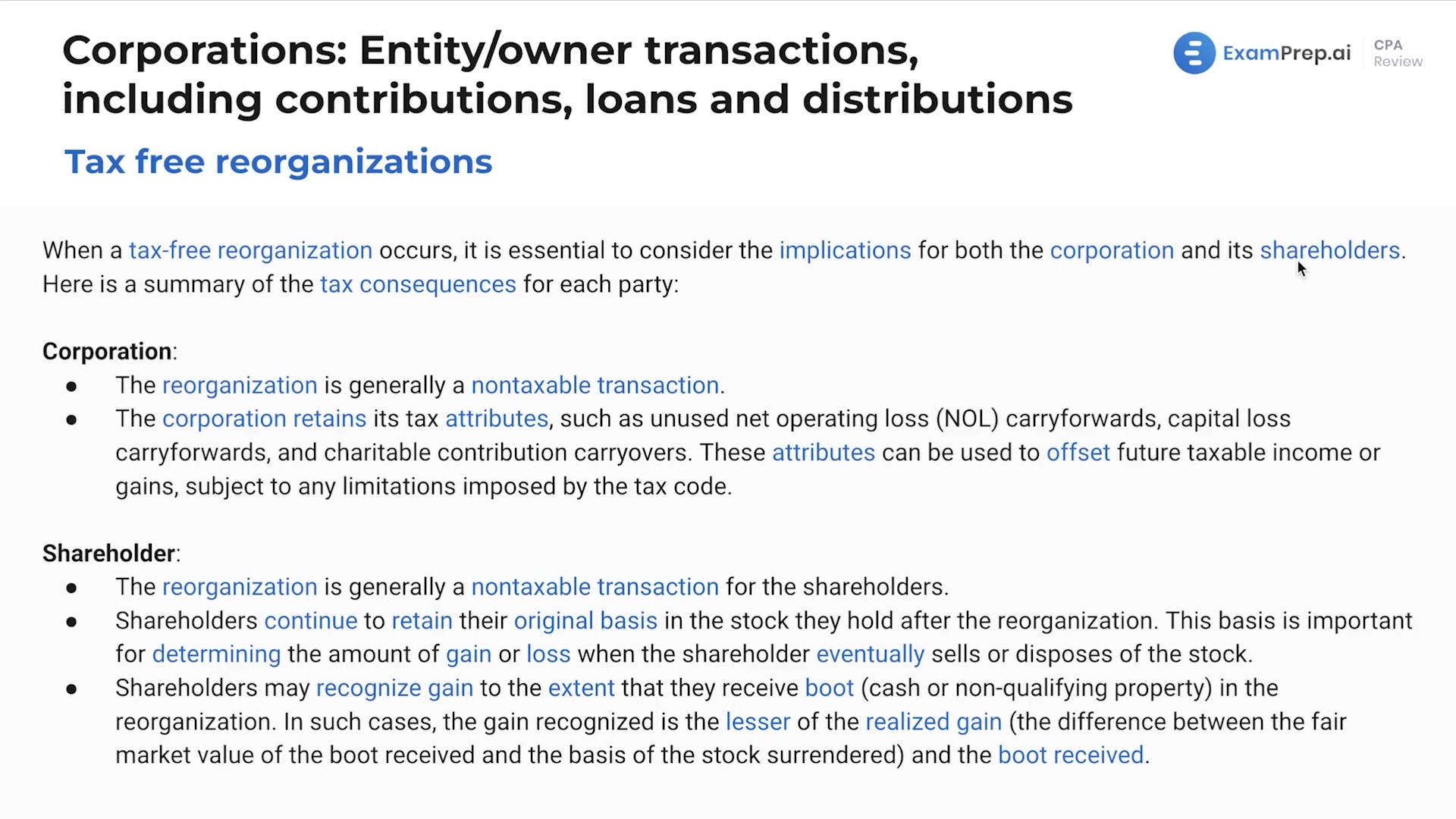

In this lesson, Nick Palazzolo, CPA, breaks down the complexities of tax-free reorganizations. He navigates through the labyrinth of corporate restructuring, providing clear examples and highlighting key implications for both corporations and their shareholders when it comes to taxes. From mergers and acquisitions to divisive reorganizations and recapitalizations, he analyzes each type—A through F—clarifying when transactions result in tax neutrality. The conversation also sheds light on what constitutes boot and how it affects gain recognition, an essential element for anyone navigating the corporate tax landscape. Additionally, Nick uses a relatable anecdote and practical examples to ensure these technical concepts are both understandable and memorable, setting the stage for a thorough comprehension of how tax attributes such as net operating losses and carryforwards fit into the picture of corporate reorganizational maneuvers.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free