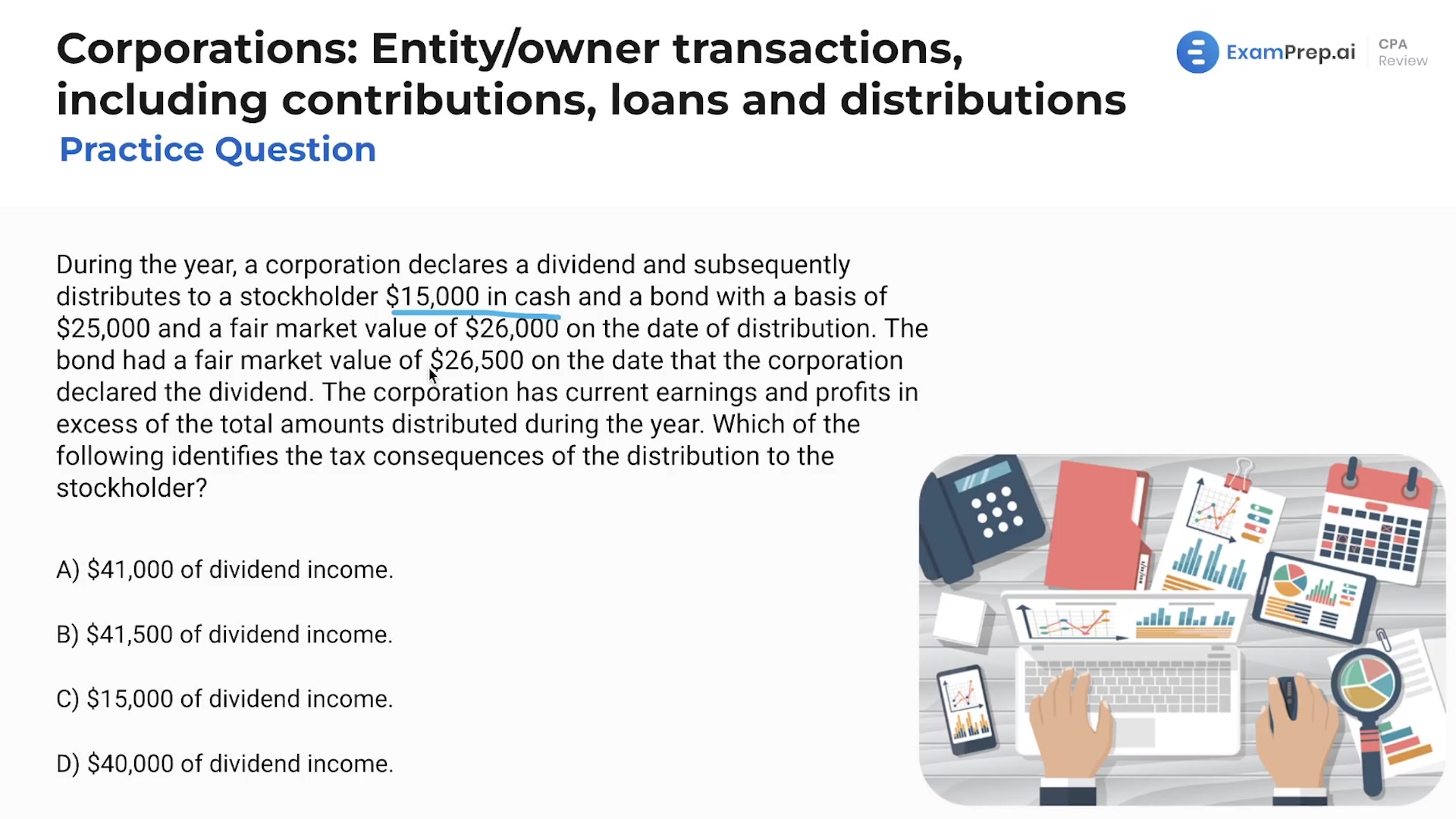

In this lesson, Nick Palazzolo, CPA, helps unravel the complexities of entity/owner transactions, with a focus on corporate distributions and their tax implications. Nick begins by working through a question about the tax consequences of different forms of distribution to shareholders, such as cash and bonds. He clarifies how the value of such distributions is determined for tax purposes, emphasizing the practical aspects of what is actually received by the shareholder. Moving on, he tackles a trickier situation involving the distribution of land and the intricacies of non-recourse liabilities, showing how to calculate the corporation's recognized gain in the process. Throughout, Nick's explanations bring clarity to the often-confusing topic of corporate distributions, equipping you with the knowledge to tackle similar questions with confidence.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free