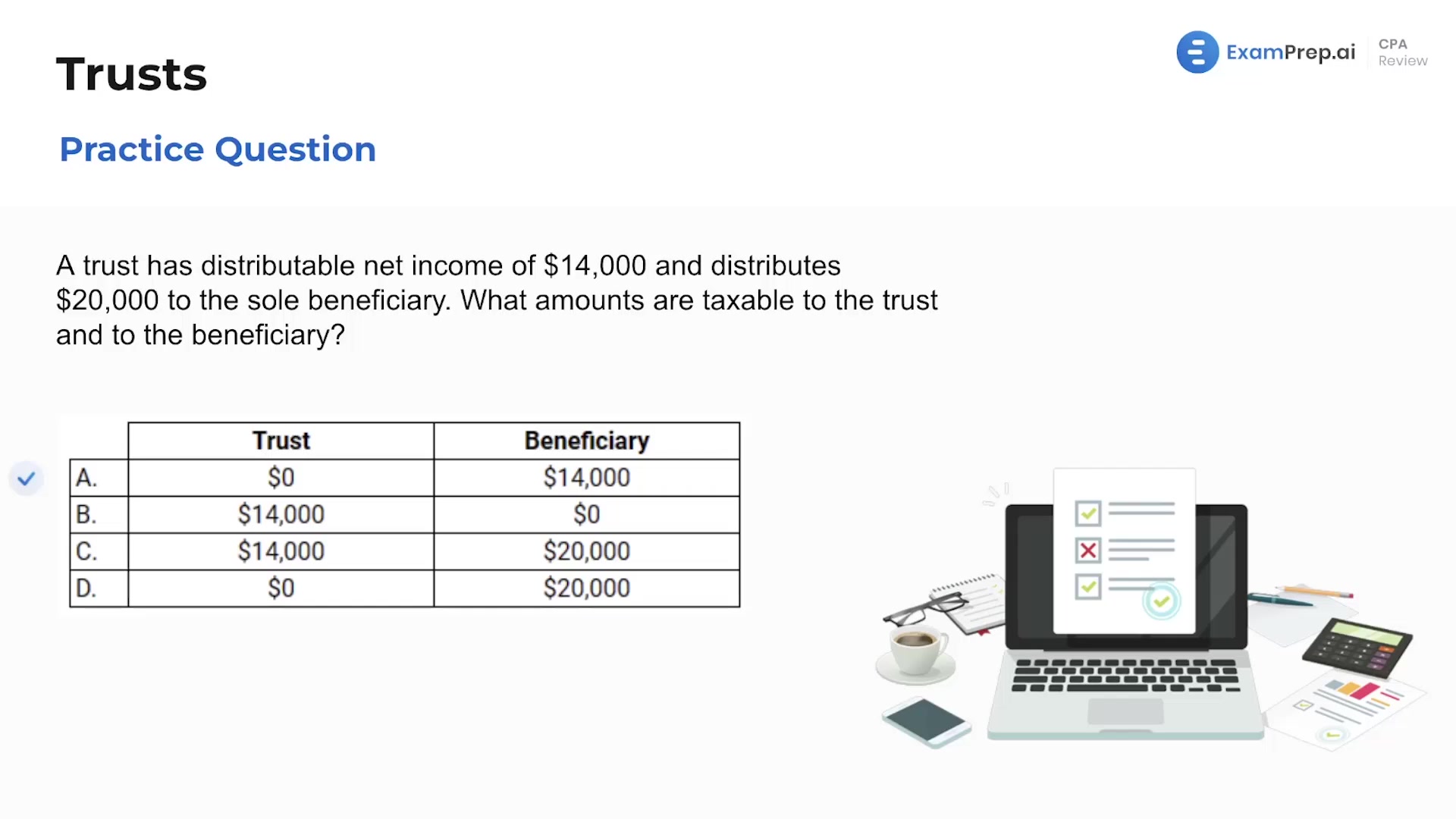

Distributable Net Income

Distributable Net Income

Trusts Summary

Trusts Summary

Trusts - Practice Questions

Trusts - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate