Net Operating and Capital Loss Utilization

Net operating and capital loss utilization refers to the application of losses from business operations or capital losses against current or future taxable income to reduce tax liability. This involves carrying these losses forward or backward to offset gains in accordance with tax regulations, enabling tax savings across different tax periods.

Lesson Videos

Corporations: Net Operating Losses and Capital Loss Limitations Overview

Corporations: Net Operating Losses and Capital Loss Limitations Overview

Introduction to Corporations: Net Operating Losses and Capital Loss Limitations

Introduction to Corporations: Net Operating Losses and Capital Loss Limitations

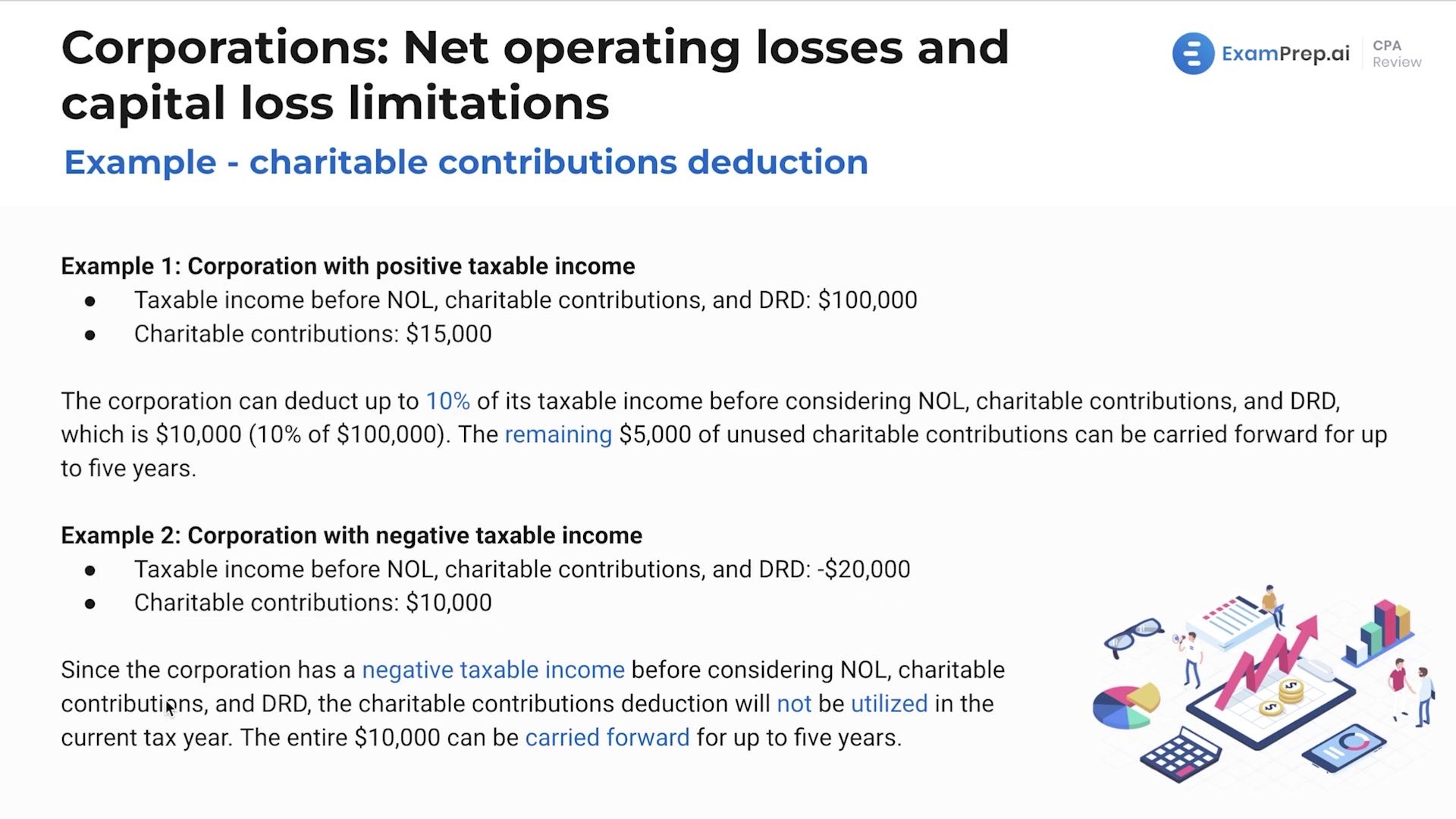

Charitable Contributions Deduction

Charitable Contributions Deduction

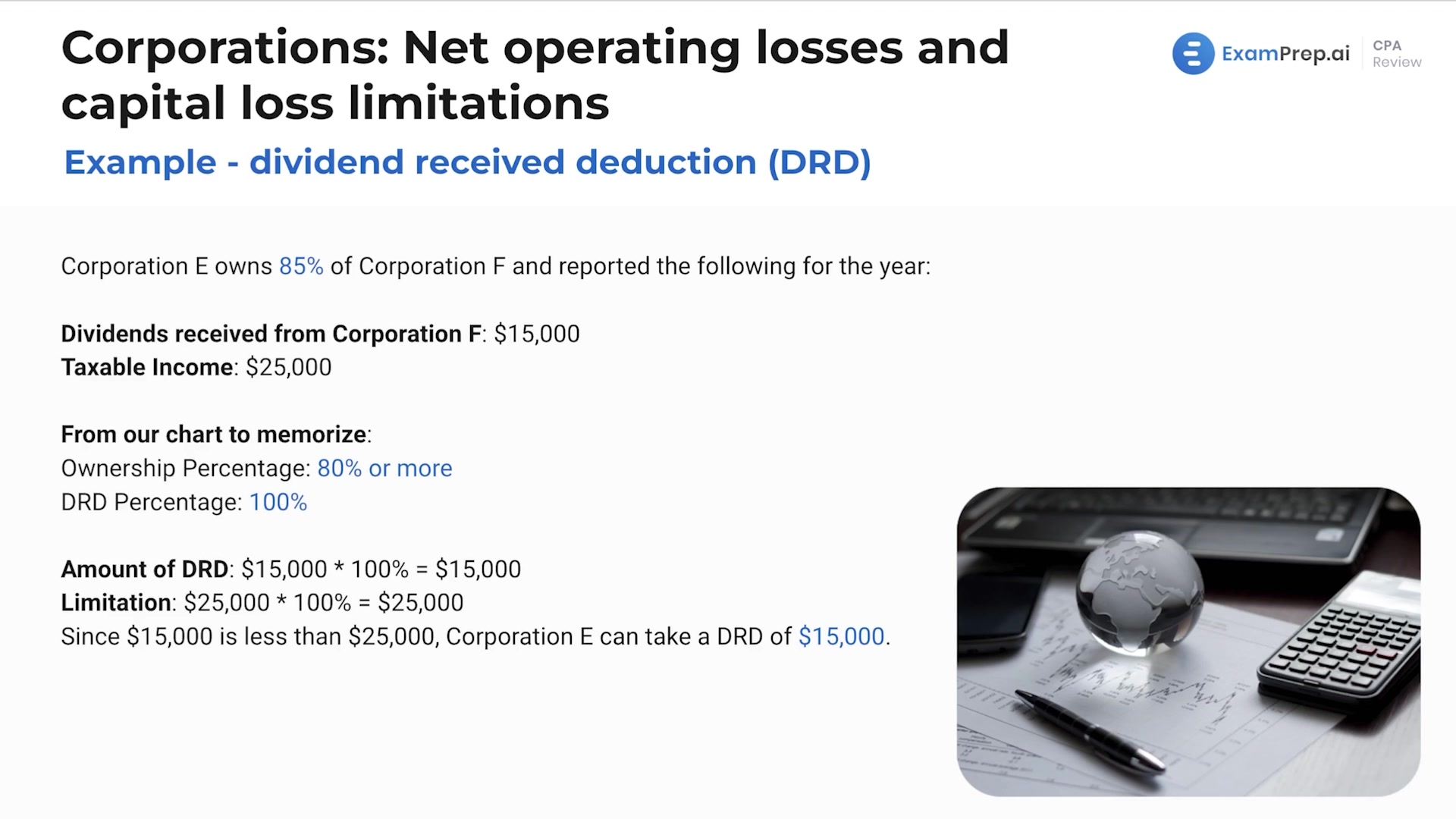

Dividend Received Deduction

Dividend Received Deduction

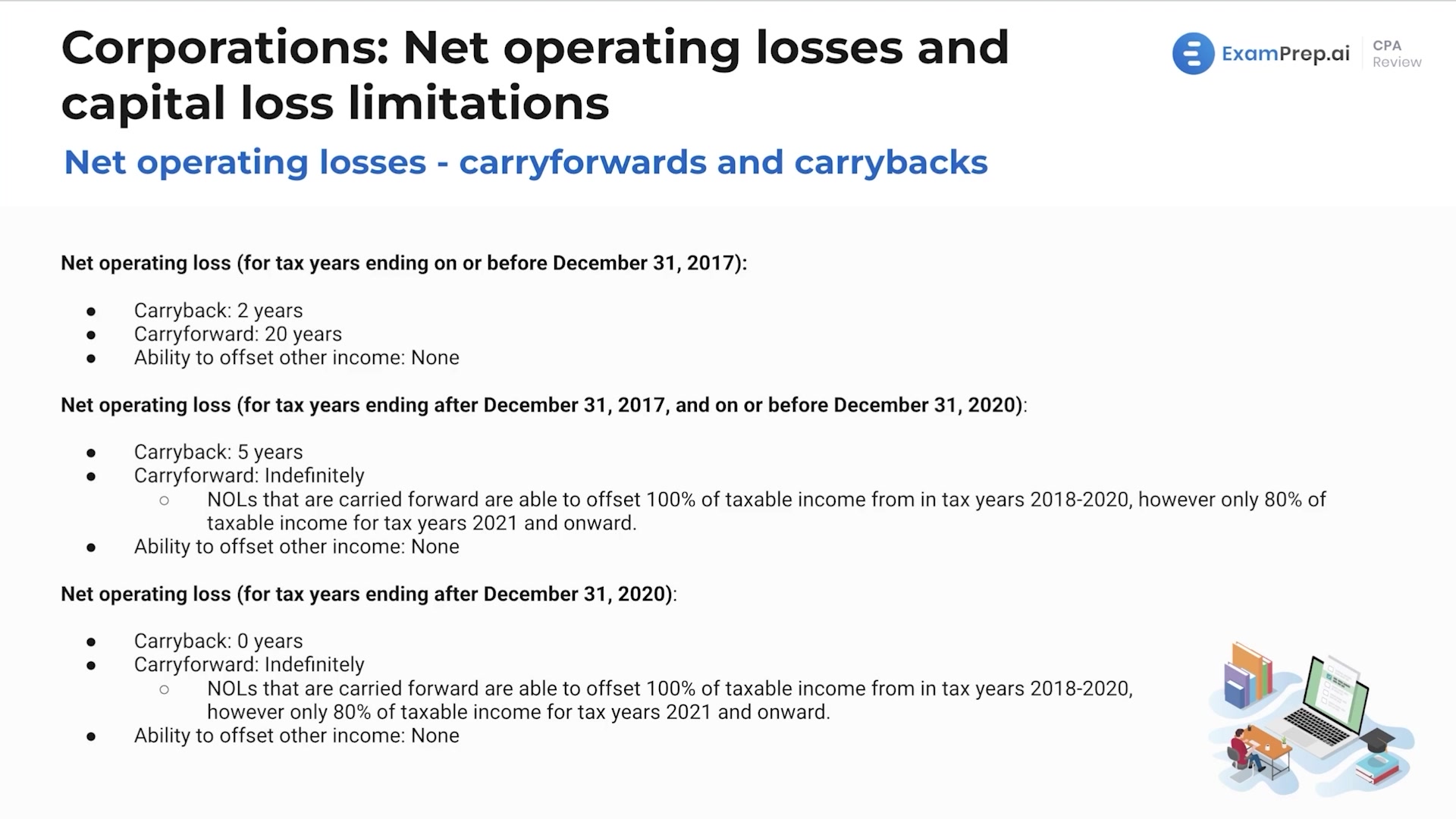

Net Operating Losses and Capital Losses

Net Operating Losses and Capital Losses

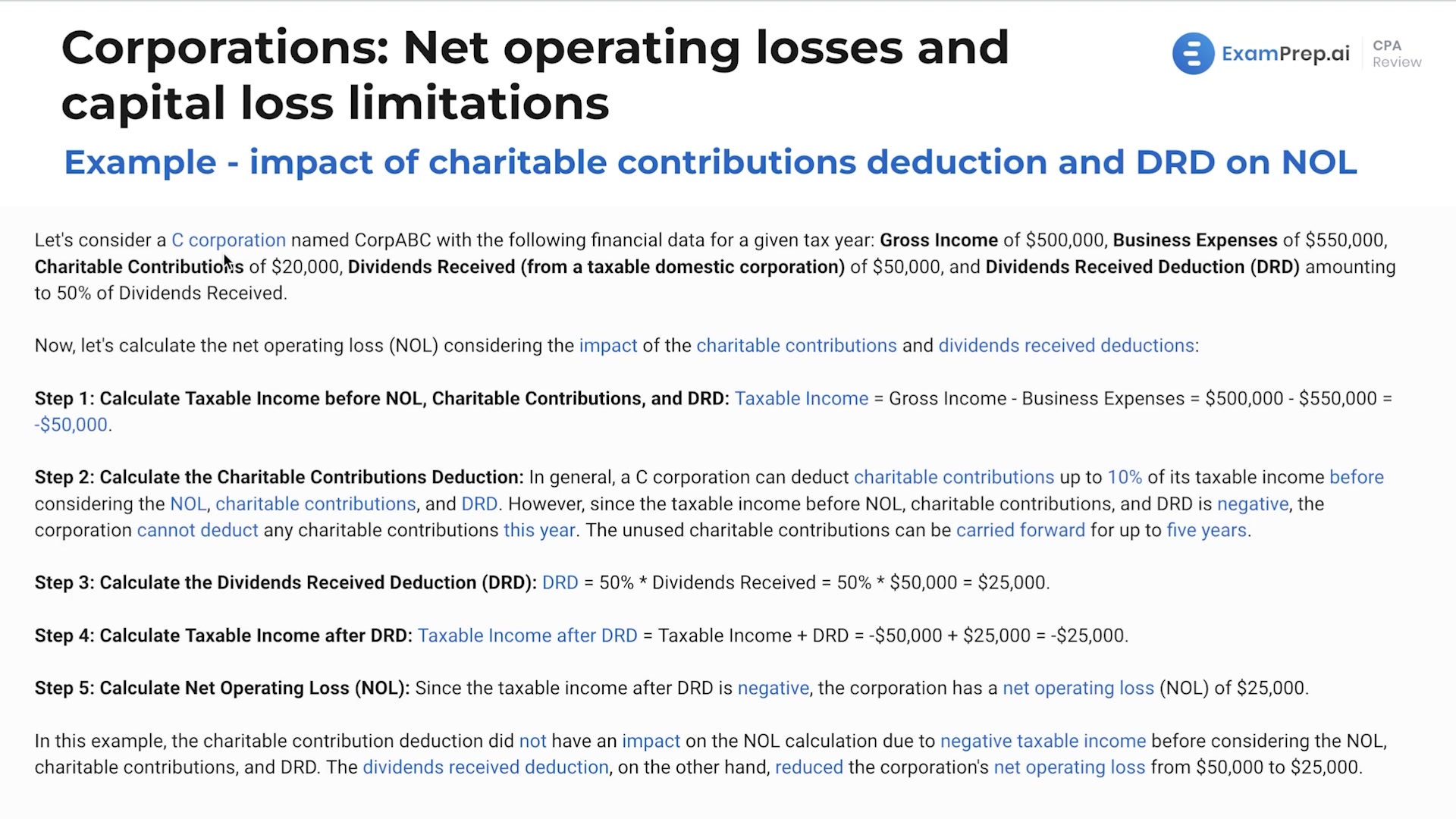

Impact of Charitable Contributions Deduction and Dividend Received Deduction on NOL

Impact of Charitable Contributions Deduction and Dividend Received Deduction on NOL

Corporations: Net Operating Losses and Capital Loss Limitations Summary

Corporations: Net Operating Losses and Capital Loss Limitations Summary

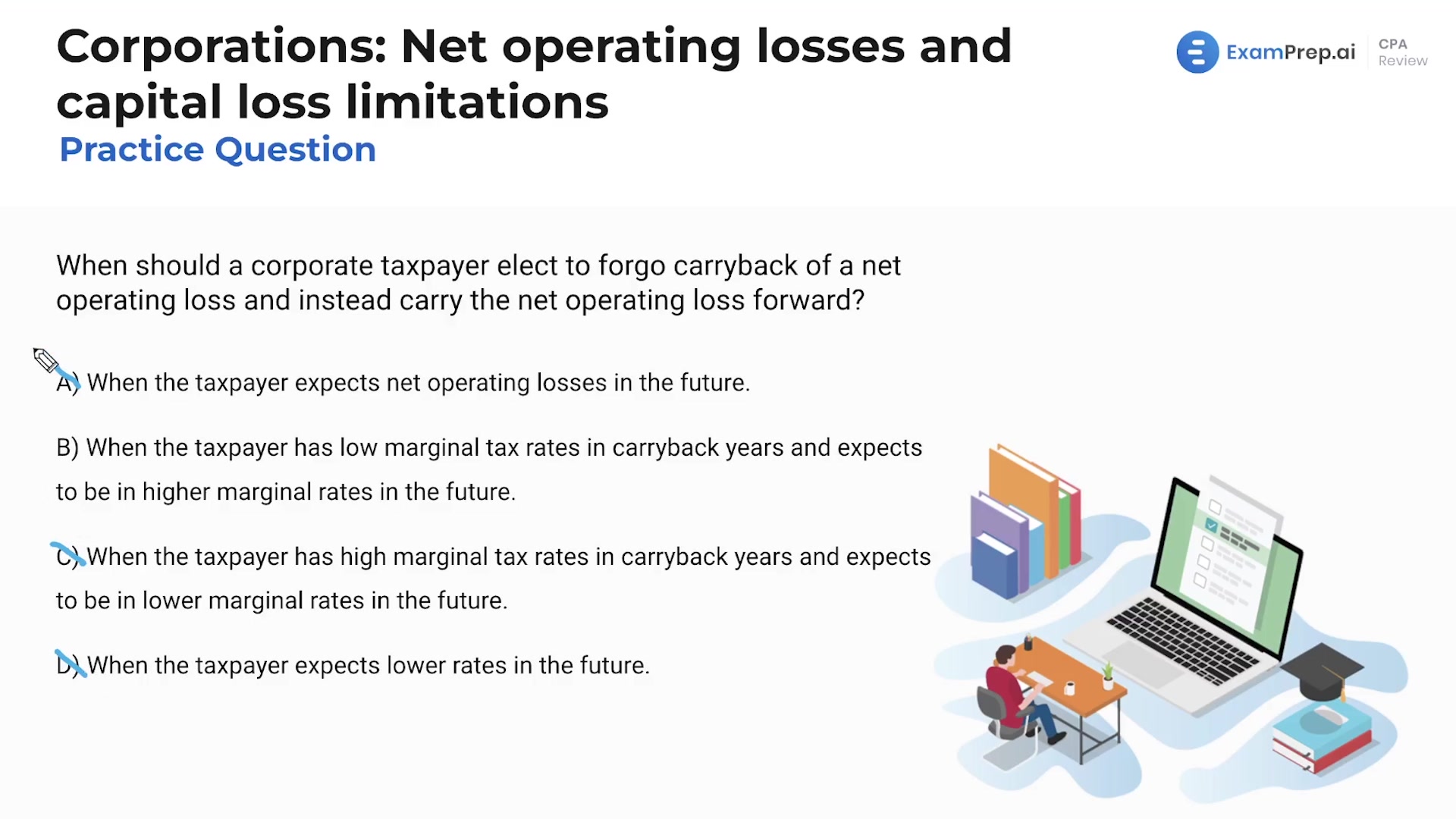

Corporations: Net Operating Losses and Capital Loss Limitations - Practice Questions

Corporations: Net Operating Losses and Capital Loss Limitations - Practice Questions

"Examprep.ai helped me pass all 4 CPA exams on the first try. I highly recommend. I especially like the feedback and ratings the software provides so I know where to focus my time."

Daniel H., CPA

"I can't recommend ExamPrep.ai enough. Nick's lessons turned concepts I struggled with into strengths. I was able to pass FAR right before other exams expired!"

Andrew K, CPA

"I just want to say thank you for the great lesson videos. I couldn't stay awake through lectures of another course. After watching all your FAR lessons I was finally able to pass!"

Alyssa M., CPA Candidate