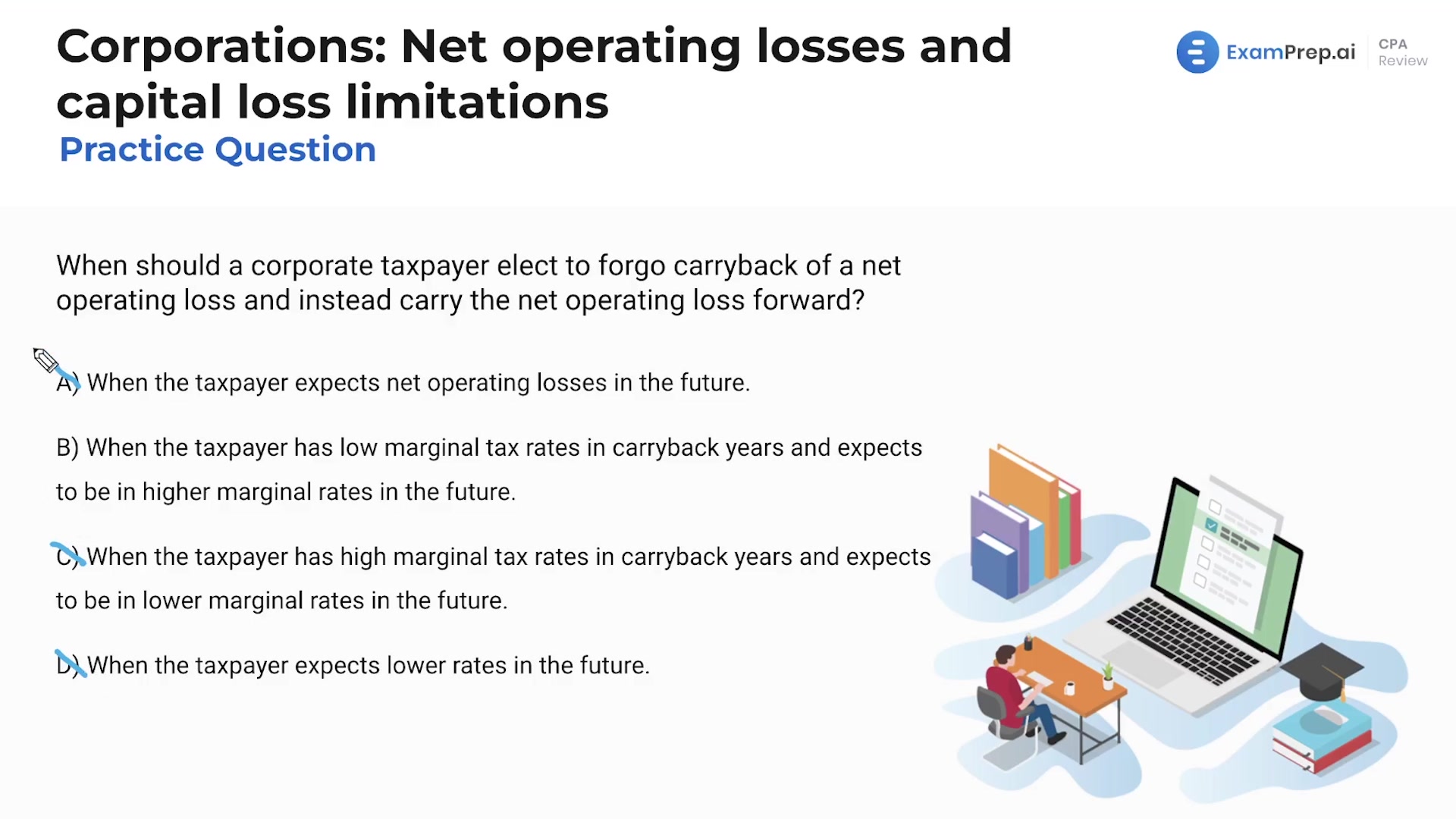

In this lesson, brush up on corporate tax intricacies with Nick Palazzolo, CPA, who walks through multiple-choice questions on corporate net operating losses and capital loss limitations. Dive into strategic decision-making on whether to carryback a net operating loss or carry it forward, considering future tax obligations and marginal tax rates. Then, shift gears to tackle a complex scenario involving a C corporation's capital loss and the carryover rules. Watch as Nick dissects the limitations on capital losses against past gains and taxable income, providing a detailed look at how to navigate through these tricky calculations. With practical examples and clear explanations, this session offers a thorough understanding of how to maximize tax benefits and avoid common pitfalls in corporate tax planning.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free