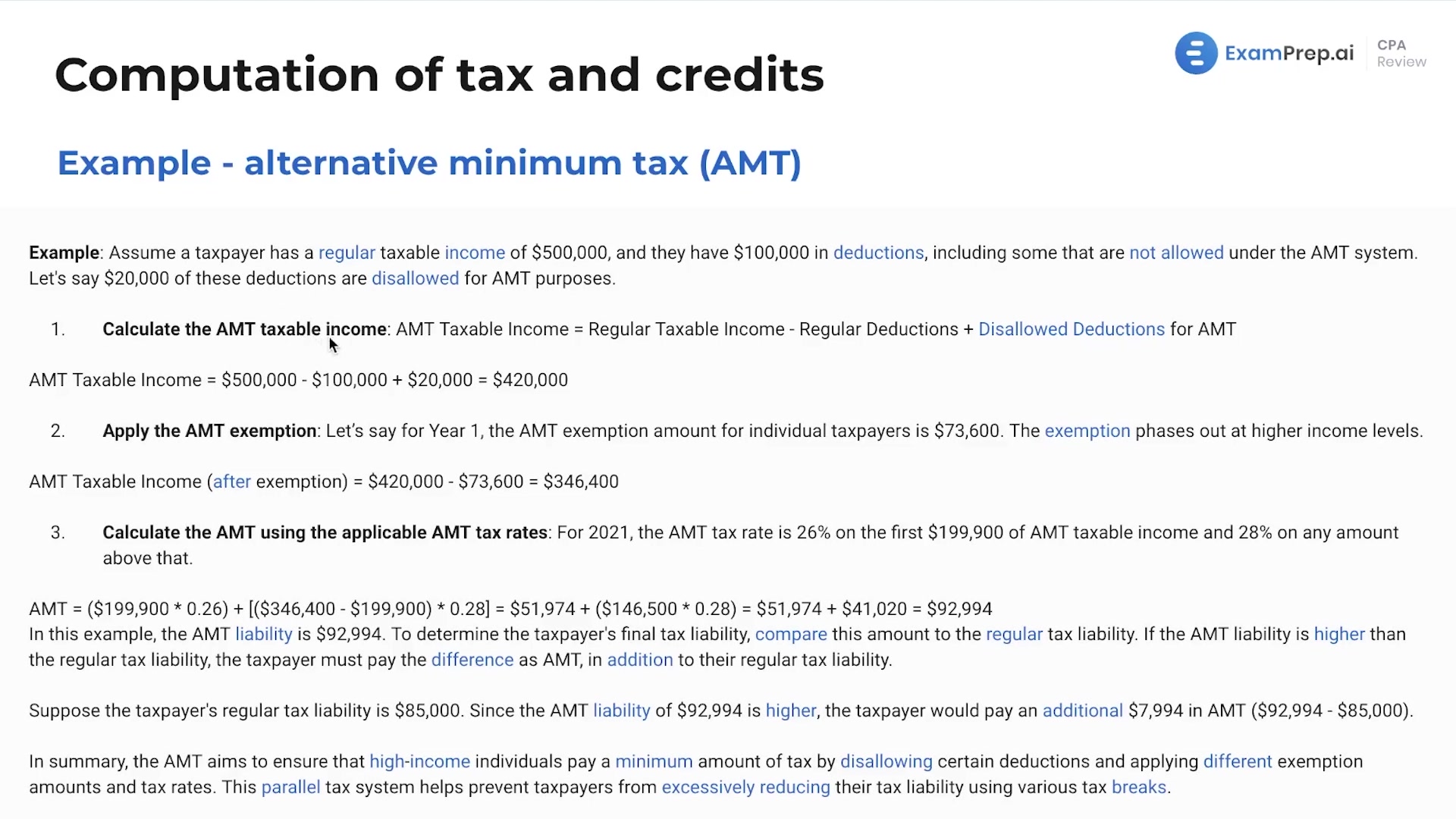

In this lesson, Nick Palazzolo takes a dive into the realm of the Alternative Minimum Tax (AMT), a concept no longer examined but still intriguing for its impact on the tax system. Nick provides an overview of AMT as a parallel tax system designed to ensure high-income earners meet a minimum tax threshold, by disallowing certain deductions and implementing unique exemption amounts and rates. He walks through an example to explain how AMT calculations vary from regular tax calculations, emphasizing that this knowledge is for informational purposes rather than exam preparation. With a clear, straightforward breakdown, Nick strips away the complexity of AMT, pointing out its purpose of preventing tax liability reductions through various deductions and credits.

Unlock the rest of the videos in this topic free by studying on our platform! Permanently unlock up to five topics by watching videos, practicing questions, doing flashcards, or practicing simulations.

Unlock Video Free