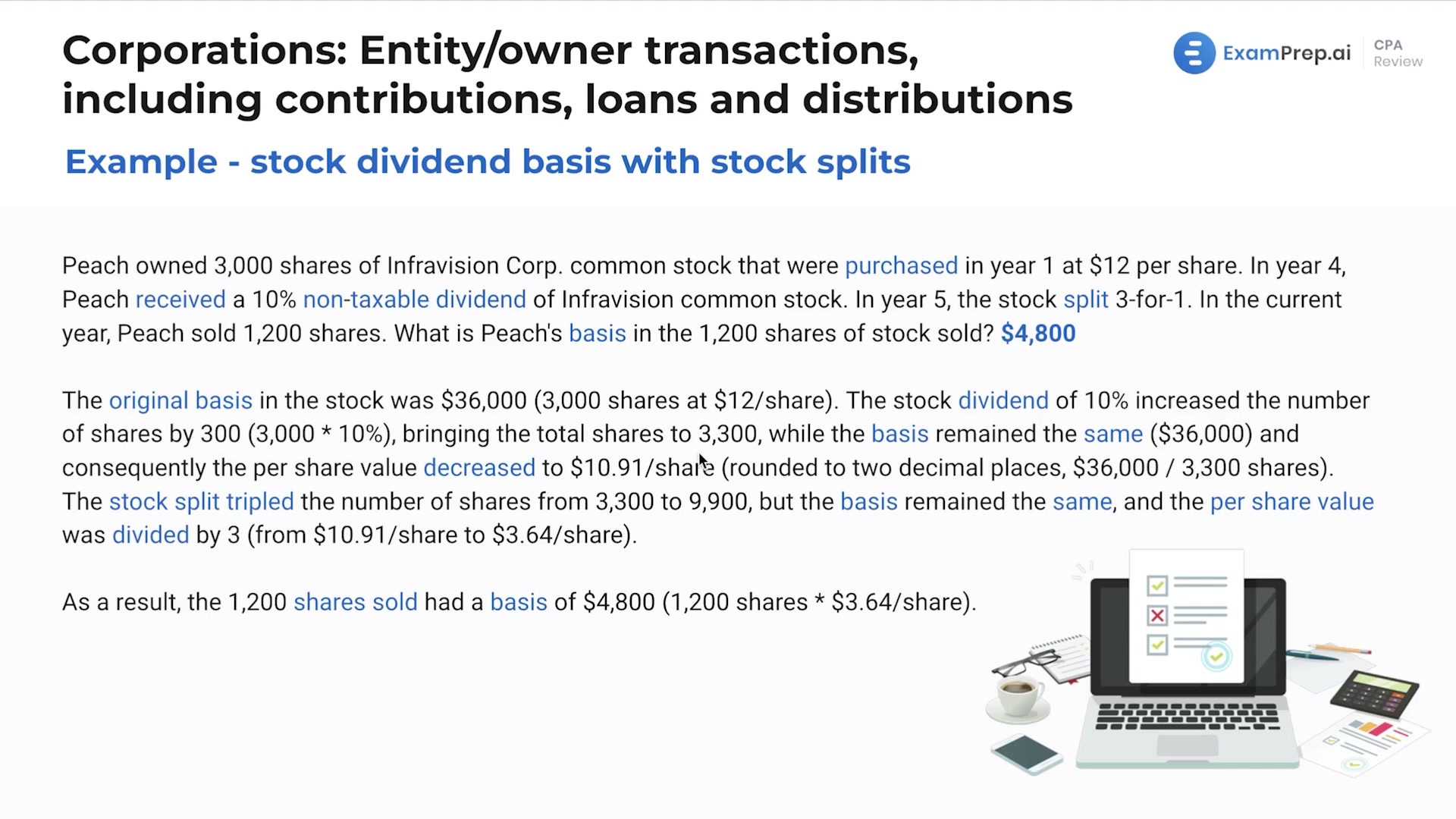

In this lesson, Nick Palazzolo, CPA, breaks down the complexities of handling stock basis calculations in the light of stock dividends and stock splits. He walks through a detailed example, demonstrating how these corporate actions affect the basis of stock for an investor. Here, he illustrates the story of an Infravision Corp shareholder dealing with a stock dividend followed by a three-for-one stock split and the subsequent sale of a portion of shares. Nick methodically explains the calculation steps, ensuring that the basis per share is correctly adjusted after each corporate event, an essential skill for mastering equity transactions in accounting.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free