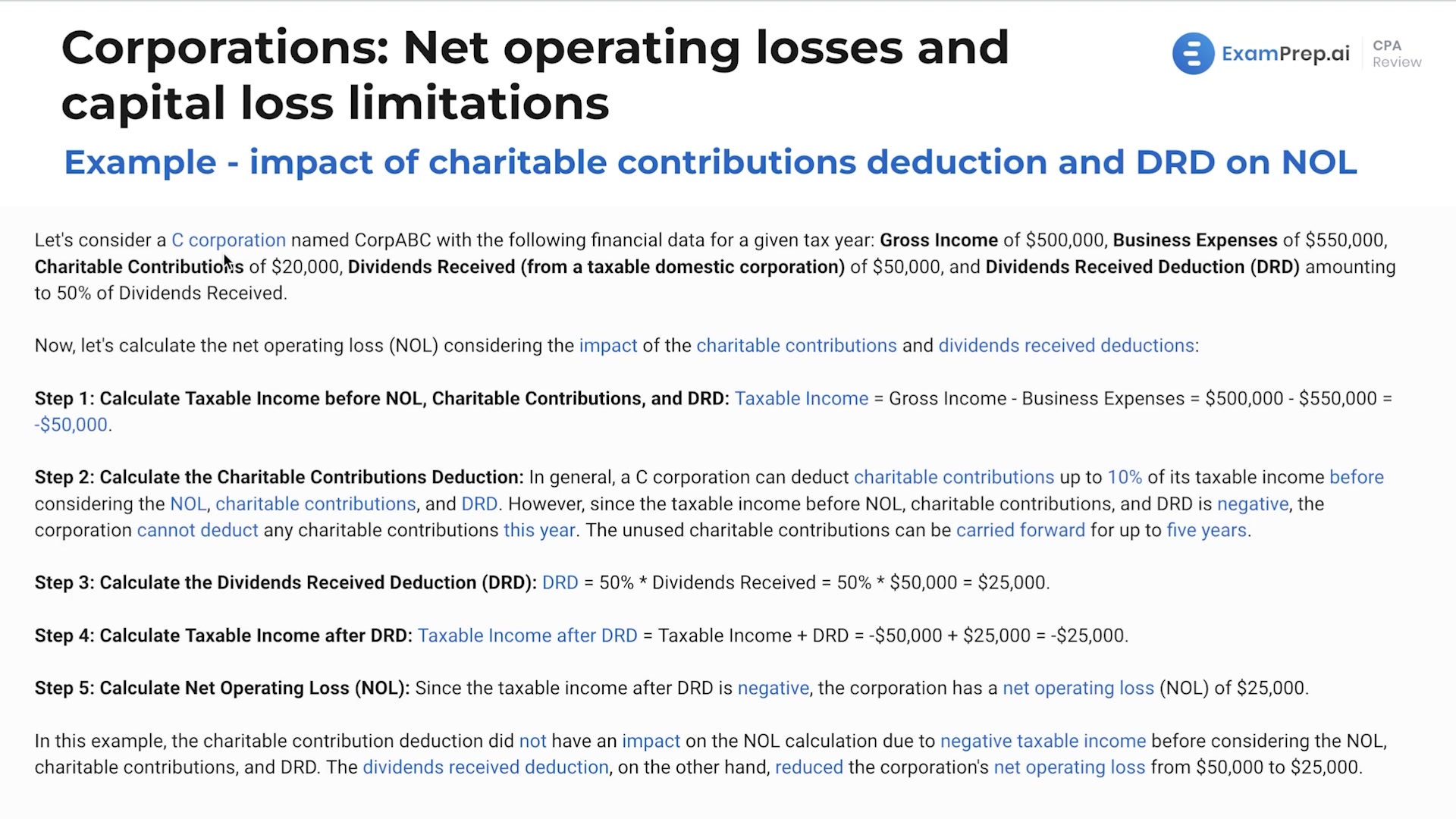

In this lesson, immerse yourself in the intricacies of how a corporation's charitable contributions deduction and Dividend Received Deduction (DRD) affect its Net Operating Loss (NOL) calculation. Nick Palazzolo, CPA, methodically dissects the conditions under which these deductions can either increase or decrease the NOL. For corporations with positive taxable income before the deductions, learn how these can lower taxable income and potentially amplify the NOL. Conversely, grasp why a negative taxable income beforehand means the charitable contribution won't affect the NOL for the current year. Nick underscores the importance of understanding these differences through a practical example of a C corporation, showing the step-by-step impact on the NOL. By the end of this lesson, the call to action is clear: memorize key elements to navigate these tax scenarios with ease, equipping you with the knowledge to tackle exam questions confidently.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free