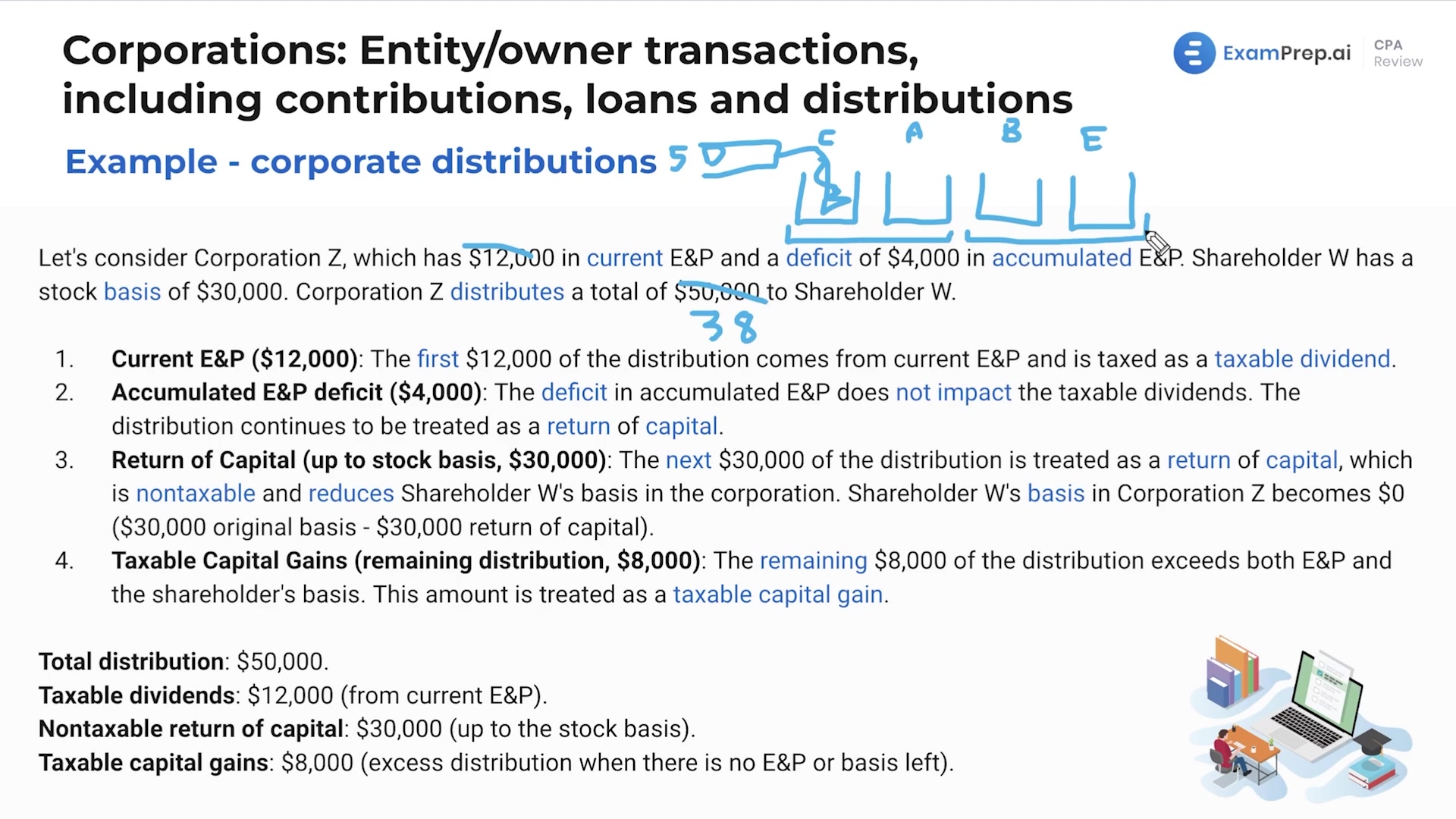

In this lesson, Nick Palazzolo, CPA, unravels the complexities of corporate distributions with an intuitive "filling up buckets" concept. By breaking down the intricacies of taxable dividends, return of capital, and capital gains, Nick paints a vivid picture, transforming the theoretical into practical understanding. Using the delightful analogy of a faucet filling various buckets, he creatively demonstrates how different types of distributions are treated tax-wise, from current and accumulated earnings and profits to shareholder stock basis. Nick also ensures to forewarn about common exam pitfalls and encourages hands-on practice with both straightforward and trickier scenarios involving deficits in accumulated earnings and profits. Engaging with these examples is like adding color to financial concepts, making this a lesson that not only enlightens but also entertains.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free